Allen County Affidavit of Surviving Joint Tenant Form (Kentucky)

All Allen County specific forms and documents listed below are included in your immediate download package:

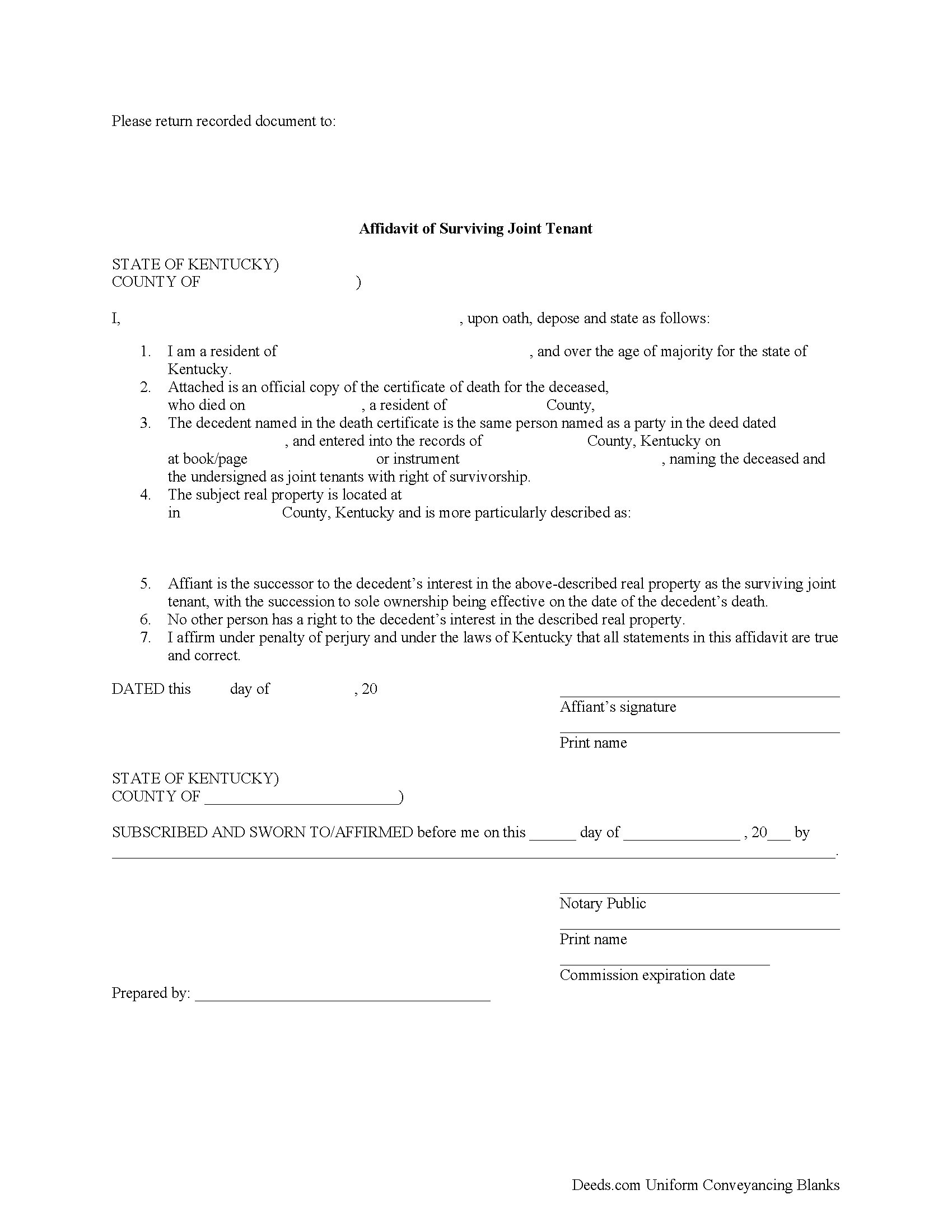

Affidavit of Surviving Joint Tenant Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Allen County compliant document last validated/updated 6/12/2024

