Harper County Transfer on Death Deed Revocation Form

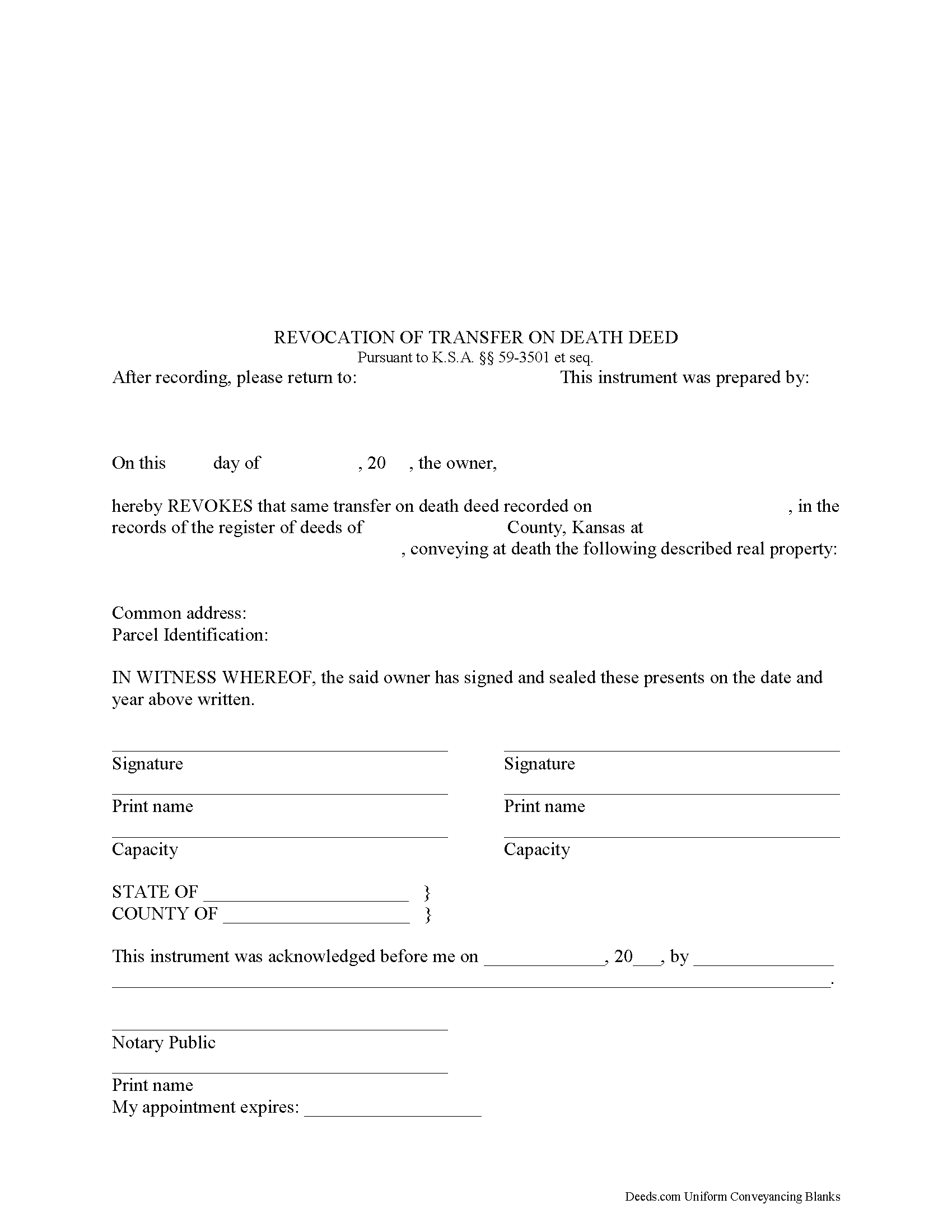

Harper County Revocation of Transfer on Death Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

