Marshall County Limited Warranty Deed Form

Marshall County Limited Warranty Deed Form

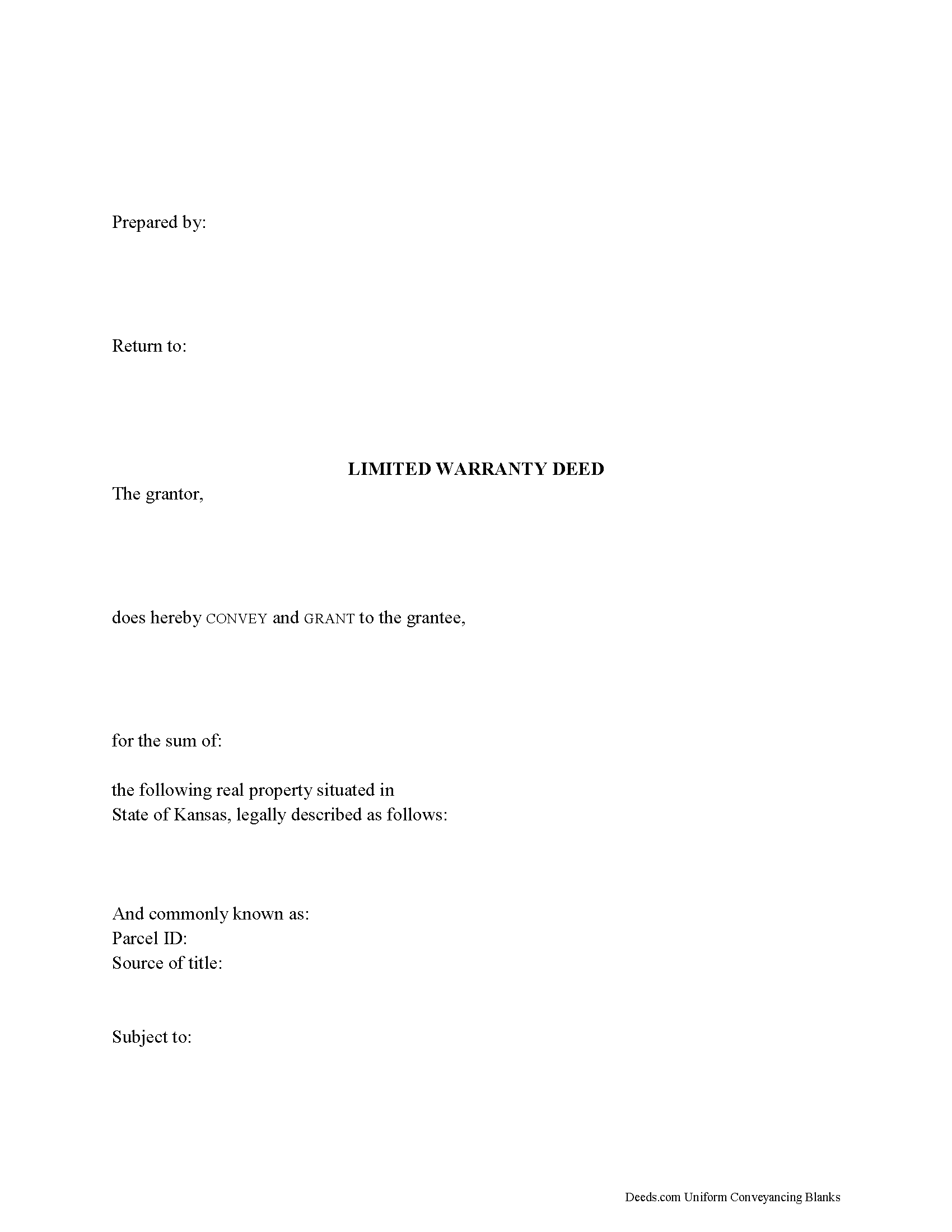

Fill in the blank form formatted to comply with all recording and content requirements.

