Worcester County Trustee Deed Form (Massachusetts)

All Worcester County specific forms and documents listed below are included in your immediate download package:

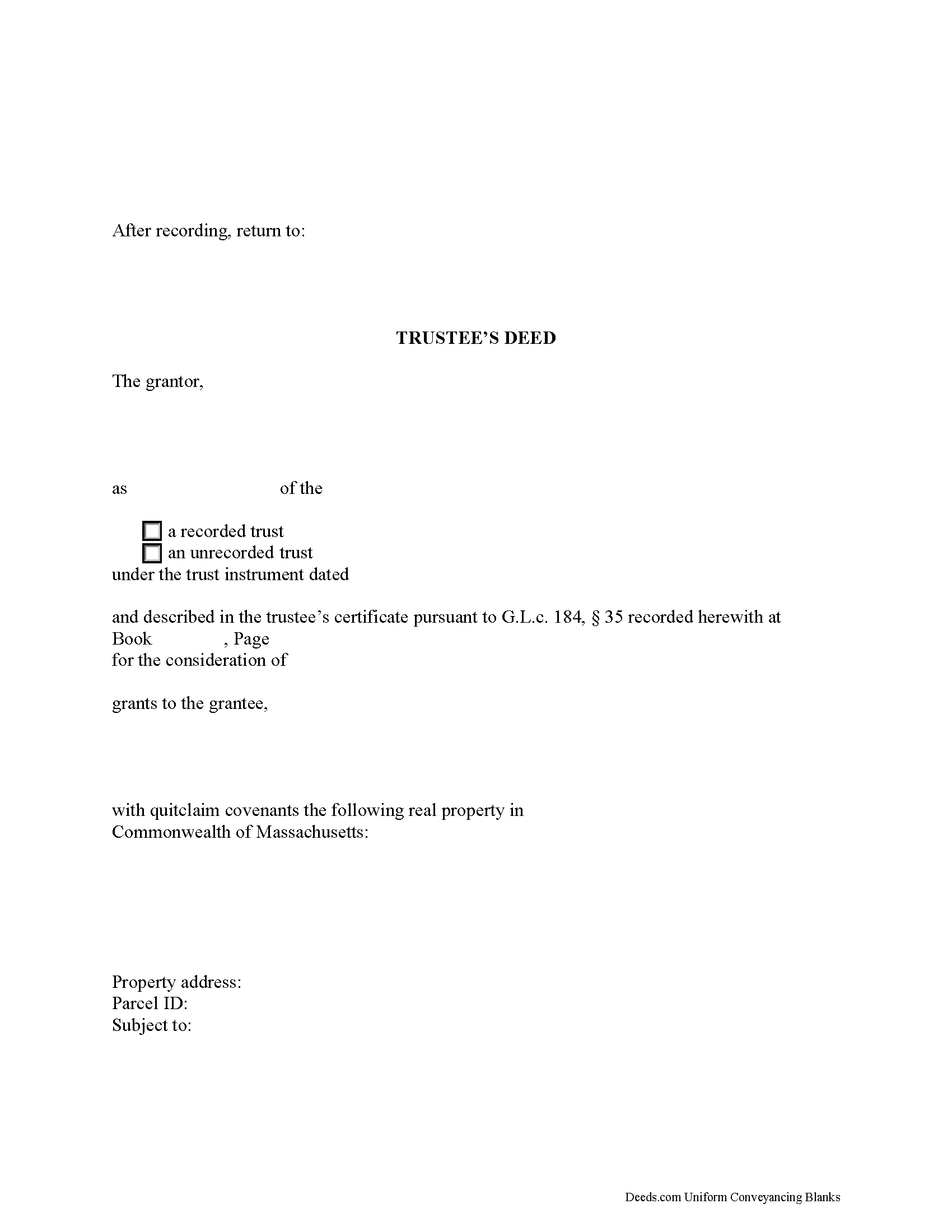

Trustee Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Worcester County compliant document last validated/updated 1/27/2025

