Mecosta County Disclaimer of Interest Form

Last validated December 23, 2025 by our Forms Development Team

Mecosta County Disclaimer of Interest Form

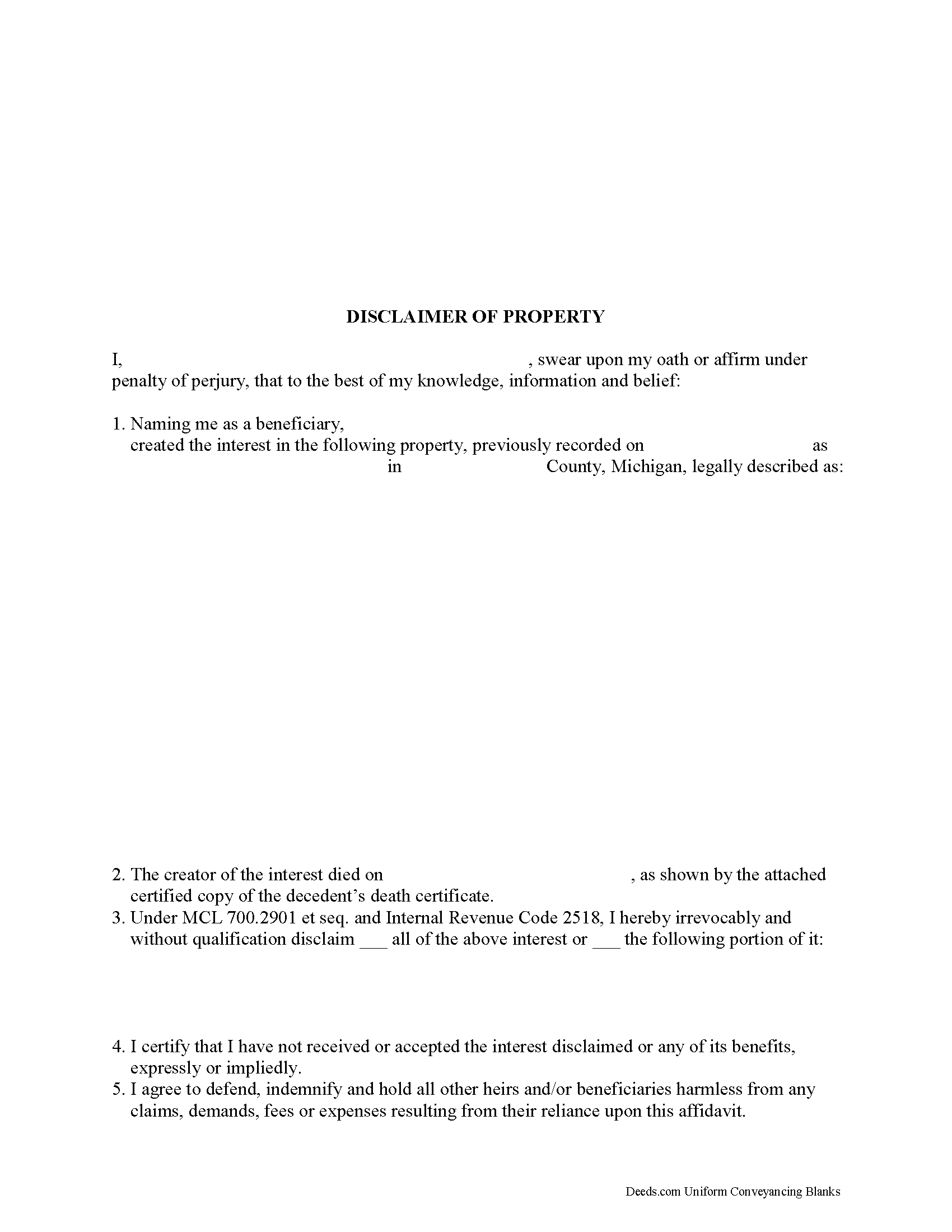

Fill in the blank form formatted to comply with all recording and content requirements.

