Osceola County Lady Bird Quitclaim Deed Form

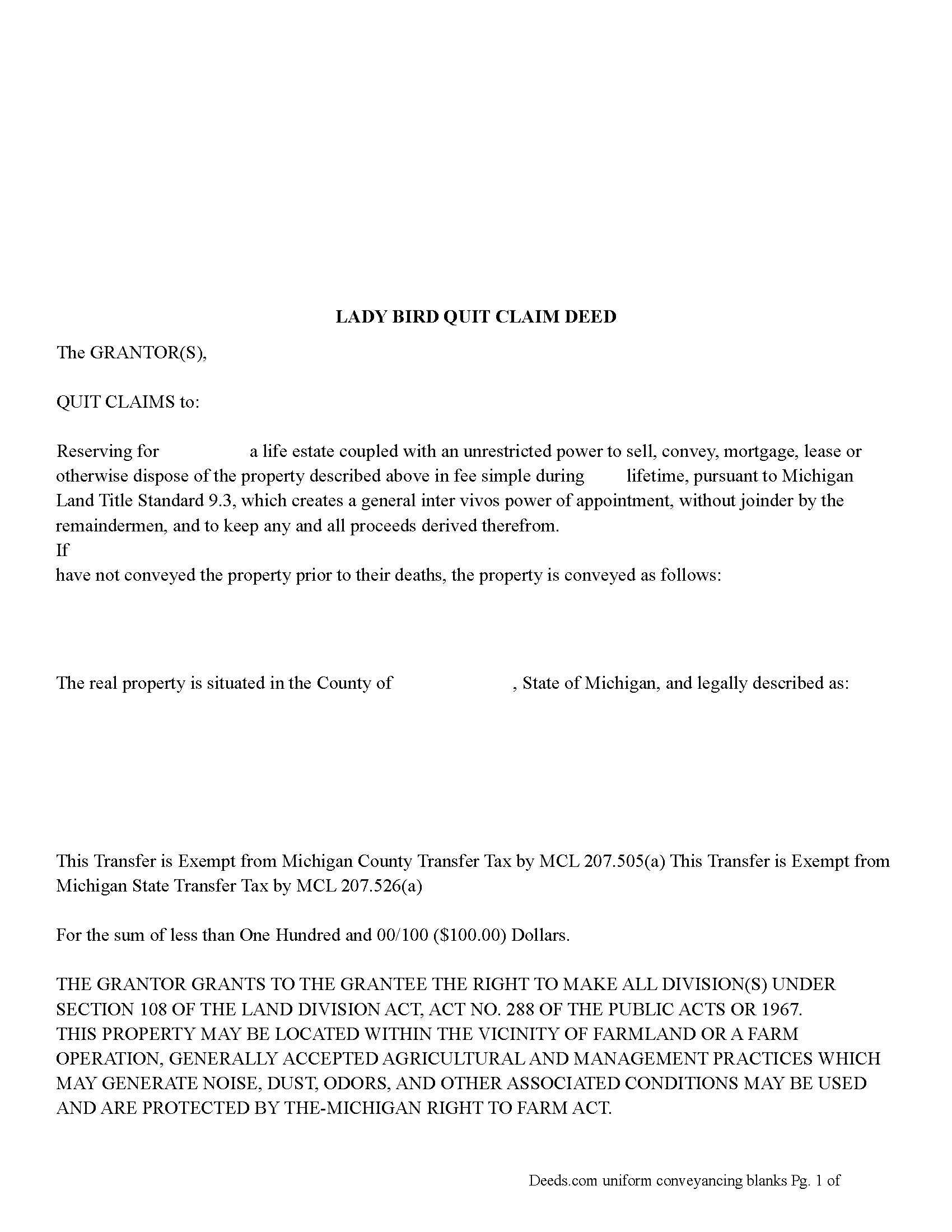

Osceola County Lady Bird Quitclaim Deed Form

Fill in the blank Lady Bird Quitclaim Deed form formatted to comply with all Michigan recording and content requirements.

