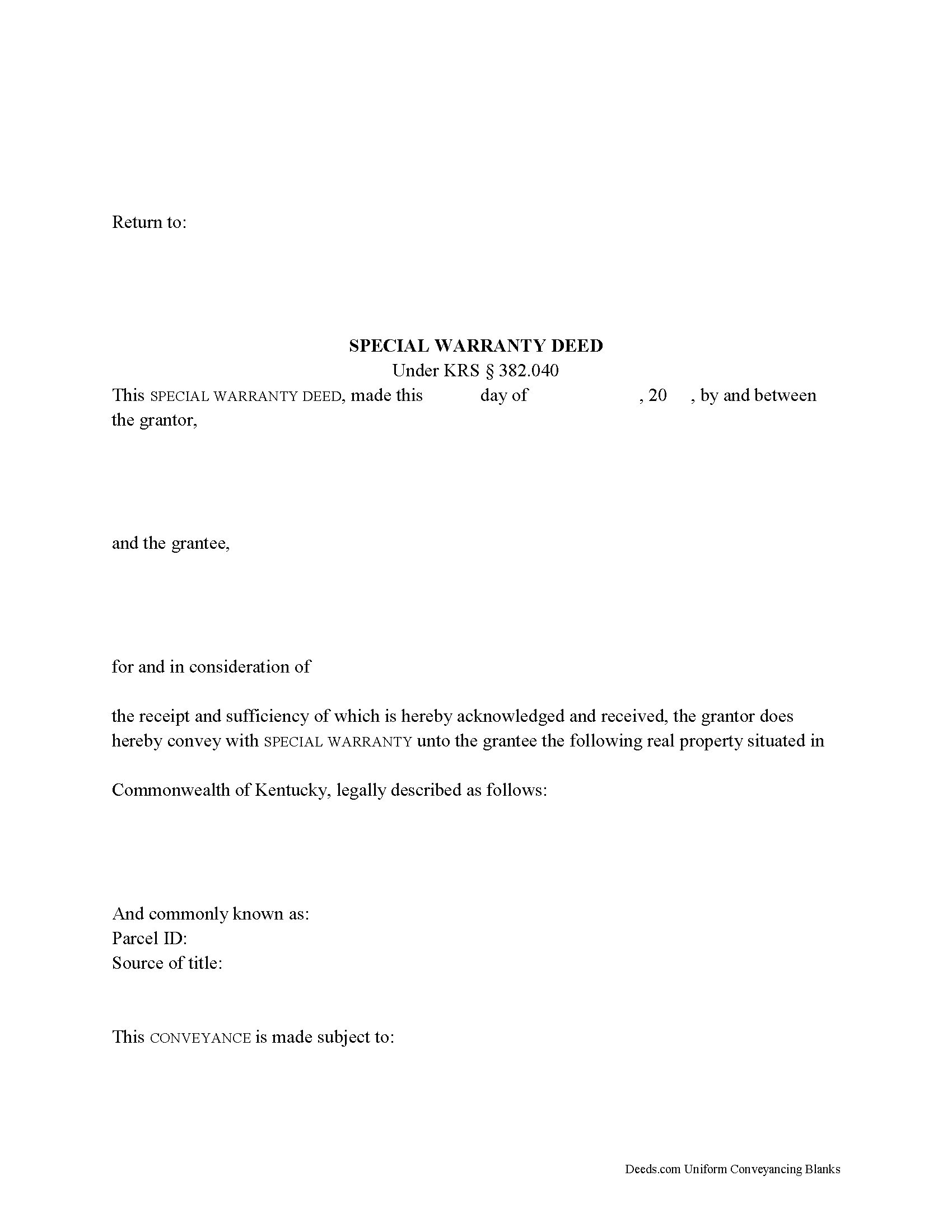

Hardin County Special Warranty Deed Form

Hardin County Special Warranty Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

