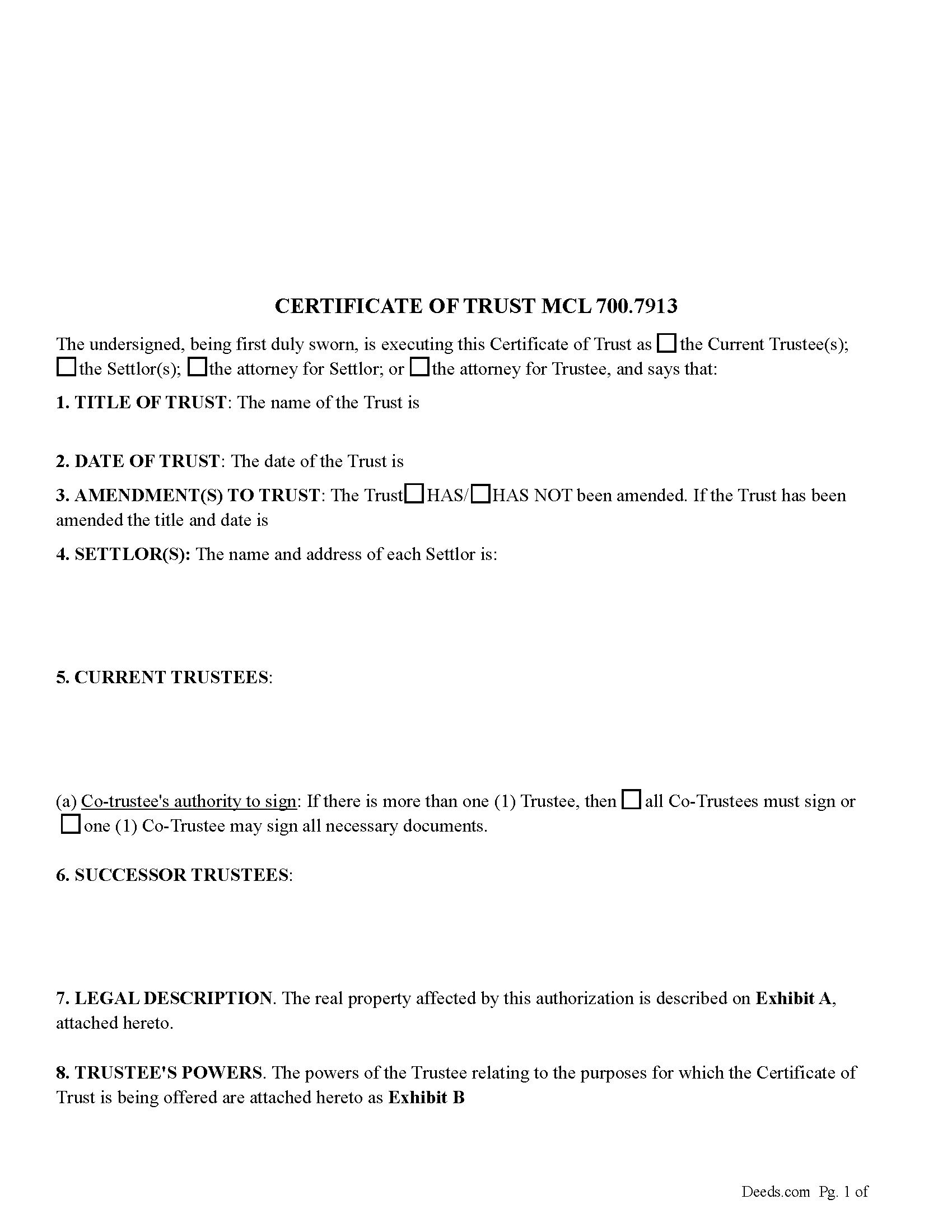

Ingham County Certificate of Trust MCL 700.7913 Form

Ingham County Michigan Certificate of Trust MCL 700.7913 Form

Fill in the blank form formatted to comply with all recording and content requirements.