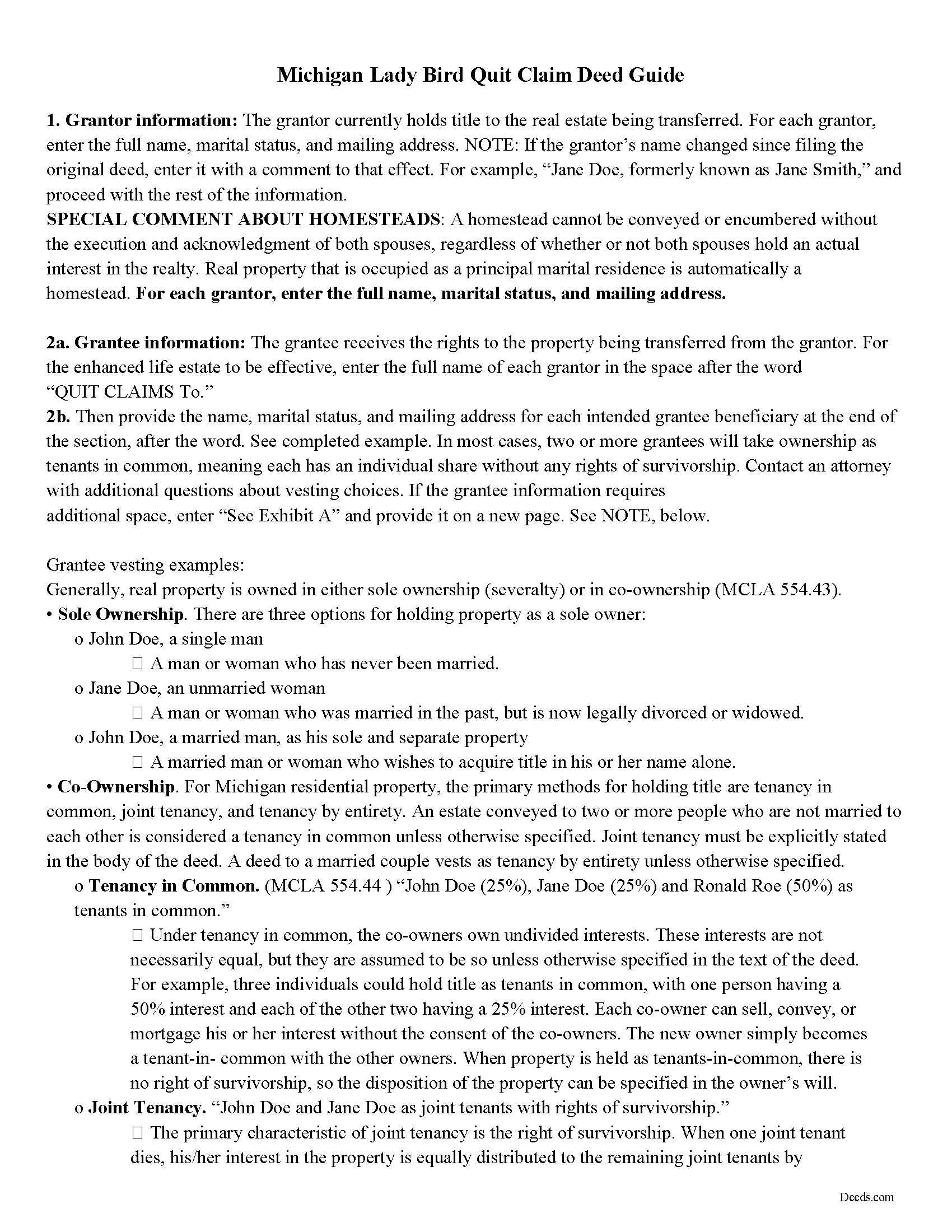

Osceola County Lady Bird Quitclaim Deed Guide

Line by line guide explaining every blank on the Lady Bird Quitclaim Deed form.

