Allegan County Land Contract Form

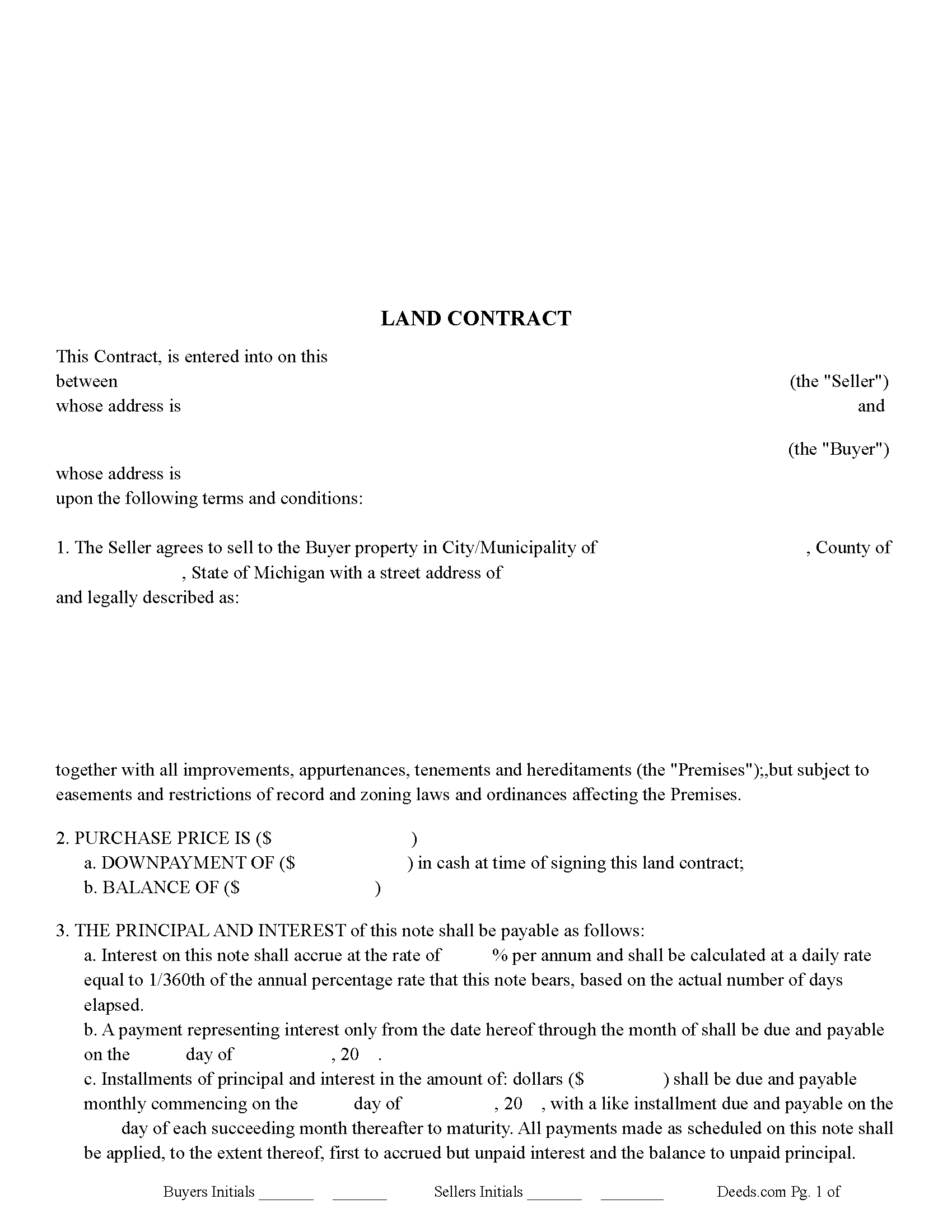

Allegan County Land Contract Form

Fill in the blank form formatted to comply with all recording and content requirements.

