Osceola County Correction Deed Form

Osceola County Correction Deed Form

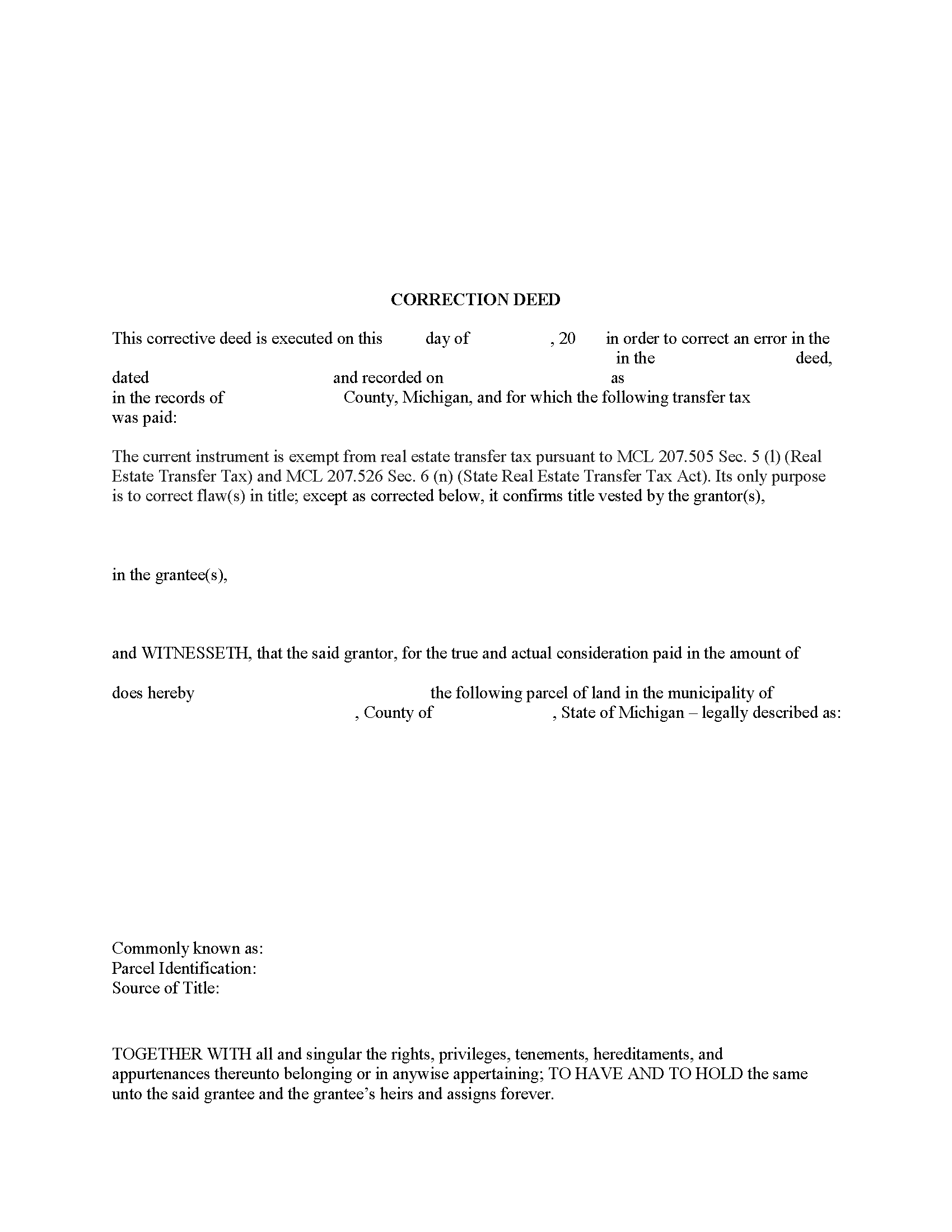

Fill in the blank form formatted to comply with all recording and content requirements.

