Hardin County Partial Conditional Lien Waiver Form

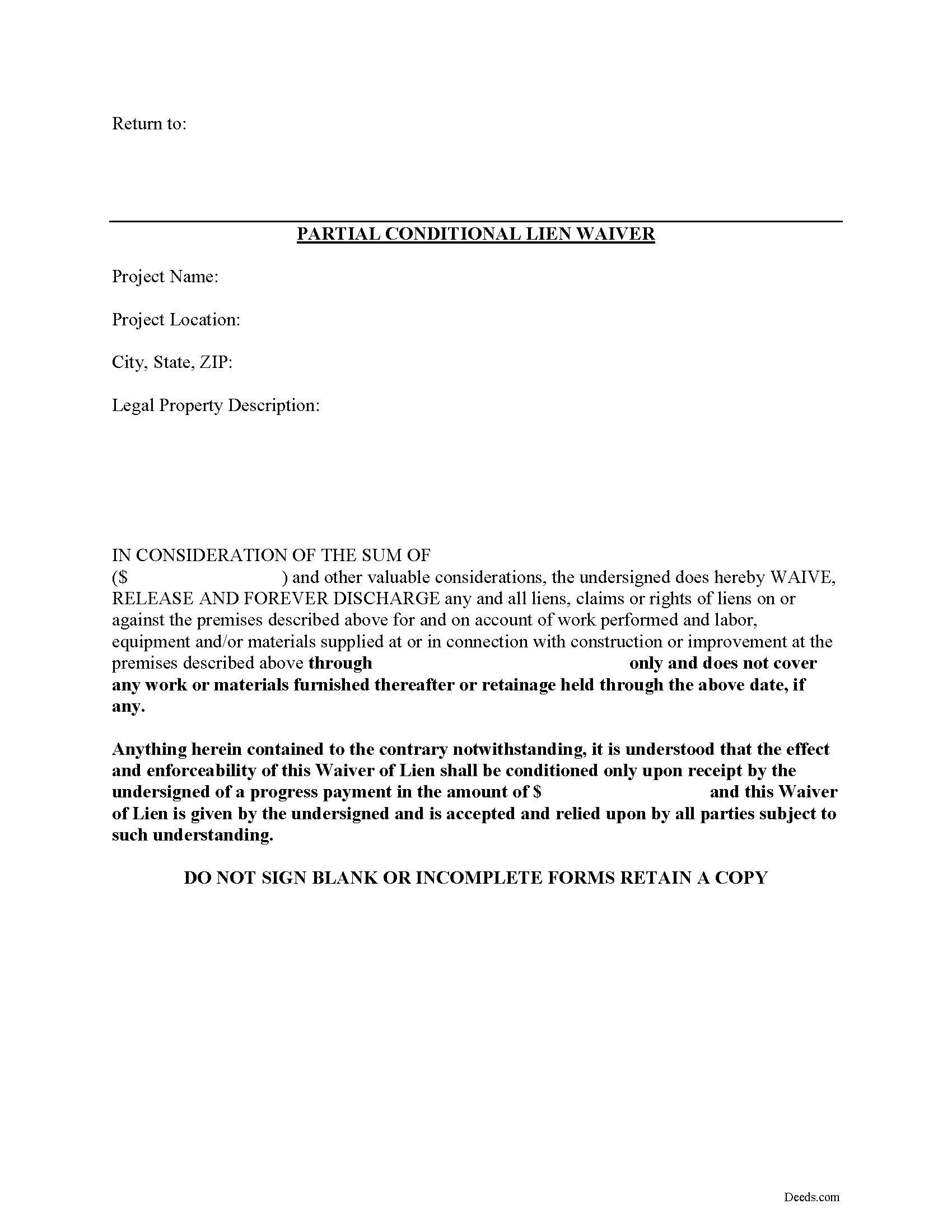

Hardin County Partial Conditional Lien Waiver Form

Fill in the blank Partial Conditional Lien Waiver form formatted to comply with all Kentucky recording and content requirements.