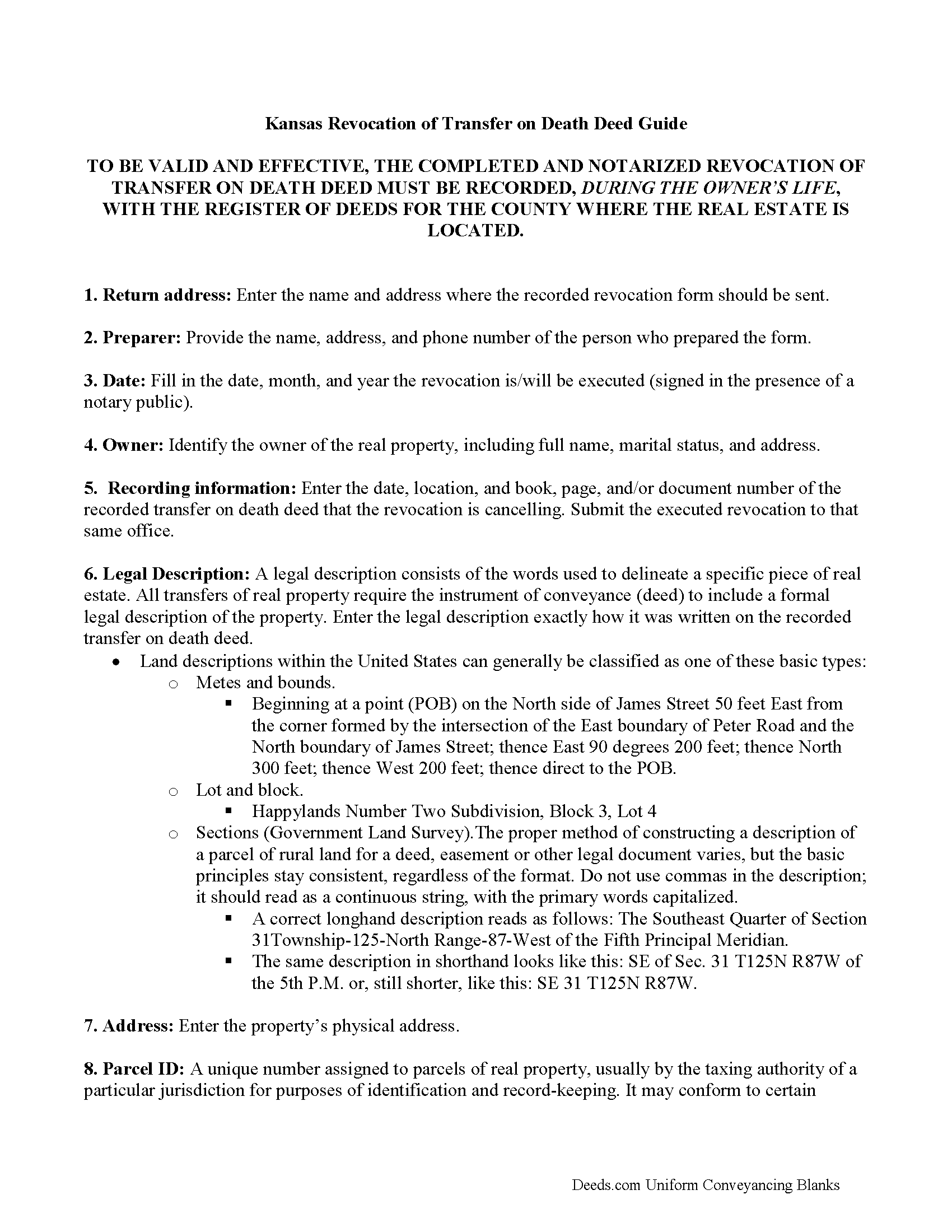

Harper County Transfer on Death Deed Revocation Guide

Line by line guide explaining every blank on the form.