Osceola County Correction Deed Guide

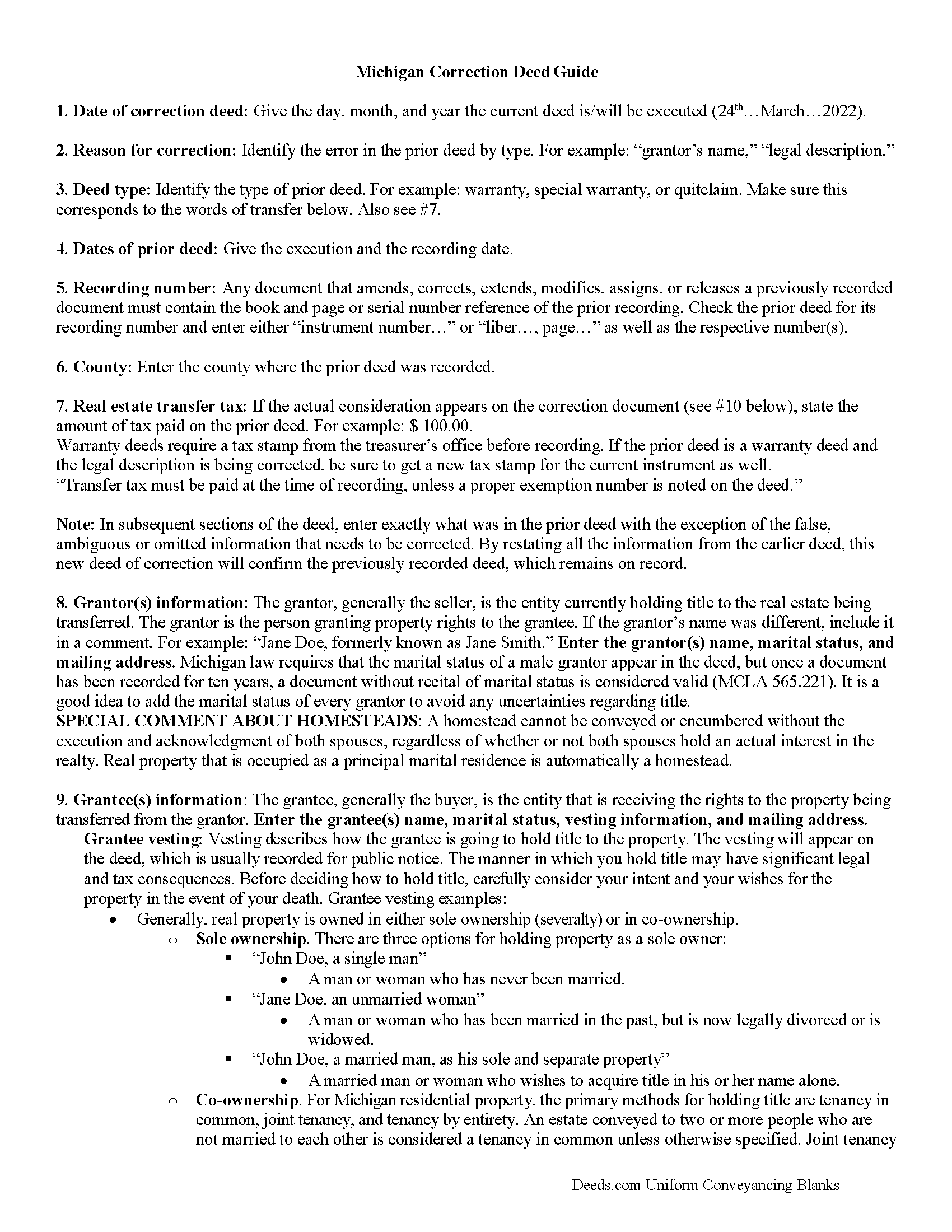

Line by line guide explaining every blank on the form.