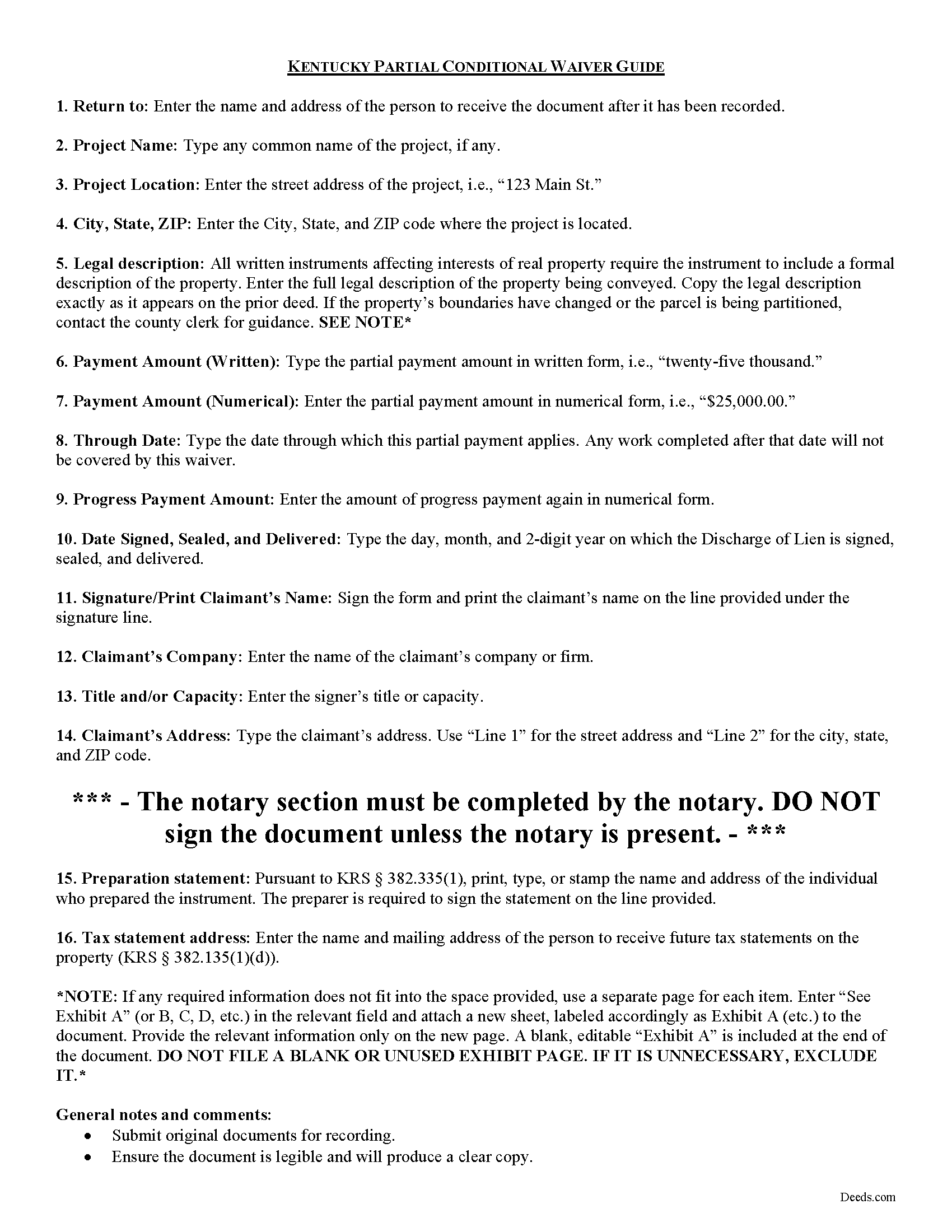

Hardin County Partial Conditional Lien Waiver Guide

Line by line guide explaining every blank on the form.

