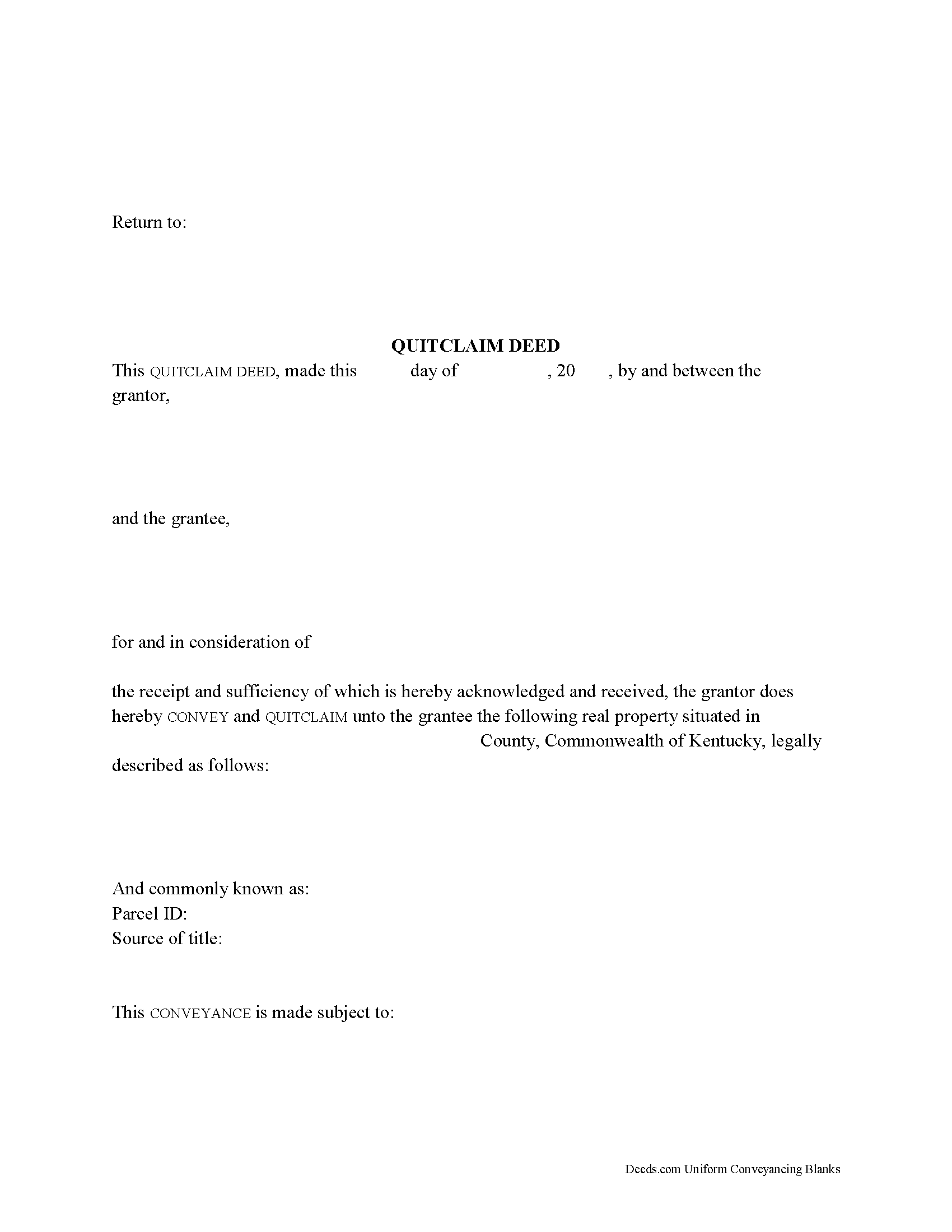

Harrison County Quitclaim Deed Form

Harrison County Quitclaim Deed Form

Fill in the blank Quitclaim Deed form formatted to comply with all Kentucky recording and content requirements.

