Hardin County Deed of Release for release of Mortgage Form

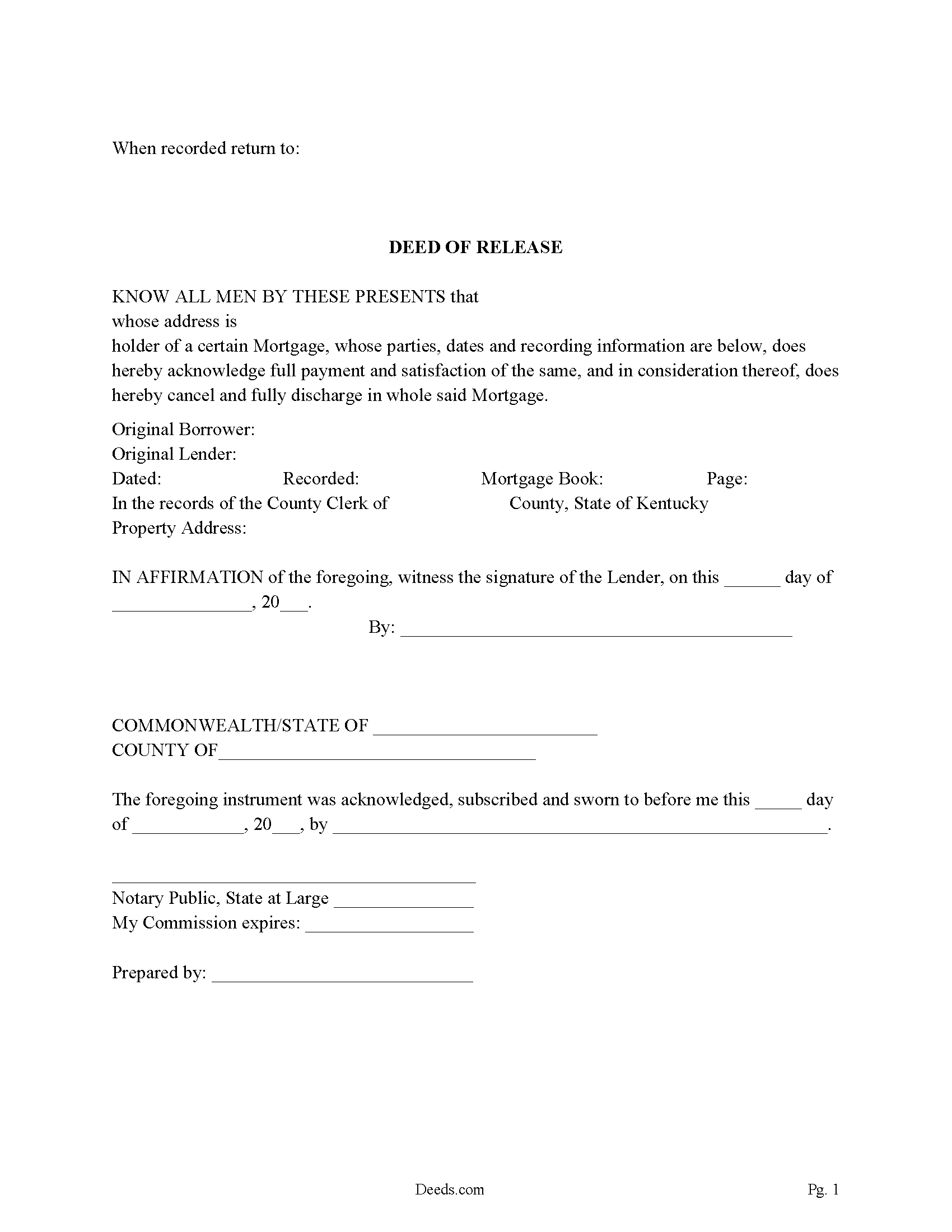

Hardin County Deed of Release Form

Fill in the blank form formatted to comply with all recording and content requirements.