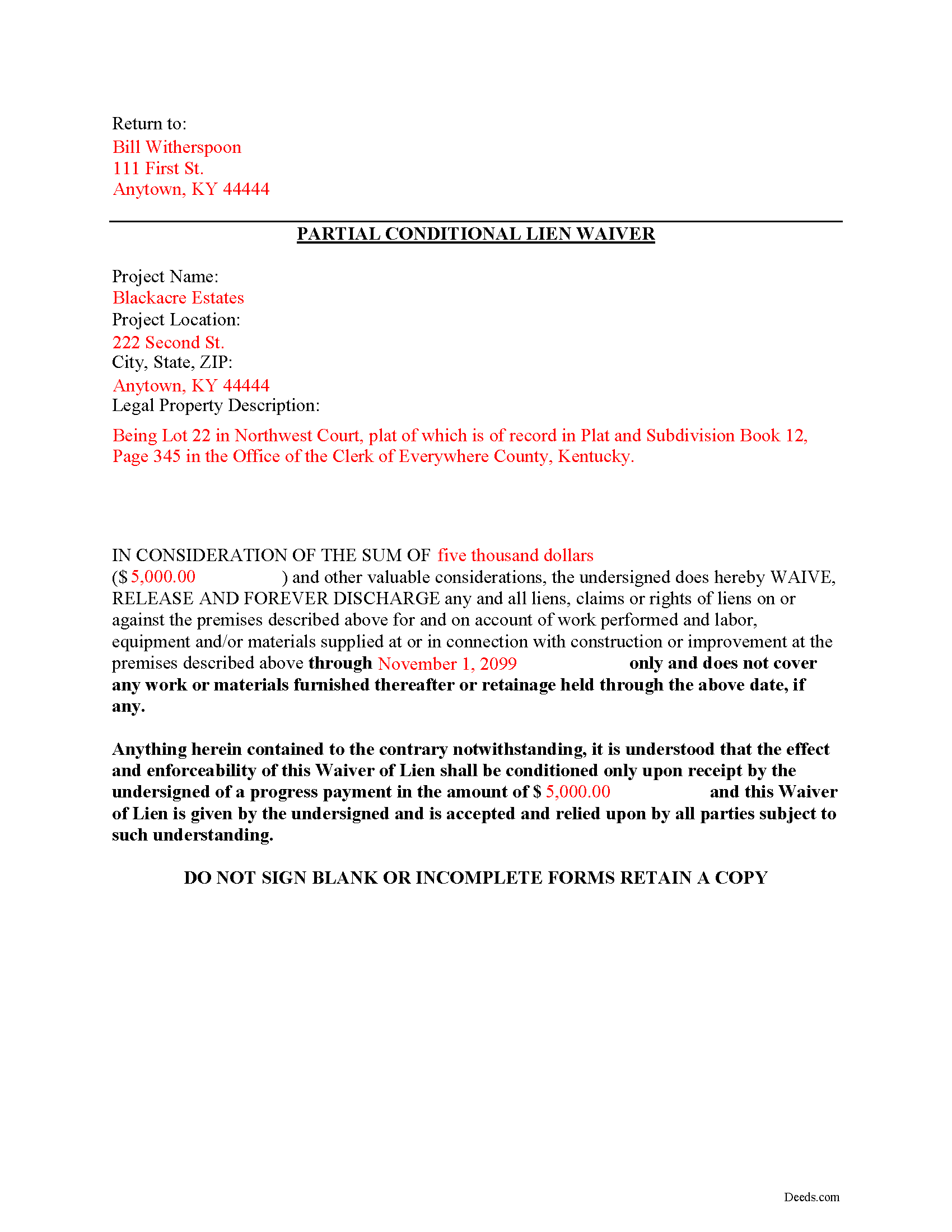

Hardin County Completed Example of the Partial Conditional Lien Waiver Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Kentucky and Hardin County documents included at no extra charge:

Where to Record Your Documents

Hardin County Clerk

Elizabethtown, Kentucky 42701

Hours: 8:00 to 4:30 M-F

Phone: (270) 765-2171

Recording Tips for Hardin County:

- Verify all names are spelled correctly before recording

- Ask if they accept credit cards - many offices are cash/check only

- Request a receipt showing your recording numbers

- Have the property address and parcel number ready

- Mornings typically have shorter wait times than afternoons

Cities and Jurisdictions in Hardin County

Properties in any of these areas use Hardin County forms:

- Cecilia

- Eastview

- Elizabethtown

- Fort Knox

- Glendale

- Radcliff

- Rineyville

- Sonora

- Upton

- Vine Grove

- West Point

- White Mills

Hours, fees, requirements, and more for Hardin County

How do I get my forms?

Forms are available for immediate download after payment. The Hardin County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Hardin County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Hardin County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Hardin County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Hardin County?

Recording fees in Hardin County vary. Contact the recorder's office at (270) 765-2171 for current fees.

Questions answered? Let's get started!

