Keweenaw County Grant Deed Form

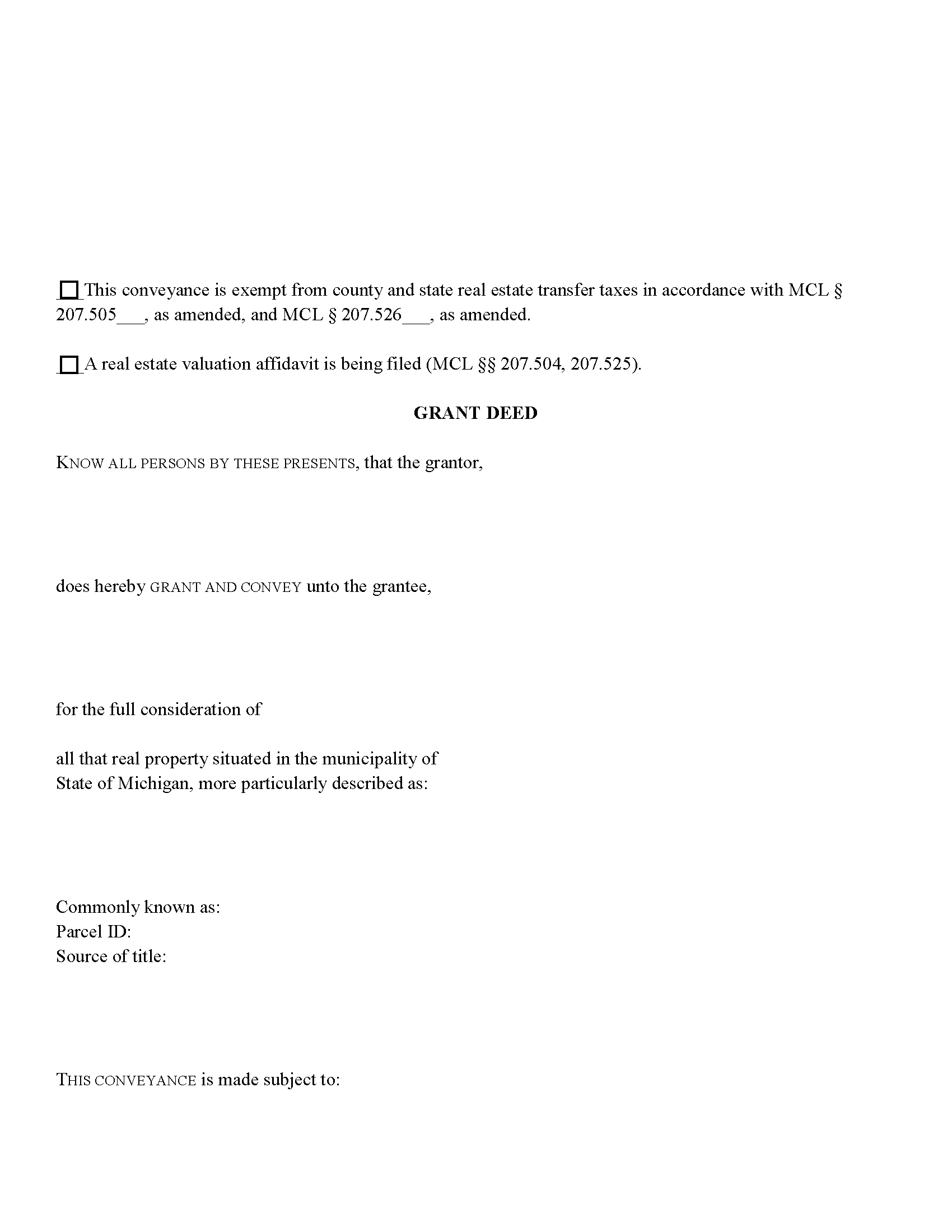

Keweenaw County Grant Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