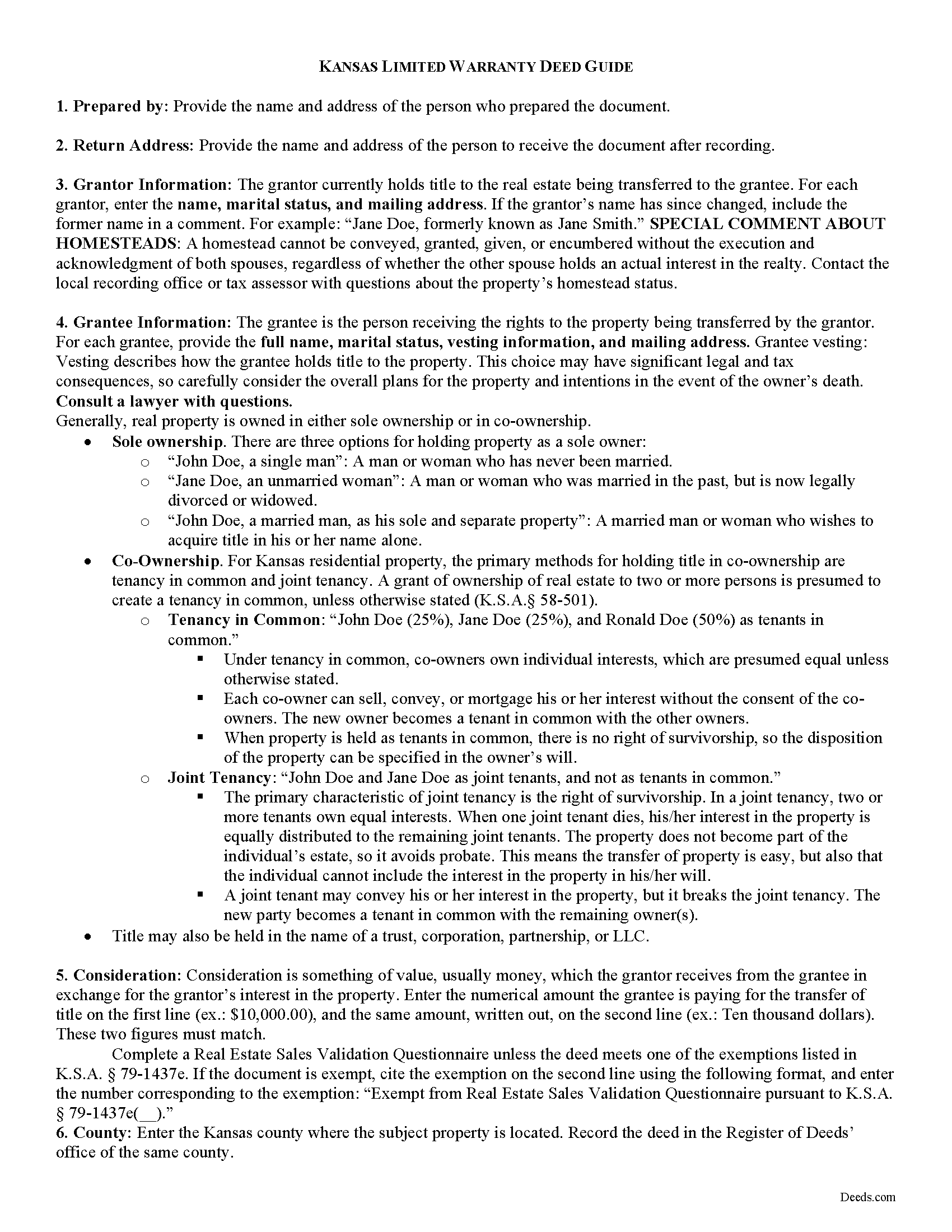

Marshall County Limited Warranty Deed Guide

Line by line guide explaining every blank on the form.

