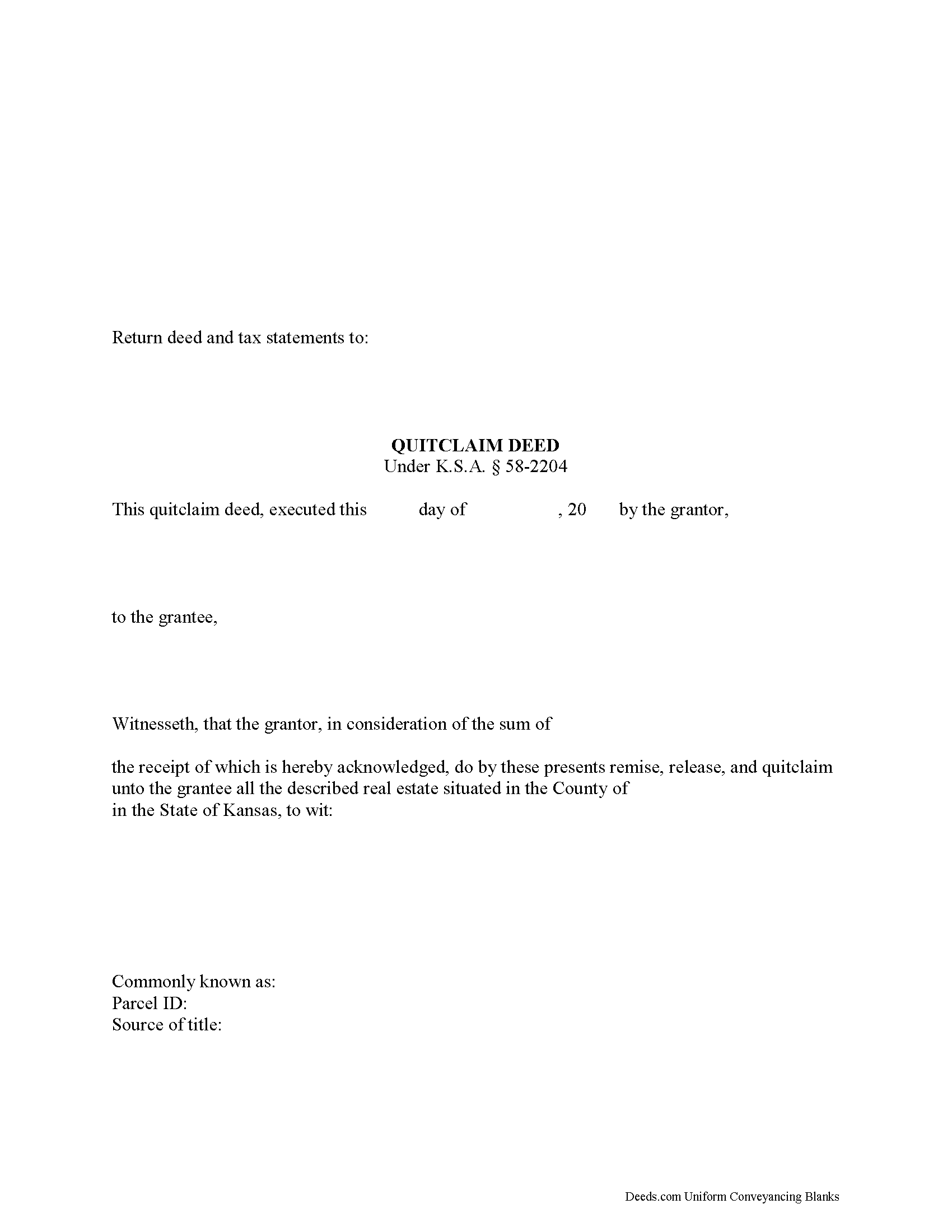

Jefferson County Quitclaim Deed Form

Jefferson County Quitclaim Deed Form

Fill in the blank Quitclaim Deed form formatted to comply with all Kansas recording and content requirements.