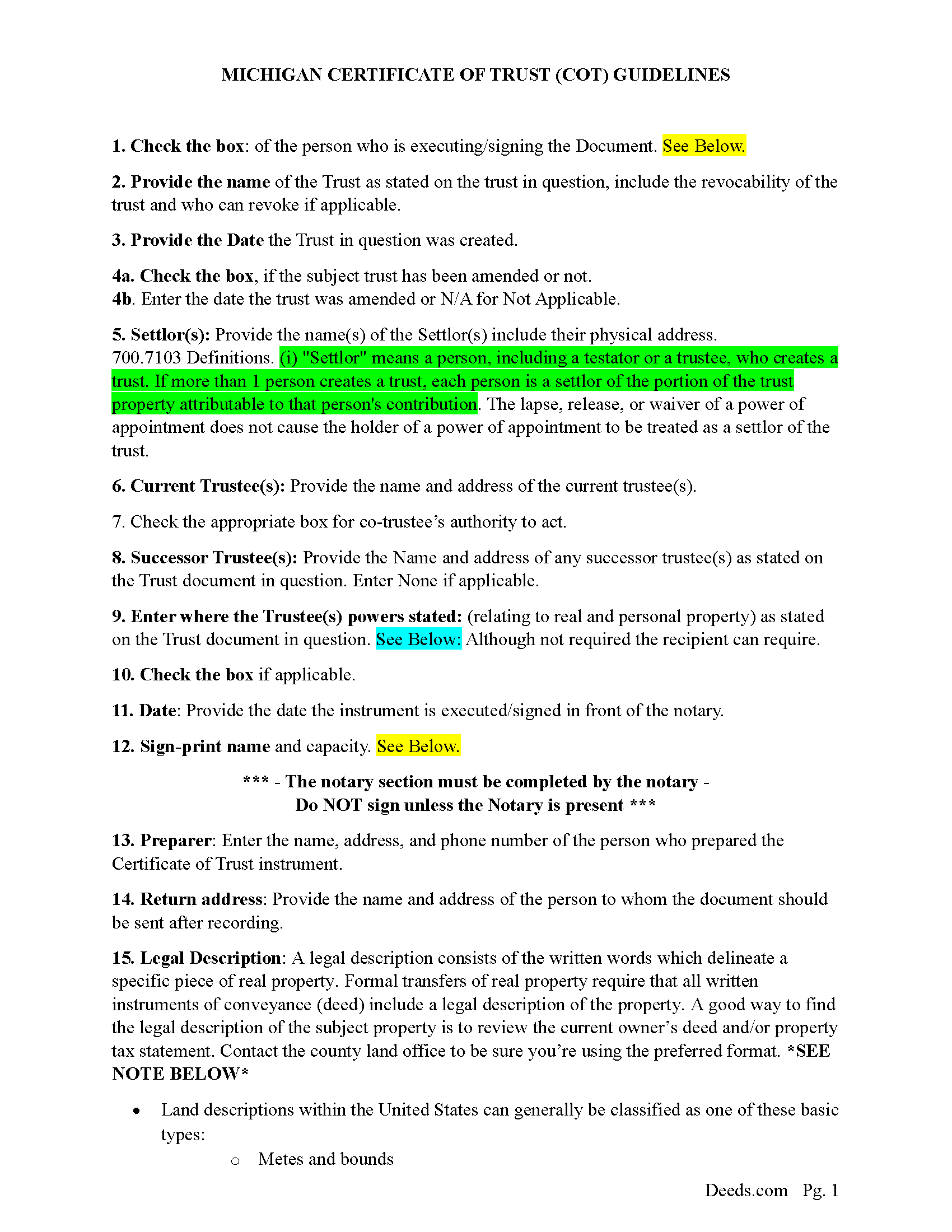

Ingham County Certificate of Trust Guidelines

Line by line guide explaining every blank on the form.