Osceola County Completed Example of the Correction Deed Document

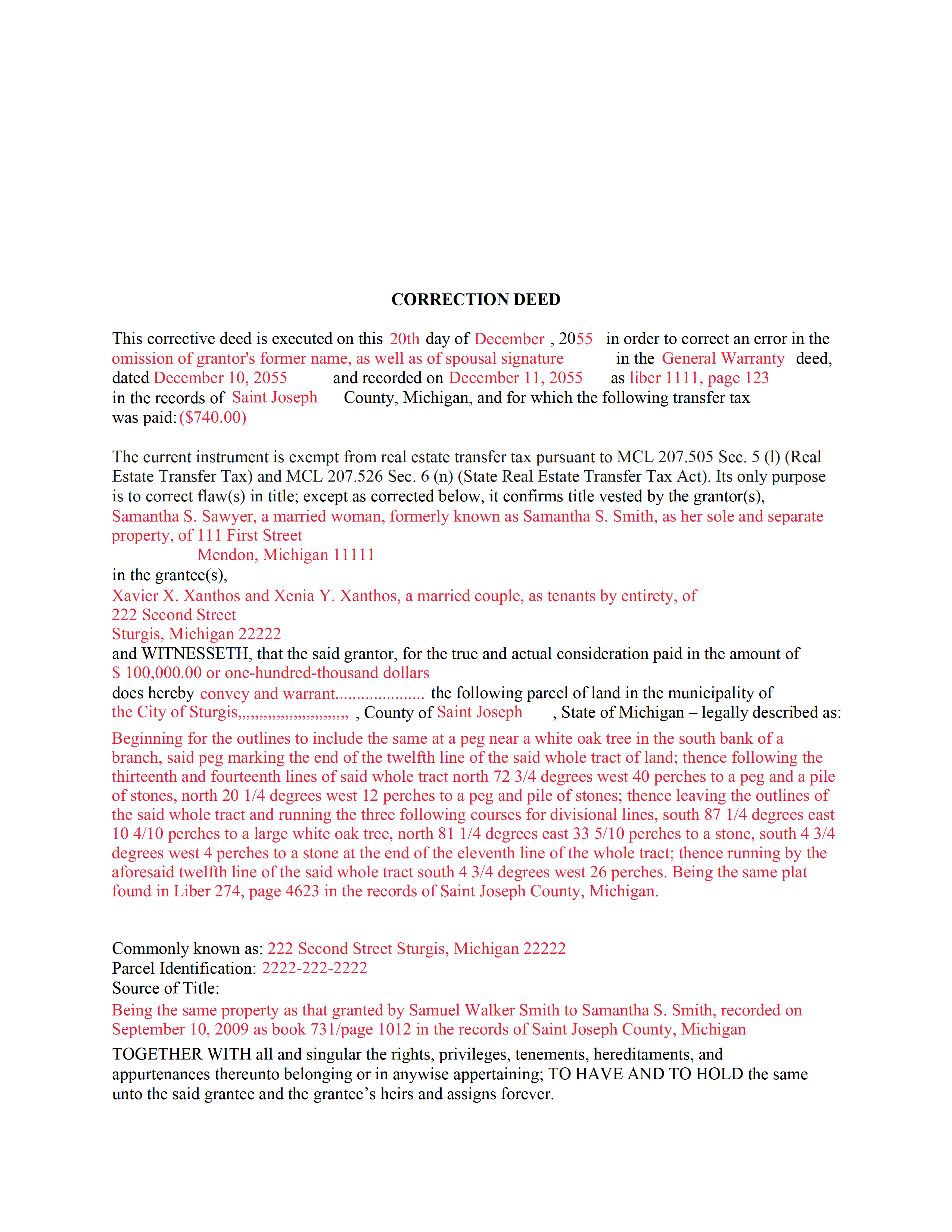

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Michigan and Osceola County documents included at no extra charge:

Where to Record Your Documents

Osceola County Register of Deeds

Reed City, Michigan 49677

Hours: Monday - Friday 9:00 a.m. - 5:00 p.m.

Phone: (231) 832-6113

Recording Tips for Osceola County:

- Leave recording info boxes blank - the office fills these

- Ask about their eRecording option for future transactions

- Avoid the last business day of the month when possible

Cities and Jurisdictions in Osceola County

Properties in any of these areas use Osceola County forms:

- Evart

- Hersey

- Leroy

- Marion

- Reed City

- Sears

- Tustin

Hours, fees, requirements, and more for Osceola County

How do I get my forms?

Forms are available for immediate download after payment. The Osceola County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Osceola County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Osceola County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Osceola County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Osceola County?

Recording fees in Osceola County vary. Contact the recorder's office at (231) 832-6113 for current fees.

Questions answered? Let's get started!

Use this correction deed to correct an error in a previously executed and recorded deed.