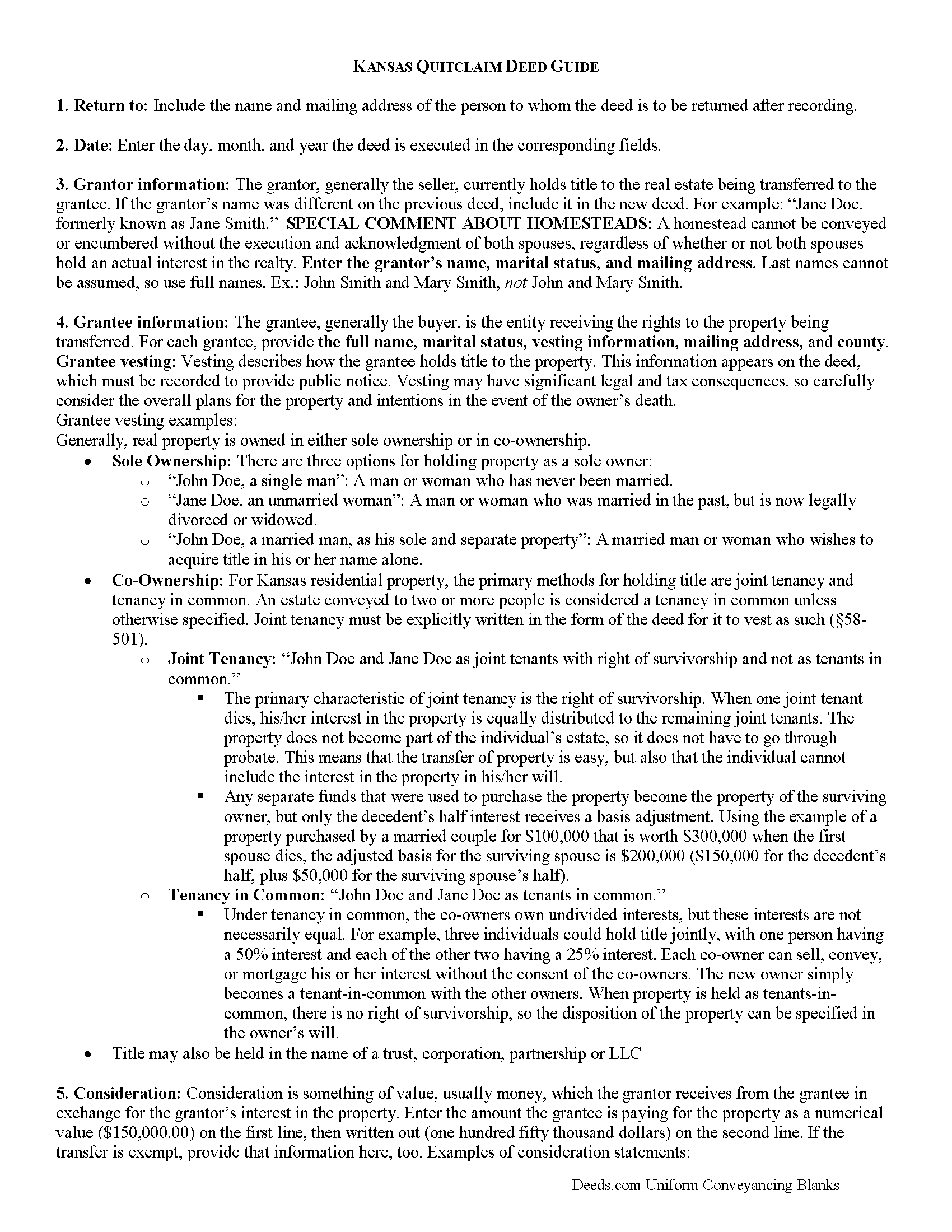

Jefferson County Quitclaim Deed Guide

Line by line guide explaining every blank on the Quitclaim Deed form.

