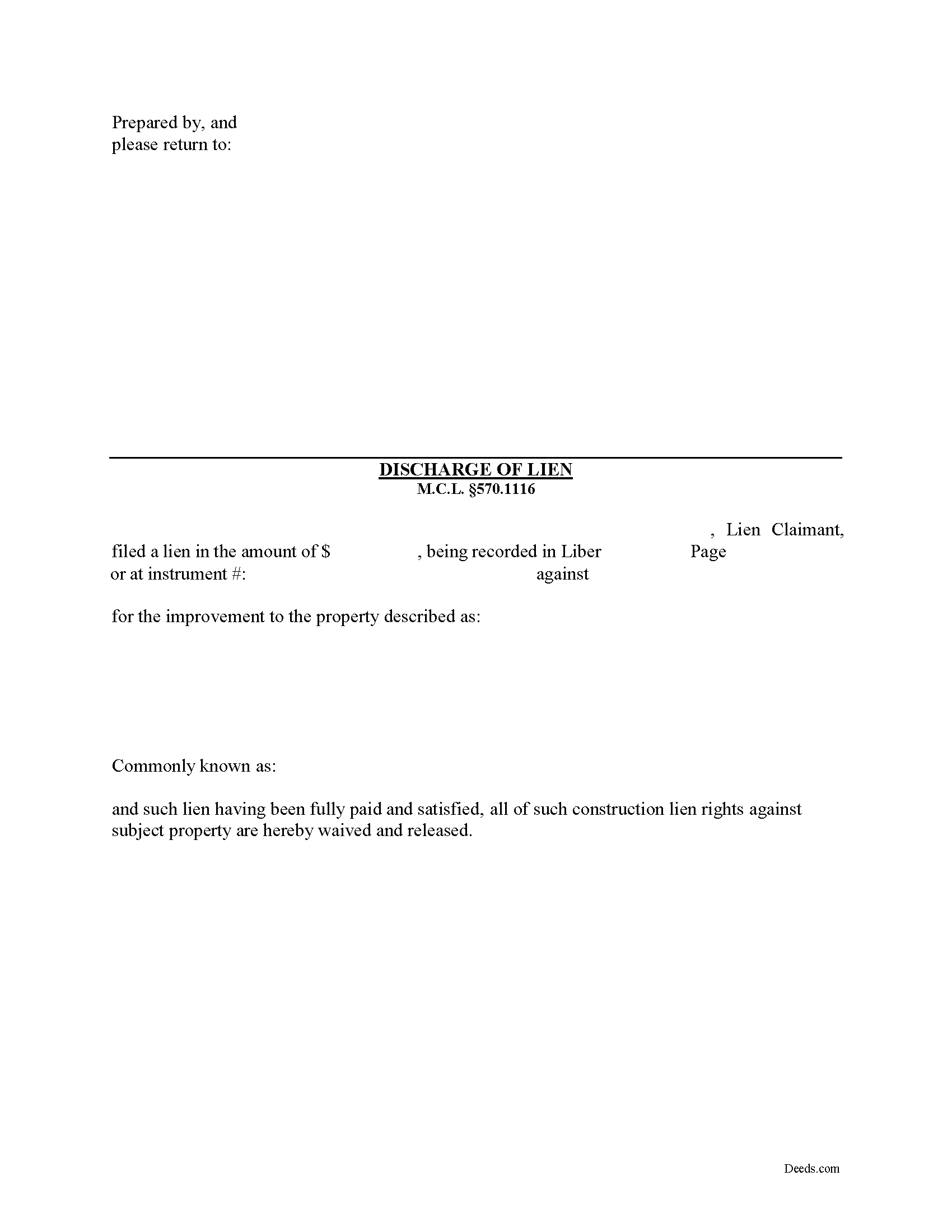

Allegan County Discharge of Lien Form

Allegan County Discharge of Lien Form

Fill in the blank form formatted to comply with all recording and content requirements.