Mechanic's liens are governed under Chapter 376 of Kentucky Revised Statutes (K.R.S.). Although Kentucky law doesn't provide a required format for a waiver, claimants can use various types of lien waivers in order to simplify payments between contractors, subcontractors, customers, and property owners. A waiver is a knowing relinquishment of a right. In this case, the person granting the waiver is relinquishing the right to seek a mechanic's lien for all or part of the amount due. This assurance is usually enough to get the other party to pay.

Lien waivers are generally either based on a partial/progress payment or a final payment, and may be conditional or unconditional. Partial waivers release a portion of the lien rights, determined by the amount paid. Final waivers release all lien rights because the balance is paid in full. Conditional waivers give more protection to the claimant, and are dependent on any payments clearing the bank. Unconditional waivers give the advantage to the party responsible for paying, and take effect immediately upon recording, regardless of whether or not the bank covers the check.

Regardless of their nature, waivers must identify the parties, a description of the location and type of goods and/or services provided, significant dates, fees, and payments. Record the completed waiver in the office responsible for maintaining the land records for the county where the subject property is located.

A partial conditional waiver is used when a progress or partial payment is made and money is still due and owing. The waiver applies only to the partial payment amount and is conditioned upon the actual receipt of that money.

This article is provided for information purposes only and should not be relied upon as a substitute for the advice from a legal professional. Please speak with an attorney with questions about using a lien waiver, or for any other issues related to liens in Kentucky.

Important: Your property must be located in Hardin County to use these forms. Documents should be recorded at the office below.

This Partial Conditional Lien Waiver meets all recording requirements specific to Hardin County.

Our Promise

The documents you receive here will meet, or exceed, the Hardin County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Hardin County Partial Conditional Lien Waiver form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Lauren D.

May 13th, 2019

Prompt and helpful

Thank you!

Andrea R.

July 10th, 2020

Easy and fast. Thank you so much!!

Thank you!

Ralph B.

November 25th, 2023

My needs were met quickly and efficiently with very little wait. Deeds.com made it easy to understand and use their program and I couldn't be more happy with the results!

It was a pleasure serving you. Thank you for the positive feedback!

Desiree R.

August 19th, 2024

very easy to use

We are delighted to have been of service. Thank you for the positive review!

Shirley G.

March 8th, 2019

Excellent so far. Quick response!

Thank you!

Rip V.

October 5th, 2022

Found the forms I needed but had to type these out my self in Word since these forms do not allow any information to be saved. I understand you want this to be proprietary information but you failed to deliver a usable product. I printed this template and built my own in microsoft word. Good examples and instructions with poor execution. I lost hours of typing and nearly lost real estate deals due to these documents not being in a format ready to use. Will be using another service next time or buying these as guides alone.

Thank you for taking the time to leave your feedback. Sorry to hear of the struggle you had using our forms. We will look into the issues you reported to see what we can do to provide a better product. For your trouble we have provided a full refund of your order.

Shawn B.

November 17th, 2021

Deeds.com support is very quick and responsive. Would use again and recommend to others in need of e-recording.

Thank you for your feedback. We really appreciate it. Have a great day!

Peggy H.

December 9th, 2022

Very good!

Thank you!

Norman J.

October 3rd, 2023

I really enjoyed your service. It was great.

Thank you!

Donald P.

November 12th, 2019

Very fast and efficient. Easy to fill out but was upset the latest tax exemptions ruled in 2014 did not seem to be included. Exclusion of sale to blood relatives, etc. _ the one I needed.

Thank you for your feedback. We really appreciate it. Have a great day!

Angelique A.

December 27th, 2018

Very helpful and quick customer service. Highly recommended

Thank you for your feedback Angelique, we appreciate you. Have a great day!

Kate J.

January 10th, 2022

Easy to use.

Thank you!

Terri A B.

July 17th, 2025

The process was easy and cost was reasonable. My only suggestion is to allow user the ability to shorten the space between the county and state and the space after the month. I needed to draw a line at the courthouse before they would file it.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

Rebecca M.

December 28th, 2021

This was pretty easy to fill out. The directions on all of the forms was very good. This should make life much easier at the County Recorder. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Remon W.

January 26th, 2021

Excellent and fast service. I will be using this site as needed in the future.

Thank you Remon, we appreciate you.