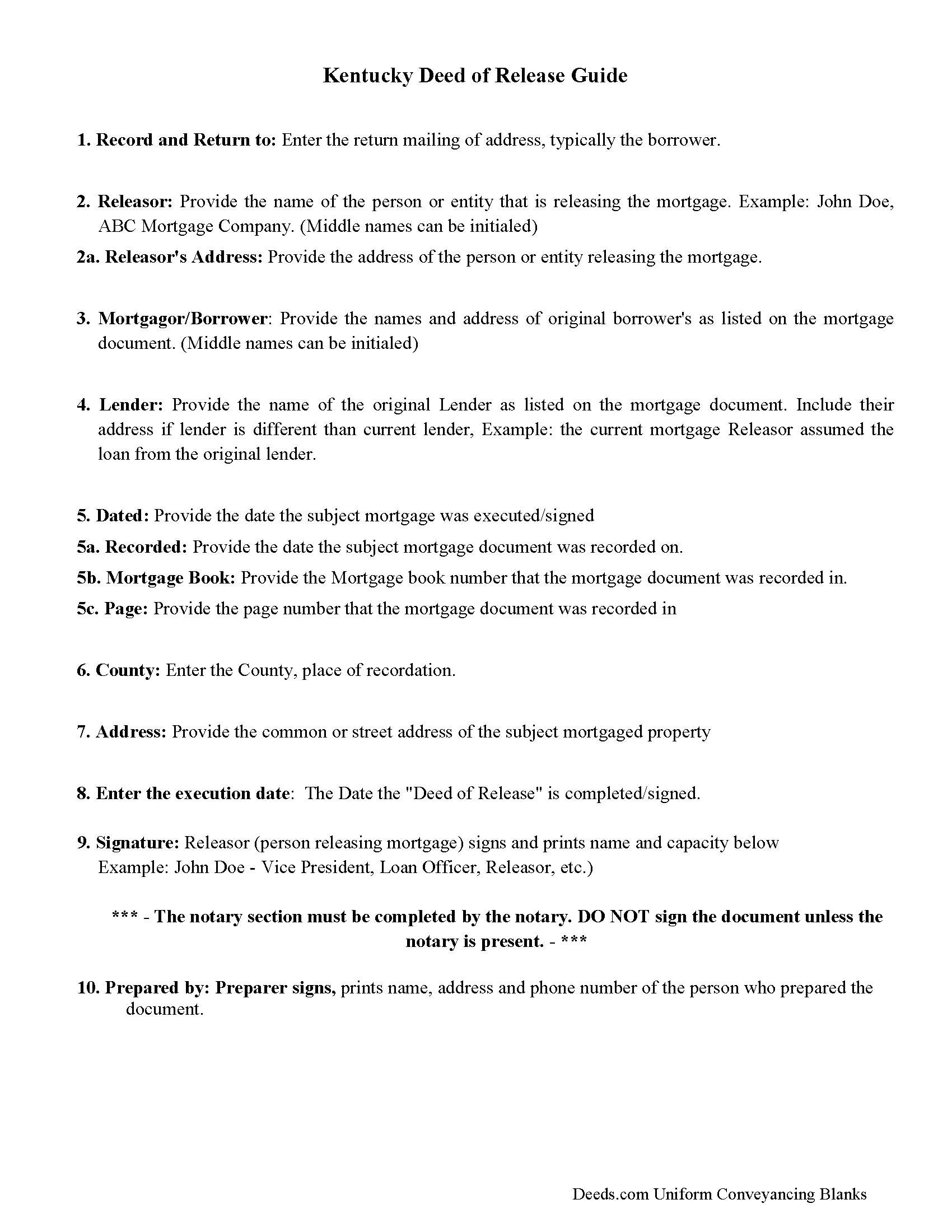

Hardin County Deed of Release Guidelines

Line by line guide explaining every blank on the form.