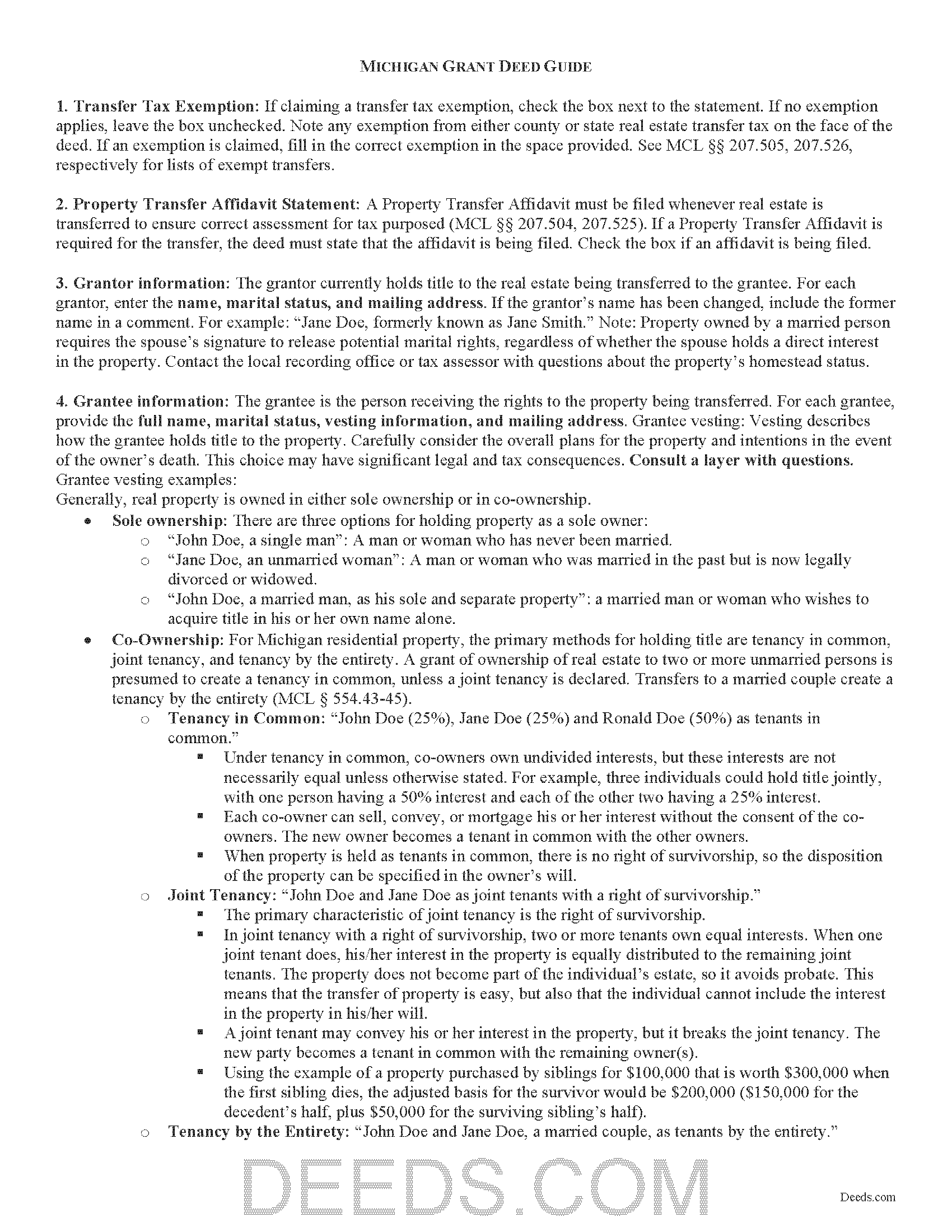

Keweenaw County Grant Deed Guide

Line by line guide explaining every blank on the form.