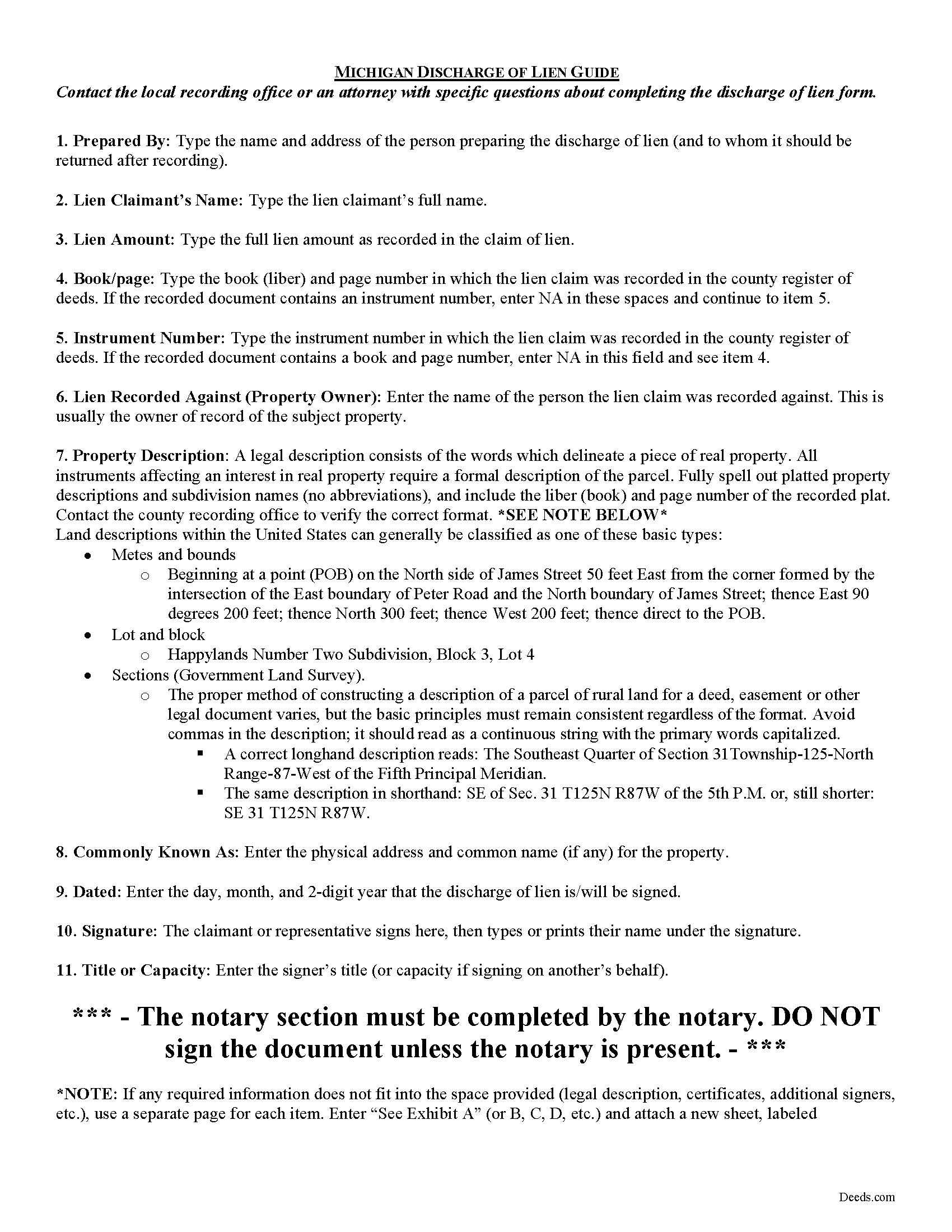

Allegan County Discharge of Lien Guide

Line by line guide explaining every blank on the form.