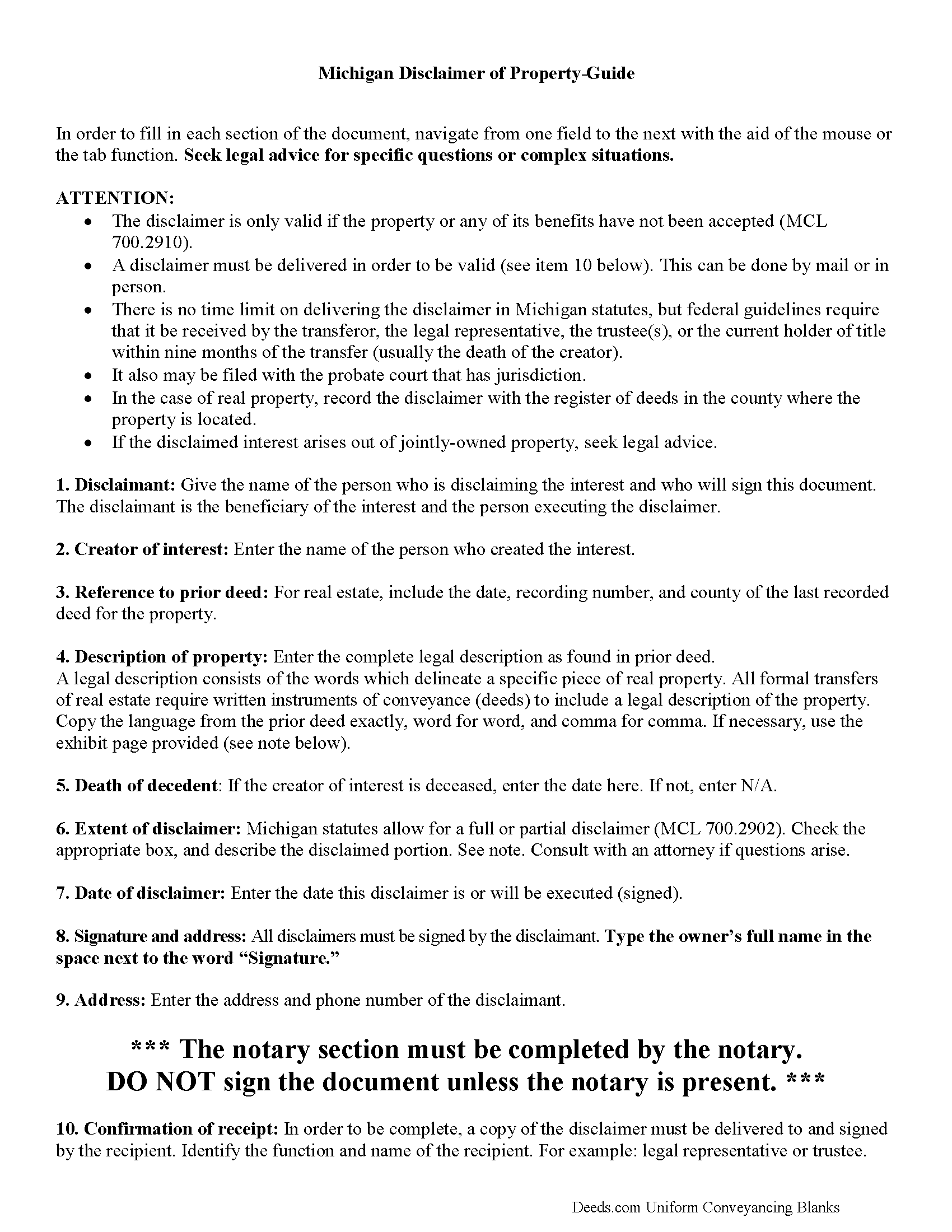

Mecosta County Disclaimer of Interest Guide

Line by line guide explaining every blank on the form.