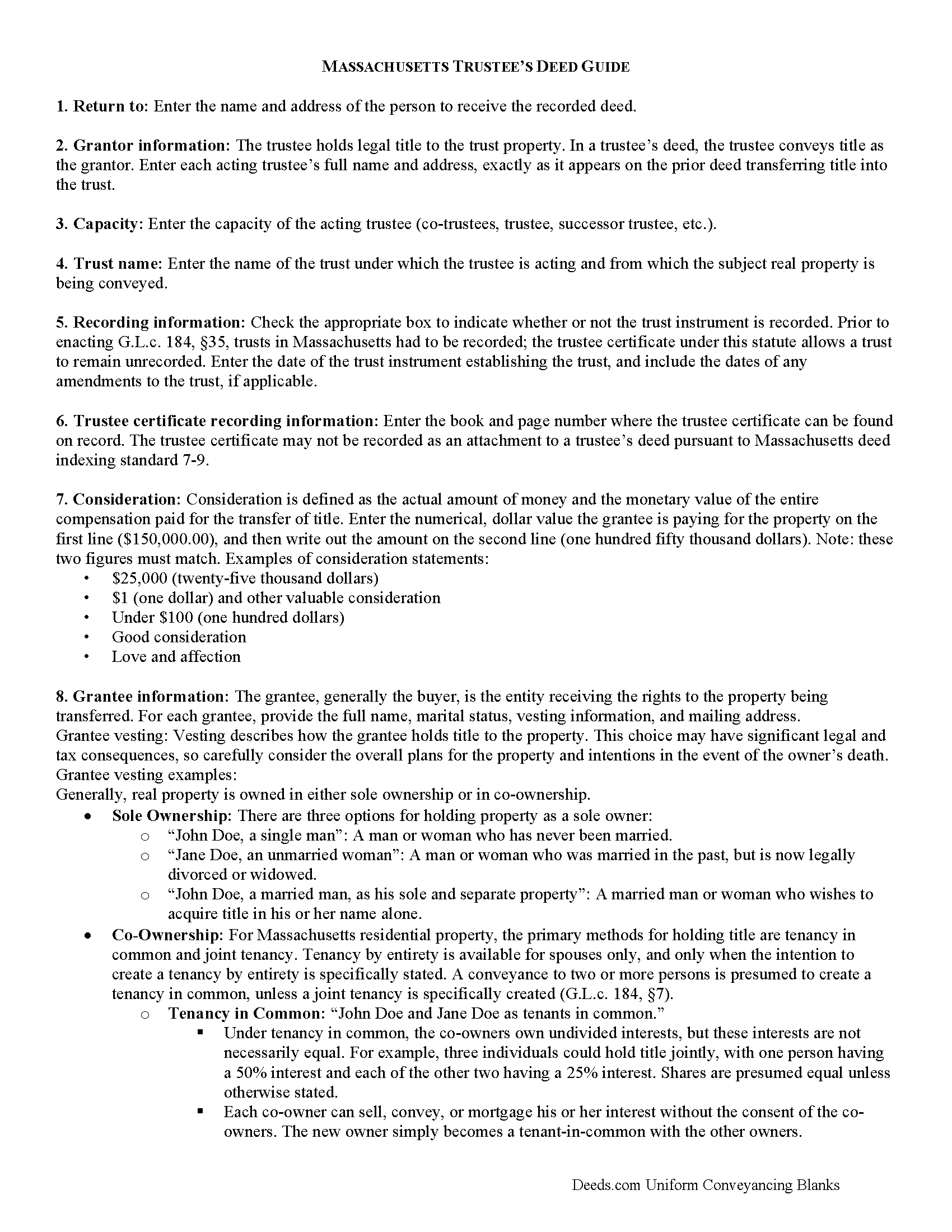

Trustee Deed Guide

Line by line guide explaining every blank on the form.