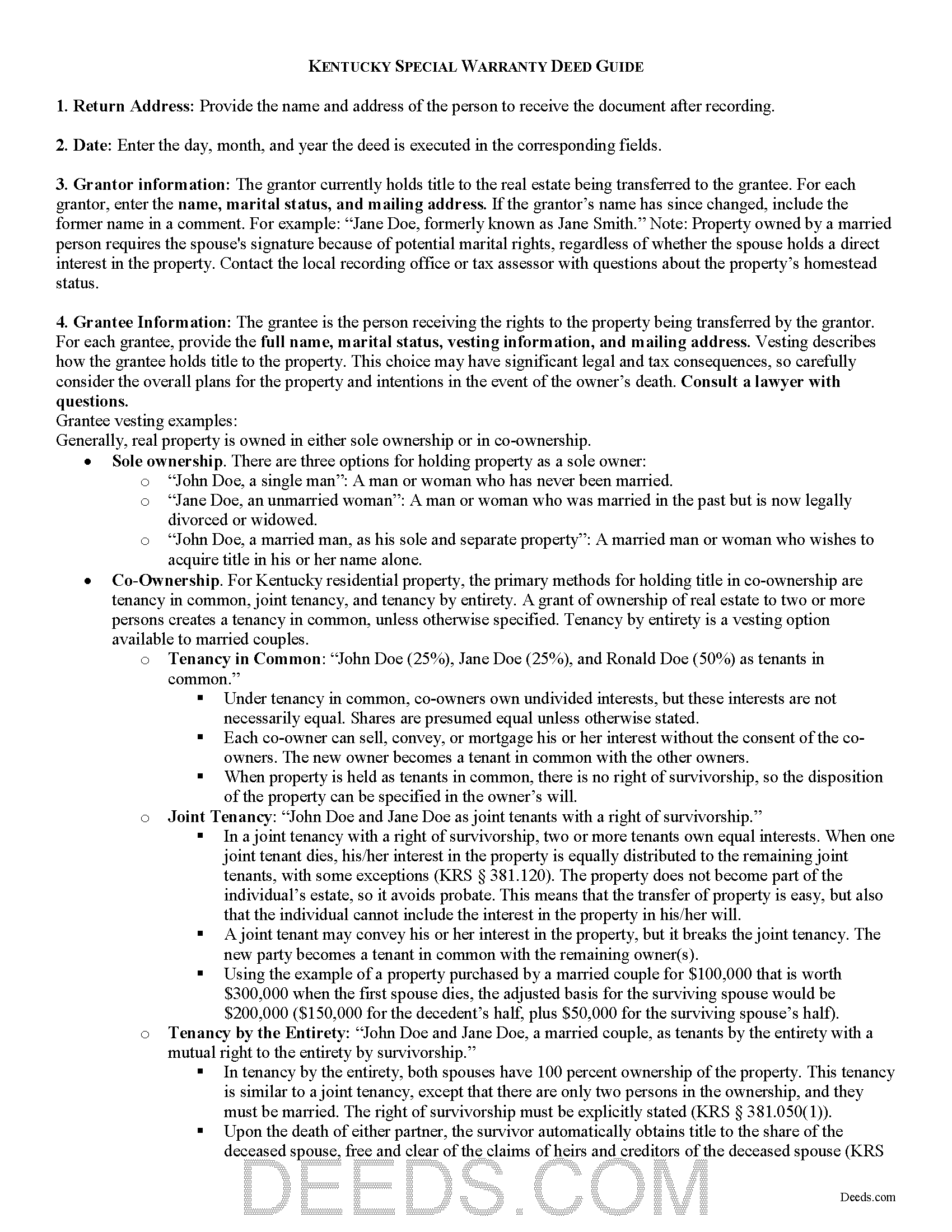

Hardin County Special Warranty Deed Guide

Line by line guide explaining every blank on the form.