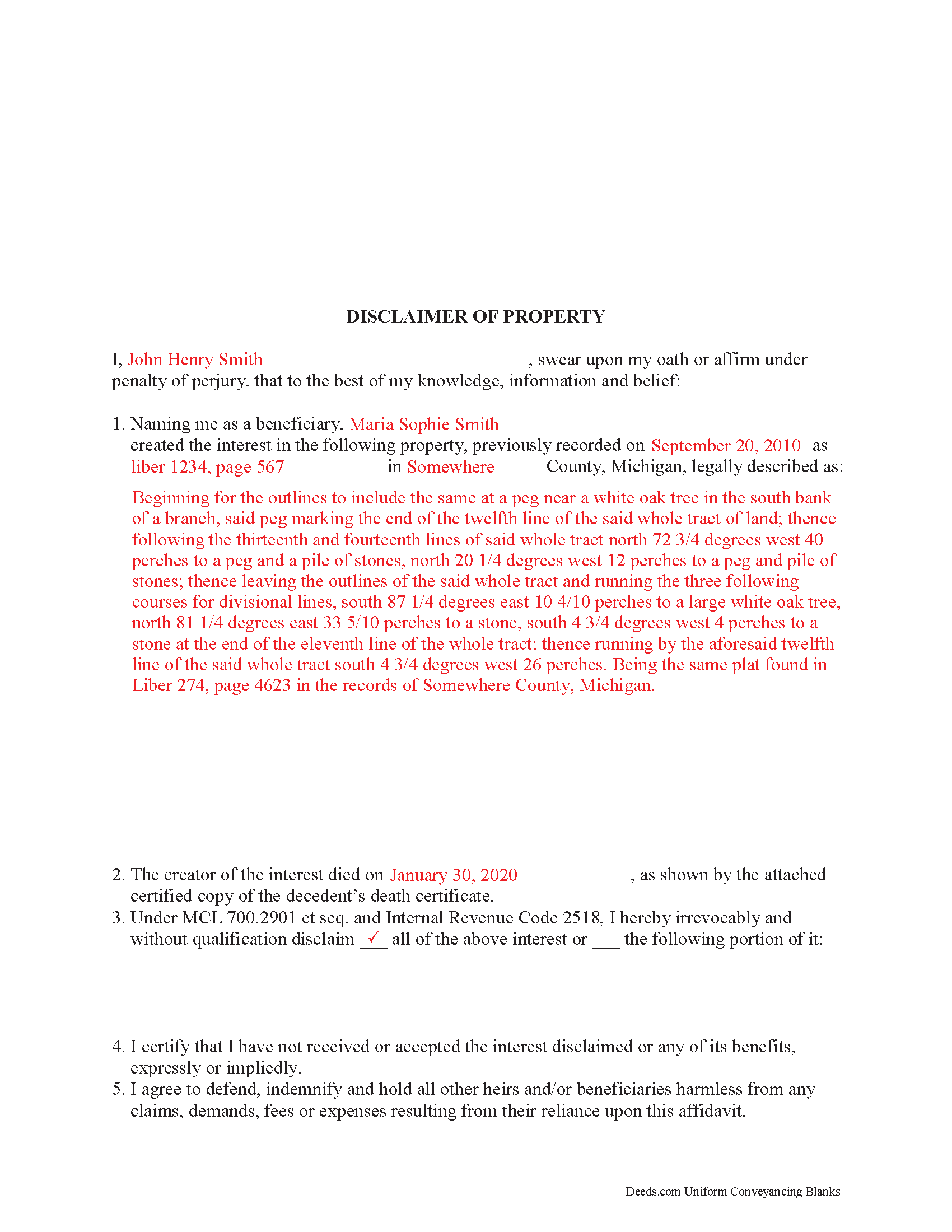

Mecosta County Completed Example of the Disclaimer of Interest Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Michigan and Mecosta County documents included at no extra charge:

Where to Record Your Documents

Mecosta County Register of Deeds

Big Rapids, Michigan 49307

Hours: 8:30 to 5:00 M-F

Phone: (231) 592-0148

Recording Tips for Mecosta County:

- Documents must be on 8.5 x 11 inch white paper

- Both spouses typically need to sign if property is jointly owned

- Leave recording info boxes blank - the office fills these

- Check margin requirements - usually 1-2 inches at top

- Consider using eRecording to avoid trips to the office

Cities and Jurisdictions in Mecosta County

Properties in any of these areas use Mecosta County forms:

- Barryton

- Big Rapids

- Chippewa Lake

- Mecosta

- Morley

- Paris

- Remus

- Rodney

- Stanwood

Hours, fees, requirements, and more for Mecosta County

How do I get my forms?

Forms are available for immediate download after payment. The Mecosta County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Mecosta County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Mecosta County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Mecosta County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Mecosta County?

Recording fees in Mecosta County vary. Contact the recorder's office at (231) 592-0148 for current fees.

Questions answered? Let's get started!