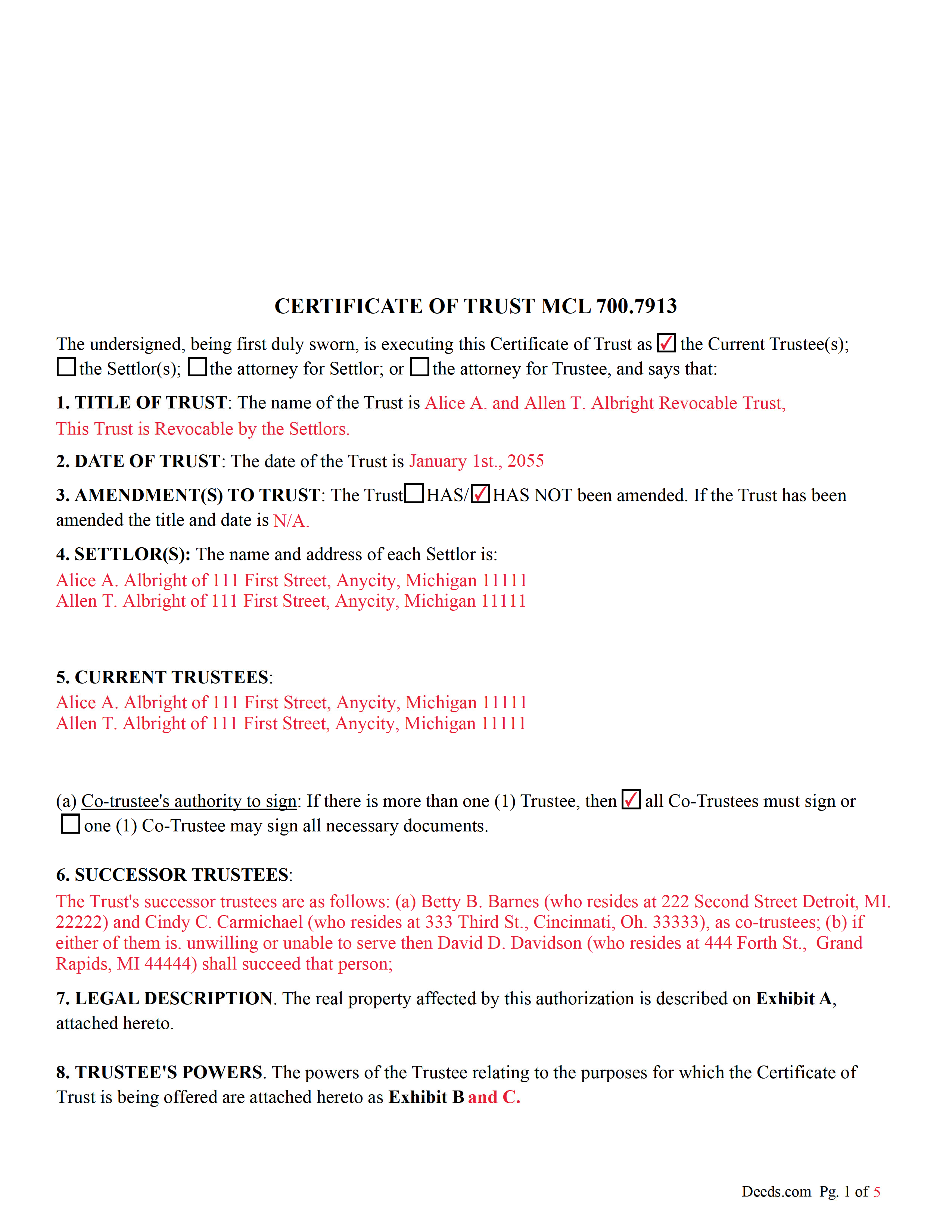

Ingham County Completed Example of the Certificate of Trust Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Michigan and Ingham County documents included at no extra charge:

Where to Record Your Documents

Ingham County Register of Deeds

Mason, Michigan 48854-0195

Hours: 8:00 to 5:00 M-F / Vault hours are By Appointment Only between the hours of 8:30 and 4 daily

Phone: 517-676-7216

Recording Tips for Ingham County:

- Leave recording info boxes blank - the office fills these

- Avoid the last business day of the month when possible

- Ask about accepted payment methods when you call ahead

Cities and Jurisdictions in Ingham County

Properties in any of these areas use Ingham County forms:

- Dansville

- East Lansing

- Haslett

- Holt

- Lansing

- Leslie

- Mason

- Okemos

- Onondaga

- Stockbridge

- Webberville

- Williamston

Hours, fees, requirements, and more for Ingham County

How do I get my forms?

Forms are available for immediate download after payment. The Ingham County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Ingham County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Ingham County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Ingham County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Ingham County?

Recording fees in Ingham County vary. Contact the recorder's office at 517-676-7216 for current fees.

Questions answered? Let's get started!

New legislation was signed into law in 2018 that, in essence, consolidated the two types of certificates of trust into one, a (Certificate of Trust) and a (Certificate of Trust Existence and Authority). This Certificate of Trust allows those with an interest in real property the necessary information regarding the Trust to help either fund the Trust or allow real property to be transferred with a clear title. A COT provides pertinent/relevant information needed to satisfy title companies and/or banks. When a Trustee wants to sell real property that is part of a trust, a COT will be required at or before the closing.

Pursuant to the current law, a certificate of trust must include:

The name of the trust, the date of the trust, and the date of each operative trust instrument.

The name and address of each current trustee.

The powers of the trustee relating to the purposes for which the certificate of trust is offered.

The revocability or irrevocability of the trust and the identity of any person holding the power to revoke the trust.

The authority of co-trustees to sign on behalf of the trust or otherwise authenticate on behalf of the trust and whether all or less than all co-trustees are required to exercise the trustee powers.

A statement that the trust has not been revoked, modified or amended in any manner that would cause the representations included in the certificate of trust to be incorrect.

The certificate of trust may be signed or otherwise authenticated by the settlor, any trustee (including a successor trustee), or an attorney for the settlor or the trustee.

700.7913 Certificate of trust.

Sec. 7913.

(1) Instead of furnishing a copy of the trust instrument to a person other than a trust beneficiary, the trustee may furnish to the person a certificate of trust that must include all of the following information:

(a) The name of the trust, the date of the trust, and the date of each operative trust instrument.

(b) The name and address of each current trustee.

(c) The powers of the trustee relating to the purposes for which the certificate of trust is being offered.