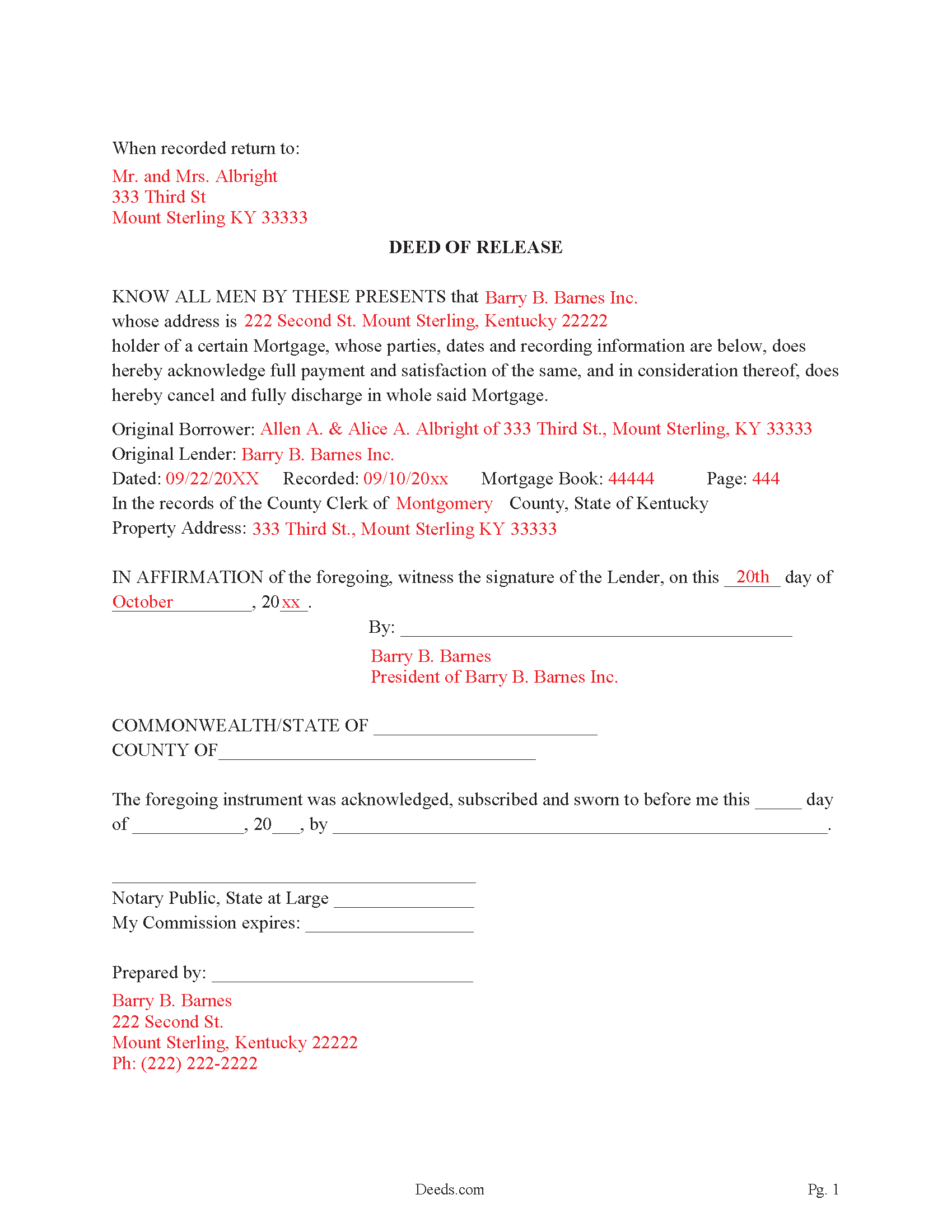

Hardin County Completed Example - Deed of Release

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Kentucky and Hardin County documents included at no extra charge:

Where to Record Your Documents

Hardin County Clerk

Elizabethtown, Kentucky 42701

Hours: 8:00 to 4:30 M-F

Phone: (270) 765-2171

Recording Tips for Hardin County:

- Bring your driver's license or state-issued photo ID

- Recording fees may differ from what's posted online - verify current rates

- Ask about their eRecording option for future transactions

- Both spouses typically need to sign if property is jointly owned

- Leave recording info boxes blank - the office fills these

Cities and Jurisdictions in Hardin County

Properties in any of these areas use Hardin County forms:

- Cecilia

- Eastview

- Elizabethtown

- Fort Knox

- Glendale

- Radcliff

- Rineyville

- Sonora

- Upton

- Vine Grove

- West Point

- White Mills

Hours, fees, requirements, and more for Hardin County

How do I get my forms?

Forms are available for immediate download after payment. The Hardin County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Hardin County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Hardin County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Hardin County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Hardin County?

Recording fees in Hardin County vary. Contact the recorder's office at (270) 765-2171 for current fees.

Questions answered? Let's get started!

"Deed of Release" often known as a "Satisfaction of Mortgage" in other states, is used to cancel, release and discharge a mortgage instrument.

In this form the releasor acknowledges satisfaction and in consideration thereof, does hereby cancel and fully discharge in whole said Mortgage.

A deed of release is a recorded document that generally has to be filed within 30 days of mortgage satisfaction to avoid damages. This form (shall be executed as deeds are executed and shall be as effectual for the purposes therein expressed.) (KRS 382.020 Deeds of release.)

382.360 Discharge of liens by deed or mortgage -- Assignment of mortgage -- Effect. (Effective until January 1, 2020)

(1) Liens by deed or mortgage may be discharged by an entry acknowledging their satisfaction on the margin of the record thereof, or in the alternative, at the option of the county clerk, in a marginal entry record, signed by the person entitled thereto, or his or her personal representative or agent, and attested by the clerk, or may be discharged by a separate deed of release, which shall recite the date of the instrument and deed book and the page wherein it is recorded. Such release in the case of a mortgage or deed of trust shall have the effect to reinstate the title in the mortgagor or grantor or person entitled thereto. Each entry in the marginal entry record shall be linked to its respective referenced instrument in the indexing system for the referenced instruments.