Included Worcester County compliant document last validated/updated 6/20/2025

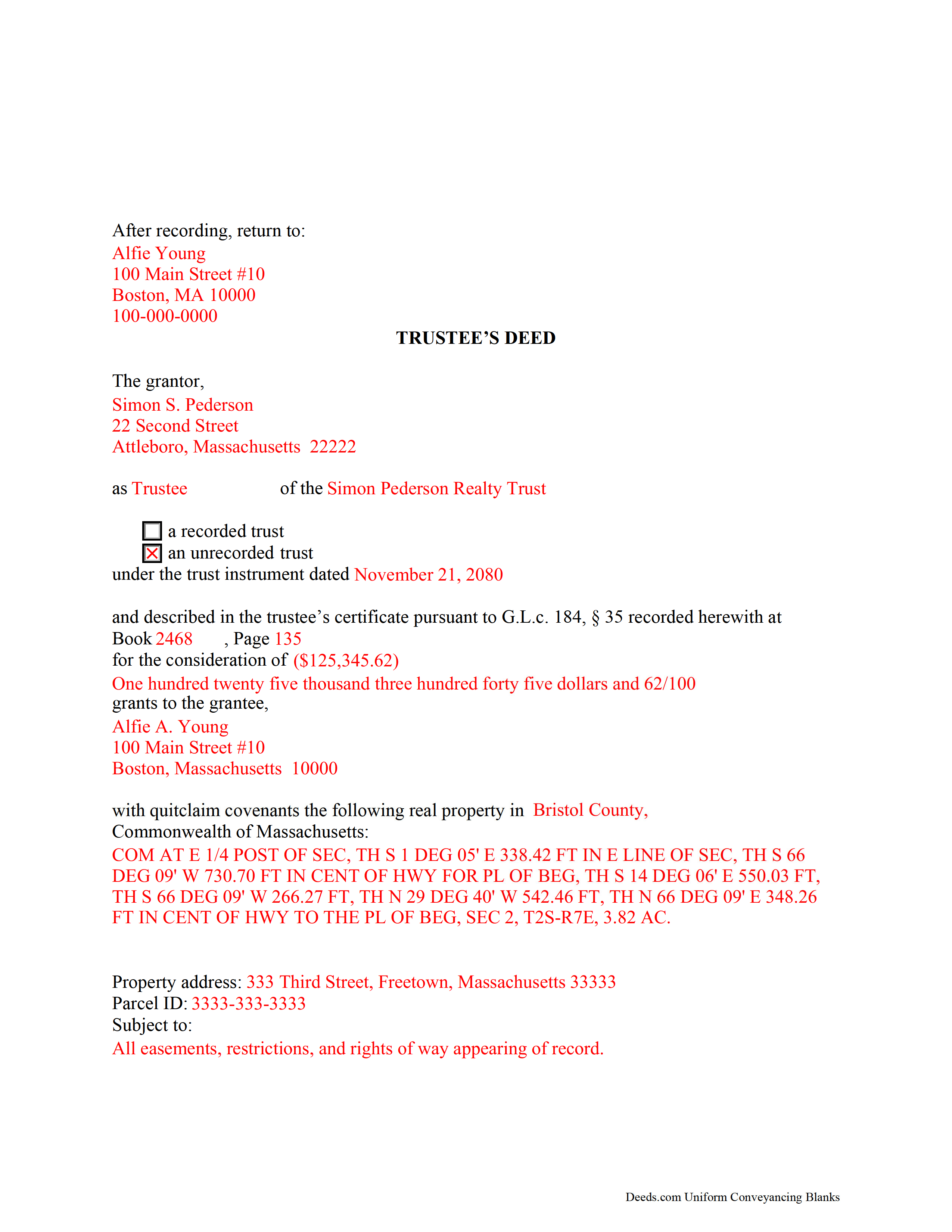

Completed Example of the Trustee Deed Document

Example of a properly completed form for reference.

Included Worcester County compliant document last validated/updated 6/19/2025

The following Massachusetts and Worcester County supplemental forms are included as a courtesy with your order:

When using these Trustee Deed forms, the subject real estate must be physically located in Worcester County. The executed documents should then be recorded in one of the following offices:

Worcester District Registry of Deeds

90 Front St, Worcester, Massachusetts 01608

Hours: 9:00am to 4:00 pm M-F

Phone: (508) 798-7717

Worcester Northern District Registry of Deeds

Putnam Place - 166 Boulder Dr, Suite 202, Fitchburg, Massachusetts 01420

Hours: 8:30 to 4:30 M-F / Recording until 4:00

Phone: (978) 342-2132

Local jurisdictions located in Worcester County include:

- Ashburnham

- Athol

- Auburn

- Baldwinville

- Barre

- Berlin

- Blackstone

- Bolton

- Boylston

- Brookfield

- Charlton

- Charlton City

- Charlton Depot

- Cherry Valley

- Clinton

- Douglas

- Dudley

- East Brookfield

- East Princeton

- East Templeton

- Fayville

- Fiskdale

- Fitchburg

- Gardner

- Gilbertville

- Grafton

- Hardwick

- Harvard

- Holden

- Hopedale

- Hubbardston

- Jefferson

- Lancaster

- Leicester

- Leominster

- Linwood

- Lunenburg

- Manchaug

- Mendon

- Milford

- Millbury

- Millville

- New Braintree

- North Brookfield

- North Grafton

- North Oxford

- North Uxbridge

- Northborough

- Northbridge

- Oakham

- Oxford

- Paxton

- Petersham

- Princeton

- Rochdale

- Royalston

- Rutland

- Shrewsbury

- South Barre

- South Grafton

- South Lancaster

- Southborough

- Southbridge

- Spencer

- Sterling

- Still River

- Sturbridge

- Sutton

- Templeton

- Upton

- Uxbridge

- Warren

- Webster

- West Boylston

- West Brookfield

- West Millbury

- West Warren

- Westborough

- Westminster

- Wheelwright

- Whitinsville

- Winchendon

- Winchendon Springs

- Worcester

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Worcester County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Worcester County using our eRecording service.