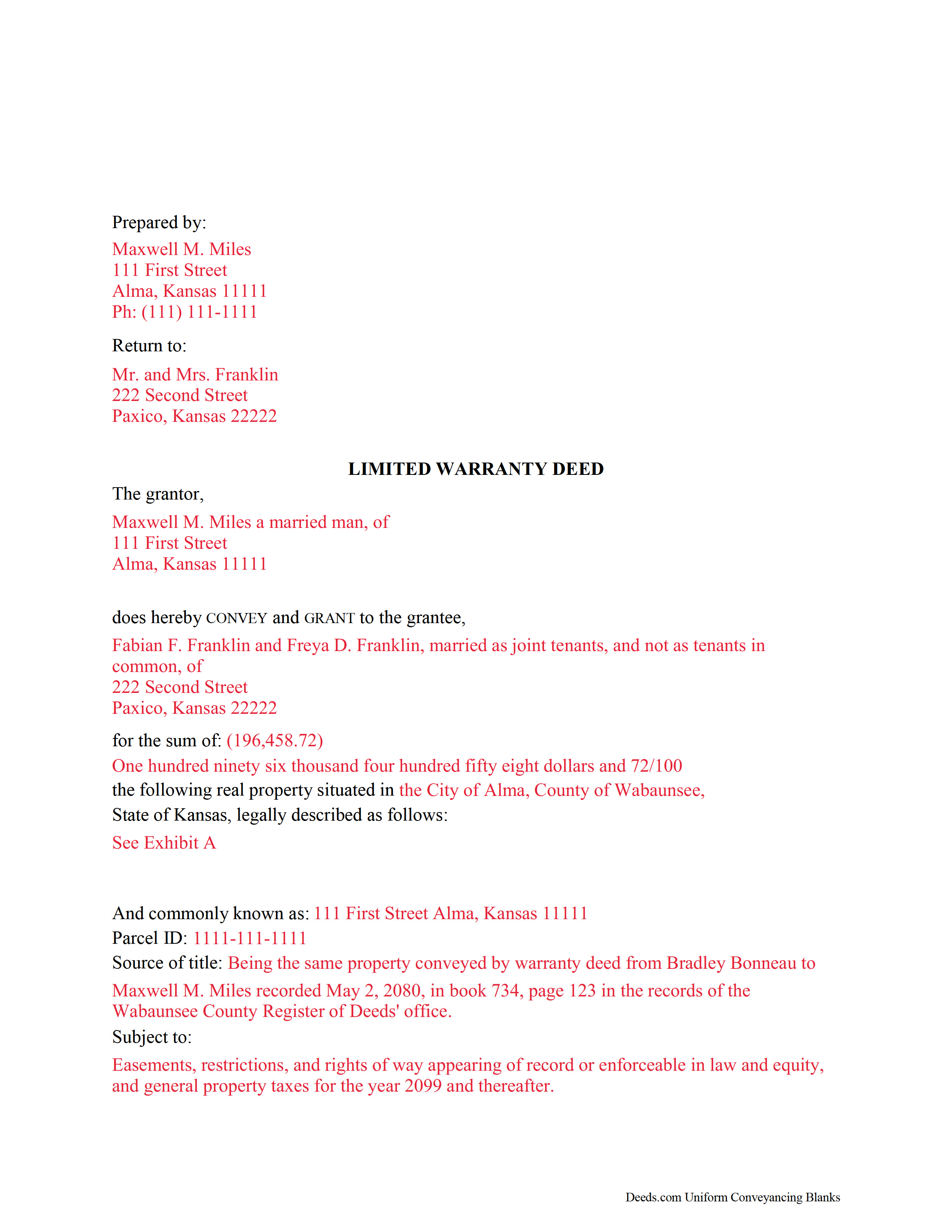

Marshall County Completed Example of the Limited Warranty Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Kansas and Marshall County documents included at no extra charge:

Where to Record Your Documents

Marshall County Register of Deeds

Marysville, Kansas 66508

Hours: 8:30 to 5:00 M-F

Phone: (785) 562-3226

Recording Tips for Marshall County:

- Verify all names are spelled correctly before recording

- Avoid the last business day of the month when possible

- Recorded documents become public record - avoid including SSNs

- Recording early in the week helps ensure same-week processing

Cities and Jurisdictions in Marshall County

Properties in any of these areas use Marshall County forms:

- Axtell

- Beattie

- Blue Rapids

- Bremen

- Frankfort

- Home

- Marysville

- Oketo

- Summerfield

- Vermillion

- Waterville

Hours, fees, requirements, and more for Marshall County

How do I get my forms?

Forms are available for immediate download after payment. The Marshall County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Marshall County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Marshall County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Marshall County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Marshall County?

Recording fees in Marshall County vary. Contact the recorder's office at (785) 562-3226 for current fees.

Questions answered? Let's get started!

A limited warranty deed is a legal document used to transfer, or convey, rights in real property from a grantor (seller) to a grantee (buyer). This type of deed provides significant liability protection for the grantor, and less protection for the buyer. In a limited warranty deed, the grantor only warrants against defects in the title during his or her ownership, and that he or she is authorized to sell the property. However, it does not guarantee freedom from claims on the title originating before the grantor owned the property.

A lawful limited warranty deed includes the grantor's full name and marital status, as well as the grantee's full name, marital status, mailing address, and vesting. Vesting describes how the grantee holds title to the property. For Kansas residential property, the primary methods for holding title in co-ownership are tenancy in common and joint tenancy. A grant of ownership of real estate to two or more persons is presumed to create a tenancy in common, unless otherwise stated (K.S.A. 58-501).