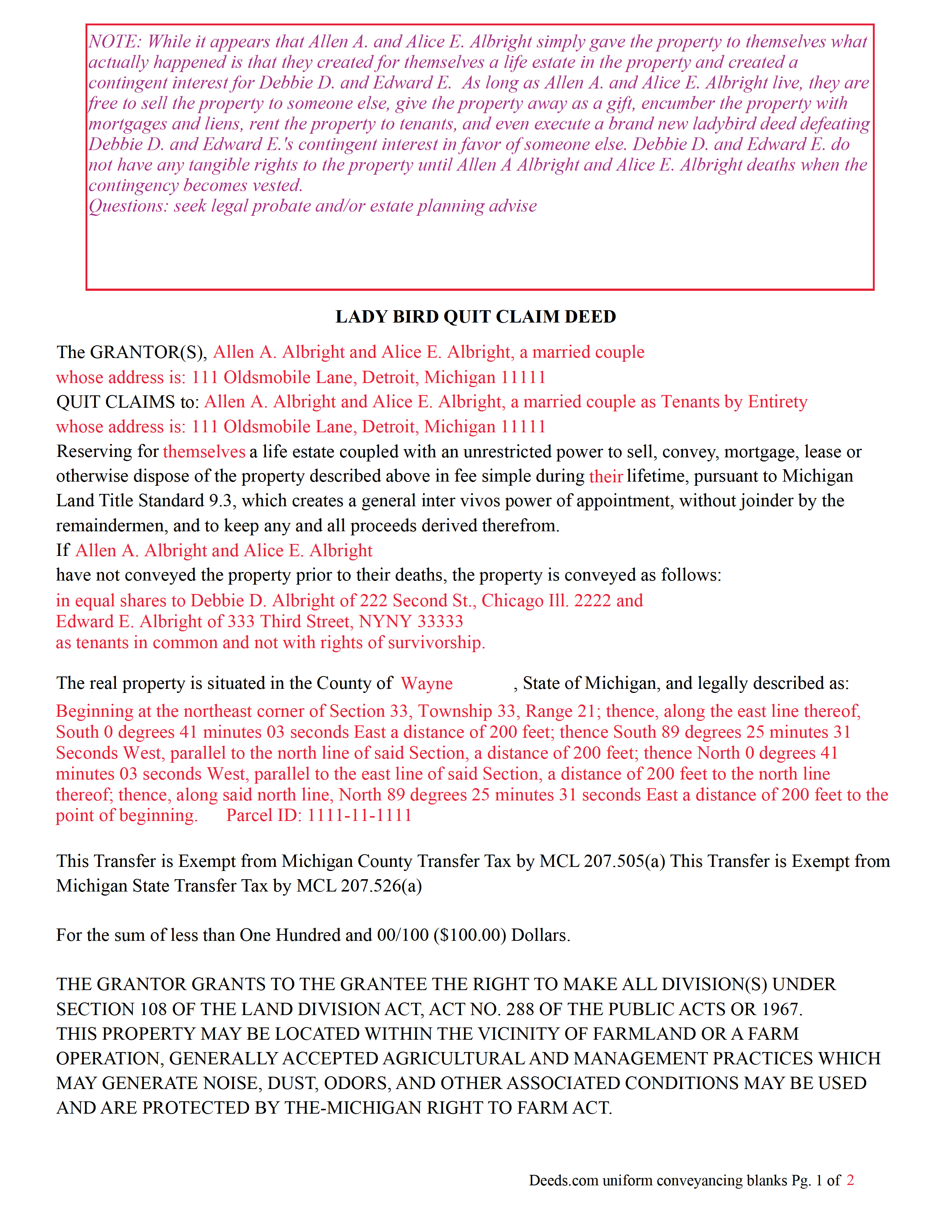

Osceola County Completed Example Version 1 of the Lady Bird Quitclaim Deed Document

Example of a properly completed Michigan Lady Bird Quitclaim Deed document for reference.