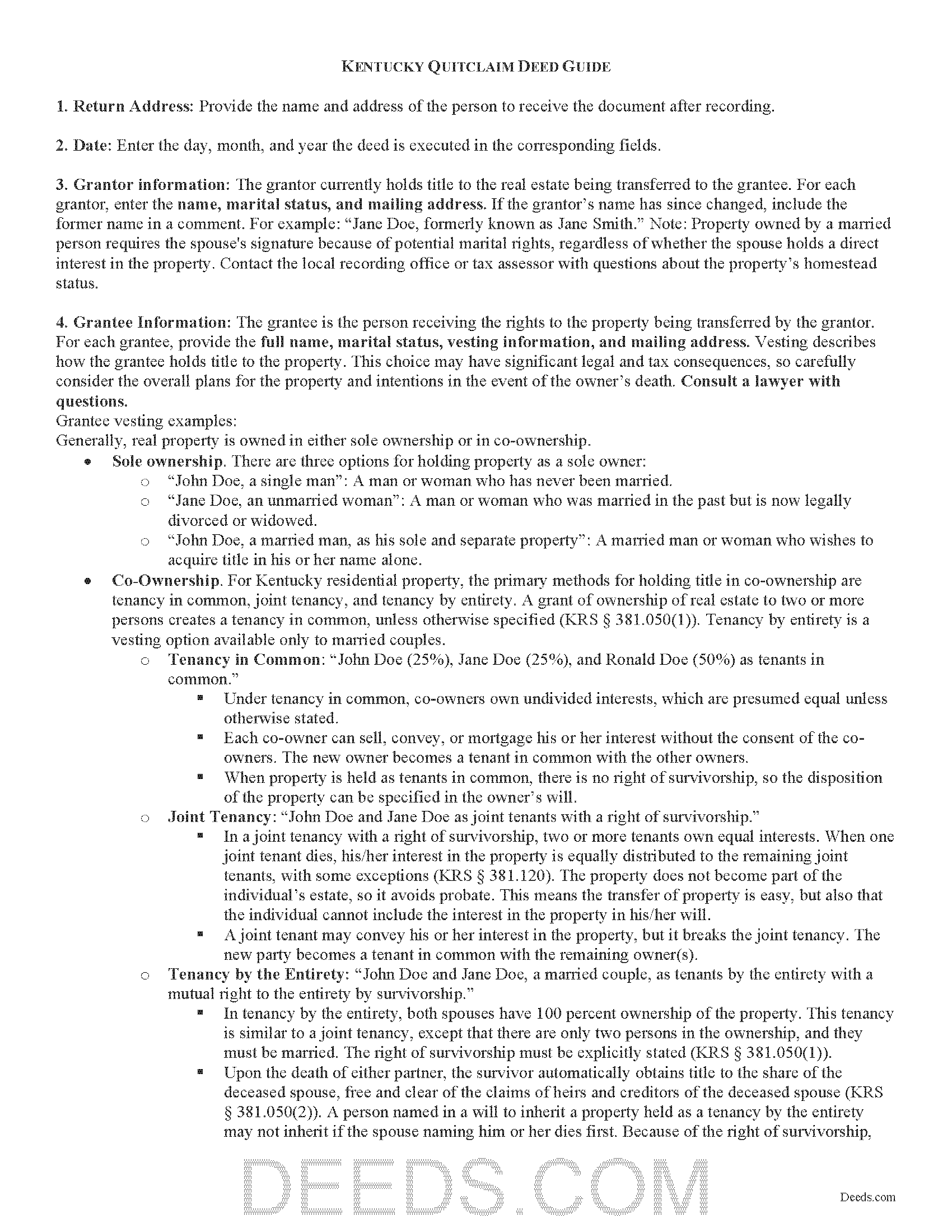

Harrison County Quitclaim Deed Guide

Line by line guide explaining every blank on the Quitclaim Deed form.