Michigan Disclaimer/Renunciation of Property - Description

A beneficiary of an interest in property in Michigan can disclaim and renounce all or part of a bequeathed interest in, or power over, that property under MCL 700.2902, as long as it has not been accepted through actions that indicate ownership or through a written waiver of the right to disclaim (MCL 700.2910).

The written disclaimer must identify the creator of the interest, provide a description of the disclaimed interest, a declaration of the disclaimer and its extent, and it must be signed by the disclaiming party (MCL 700.2903).

A disclaimer must be delivered in order to be valid, which can be done by mail or in person (MCL700.2906(1)). There is no time limit on this delivery in Michigan statutes, but federal guidelines require that it be received by the transferor, the legal representative, the trustee(s), or the current holder of title within nine months of the transfer (usually the death of the creator). The disclaimer may also be filed with the probate court that would or is going to handle the estate. In the case of real property, it can be recorded with the register of deeds in the county where the property is located (MCL 700.2906(3)).

A disclaimer functions as a non-acceptance rather than as transfer of the interest; it is irrevocable and binding for the disclaimant and those claiming under him or her (MCL 700.2909), so be sure to consult an attorney when in doubt about the drawbacks and benefits of disclaiming inherited property.

(Michigan DOI includes form, guidelines, and completed example)

Important: Your property must be located in Mecosta County to use these forms. Documents should be recorded at the office below.

This Disclaimer of Interest meets all recording requirements specific to Mecosta County.

Our Promise

The documents you receive here will meet, or exceed, the Mecosta County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Mecosta County Disclaimer of Interest form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4622 Reviews )

Kevin L.

May 31st, 2019

All the paperwork I need......Great service

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Timothy S.

June 12th, 2021

The Quit Claim form was submitted, accepted, and processed by Davidson County with no hiccups. Recommended service!

Thank you!

Chuck M.

May 30th, 2019

Easy to use service. However, the product that I purchased did not meet my needs. No fault of the company.

Thank you for your feedback Chuck. We certainly don't want you to purchase something you can not use. We have canceled your order and payment. Have a wonderful day.

Sharon B.

April 3rd, 2024

Downloaded pdf form was difficult to use,/modify and has too much space between sections.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

Mary B.

February 8th, 2023

Your information was orderly and very clear and helpful. Thanks!

Thank you for your feedback. We really appreciate it. Have a great day!

Brenda B.

January 6th, 2019

Excellent transaction.

Thank you Brenda.

samira m.

December 9th, 2022

I love whoever is behind this website. I bought the wrong form and I told them and they refunded me asap! I figured out which form I need days later and bought it just now. They didn't have to refund me for my own mistake. That was very kind. I'll be returning for any other forms I may need and will tell others too. Thank you so much!!!!!

Thank you for your feedback. We really appreciate it. Have a great day!

Jason U.

September 16th, 2024

Extremely useful! The guide was excellent with the sample. Used and went exceptionally smoothly.

Thank you for your positive words! We’re thrilled to hear about your experience.

A Rod P.

May 25th, 2019

The website was short and to the point. And I receive three responses quite quickly.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

TIFFANY C.

May 20th, 2020

It would be nice if the notary State was fillable, we are having to notarize in another State. Also, need more room to add 2 beneficiaries with two different addresses.

Thank you for your feedback. We really appreciate it. Have a great day!

Phyllis M.

August 3rd, 2019

Using your site was very easy. I found what my friend said she wanted easily and downloaded it to retype her quitclaim deed.

Thank you for your feedback. We really appreciate it. Have a great day!

DAVID JOHN M.

February 25th, 2019

The Transfer On Death Deed did work for New Mexico! Though I did have to add the long property description to the "Exhibit" page that was included with the document. Great website! Will use again! Thanks!!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

William G.

August 10th, 2023

So far so good. I will be taking the report to the Marion County Clerks office this week to see if it meets their requirements. If so, I will definitely be able to recommend Deeds.com to others.

Thank you for your feedback. We really appreciate it. Have a great day!

Scott W.

March 31st, 2020

Wow! That was easy! I was expecting a more difficult process. Upload your docs and wait for a response. Which was minutes later. I would give it 6 stars.

Thank you for your kind words Scott, glad we could help.

Stephenie A.

January 11th, 2019

No review provided.

Thank you!