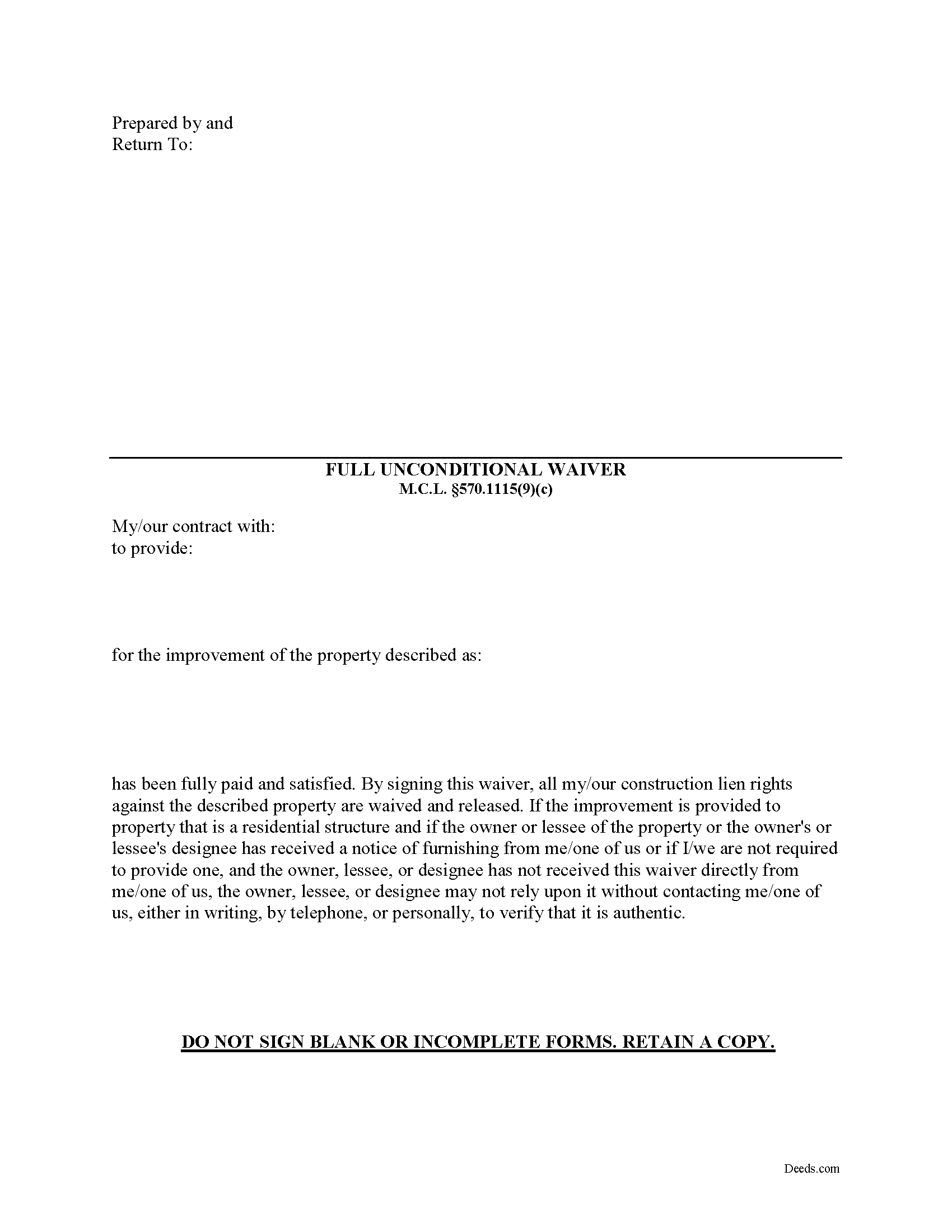

Jackson County Full Unconditional Waiver of Lien Form

Jackson County Full Unconditional Waiver of Lien Form

Fill in the blank form formatted to comply with all recording and content requirements.