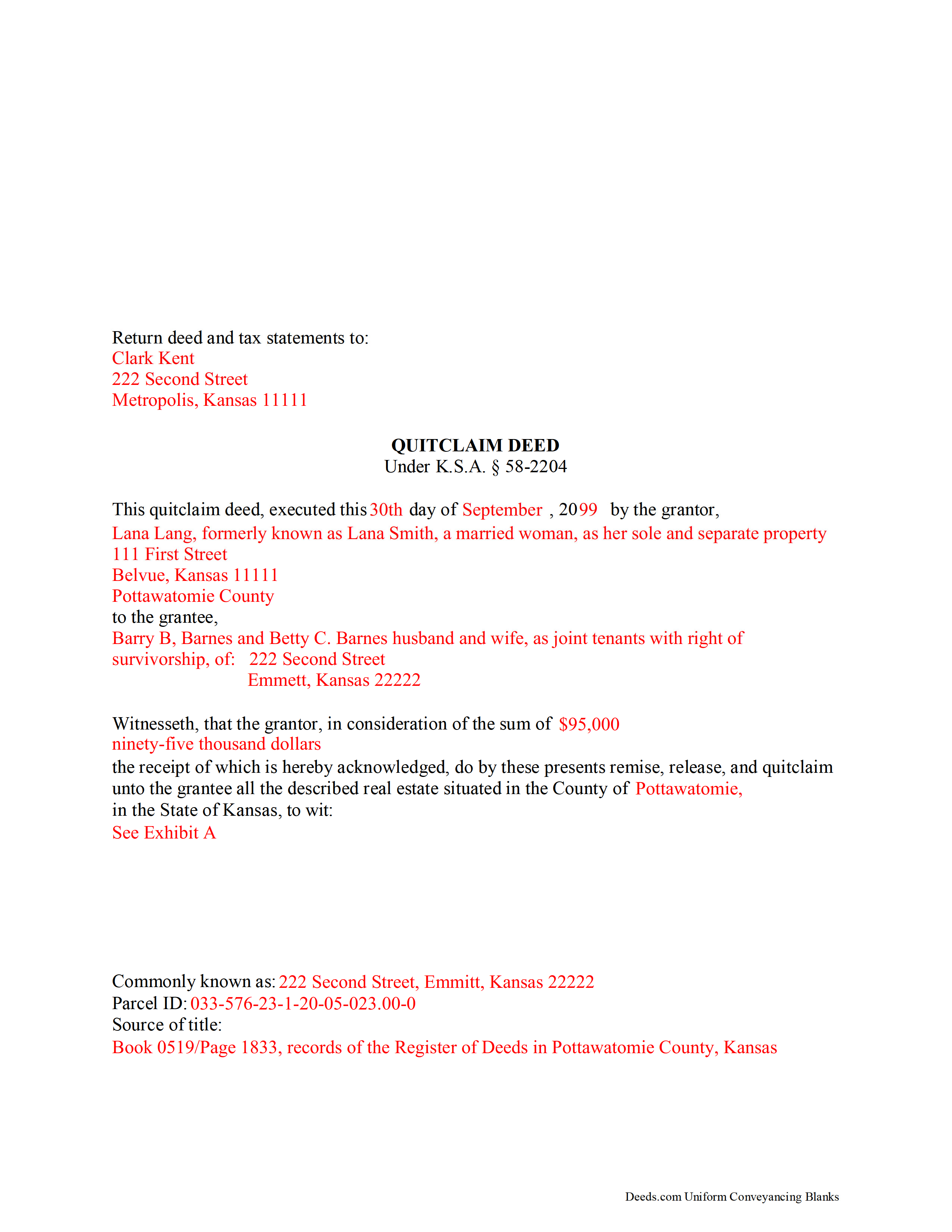

Jefferson County Completed Example of the Quitclaim Deed Document

Example of a properly completed Kansas Quitclaim Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Kansas and Jefferson County documents included at no extra charge:

Where to Record Your Documents

Jefferson County Register of Deeds

Oskaloosa, Kansas 66066

Hours: 8:00am to 4:30pm M-F

Phone: (785) 863-2243

Recording Tips for Jefferson County:

- Recording fees may differ from what's posted online - verify current rates

- Recorded documents become public record - avoid including SSNs

- Ask for certified copies if you need them for other transactions

Cities and Jurisdictions in Jefferson County

Properties in any of these areas use Jefferson County forms:

- Grantville

- Mc Louth

- Meriden

- Nortonville

- Oskaloosa

- Ozawkie

- Perry

- Valley Falls

- Winchester

Hours, fees, requirements, and more for Jefferson County

How do I get my forms?

Forms are available for immediate download after payment. The Jefferson County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Jefferson County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Jefferson County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Jefferson County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Jefferson County?

Recording fees in Jefferson County vary. Contact the recorder's office at (785) 863-2243 for current fees.

Questions answered? Let's get started!

Kansas Quitclaim Deed Content:

K.S.A. 58-2202 explains that "every conveyance of real estate shall pass all the estate of the grantor therein." K.S.A. 58-2202 states that transfers in ownership of land are valid when a deed is executed by someone with an ownership interest in the property. K.S.A. 58-2204 provides the statutory form for quitclaim deeds, including the minimum requirements and correct language. The necessary information includes the names and addresses of all grantors and grantees, a complete legal description of the property, the consideration (usually money), and the notarized signature of the grantor or an authorized representative. K.S.A. 58-2209 reinforces the requirement of the grantor's notarized signature. K.S.A. 58-2211 expands the discussion about who may acknowledge the instrument to include those authorized by uniform law to perform notarial acts. K.S.A. 28-115 states that all signatures must have the signor's name typed or printed immediately below them. Finally, K.S.A. 58-2221 adds the obligation to include details about the transaction in which the grantor gained ownership of the property. In addition, be certain that the document contains an appropriately descriptive heading (in this case, "Quit Claim Deed).