Correction deeds are used to adjust the earlier deed when that document contains minor errors of omission or typographical errors, sometimes called scrivener's mistakes. For example, a misspelled name, an omitted or wrong middle initial, a minor error in the property description, or an omitted execution date. Do not us the correction deed for more substantial changes, such as the removal of a name from a deed. Such alterations are better handled through a quit claim deed.

The correction deed, also called corrective deed, must state that its sole purpose is to correct a specific error, which is usually identified by type. For example: an error in the grantor's name, or an error in the grantor's marital status. It also must clearly reference the type of document it is correcting and state the execution and recording date of that prior document, as well as the number under which it was recorded, either referred to as instrument number or liber (book) and page number.

In subsequent sections, the correction deed repeats the information that was in the prior deed with the exception of the false, ambiguous or omitted information that needs to be corrected. By restating all the information from the earlier deed, this new deed of correction will confirm the previously recorded deed, which remains on record as is.

Warranty deeds require a tax stamp from the treasurer's office before recording. If the prior deed is a warranty deed and the legal description is being corrected, be sure to get a new tax stamp for the current instrument as well. In some counties, any deed that contains the word "warrant" must be checked by the treasurer's office first regardless of the type of correction.

(Michigan CD Package includes form, guidelines, and completed example)

Important: Your property must be located in Osceola County to use these forms. Documents should be recorded at the office below.

This Correction Deed meets all recording requirements specific to Osceola County.

Our Promise

The documents you receive here will meet, or exceed, the Osceola County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Osceola County Correction Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Dorothea H.

November 23rd, 2020

I am so glad I chose Deeds.com for my forms! The directions were clear and comprehensive, and the form allowed for customization far beyond the free forms I had looked at before. I highly recommend this site!

Thank you for your feedback. We really appreciate it. Have a great day!

CINDY P.

July 30th, 2019

Such any easy process! Thank you!

Thank you Cindy, we appreciate your feedback.

Sallie L.

July 7th, 2021

Easy, information given was very helpful!

Thank you!

Jose D.

January 27th, 2021

A little difficult in the beginning but with the messaging back and forth it was very simple and fast. Thank you for your help.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Patricia N.

May 7th, 2025

Wonderful fast service, quick thoughtful responses on chat! Files download easily too, great pruces

We are delighted to have been of service. Thank you for the positive review!

JOANNE W.

November 13th, 2019

Excellent product and so easily obtained. Well worth the price.

Thank you for your feedback. We really appreciate it. Have a great day!

Howard T.

February 26th, 2019

Easy to use and it is very user friendly.

Thank you!

Elizabeth C.

September 23rd, 2020

Very happy, thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Beverly A.

June 13th, 2019

The forms are incredibly easy to fill out. Thanks for the examples!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jennifer H.

October 12th, 2020

Deeds.com is amazing. It made finding out how to file legal documents worry free and easily understood. Thank You

Thank you for your feedback. We really appreciate it. Have a great day!

Tanya H.

July 21st, 2020

Could not be happier with deeds.com forms. The guide helped more than one can imagine, great resource.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Susan E.

April 13th, 2020

Great experience from a great staff at Deeds.com. Highly recommended!

So glad we could help Susan. Thanks for the kind words.

Jorge F.

October 15th, 2021

It would be helpful for documents to be in word format as well and for PDF version not to be locked.

Thank you for your feedback. We really appreciate it. Have a great day!

Bobby W.

January 3rd, 2019

The site delivered just what it promised - I needed a specific deed formatted for a specific county/state, and they delivered it at a great price. One note for improvement - it is not intuitively obvious that I could go back and re-download if necessary and this caused me stress, but a follow up email alleviated this. Great service!

Thank you for the kind words Bobby, have a great day!

Alexandra M.

April 28th, 2021

Needed a Limited Power of Attorney form for a real estate transaction in another state. Proper form came up immediately and was fairly easy to complete. I think the sample completed form should have been more completely explained in layman's language instead of legalese (such as person granting permission instead of grantor or something like your name and address and the person who will be signing on your behalf) but since the form was one price no matter how many ways it was printed out, it was fine. I just filled it out several ways and had it notarized and sent it to my sister. Whichever combination is appropriate she and the lawyer will have. I found the site easy to navigate

We appreciate your business and value your feedback. Thank you. Have a wonderful day!