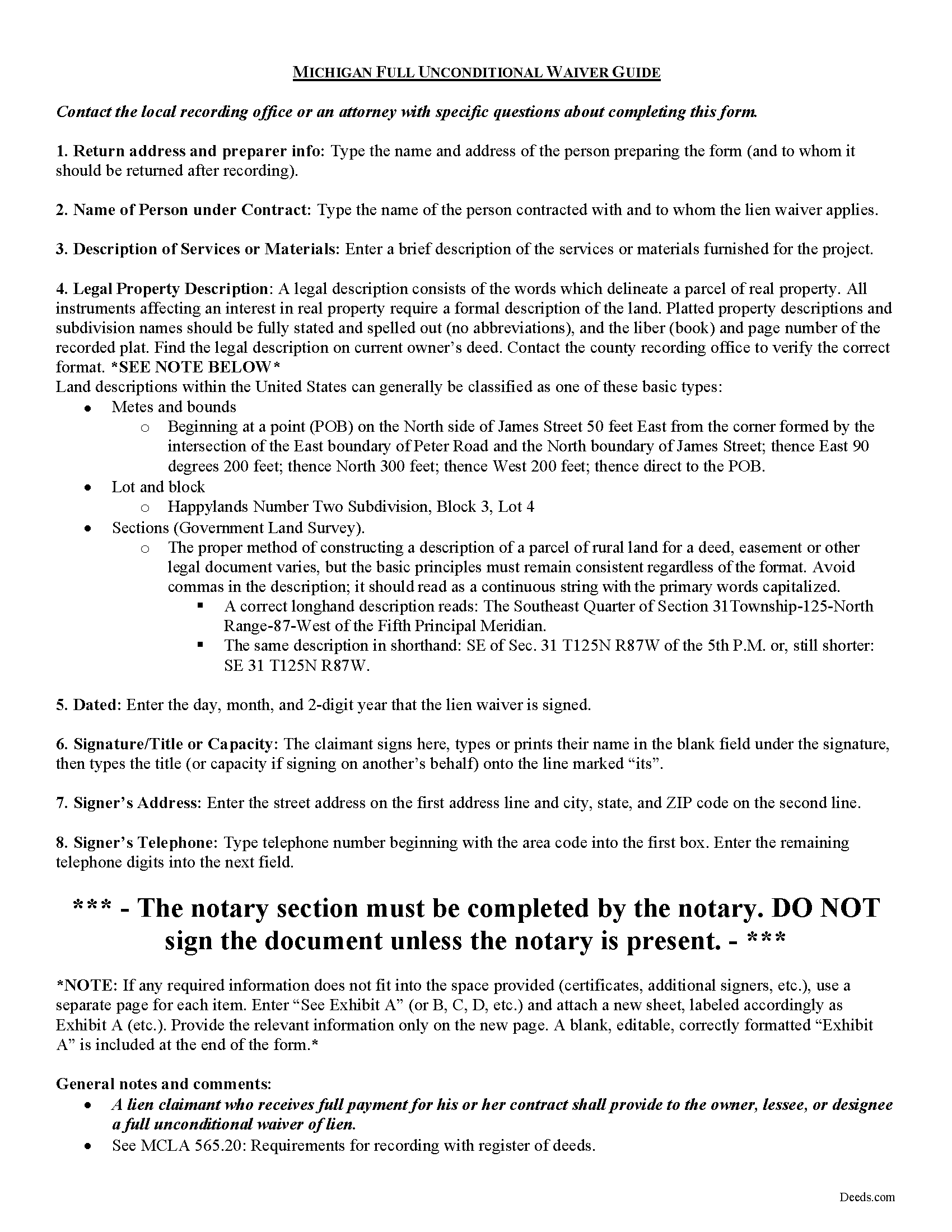

Jackson County Full Unconditional Waiver of Lien Guide

Line by line guide explaining every blank on the form.