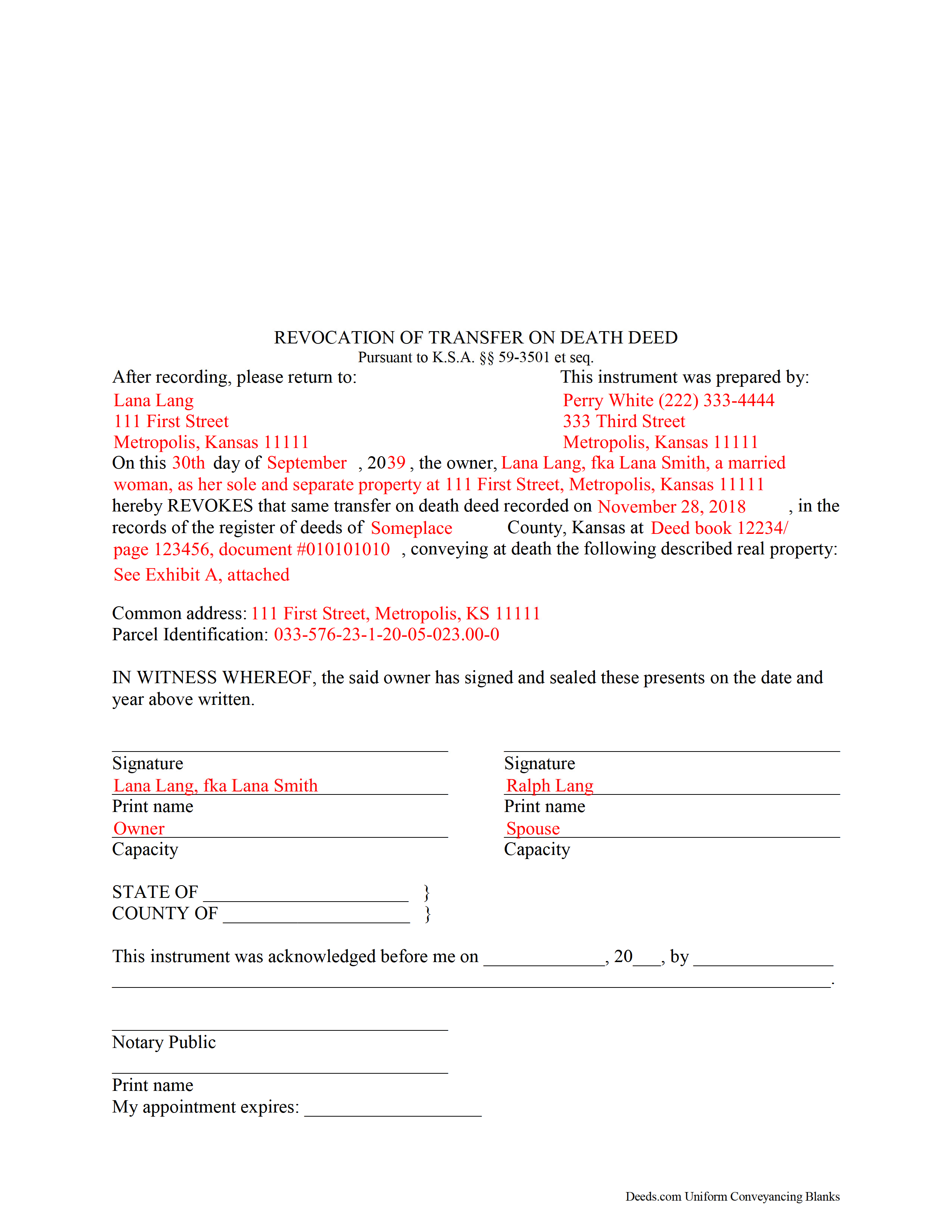

Harper County Completed Example of the Revocation of Transfer on Death Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Kansas and Harper County documents included at no extra charge:

Where to Record Your Documents

Harper County Register of Deeds

Anthony, Kansas 67003

Hours: 8:00 to 5:00 M-F

Phone: (620) 842-5336

Recording Tips for Harper County:

- Documents must be on 8.5 x 11 inch white paper

- Double-check legal descriptions match your existing deed

- Ask if they accept credit cards - many offices are cash/check only

- Check margin requirements - usually 1-2 inches at top

- Recording fees may differ from what's posted online - verify current rates

Cities and Jurisdictions in Harper County

Properties in any of these areas use Harper County forms:

- Anthony

- Attica

- Bluff City

- Danville

- Freeport

- Harper

- Waldron

Hours, fees, requirements, and more for Harper County

How do I get my forms?

Forms are available for immediate download after payment. The Harper County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Harper County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Harper County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Harper County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Harper County?

Recording fees in Harper County vary. Contact the recorder's office at (620) 842-5336 for current fees.

Questions answered? Let's get started!

Kansas transfer on death deeds (TODDs) are governed by K.S.A. 59-3501 (2012) et seq. Revocation, specifically, is addressed in.

The transfer on death deed is a flexible estate planning tool which became available to Kansas land owners in 1997. Revocability, one of the many unique features of this deed, is based on the fact that the conveyance has no effect until after the owner dies.