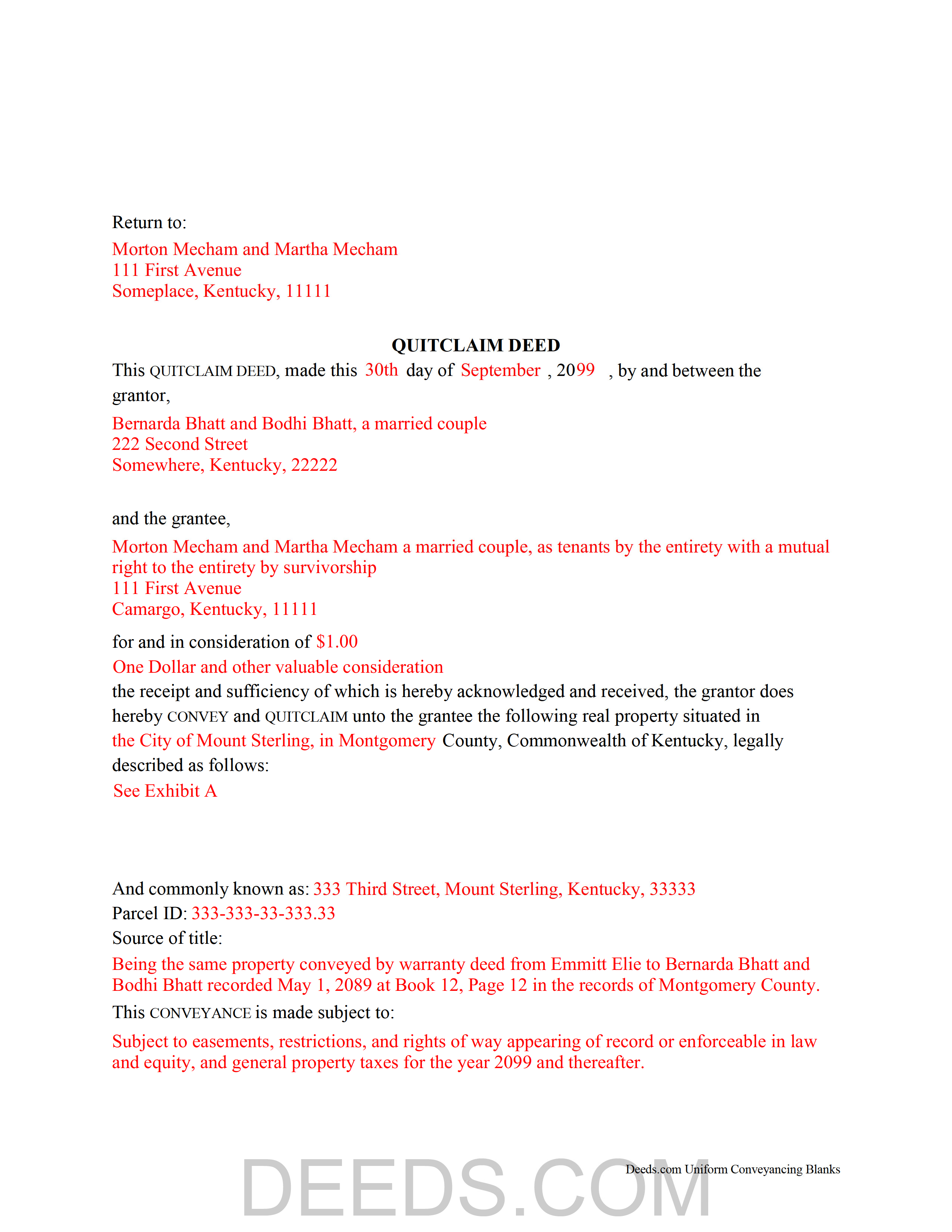

Harrison County Completed Example of the Quitclaim Deed Document

Example of a properly completed Kentucky Quitclaim Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Kentucky and Harrison County documents included at no extra charge:

Where to Record Your Documents

Harrison County Clerk

Cynthiana, Kentucky 41031

Hours: 8:30am to 4:00pm on Mon-Wed, Fri & 8:30am to 5:00pm on Thur

Phone: (859) 235-0513 for Deed Room

Recording Tips for Harrison County:

- Ask if they accept credit cards - many offices are cash/check only

- Double-check legal descriptions match your existing deed

- Verify all names are spelled correctly before recording

Cities and Jurisdictions in Harrison County

Properties in any of these areas use Harrison County forms:

- Berry

- Cynthiana

Hours, fees, requirements, and more for Harrison County

How do I get my forms?

Forms are available for immediate download after payment. The Harrison County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Harrison County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Harrison County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Harrison County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Harrison County?

Recording fees in Harrison County vary. Contact the recorder's office at (859) 235-0513 for Deed Room for current fees.

Questions answered? Let's get started!

Real property transfers are governed by Chapter 382 of the Kentucky Revised Statutes.

Although they are not defined in the statutes, Kentucky accepts quitclaim deeds to transfer the rights, title, and interest in real estate, if any, from the grantor (seller) to the grantee buyer), with no protections for the grantee. There may be potential unknown claims or restrictions on the title, and the buyer accepts the risk that the grantor may not have complete ownership of the property. Because of this, quitclaim deeds are commonly used to clear title, for transfers between family members, or in other situations where warranties are not necessary.