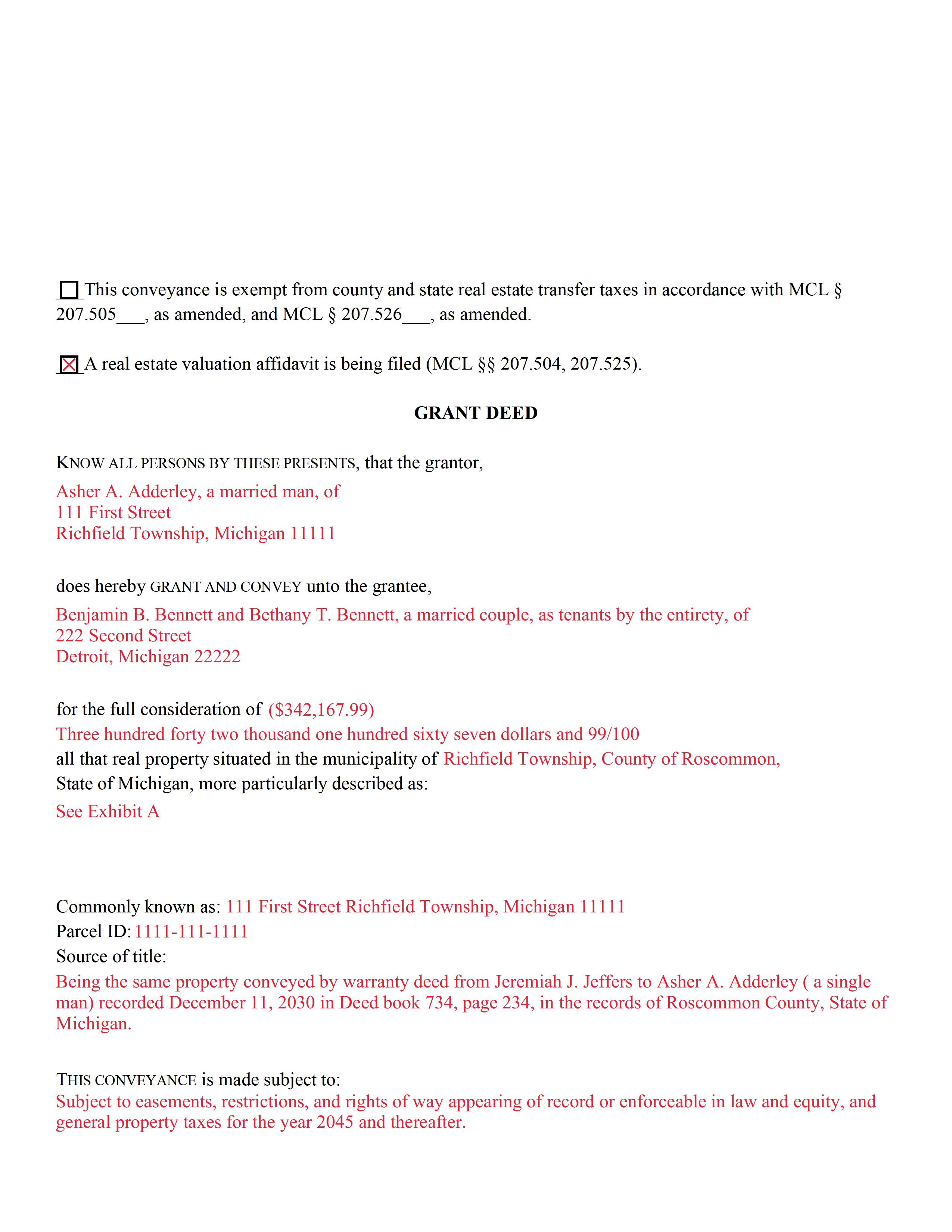

Keweenaw County Completed Example of the Grant Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Michigan and Keweenaw County documents included at no extra charge:

Where to Record Your Documents

Keweenaw County Register of Deeds

Eagle River, Michigan 49950

Hours: Monday - Friday 9:00am to 4:00pm

Phone: (906) 337-2229

Recording Tips for Keweenaw County:

- Verify all names are spelled correctly before recording

- Check margin requirements - usually 1-2 inches at top

- Recording fees may differ from what's posted online - verify current rates

- Bring extra funds - fees can vary by document type and page count

- Recording early in the week helps ensure same-week processing

Cities and Jurisdictions in Keweenaw County

Properties in any of these areas use Keweenaw County forms:

- Ahmeek

- Allouez

- Copper Harbor

- Mohawk

Hours, fees, requirements, and more for Keweenaw County

How do I get my forms?

Forms are available for immediate download after payment. The Keweenaw County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Keweenaw County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Keweenaw County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Keweenaw County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Keweenaw County?

Recording fees in Keweenaw County vary. Contact the recorder's office at (906) 337-2229 for current fees.

Questions answered? Let's get started!

Real property conveyances are governed by Chapter 565 of the Michigan Legislature, but grant deeds are not statutory forms in Michigan.

Grant deeds convey property from the grantor (generally the owner) to the grantee (generally the purchaser), with the guarantee that the grantor has not previously sold the real property interest being conveyed to the grantee, and that the property is without any liens or encumbrances, except for those specified in the deed.