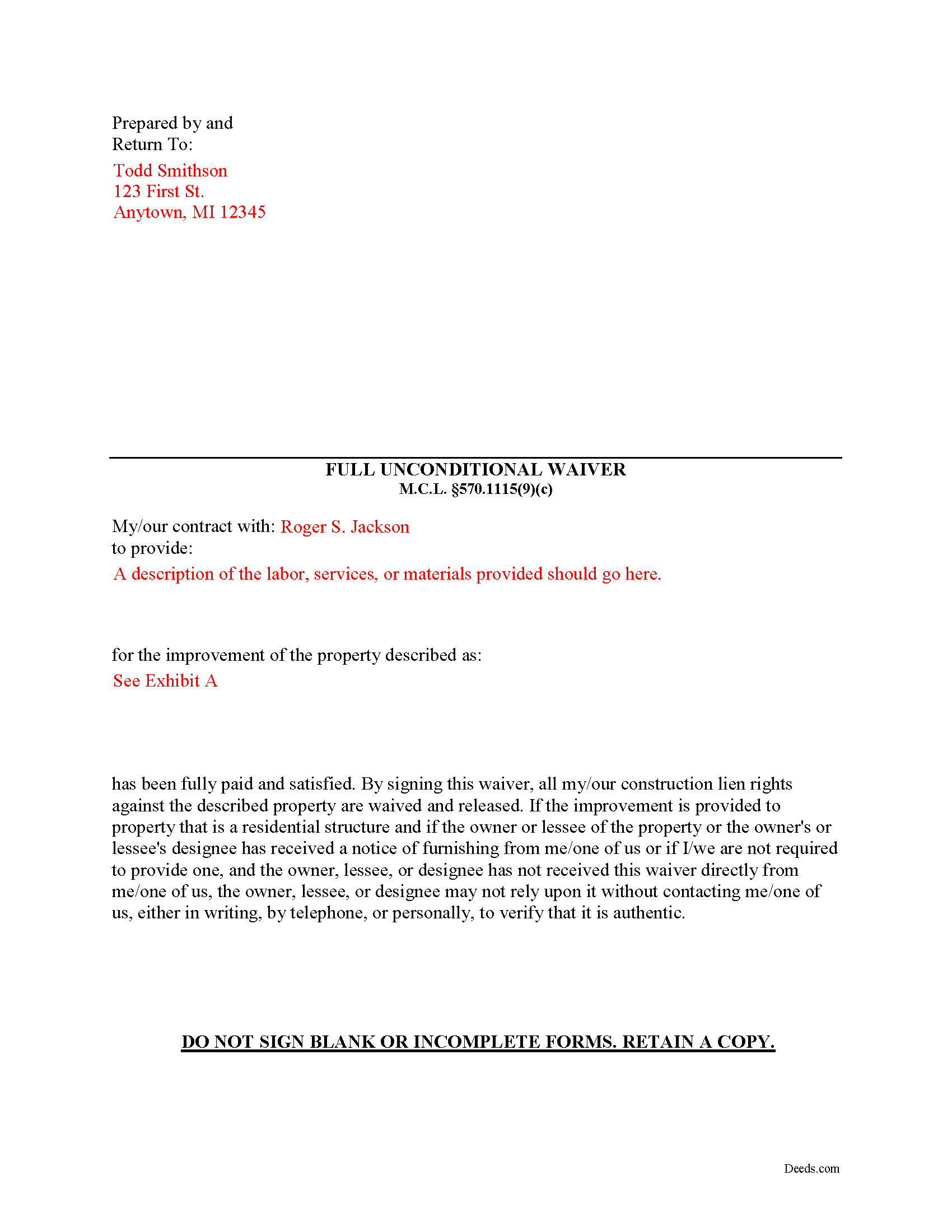

Jackson County Completed Example of the Full Unconditional Waiver of Lien Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Michigan and Jackson County documents included at no extra charge:

Where to Record Your Documents

Jackson County Register of Deeds

Jackson, Michigan 49201

Hours: 8:00am-5:00pm M-F

Phone: (517) 788-4350

Recording Tips for Jackson County:

- Ensure all signatures are in blue or black ink

- Ask about their eRecording option for future transactions

- Bring extra funds - fees can vary by document type and page count

Cities and Jurisdictions in Jackson County

Properties in any of these areas use Jackson County forms:

- Brooklyn

- Clarklake

- Concord

- Grass Lake

- Hanover

- Horton

- Jackson

- Michigan Center

- Munith

- Napoleon

- Norvell

- Parma

- Pleasant Lake

- Rives Junction

- Spring Arbor

- Springport

Hours, fees, requirements, and more for Jackson County

How do I get my forms?