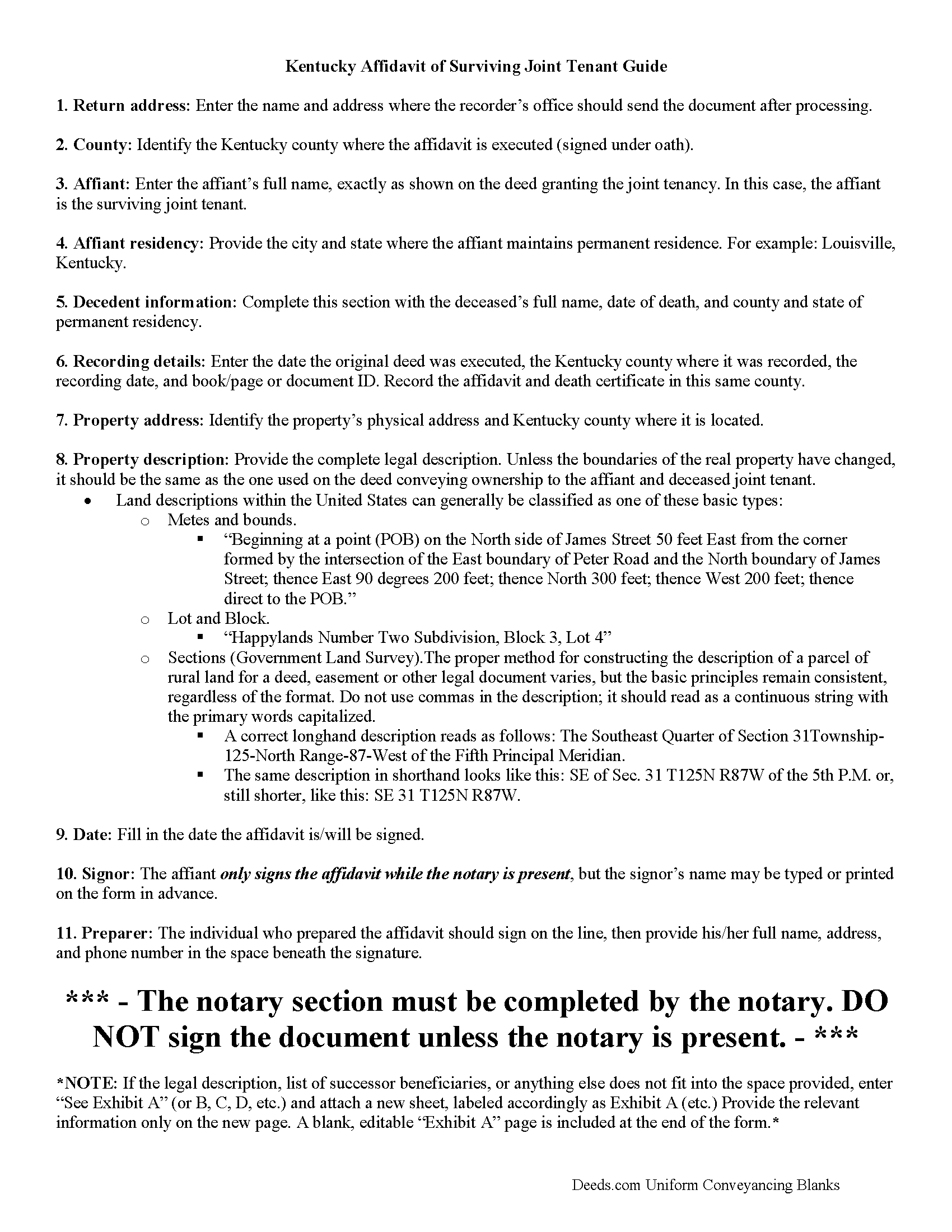

Affidavit of Surviving Joint Tenant Guide

Line by line guide explaining every blank on the form.