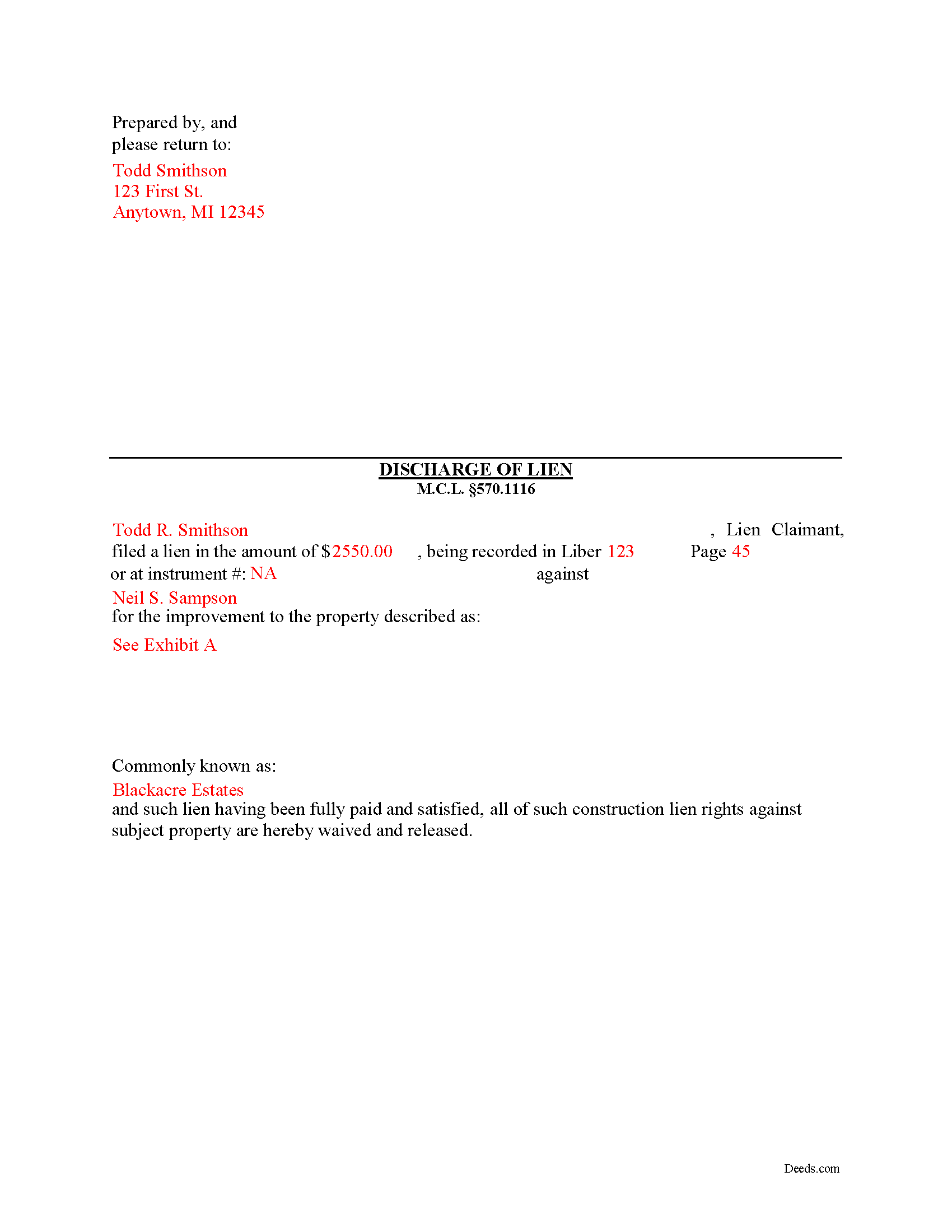

Allegan County Completed Example of the Discharge of Lien Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Michigan and Allegan County documents included at no extra charge:

Where to Record Your Documents

Register of Deeds

Allegan, Michigan 49010

Hours: 8:00am - 5:00pm M-F

Phone: (269) 673-0390

Recording Tips for Allegan County:

- Ensure all signatures are in blue or black ink

- Recording fees may differ from what's posted online - verify current rates

- Have the property address and parcel number ready

- Verify the recording date if timing is critical for your transaction

Cities and Jurisdictions in Allegan County

Properties in any of these areas use Allegan County forms:

- Allegan

- Bradley

- Burnips

- Dorr

- Douglas

- Fennville

- Glenn

- Hamilton

- Hopkins

- Martin

- Moline

- Otsego

- Plainwell

- Pullman

- Saugatuck

- Shelbyville

- Wayland

Hours, fees, requirements, and more for Allegan County

How do I get my forms?