Forms are available for immediate download after payment. The Jackson County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Jackson County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Jackson County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Jackson County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Jackson County?

Recording fees in Jackson County vary. Contact the recorder's office at (517) 788-4350 for current fees.

Questions answered? Let's get started!

During the construction process, a property owner (or his or her lessee) may ask the contractor for a mechanic's lien waiver in exchange for a full or partial payment.

Michigan law defines four permissible types of lien waivers. These include: (1) Partial Unconditional Waiver, (2) Partial Conditional Waiver, (3), Full Unconditional Waiver, and (4) Full Conditional Waiver. M.C.L. 570.1115(9).

Use a full unconditional waiver of lien when the claimant receives full payment for his or her contract from the owner, lessee, or designee. M.C.L. 570.1115(2).

A waiver of a lien will be effective when a person makes a payment relying on the waiver, unless at the time the payment was made, the person making the payment had written notice that the payment or consideration for the waiver has failed (i.e., the check bounced at the bank). M.C.L. 570.1115(6).

Lien waiver forms must be in writing and must comply with Michigan law to be valid. Include the names of the contractor and the property owner, and identify the property covered by the recorded lien.

Lien waivers can be confusing and issuing the wrong kind of waiver (or issuing one too early) can result in dire consequences for mechanic's liens. Contact an attorney with questions about waivers or any other issues related to liens.

Important: Your property must be located in Jackson County to use these forms. Documents should be recorded at the office below.

This Full Unconditional Waiver of Lien meets all recording requirements specific to Jackson County.

Our Promise

The documents you receive here will meet, or exceed, the Jackson County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Jackson County Full Unconditional Waiver of Lien form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4580 Reviews )

Nina F.

September 23rd, 2020

My experience could not have been better. Easy to communicate with, even though I'm largely ignorant of technical problem-solving. I may be addle-minded with 83 years on earth, but I think they actually cared about solving my problem and were sorry it was beyond their territory. Truly extra nice.

Thank you for your feedback. We really appreciate it. Have a great day!

Tracy E.

December 19th, 2020

This is so convenient. Thank you.

Thank you!

Pouya N.

November 6th, 2020

THEY ARE AWSOME. MAKE IT REALLY EASY AND EFFICIENT TO WORK. THANK YOU

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Patricia R.

March 2nd, 2025

Very helpful. Worth the cost. Hopefully we will be able to proceed without expense of an attorney.

We are thankful for your continued support and feedback, which inspire us to continuously improve. Thank you..

DAVID JOHN M.

February 25th, 2019

The Transfer On Death Deed did work for New Mexico! Though I did have to add the long property description to the "Exhibit" page that was included with the document. Great website! Will use again! Thanks!!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ben G.

September 21st, 2020

Faster AND less expensive than recording in person. Will be using again (and not just because of COVID).

Thank you!

Maria D.

May 22nd, 2020

Deeds.com has done a great job. I really recommend to everyone who needs this service, fast & reliable. Thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jami B.

November 6th, 2019

I was blown away by all the information I received for just $19.00!! I am still reading through it. Great job of explaining everything.

Thank you!

Terrance S.

April 6th, 2020

I'd say 5 stars. Thank you.

Thank you!

edward m.

February 27th, 2019

I would rate it 5 stars also. Eddie M.

Thank you!

Thomas C.

January 20th, 2020

Customer service was excellent!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jerry K G.

August 23rd, 2022

I got what I asked for, almost instantly.

Thank you!

Gina I.

June 14th, 2021

Found the forms I needed with no problem and easy to fill out thanks to the guide that is with it. Big help!

Thank you for your feedback. We really appreciate it. Have a great day!

Earl L.

February 13th, 2019

Fair!

Thank you!

Thelma S.

October 5th, 2019

So easy to navigate.

Thank you!