Compared to a statutory warranty deed, grant deeds offer less protection to the grantee as they do not require the grantor to defend the title claims. However, they still offer more protection than a statutory quitclaim deed, guaranteeing that the owner does have a valid ownership interest in the property.

In addition to meeting all state and local standards for recorded documents, a lawful deed must include the grantor's full name and marital status, as well as the grantee's name, marital status, address, and vesting (MCL 565.201). Vesting describes how the grantee holds title to the property. For Michigan residential property, the primary methods for holding title are tenancy in common, joint tenancy, and tenancy by the entirety. A grant of ownership of real estate to two or more unmarried persons is presumed to create a tenancy in common unless a joint tenancy is declared. Transfers to a married couple create a tenancy by the entirety (MCL 554.43-45).

As with any conveyance of real estate, a grant deed requires a complete legal description of the parcel, the source of title, and a statement of the full consideration given for the transaction. If the consideration reported is nominal or not disclosed, file a Real Estate Transfer Tax Valuation Affidavit (form 2705) with the local Register of Deeds. This is important, as the value of the transfer must be known in order to calculate transfer tax (MCL 207.525).

In all cases where real estate is transferred, file a Property Transfer Affidavit (form 2766) to ensure correct assessment for tax purposes. The new owner must file in the municipality where the property is located within 45 days of transfer (MCL 207.504, 207.525).

In Michigan, a deed cannot be recorded unless it has been acknowledged (MCL 565.47). Recording preserves a clear chain of title for the property and provides public notice of the transfer. This protects both the grantor and the grantee from claims based on inaccurate information. Any deed executed within the state must be acknowledged before a judge, clerk of a court of record, or a notary public of the same state (MCL 565.8). If the deed is executed in another state, it may be acknowledged according to the laws of that state (MCL 565.9).

This article is provided for informational purposes only and is not a substitute for legal advice. Contact a lawyer with questions about grant deeds or for any other issues related to transfers of real property in Michigan.

(Michigan GD Package includes form, guidelines, and completed example)

Important: Your property must be located in Keweenaw County to use these forms. Documents should be recorded at the office below.

This Grant Deed meets all recording requirements specific to Keweenaw County.

Our Promise

The documents you receive here will meet, or exceed, the Keweenaw County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Keweenaw County Grant Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4607 Reviews )

brian p.

October 12th, 2019

Good, easy to use, quit claim form worked as expected.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

sharon s.

October 22nd, 2020

great site for downloading forms

Thank you!

William J. T.

July 9th, 2019

Satisfied with downloaded documents.

Thank you!

Lori F.

July 16th, 2020

These folks are so amazing! They were very kind, patient and the communication was above and beyond. Basically, THEY ROCK!

Thank you!

Ralph B.

November 25th, 2023

My needs were met quickly and efficiently with very little wait. Deeds.com made it easy to understand and use their program and I couldn't be more happy with the results!

It was a pleasure serving you. Thank you for the positive feedback!

scott m.

February 21st, 2021

thanks- easy as pie.

Thank you!

Nello P.

January 4th, 2021

very satisfied, useful, and of great assistance

Thank you!

James R.

July 31st, 2019

Super website. Easy to use and stuff is well organized.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Cynthia B.

July 21st, 2023

So simple to e-record my two documents. The communication was fast and very helpful. Thank you so much!

Thank you for your feedback. We really appreciate it. Have a great day!

Cecil S.

January 3rd, 2023

EXCELLENT SERVICE DONE WELL AND QUICKLY

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joel B.

August 10th, 2022

I would have liked more room in the text fields for describing the potential claim. had to use Exhibit A. Could not delete Exhibit B. Alo would like to have a custom footer - not deeds.com. Unprofessional.

Thank you for your feedback. We really appreciate it. Have a great day!

Laura R.

August 13th, 2022

Afficavit worked kind of pricey

Thank you for your feedback. We really appreciate it. Have a great day!

Dorothy S.

November 11th, 2020

Great service and documents that solved my legal issues I was frustrated with my inability to safe my information on the template and add an extra field box. Please make those instructions more clear for future customers.

Thank you for your feedback. We really appreciate it. Have a great day!

Kayreen B.

April 24th, 2023

Very happy with my experience with using Deeds.com! Especially easy to use with the sample page of what a form looks like filled out. saved a lot of money and it worked!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Imari E.

June 11th, 2020

QUICK SERVICE

Thank you!