Forms are available for immediate download after payment. The Allegan County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Allegan County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Allegan County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Allegan County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Allegan County?

Recording fees in Allegan County vary. Contact the recorder's office at (269) 673-0390 for current fees.

Questions answered? Let's get started!

Discharging a Claim of Mechanics or Construction Lien in Michigan

Lien claims must be discharged when the underlying claim is paid or the lien must be dissolved for any other reason provided by law. To accomplish this, the claimant records a discharge of lien document in the Register of Deeds in the county where the property is located. The lien is officially released after recording this form.

The discharge of lien form contains the following information: (1) lien claimant's name, (2) amount of the lien claim, (3) the book and page number where the recorded lien claim can be found in the county register of deeds, (4) property owner's name, (5) legal property description, and (6) common name of the property. Take care when discharging the lien, because once the lien has been officially released, the claimant loses a valuable tool to coerce payment.

This article is provided for informational purposes only and should not be relied on as a substitute for the advice of an attorney. Please consult a Michigan attorney with any questions about discharging a recorded lien claim, or any other issues related to liens.

Important: Your property must be located in Allegan County to use these forms. Documents should be recorded at the office below.

This Discharge of Lien meets all recording requirements specific to Allegan County.

Our Promise

The documents you receive here will meet, or exceed, the Allegan County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Allegan County Discharge of Lien form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4580 Reviews )

Evelyn B.

June 23rd, 2023

Wow! Deeds.com provided proficient eRecording with great response time and great service... and it was super easy, super fast, and very reasonably priced. What more could you possibly want?! Highly recommended!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Helen H.

August 31st, 2022

I had a notary to read over my quitclaim deed and she said it looked good. So I am pleased.

Thank you!

MARILYN I.

March 20th, 2023

Very pleased with your user friendly site.

Thank you!

Erik H.

July 16th, 2020

tl;dr - Bookmarked and anticipating using this site for years to come. My justification for rating 5/5 1. Provide intuitive method for requesting property records. 2. Cost for records *seems reasonable. 3. They clearly state that interested parties could gather these records at more affordable costs through the county (which was more confusing for an inexperienced person such as myself). I mean, I appreciate and respect this level of honesty. *I didn't shop around too much because it was difficult for me to find other services that could deliver CA property records.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Salvatore R.

January 18th, 2023

It was fast and easy to find.

Thank you!

Patricia W.

October 1st, 2020

The technology and service was excellent. The content was too limited. I was seeking to find out about 61b deeds on the property and that was not provided.

We appreciate your feedback Patricia.

Erika M.

November 13th, 2020

Received the forms I ordered, found them to be easy to complete with the guide and example that was included. Had no issues recording them, smooth as silk from start to finish.

Thank you for your feedback. We really appreciate it. Have a great day!

Barbara M.

November 21st, 2020

We love this service - so easy to use and quick. It is the second time we have used Deeds.com, in two different states. Wonderful service!

Thank you for your feedback. We really appreciate it. Have a great day!

Kathy B.

November 24th, 2020

Works easy enough and good directions on the form, however no help when I got locked out. Had to do a completely new account name and email address.

Thank you!

Ron B.

September 15th, 2019

Solved my requirement. Happy to have found the site

Thank you for your feedback. We really appreciate it. Have a great day!

Kellie Z.

December 4th, 2020

Wow! So much simpler & faster than I had expected. I had thought it would take weeks to get filed & took days- yea! Super easy & speedy!

Thank you!

Virginia S.

October 24th, 2021

Very quick process and forms were downloaded. I am very pleased with the detailed information for filling out the forms. Would use again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Mark M.

October 1st, 2020

So nice to find the forms I was looking for. Great site!! Thanks

Thank you for your feedback. We really appreciate it. Have a great day!

Charles K.

December 23rd, 2021

So far it has been a good experience. I am working on getting a beneficiary deed.

Thank you for your feedback. We really appreciate it. Have a great day!

Paul A.

March 27th, 2020

Your service is awesome!

Thank you!