A lawful quitclaim deed identifies the names and addresses of each grantor and grantee. Kentucky law requires all recorded documents or documents affecting a change in property ownership to contain information on how the grantee will hold title (vesting). For residential property, the primary methods for holding title in co-ownership are tenancy in common, joint tenancy, and tenancy by entirety. A grant of real estate to two or more persons creates a tenancy in common, unless otherwise specified. Tenancy by entirety is available to married couples only (KRS 381.050(1)).

Provide the complete legal description of the property and a reference to the previously recorded document transferring title to the grantor. State the full amount of consideration exchanged during the transfer, or, if nominal or no consideration has been exchanged, the fair cash value of the property (KRS 385.135). The county assesses a transfer tax on the consideration, due at the time of recording, unless the transaction is exempt under KRS 142.050. At the end of the instrument, include the preparer's name, address, and signature (KRS 382.335) and identify the in-care-of tax address (KRS 382.110(2)). Finally, the form must meet all state and local standards for recorded documents.

The signatures of both the grantor and grantee must be notarized for the deed to be recorded (KRS 382.130). Submit the signed, completed deed, along with any supplemental documentation necessary for the specific transaction, to the local county clerk's office of the county in which the property is located (KRS 382.110(1)). Recording the deed preserves a clear chain of ownership history and provides public notice of the transfer.

This article is provided for informational purposes only and is not a substitute for legal advice. Contact an attorney with questions about quitclaim deeds or for any other issues related to the transfer of real property in Kentucky.

(Kentucky Quitclaim Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Harrison County to use these forms. Documents should be recorded at the office below.

This Quitclaim Deed meets all recording requirements specific to Harrison County.

Our Promise

The documents you receive here will meet, or exceed, the Harrison County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Harrison County Quitclaim Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4580 Reviews )

Thomas W.

February 9th, 2021

Found what I needed, thanks.

Thank you!

Linda P.

October 26th, 2020

Very informative. It was very helpful.

Thank you!

Nancy H.

December 31st, 2018

Site was excellent and saved a trip to the County office to pick up forms.

Thank you Nancy. Glad we could help. Have a great day!

Michael H.

April 8th, 2022

another exact match with what i needed, thank you! the recorded of deeds accepted it with no problem.

Thank you for your feedback. We really appreciate it. Have a great day!

Barbara D.

October 9th, 2019

Appreciate this service!

Thank you!

Jessica H.

March 3rd, 2021

As a first time user I was a little skeptical of the service. But Deeds.com put all my worries aside. Their service is quick and easy. I will definitely be using it again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Gretchen N.

February 8th, 2019

The filled out form could have been placed on the real form then deleted with current info. Form quite simplified but example & help good.

Thank you for your feedback Gretchen.

GLENN C.

January 22nd, 2020

Your response was very thorough

Thank you for your feedback. We really appreciate it. Have a great day!

Dennis F.

December 20th, 2024

The release of mortgage form was OK, and accepted at the recorder's office, but there were some problems. Many of the fields to type in were too small to accept the data, and I could not find a way to change the field size or use a smaller font. Otherwise I was satisfied.

Your feedback is a crucial part of our dedication to ongoing improvement. Thank you for your insightful comments.

Dagmar R.

April 28th, 2021

Great Service, very helpful and knowledgeable.

Thank you for your feedback. We really appreciate it. Have a great day!

Allen H.

April 30th, 2021

Your program was invaluable to us, I used it for my Mom's estate and when she passed the transition was seamless and no probate was involved. I am going to use this for myself to transfer my property over to my children in upon my death. Can't say enough positive things about it. Thanks, Allen

Thank you!

Wanda B.

July 22nd, 2022

Great prompt and efficient service!

Thank you for your feedback. We really appreciate it. Have a great day!

CHARLES V.

June 4th, 2019

Legit. Reasonable prices.

Thank you for your feedback. We really appreciate it. Have a great day!

Barbara A.

April 25th, 2024

Always helpful!

We are thankful for your continued support and feedback, which inspire us to continuously improve. Thank you..

Robert S.

March 2nd, 2025

My Quick claim formsi downloaded had not come through so I contacted customer service and they provided me with the instructions on how to retrieve my forms, A plus service.

We are delighted to have been of service. Thank you for the positive review!