(2) If a lien or mortgage is released by a deed of release, the clerk shall immediately, at the option of the clerk, either link the release and its filing location to its respective referenced instrument in the indexing system for the referenced instrument, or endorse on the margin of the record wherein the lien is retained "Released by deed of release (stating whether in whole or in part) lodged for record (giving date, deed book and page wherein such deed of release may be found)" and the clerk shall also attest such certificate. The clerk shall cause the original deed of release to be delivered to the mortgagor or grantor or person entitled thereto.

(3) When a mortgage is assigned to another person, the assignee shall file the assignment for recording with the county clerk within thirty (30) days of the assignment and the county clerk shall attest the assignment and shall note the assignment in the blank space, or in a marginal entry record, beside a listing of the book and page of the document being assigned. Provided, however, that an assignee that reassigns the note prior to the thirtieth day after first acquiring the assignment may request that the subsequent assignee file the unfiled assignment with the new reassignment.

(4) Delivering an assignment to the assignee or a lien release to the mortgagor shall not substitute for filing the assignment or release with the county clerk, as required by this section.

(5) Notwithstanding the provisions of this section, nothing in this chapter shall require the legal holder of any note secured by lien in any deed or mortgage to file a release of any mortgage when the mortgage securing such paid note also secures a note or other obligation which remains unpaid.

(6) Failure of an assignee to record a mortgage assignment shall not affect the validity or perfection, or invalidity or lack of perfection, of a mortgage lien under applicable law.

Formatted to meet Kentucky recording standards for documents that encumber title to real property. The preparer of the instrument must endorse/sign, print name, address. (see KRS 382.335 (1)). return mail address (See KRS 382.335 & KRS 382.240)

(Kentucky Deed of Release Package includes form, guidelines, and completed example)

Important: Your property must be located in Hardin County to use these forms. Documents should be recorded at the office below.

This Deed of Release for release of Mortgage meets all recording requirements specific to Hardin County.

Our Promise

The documents you receive here will meet, or exceed, the Hardin County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Hardin County Deed of Release for release of Mortgage form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Randi M.

November 30th, 2020

We could never figure out how to get to the website to order.

Sorry to hear that Randi. We do hope that you found something more suitable to your needs elsewhere.

Kevin B.

March 31st, 2019

It looks like it can be a huge time saver. I did a deed and appeared very professional.

Thank you for your feedback. We really appreciate it. Have a great day!

Lynd P.

January 14th, 2019

Good

Thanks Lynd.

Theresa M.

August 12th, 2023

Simple and quick service!!

Thank you!

Barbara D.

October 9th, 2019

Appreciate this service!

Thank you!

Adam W.

October 6th, 2021

Great stuff

Thank you!

Desmond L.

December 27th, 2018

Easy access

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Bruce C.

February 13th, 2024

Easy to navigate. The guide and sample helped a lot, including the availability of "Exhibit A". Knowing your documents are guaranteed to be in the required format and the ease of using your forms has been a great service, Thank you!

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Kathleen M.

April 14th, 2020

Your Service was excellent. Very responsive. Thank you.

Thank you!

Jordan L.

February 16th, 2023

Quick and easy. Lets do it again!

Thank you!

Christopher B.

October 3rd, 2020

The service was simple and easy enough but the UI isn't the easiest on the eyes and the process is a tad strange.

Thank you for your feedback. We really appreciate it. Have a great day!

Robert H.

April 18th, 2020

I am very pleased with your service.

Thank you!

Laryn A.

March 3rd, 2020

Very happy with the beneficiary deed forms packet. It was helpful to have an example of a properly filled out form. The only suggestion would be is to show where the exemption code should be placed on the form.

Thank you for your feedback. We really appreciate it. Have a great day!

Grace V.

February 29th, 2020

Easy to use

Thank you!

Kathy C.

August 19th, 2021

Lee County, FL did accept the "Satisfaction of Mortgage" form. It was easy to fill out except for a couple of areas. Your fill in areas need to accommodate for whatever space needed for the pertinent information we as customers have to fill out. As individuals, banks have their own. Example when there are more than 1 party and information needed. Example of Document #; I was 1 number short (using Exhibit A was ridiculous.) So I had to write in the # after printing. Very unprofessional looking on a legal document. Just saying. Also, in Lee County, FL your document # is called "Instrument #, not said in your instructions. Hope this information helps for updates on your forms.

Thank you for your feedback. We really appreciate it. Have a great day!