As with any conveyance of real estate, a limited warranty deed must meet all state and local standards for recorded documents. It also requires a complete legal description of the parcel. Include the derivation of the grantor's title to the property to prove a clear chain of title, and detail any restrictions associated with the property.

Within Kansas, a deed must be acknowledged by a county clerk, register of deeds, or mayor or clerk of an incorporated city (K.S.A. 58-2211). Any deed that has been executed and acknowledged in another state before a person authorized by the Uniform Law on Notarial Acts will still be valid (K.S.A. 58-2228). The deed must be signed by the grantor, then acknowledged and recorded as directed by K.S.A. 58-2205.

Submit the deed for recording in the county where the property is located. Include all relevant documents, affidavits, forms, and fees with the along with the deed for recording. Complete a Real Estate Sales Validation Questionnaire for the deed unless it meets one of the exemptions provided in K.S.A. 79-1437e. Contact the local recording office with questions.

This article is provided for informational purposes only and is not a substitute for legal advice. Contact a lawyer with questions about limited warranty deeds or for any other issues related to the transfer of real property in Kansas.

(Kansas Limited Warranty Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Marshall County to use these forms. Documents should be recorded at the office below.

This Limited Warranty Deed meets all recording requirements specific to Marshall County.

Our Promise

The documents you receive here will meet, or exceed, the Marshall County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Marshall County Limited Warranty Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4587 Reviews )

Sharon B.

April 3rd, 2024

Downloaded pdf form was difficult to use,/modify and has too much space between sections.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

Gary K.

November 15th, 2019

Straightforward and pretty easy to use. The only downside is that there is no way to contact them directly. The number on the website is answered only by a voicemail with no return calls. Pricing seems fair compared to other services and much more efficient that filing "over the counter."

Thank you for your feedback. We really appreciate it. Have a great day!

Marion Paul W.

January 31st, 2019

Quick service .Easy download.I ordered Quit Claim and should have ordered warranty deed. I will make it work

Thank you!

William S C.

June 11th, 2021

The Lady Bird Deed appears to be fine with me as are the instructions. However, there apparently are no specific laws in Texas addressing them other than they are OK. The problem is that lenders are surely going to use them as triggers for their due on sale clauses, especially as the current small mortgage rates begin to increase. The solution to that seems to be to sign and have them notarized, but not to record them unless the holder needs to enforce the provisions. It seems to me that you should consider your solution to that problem in your instructions.

Thank you for your feedback. We really appreciate it. Have a great day!

Elizabeth W.

February 9th, 2023

would have been smart to give each pdf a name instead of unintelligible numbers...

Thank you for your feedback. We really appreciate it. Have a great day!

Rhobe M.

May 8th, 2023

Very user friendly site. I was able to get the information I needed fast.

Thank you!

Jesse C.

December 29th, 2018

I had a little problem understanding how to copie and use.

Thank you for your feedback Jesse. If you are having any issues please contact us so our customer care department can help you out.

ROBERT M.

May 27th, 2019

Lots of Info. Forms seem straightforward. Easy to Fill out.

Thank you for your feedback. We really appreciate it. Have a great day!

Ralph H.

May 8th, 2019

Your documents resolved my problem. Thanks.

Thank you Ralph, we appreciate your feedback.

Karen S.

October 19th, 2021

Deeds.com made everything easy, with instructions and samples it was simple to fill out the forms. I loved that it was county specific.

Thank you for your feedback. We really appreciate it. Have a great day!

Robert h.

February 25th, 2019

excellent and simple to use. Great price for this.

Thank you Robert! We really appreciate your feedback.

Kristy T.

March 21st, 2019

Using your site made gifting personal property (land) so quick and easy. The forms were presented ready to complete and included detailed instructions. The "completed form" example was helpful. I definitely recommend your site to anyone who does not wish to pay expensive lawyer fees.

Thank you Kristy, we appreciate your feedback

Edward L.

March 6th, 2019

Excellent web site with just the right documents. Filled a very important need in less tha 2 minutes time.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Michael S.

September 16th, 2024

Great product and service. So convenient.

Your satisfaction with our services is of utmost importance to us. Thank you for letting us know how we did!

David S.

March 7th, 2022

Very good website. All government should be that clear and efficient.

Thank you!