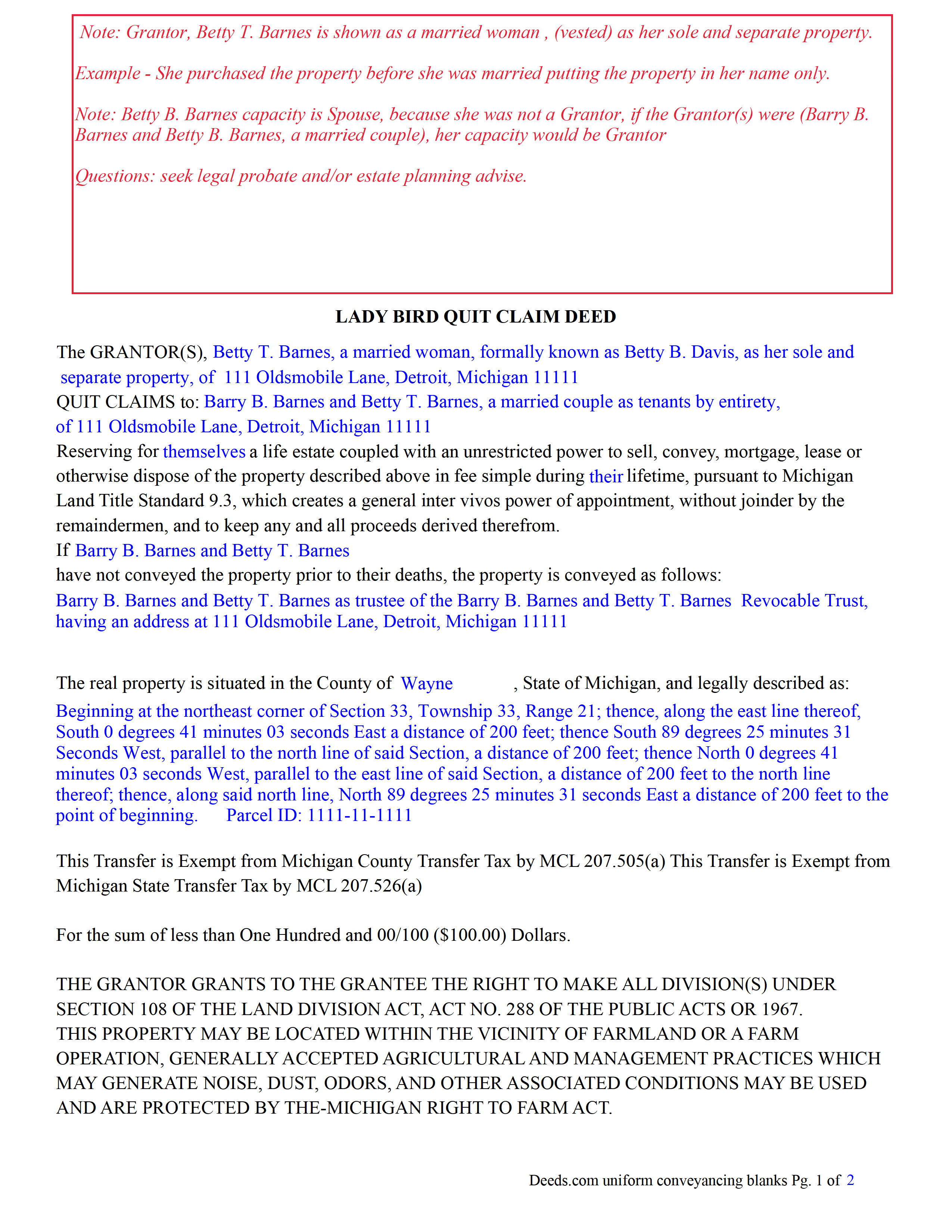

Osceola County Completed Example Version 2 of the Lady Bird Quitclaim Deed Document

Example of a properly completed Michigan Lady Bird Quitclaim Deed document for reference.

All 4 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Michigan and Osceola County documents included at no extra charge:

Where to Record Your Documents

Osceola County Register of Deeds

Reed City, Michigan 49677

Hours: Monday - Friday 9:00 a.m. - 5:00 p.m.

Phone: (231) 832-6113

Recording Tips for Osceola County:

- Double-check legal descriptions match your existing deed

- Both spouses typically need to sign if property is jointly owned

- Mornings typically have shorter wait times than afternoons

Cities and Jurisdictions in Osceola County

Properties in any of these areas use Osceola County forms:

- Evart

- Hersey

- Leroy

- Marion

- Reed City

- Sears

- Tustin

Hours, fees, requirements, and more for Osceola County

How do I get my forms?