Included Allen County compliant document last validated/updated 6/7/2024

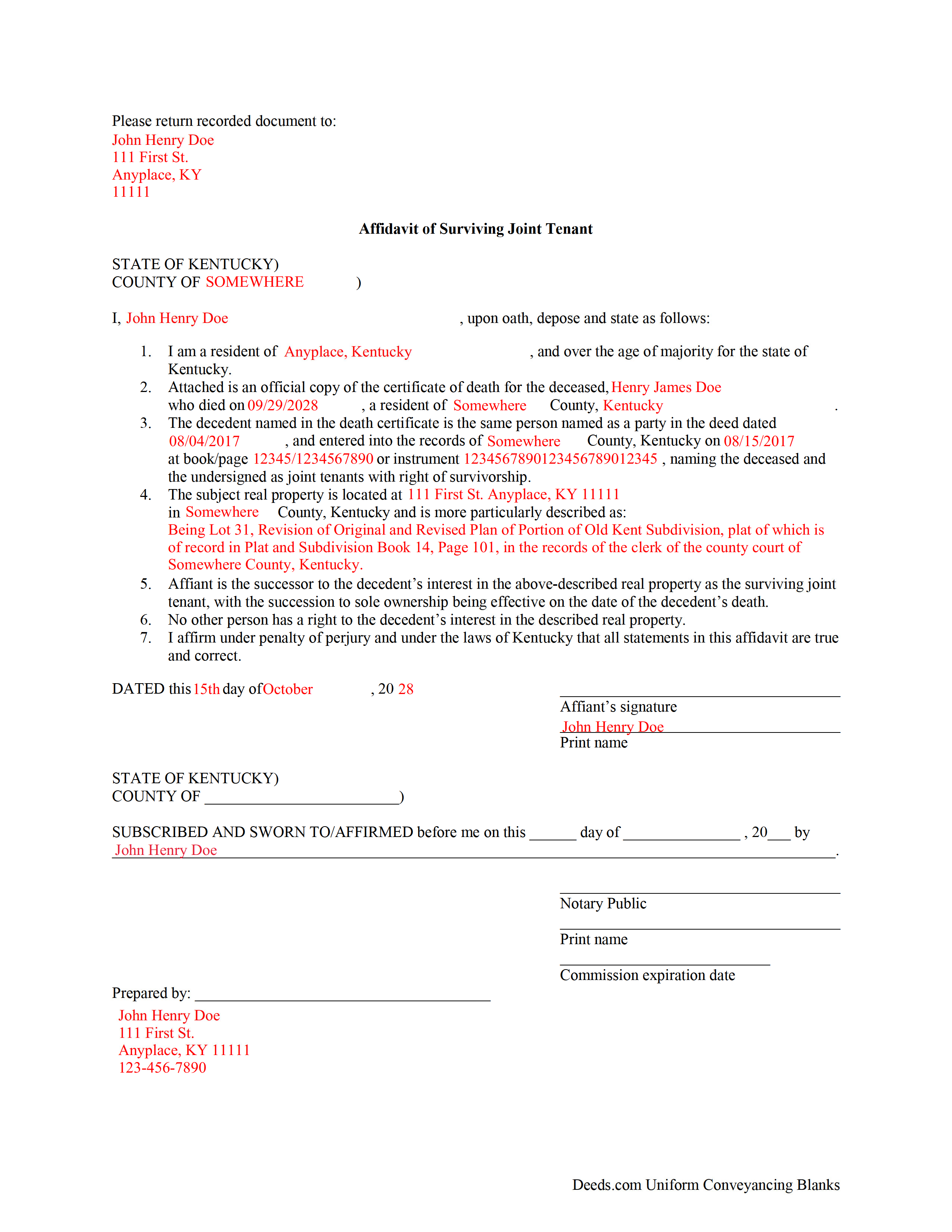

Completed Example of the Affidavit of Surviving Joint Tenant Document

Example of a properly completed form for reference.

Included Allen County compliant document last validated/updated 7/2/2024

The following Kentucky and Allen County supplemental forms are included as a courtesy with your order:

When using these Affidavit of Surviving Joint Tenant forms, the subject real estate must be physically located in Allen County. The executed documents should then be recorded in the following office:

Allen County Clerk

201 West Main St, Rm 6, Scottsville, Kentucky 42164

Hours: Mon - Fri 8:30 to 4:30 & Sat 8:00 to noon

Phone: (270) 237-3706

Local jurisdictions located in Allen County include:

- Adolphus

- Holland

- Scottsville

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Allen County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Allen County using our eRecording service.

Are these forms guaranteed to be recordable in Allen County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Allen County including margin requirements, content requirements, font and font size requirements.

Can the Affidavit of Surviving Joint Tenant forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Allen County that you need to transfer you would only need to order our forms once for all of your properties in Allen County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Kentucky or Allen County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Allen County Affidavit of Surviving Joint Tenant forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Real property ownership and conveyance is governed by Title XXII of the Kentucky Revised Statutes.

Kentucky's standard version of joint tenancy resembles tenancy in common, in that "when a joint tenant dies, the joint tenant's part of the joint estate, real or personal, shall descend to the joint tenant's heirs, or pass by devise, or go to the joint tenant's personal representative, subject to debts, curtesy, dower, or distribution" (KRS 318.120). Basically, this means that each joint tenant owns an individual share of the whole property.