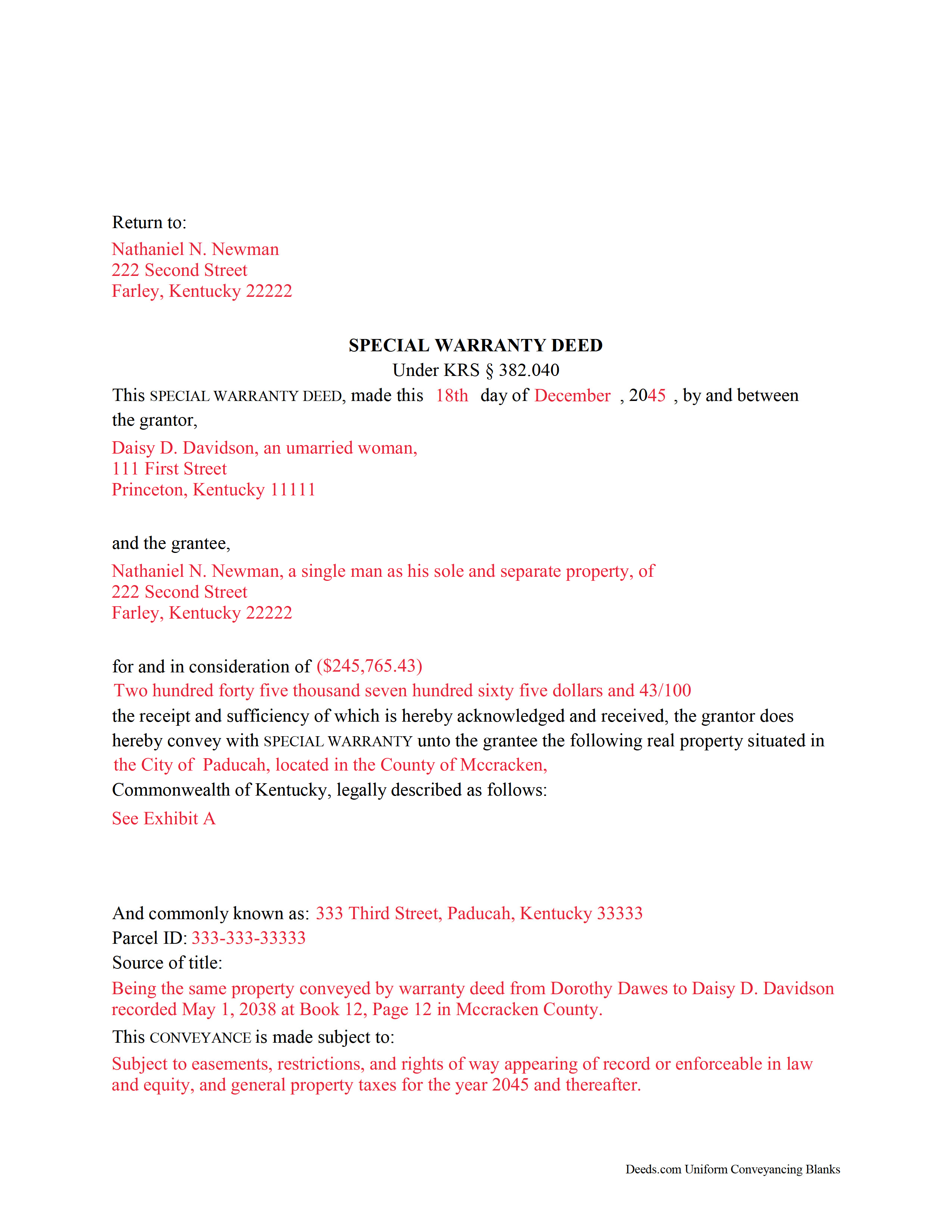

Hardin County Completed Example of the Special Warranty Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Kentucky and Hardin County documents included at no extra charge:

Where to Record Your Documents

Hardin County Clerk

Elizabethtown, Kentucky 42701

Hours: 8:00 to 4:30 M-F

Phone: (270) 765-2171

Recording Tips for Hardin County:

- Verify all names are spelled correctly before recording

- Make copies of your documents before recording - keep originals safe

- Recording fees may differ from what's posted online - verify current rates

Cities and Jurisdictions in Hardin County

Properties in any of these areas use Hardin County forms:

- Cecilia

- Eastview

- Elizabethtown

- Fort Knox

- Glendale

- Radcliff

- Rineyville

- Sonora

- Upton

- Vine Grove

- West Point

- White Mills

Hours, fees, requirements, and more for Hardin County

How do I get my forms?

Forms are available for immediate download after payment. The Hardin County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Hardin County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Hardin County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Hardin County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Hardin County?

Recording fees in Hardin County vary. Contact the recorder's office at (270) 765-2171 for current fees.

Questions answered? Let's get started!

Real property conveyances are governed by Chapter 382 of the Kentucky Revised Statutes.

Special warranty deeds are statutory under KRS 382.040 and transfer ownership of real property from the grantor (the seller) to the grantee (the buyer) with limited warranties of title. They provide guarantees that the grantor is the true owner of the property, has the legal right to convey it, and will defend the title against any claims originating from the time they owned the property. However, the grantor does not guarantee that there are no other title defects before they owned it, so this type of deed offers more protection for the grantor, and less for the grantee.

A lawful special warranty deed includes the names and addresses of each grantor and grantee. Kentucky requires all recorded documents or documents affecting a change in property ownership to contain information on how the grantee will hold title. For residential property, the primary methods for holding title in co-ownership are tenancy in common, joint tenancy, and tenancy by entirety. A grant of ownership of real estate to two or more persons creates a tenancy in common, unless otherwise specified. Tenancy by entirety is a vesting option available to married couples only (KRS 381.050(1)).