Forms are available for immediate download after payment. The Osceola County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Osceola County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Osceola County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Osceola County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Osceola County?

Recording fees in Osceola County vary. Contact the recorder's office at (231) 832-6113 for current fees.

Questions answered? Let's get started!

A Michigan lady bird quitclaim deed is based on the statutes regarding power of appointment. According to Michigan Land Standards 6th Edition, Standard 9.3

Michigan Land Title Standards Act 9.3 reads: The holder of a life estate, coupled with an absolute power to dispose of the fee estate by inter vivos conveyance, can convey a fee simple estate during the lifetime of the holder. If the power is not exercised, the gift becomes effective.

In Michigan, a Lady Bird Deed Quitclaim Deed is a type of Quitclaim Deed that allows the Grantor, to transfer their property upon their death to a named beneficiary. This is a great tool for estate planning and helps to avoid probate court. These courts deal with someone's assets and belongings after they pass away. Going through this court is typically expensive and time-consuming.

As long as the Grantor lives, he/she/they are free to sell the property to someone else, give the property away as a gift, encumber the property with mortgages and liens, rent the property to tenants, and even execute a brand-new ladybird deed defeating Grantee's contingent interest in favor of someone else. Grantee(s) does/do not have any tangible rights to the property until Grantor's death when the contingency becomes vested.

Consult an estate planning attorney with questions including ladybird deeds.

(Michigan Lady Bird QCD Package includes form, guidelines, and completed example)

Important: Your property must be located in Osceola County to use these forms. Documents should be recorded at the office below.

This Lady Bird Quitclaim Deed meets all recording requirements specific to Osceola County.

Our Promise

The documents you receive here will meet, or exceed, the Osceola County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Osceola County Lady Bird Quitclaim Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4588 Reviews )

L B W.

January 22nd, 2021

Bottom line - it was certainly worth the $21 (+-?) I paid for the form and instructions, etc. Admittedly the form is a little inflexible in terms of editing for readability but I understand that offering greater flexibility would likely make theft more likely. So I'm happy with what I got. One suggestion - add more info about what's required in the "Source of Title" section.

Thank you for your feedback. We really appreciate it. Have a great day!

Jose R.

January 16th, 2020

User friendly. Smooth transaction. I saved a lot of time

Thank you for taking the time to leave your feedback Jose, we really appreciate it. Have a fantastic day!

Dorothy B.

November 4th, 2020

Love your deed service. Simple and easy.

Thank you!

Paul D.

July 24th, 2019

Easy to use! The forms were perfect and everything was explained well! Will use again!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Nigel S.

June 24th, 2025

Very simple to use. The 'completed examples' are very helpful.

Thank you for your feedback. We really appreciate it. Have a great day!

Thaddeus E.

January 5th, 2025

Quick assistance with same day recording. The tech identified barriers to successful Recordation such as image quality and worked with me to get them resolved for timely submission.

We are delighted to have been of service. Thank you for the positive review!

Sharla B.

November 25th, 2019

Was very helpful it helped me find out everything I needed for the deed.

Thank you!

Riley K G.

June 23rd, 2022

Awesome, way better than some other offerings out there. Unfortunately some people won't realize that until it's too late.

Thank you!

Miguel R.

August 18th, 2019

Easy to create an account! Awesome!

Thank you!

Monte J.

June 28th, 2019

Very helpful.

Thank you!

Diane C.

April 28th, 2021

This was just the info I needed

Thank you!

Renee M.

September 15th, 2021

My sister in law is in a hospital ICU with Covid, so we were trying to get her affairs in order. Deeds.com made this difficult situation so much better by making this process very easy to understand and do.

Glad we could help Renee, hoping the very best for you and your family.

Cindy H.

October 21st, 2020

Loved it! Quick and easy, done in 24 hours.

Thank you for your feedback. We really appreciate it. Have a great day!

Gwenevere J.

December 1st, 2020

Website is very informative and user friendly!

Thank you!

Mary D.

July 13th, 2021

So far, understanding the process involved to get these forms was simple. I would like to have known or received some information as to charges for filing these documents. Or, be directed to a place that lists charges.

Thank you for your feedback. We really appreciate it. Have a great day!