Are these forms guaranteed to be recordable in Worcester County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Worcester County including margin requirements, content requirements, font and font size requirements.

Can the Trustee Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Worcester County that you need to transfer you would only need to order our forms once for all of your properties in Worcester County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Massachusetts or Worcester County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Worcester County Trustee Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Used to convey title to real property held in a living (non-testamentary) trust, the trustee's deed takes its name from the party executing the conveyance, the trustee. In Massachusetts, the trustee's deed typically carries quitclaim covenants guaranteeing title against claims arising only under the grantor's duration of ownership.

Trusts are governed by the Massachusetts Uniform Trust Code at chapter 203E of the Massachusetts General Laws. In a trust, the trustee holds legal title to property conveyed into trust by the trust's settlor, for the benefit of a beneficiary. A beneficiary is someone with a present or future interest in the trust (G.L.c. 203E, 103). The terms of the trust, including a designation of the trustee, the trustee's powers, and the trust's beneficiary, are set forth in the trust instrument, which is executed by the settlor and generally not recorded.

Conveyances by trustee are generally accompanied by a trustee's certificate under G.L.c. 184, 35, evidencing the trustee's authority in the transaction at hand. The trustee's certificate is recorded separately, either simultaneously with the deed conveying real property into trust, or when the trustee acts upon the title.

The Massachusetts Real Estate Bar Association (REBA) Title Standard 33 also addresses transfers by trustees. The standard states that recipients of a trustee's deed are not obligated to inquire into the trustee's authority if the trustee's certificate is presented, which recites that third parties may rely without inquiry on the acts of said trustee. The standard also applies if a trustee's certificate is unrecorded or unreferenced in the transfer, but the transfer is executed by all trustees appearing of record to be trustees.

Apart from naming each acting trustee, the trustee's deed recites the name of the trust and contains a reference to the trustee's certificate, if any, of record. The document should also contain a reference to the prior instrument granting title to the trustee. As the conveyance affects real property, the deed requires a legal description of the affected parcel. Each acting trustee must sign the deed in the presence of a notary public for a valid transfer.

Consult a lawyer for guidance, as trust law can quickly become complex, and each situation is unique.

(Massachusetts TD Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Worcester County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Worcester County Trustee Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4563 Reviews )

JAMES D.

July 10th, 2025

Slick as can be and so convenient.rnrnWorked like a charm

Thank you for your feedback. We really appreciate it. Have a great day!

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.rn

We are delighted to have been of service. Thank you for the positive review!

Robert F.

June 30th, 2025

Breeze.... It feels silly to hire an attorney to do this for just one beneficiary. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

ROBERET D.

November 18th, 2021

after a poor start was able to get to the forms

page and find what I was looking for and every thing worked good. Just getting to the right area was a struggle but we made thanks

Bob

Thank you for your feedback. We really appreciate it. Have a great day!

James M.

July 22nd, 2023

Great selection of documents. Easy to use, with guidance material.

Thank you for taking the time to leave your feedback James. We appreciate you.

Deana A.

April 30th, 2020

Great forms and info, easy step-by-step guidance.

Thank you!

Jacqueline B.

August 23rd, 2021

The service was very clear and direct. I was able to get everything I need right now.

Your website is set up well.

Thank you

Thank you for your feedback. We really appreciate it. Have a great day!

Paul R. A.

September 10th, 2019

Great and prompt service.

Thank you for your assistance.

Paul R. Ashe, Esq.

Thank you!

Valerie C.

May 1st, 2022

Thanks

Thank you!

Jamie W.

September 27th, 2019

Very fast service. Wish I knew about this earlier.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sally S.

May 3rd, 2022

it would be nice to have explanation of all the forms required. For a first time estate DPOA, I feel a bit insecure with the forms and would like a paragraph explaining specifics for each link and what to complete for the ladybird deed. Otherwise, I love the ease of purchase with immediate links available.

Thank you for your feedback. We really appreciate it. Have a great day!

Joel M.

November 8th, 2024

Very easy and efficient. The team was quick to respond when I had questions and made it very simple.

We are delighted to have been of service. Thank you for the positive review!

john o.

August 8th, 2020

very simple to use

Thank you!

Anita W.

June 18th, 2020

Love this site. It has been truly helpful and easy to navigate.

Thank you Anita, glad we could help.

LISA B.

December 5th, 2019

GOT WHAT I NEEDED FORMS WORKED FINE.

Thank you!