Section 318.130 provides the rules for survivorship tenancy, in which the joint tenants share undivided rights to the whole property. By stating the intent to vest ownership as joint tenants with right of survivorship, when one owner dies, that portion is distributed equally among the survivors. Joint tenancy with right of survivorship is common between spouses.

In order to formalize the "automatic" transfer that occurs from a deceased joint tenant, many co-owners choose to record an affidavit of surviving joint tenant, accompanied by a certified copy of the decedent's death certificate. Recording such an affidavit provides notice to the public and any future purchasers about the updated information. It also maintains a clear chain of title (ownership history), which should reduce some of the complexity from future sales or conveyances of the real property.

Even though executing and recording an affidavit of surviving joint tenant clears the title, the deceased owner's name remains on the deed. The only way to remove that name is by executing and recording a new deed, preferably including a copy of the recorded affidavit.

(Kentucky Affidavit of Surviving Joint Tenant Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Allen County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Allen County Affidavit of Surviving Joint Tenant form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4363 Reviews )

AARON D.

July 26th, 2024

Forms were great ! Cancelled my lawyer's appointment & utilized your forms.rn

We are grateful for your feedback and looking forward to serving you again. Thank you!

Anne H.

July 25th, 2024

After some initial general confusion -- (we sold a small piece of land privately and therefore do not typically prepare such documentation (!)) -- we were able to purchase and download all forms from Deeds.com and understand how to complete it/them. The help is all there, we just needed to read and study it - the "Example" helped alot. We were able to complete the Document per your online form(s) and then take it to be signed/notarized - and take the completed paper document to the Registry -- and it is now all registered and we are All Set. rn Took the morning (only). THANK YOU. A wonderful tool!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

charles b.

July 21st, 2024

The product I needed was available, easy to download, access and complete. The instructions were very helpful. I had previously purchased another product which was terrible. I highly recommend Deeds.com

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

NANETTE G.

March 6th, 2021

I was so Happy to find a website that had deeds for property, reasonable price, helpful directions for diy flling out the deed info, no surprise hidden fees at checkout...what a relief. Saved hundreds because I can do it myself!

Great service here!!

Thank you for your feedback. We really appreciate it. Have a great day!

JANET D.

October 19th, 2019

was good choice for me but did not realize notary had to witness all 3 signatures at the same luckily had extra copy to be signed in her presence

Thank you!

Edward M.

February 15th, 2021

Great Forms, Detailed explanation on how to fill them out properly. No Issues at all.

Very e-z to use site and forms. Thanks

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Greg F.

October 14th, 2022

Sorry that this a little late. I'm VERY HAPPY with everything. The deeds paperwork was just what I was looking for. It was very to fill out, it was different than n the folks used years ago. I called the county clerk, and they were very helpful. Thank you for the paperwork it was easy to use and understand.

Thank you for your feedback. We really appreciate it. Have a great day!

Bryan C.

September 5th, 2021

Your service is sweet. It is self-explanatory and easy to download. I am excited about finding your website.

Thank you!

Mark S.

September 14th, 2023

The forms were easy and convenient to use

Thank you Mark. We appreciate your feedback.

Griselle M.

April 9th, 2020

Great service - it was my first time using the service and really recommend it. Due to COVID-19, my County Recorder's Office is closed and I was able to create the document using their vast templates, notarize it, and upload it into the system. The recording process took about 7 working days which is not bad considering that most people are working remotely. I will share this website and its many resources with my relatives and friends.

Thank you Griselle, glad we could help.

Darlene P.

November 12th, 2021

Deeds.com was a money saver for me. It made a daunting task of preparing a Quit Claim Deed a very simple task. I was happy that my documentation was accepted by my state and County first round.

Thank you Deeds.com

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joyce B.

July 25th, 2019

Very easy to purchase and download.

Thank you!

Steven b.

November 21st, 2021

We used this document in 2018 and it was acceptable to Jackson County Missouri. It worked and is valid.

Very happy with the product.

Thanks for the kind words, glad to see you back again. Have a great day!

Nancy A.

June 23rd, 2021

First time user and I was pleasantly surprised how quick and easy it was to get my Deed recorded. And the fee was not outrageous.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Karen O.

June 2nd, 2021

I often think I am smarter than I am. Thankfully there are people that know what they are doing so I can focus on my business and the big picture without worrying about the little things.

Thank you!