Provide a complete legal description of the property and the source of the current grantor's title. The deed must also include the preparer's name, address, and signature (KRS 382.335), and the in-care-of tax address (KRS 382.110(2)). State law also stipulates either listing the full amount of consideration exchanged for the transfer, or, if nominal or no consideration has been exchanged, the fair cash value of the property (KRS 385.135). The county assesses a transfer tax on the consideration, due at the time of recording, unless the transaction is exempt under KRS 142.050.

Finally, the form must meet all state and local standards for recorded documents, which may vary from county to county. Confirm these requirements with the local recording office.

Both the grantor and grantee must sign the deed in front of a notary for the deed to be recorded (KRS 382.130). Submit the completed deed, along with any supplemental documentation necessary for the specific transaction, to the county clerk's office of the county in which the property is situated (KRS 382.110(1)). Recording preserves the ownership history of the property and provides public notice of the transfer, which protects both the grantor and the grantee from claims based on false information.

This article is provided for informational purposes only and is not a substitute for legal advice. Contact an attorney with questions about special warranty deeds or for any other issues related to the transfer of real property in Kentucky.

(Kentucky Special Warranty Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Hardin County to use these forms. Documents should be recorded at the office below.

This Special Warranty Deed meets all recording requirements specific to Hardin County.

Our Promise

The documents you receive here will meet, or exceed, the Hardin County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Hardin County Special Warranty Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

Kristi L.

May 11th, 2021

Fantastic Experience! I have been through several different companies offering to do the same thing but only offering subscriptions. I have no negative reviews, took 1 business day from submission, professional and timely updates and extremely fair pricing considering the amount of time it saves you.

Thank you!

Deborah P.

September 13th, 2022

Very helpful! Easy and clear guidance. Good examples on sample forms.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Richard L.

December 17th, 2020

Service was very convenient; I received prompt assistance with my document - staff was very helpful.

Thank you!

Andrew F.

August 18th, 2022

The process was terrific. Much better than hiring someone local to process deeds, as deeds.com got back to me right away with corrections before submitting.

Thank you for your feedback. We really appreciate it. Have a great day!

Angel T.

August 26th, 2021

First the convenience to get forms without going or calling Recorder's office is outstanding. Suggest that Recorder's staff be able to guide or assist users in filling up the forms.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jaynell B.

June 25th, 2021

This website was most helpful and easy to use. Glad the information I needed was available

Thank you!

Christopher Shawn S.

November 4th, 2020

Swift and Concise Process!!! I would recommend, as well as, use again!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Fay J.

July 30th, 2020

instead of the rep giving me instructions on how to summit the documents,with 3 pages, he or she told me i had all night to figure it out!!! wow...because of that i rate the service very poorly...fast to get it done but very poor customer service...so...i give them a 2.5 rating.

Thank you for your feedback, have a wonderful day Fay.

Dina O.

December 29th, 2023

easy to use and efficient i like that they give you an example to compare your work to

We are motivated by your feedback to continue delivering excellence. Thank you!

Joyce D.

January 27th, 2019

Good after I figured out the form process. Hopefully I won't be charged for two as I redid the request thinking I might have made a mistake in the first request.

Thank you for your feedback Joyce. We have reviewed your account and there have been no duplicate orders submitted. Have a great day!

Keith R.

October 11th, 2021

Great! Love the platform. Very helpful!!

Thank you!

virginia a.

May 15th, 2022

Thank you for the prompt instructions on the download and installation. The only problem I had was trying to input data into the form once I renamed the form.and saved it. I was unable to change the size of the font and was very frustrated. In the end I finally had to redo the entire form through Word using your format.

Thank you!

James M.

November 23rd, 2020

Clear and easy instructions! Prompt notices of steps and status. Great job! I wish all counties in all states were this easy!

Thank you for your feedback. We really appreciate it. Have a great day!

Darrell S.

April 12th, 2020

Easy to follow forms, and the attached go-by and instructions made it easy to complete.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sarah N.

July 3rd, 2019

This is not at all the form that I needed. I am trying to disclaim my interest in a property, but this form is much too rigid to work for my case. It would have been nice to know some of the more specific details before purchasing the document.

Thank you for your feedback. Sorry hear of your confusion. We have canceled your order and payment. We do hope that you are able to find something more suitable to your needs. Have a wonderful day.