Recording:

K.S.A. 58-2221 explains that every written instrument conveying ownership interests in real estate should be presented for recording to the office of the register of deeds of the county where the land is located. K.S.A. 28-115 contains formatting requirements:

* Legal-sized paper (8" x 14") is the maximum size for recording without a non-standard document fee.

* The document must be printed in minimum 8-point type.

Kansas follows a "race-notice" recording statute, as described in K.S.A. 58-2222, 2223. Every written instrument, such as a quit claim deed, submitted for recording as directed, imparts constructive notice to all subsequent bona fide purchasers (buyers for value). Unrecorded deeds only provide actual notice to the parties involved with the conveyance, but because they are not entered into the public record, future buyers might not be aware of the change in ownership. For example, let's say that the grantor quit claims his/her rights to the real estate to grantee A, who fails to record the otherwise properly executed deed. Then the grantor quit claims the same property to grantee B, who records the instrument according to the statute. By presenting the deed for recordation, grantee B enters the transaction into the public record and, as a result, will generally prevail in a dispute about the real owner of the parcel of land. In short, recording the quit claim deed as soon as possible after it is executed is one of the simplest ways to preserve the rights and interests of both the buyer and the seller.

(Kansas Quitclaim Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Jefferson County to use these forms. Documents should be recorded at the office below.

This Quitclaim Deed meets all recording requirements specific to Jefferson County.

Our Promise

The documents you receive here will meet, or exceed, the Jefferson County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Jefferson County Quitclaim Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4587 Reviews )

Thomas D.

July 10th, 2019

The site is fine with one exception. About half the pdf files I downloaded were corrupted. I could not open them or view their contents. Fortunately, the link continued to work, so after I discovered this, I downloaded the corrupted files again, and they now seem fine. I do not know if my computer or the website caused this odd problem.

Thank you for your feedback. We really appreciate it. Have a great day!

GARY S.

March 16th, 2021

The forms were just what i needed and for the county i needed thankyou so much

Thank you!

Zachary F.

February 1st, 2022

I am a lawyer and purchased a specialized type of deed for a special scenario. The product received was functional, but not great. Wording is slightly clunky and the form layout was not convenient for making a professional final product. The wording also didn't contemplate a remote-state probate, which is a common scenario. Something about the PDF prevented me from doing cut and paste, so I had to do OCR to get the relevant text for inserting in my existing draft deed. Finally, while the site claims it is customized for the exact state and county, it does not appear to be well-customized for that purpose and I had to use other language (not sourced from the deeds.com document) to meet local norms.

Thank you for your feedback. We really appreciate it. Have a great day!

donald h.

January 26th, 2019

very informative and thank everyone involved,my deed needed to be changed and will adjusted.

Thank you!

Alexander M.

June 13th, 2025

Great recording service ! Very professional and easy to navigate !!!!

It was a pleasure serving you. Thank you for the positive feedback!

Sylvia H.

February 8th, 2024

Thank you so very much for such an easy experience.

Thank you for your feedback. We really appreciate it. Have a great day!

Virginia S.

October 24th, 2021

Very quick process and forms were downloaded. I am very pleased with the detailed information for filling out the forms. Would use again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joice W G.

May 5th, 2019

Easy to use and able to individualize, which was important since I needed to print more than one doc. I just wish I had an option for a less expensive purchase - seemed like a lot for just a couple docs.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Mary B.

December 1st, 2021

Great job, Deeds.com! I'm a retired lawyer, and I'm liking what I see. Well done.

Thank you!

Nancy C.

August 2nd, 2019

So easy and documents downloaded in a flash. Highly recommended. Just gotta fill out and submit done. Thank You

Thank you!

Ethan N.

January 11th, 2021

Quick, responsive service always!! Preferred way to record documents. Thanks Deeds.com!!

Thank you!

Resa J.

April 11th, 2019

Seamless. Excellent.

Thank you for your feedback Resa. Have a wonderful day!

Susanne N.

February 25th, 2021

It's hard having to change names on an account when someone dies. I called and was helped by a rep named Lilah. She was most helpful and comforting. Thank you again Lilah.

Thank you for taking the time to leave such kind words Susanne, we appreciate you.

Dean S.

March 11th, 2020

Couldn't be happier, great documents, easy to understand and complete.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Eileen B.

April 5th, 2022

I was quoted $525 to do the exact same thing from Deeds.com for only $25. Seems like a no brainer to me!

Thank you for your feedback. We really appreciate it. Have a great day!