(d) The revocability or irrevocability of the trust and the identity of any person holding a power to revoke the trust.

(e) The authority of cotrustees to sign on behalf of the trust or otherwise authenticate on behalf of the trust and whether all or less than all of the cotrustees are required to exercise powers of the trustee.

(2) A certificate of trust may be signed or otherwise authenticated by the settlor, any trustee, or an attorney for the settlor or trustee. The certificate must be in the form of an affidavit.

(3) A certificate of trust must state that the trust has not been revoked, modified, or amended in any manner that would cause the representations included in the certificate of trust to be incorrect.

(4) A certificate of trust need not include the dispositive terms of the trust instrument.

(5) A recipient of a certificate of trust may require the trustee to furnish copies of those excerpts from each trust instrument that designate the trustee and confer on the trustee the power to act in the pending transaction.

(6) A person that acts in reliance on a certificate of trust without knowledge that the representations included in the certificate of trust are incorrect is not liable to any person for so acting and may assume without inquiry the existence of the trust and other facts included in the certificate of trust.

(7) A person that in good faith enters into a transaction in reliance on a certificate of trust may enforce the transaction against the trust property as if the representations included in the certificate of trust were correct.

(8) A person that makes a demand for the trust instrument in addition to a certificate of trust or excerpts of the trust instrument is liable for damages, costs, expenses, and legal fees if the court determines that the person that made the demand did not act pursuant to a legal requirement to demand the trust instrument.

(9) This section does not limit the right of a person to obtain a copy of the trust instrument in a judicial proceeding that concerns the trust.

(Michigan COT Package includes form, guidelines, and completed example) For use in Michigan only.

Important: Your property must be located in Ingham County to use these forms. Documents should be recorded at the office below.

This Certificate of Trust MCL 700.7913 meets all recording requirements specific to Ingham County.

Our Promise

The documents you receive here will meet, or exceed, the Ingham County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Ingham County Certificate of Trust MCL 700.7913 form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

Adriana V.

July 2nd, 2020

Excellent and a very fast way to release important documents. Thank you very much.

Thank you!

Keyuna C.

April 25th, 2020

Speedy process, they provided me with the exact documents that I needed.

Thank you!

Hinz H.

May 28th, 2020

Prompt accurate service

Thank you!

Max P.

February 26th, 2021

Excellent. Timely. Efficient. Smooth. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Deborah B.

September 30th, 2021

I was skeptical after experiencing other websites. However not only did we get the form we needed for a fraction of the cost vs going to an attorney, the additional resources (guides and samples) made the completion of the Enhanced Life Quitclaim deed quite simple, quick, and painless. We were having difficulty getting my mom to agree to meeting with an attorney or even considering a Lady Bird deed. Deeds.com gave us the ability to move forward with necessary actions with family members walking my mom through the steps, explaining the process and giving her plenty of time to find the needed information. She became part of the process which made it easy for her at a time when decision making was hard. We did everything in the comfort of her own home. I can't think of a better experience or service and I would consider Deeds.com for future needs.

Thank you for the kinds words Deborah. We appreciate you taking the time to share your experience.

Janice W.

October 10th, 2020

So easy to follow the directions and get what you need. Simple Quick and Easy.' I am very pleased with the outcome.

Thank you!

Thomas Z.

November 10th, 2021

Excellent site! Very informative and easy to navigate. I would highly recommend to anyone requiring documents in a quick and through fashion.

Thank you for your feedback. We really appreciate it. Have a great day!

Joshua A.

May 13th, 2020

It was fast, secure, and reliable, and for the cost it saved me time, and driving four hours to the courthouse and back. It really saved me. Thank You.

Thank you Joshua, glad we could help.

Anthony C.

January 9th, 2021

Good information for solving my issue...

Thank you!

janitza g.

July 31st, 2020

It was easy!!! The example for completing a quickclaim deed form was very helpful!!

Thank you!

Sylvia B.

October 21st, 2020

What a wonderful resource! Forms are so easy to use, made the process a breeze. Deeds even helped with the recording. Thank you.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

George W.

February 26th, 2021

Phenomenal service! If only every request and transaction with other companies could be this seamless and efficient!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Clarence O.

July 17th, 2020

Very easy process to record a Quit Claim Deed. Would definitely recommend!

Thank you!

Michael W.

October 24th, 2019

Easy to use Website. Quick accurate data reporting. I will use the service in the future.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jose G. C.

October 2nd, 2020

It was OK but unfortunately useless. The jurisdictions are now requesting that documents such as Notices of Commencement not only be recorded at their offices, but also certified. This last service is not provided by Deeds, or at least I could not find it in your website and did not receive a response when I asked if you did. Thus, we are going back to traditional means of recording/certifying

Thank you for your feedback Jose. We do hope that you find something more suitable to your needs elsewhere. Have a wonderful day.