Why might an owner wish to cancel, or revoke, a transfer on death? Sometimes there are changes in the owner or beneficiary's circumstances, unexpected family disputes, or one or more of numerous other reasons. In this regard, the reason does not matter -- the owner holds absolute title to and control over the property. The statute at 59-3503 provides two methods for exercising this option:

(a) A designation of the grantee beneficiary may be revoked at any time prior to the death of the record owner, by executing, acknowledging and recording in the office of the register of deeds in the county where the real estate is located an instrument describing the interest revoking the designation. The signature, consent or agreement of or notice to the grantee beneficiary or beneficiaries is not required.

(b) A designation of the grantee beneficiary may be changed at any time prior to the death of the record owner, by executing, acknowledging and recording a subsequent transfer-on-death deed in accordance with K.S.A. 59-3502. The signature, consent or agreement of or notice to the grantee beneficiary or beneficiaries is not required. A subsequent transfer-on-death beneficiary designation revokes all prior designations of grantee beneficiary or beneficiaries by such record owner for such interest in real estate.

Finally, part (c) explains that a transfer-on-death deed executed, acknowledged and recorded in accordance with this act may not be revoked by the provisions of a will.

Each situation is unique, so for specific questions or to review the options for more complex situations, contact a local attorney.

(Kansas Transfer on Death Deed Revocation Package includes form, guidelines, and completed example)

Important: Your property must be located in Harper County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Deed Revocation meets all recording requirements specific to Harper County.

Our Promise

The documents you receive here will meet, or exceed, the Harper County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Harper County Transfer on Death Deed Revocation form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4587 Reviews )

DEBORAH H.

January 22nd, 2024

This is my fourth try, and I hope my form is complete and acceptable.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

janitza g.

July 31st, 2020

It was easy!!! The example for completing a quickclaim deed form was very helpful!!

Thank you!

Tyler F.

December 14th, 2020

worked great!!!

Awesome, great to hear. Thank you.

Kimberly S.

April 21st, 2022

I wasted a lot of my time because I didn't do any research to know what I needed. Nobody fault but mine.

Thank you!

Victor W.

March 9th, 2022

Once I was able to get the code Number, it all went well. I was able to easily download and print off what I needed for my lawyer. thank you.

Thank you!

Kenneth C.

August 24th, 2020

Great forms, easy to use if you have at least a sixth grade education.

Thank you!

Daniel N.

June 28th, 2024

Deeds.com provided the document template and instructions I needed, right when I needed them. I was able to navigate through an unfamiliar process with exactly the support I needed at an affordable and fair price. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jina N.

January 29th, 2019

Awesome site!! You guys really make it simple to understand and access any Deeds that I need. I know you keep very up to date forms, as my county is hard core when it comes to the smallest of details, even compared to every other county across the state. Yet you made it simple and quick, and I never had to redo anything. Even the clerk was impressed that I had it filled out correctly the first time, as that usually never happened. Even the size of type/font and the margins were perfect. That saved a lot of time, money and most of all, frustration. I've recommended you to relatives, friends and co-workers. Thanks to the staff at deeds dot com !! I truly appreciate you. j

Thank you!

DOYCE F.

September 25th, 2019

Very helpful.Thank you

Thank you!

Marilyn T.

June 30th, 2020

This is an extremely user friendly site! I had been searching the internet for days for the proper Gift Deed document. I had no idea that my state, the great state of Mississippi had their own site. I am truly looking forward to using this site for additional available documents. Many more blessings to the creator of this site! Keep them coming! Thank You!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Tonia H.

October 6th, 2021

Could not be happier with the forms received. Everything went smooth from completing them to getting them recorded. No easy feat with our recorder, always seems to be an issue but not this time... Very Happy!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

William V.

July 18th, 2021

I finally got it. Thanks, William Vickery

Thank you!

Sophia G.

February 11th, 2022

Hassle free service , and don't have to wait in line

Thank you for your feedback. We really appreciate it. Have a great day!

Ivory J.

August 1st, 2020

Haven't processed any deed documents so far. I do agree that Deed.com website browsing tool will be helpful.

Thank you!

James C.

October 29th, 2019

First time user and was directed there from a search on my home state for a state form. The downloaded form was complete with instructions and sample filled out form. I was not happy about the cost for the form, but it did the job.

Thank you for your feedback. We really appreciate it. Have a great day!