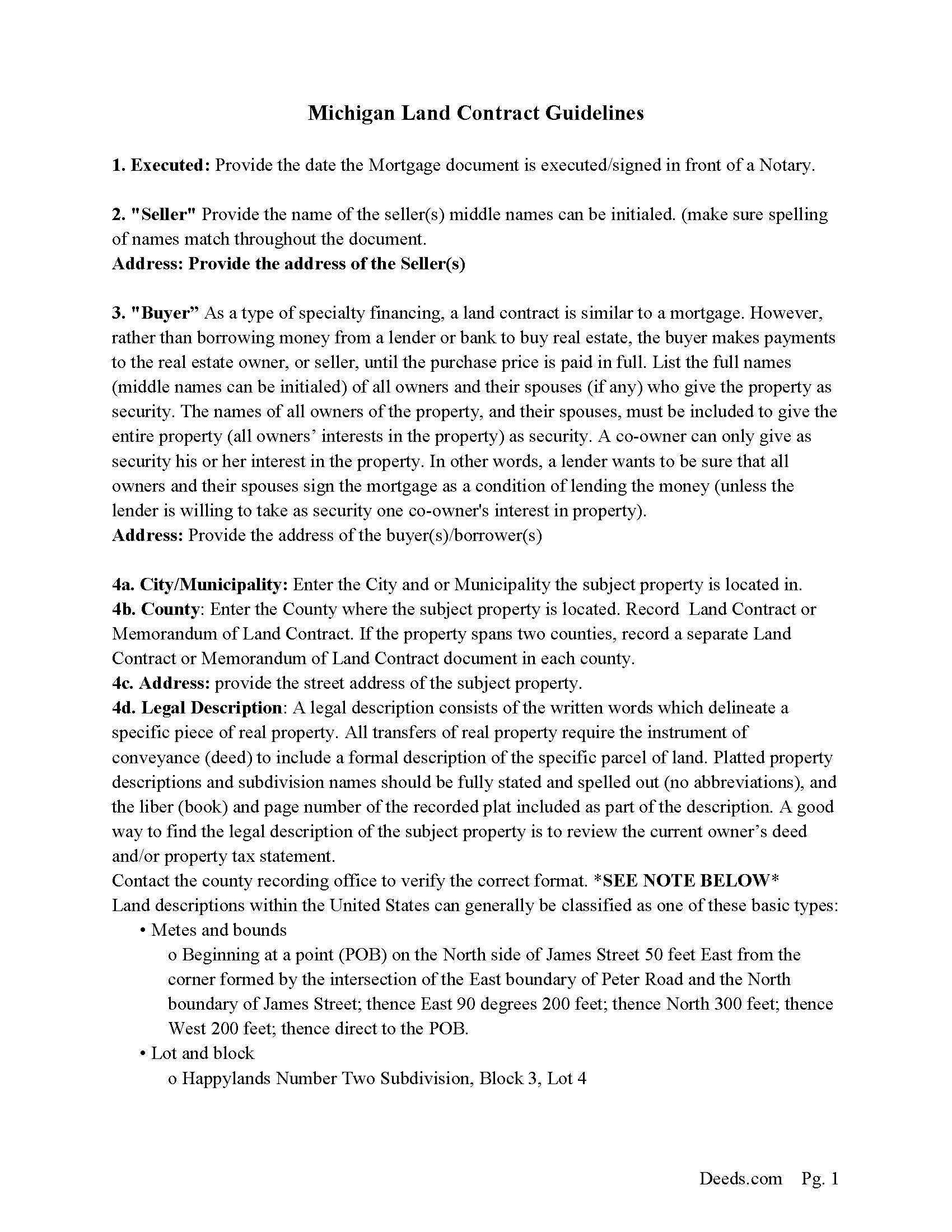

Allegan County Land Contract Guidelines

Line by line guide explaining every blank on the form.

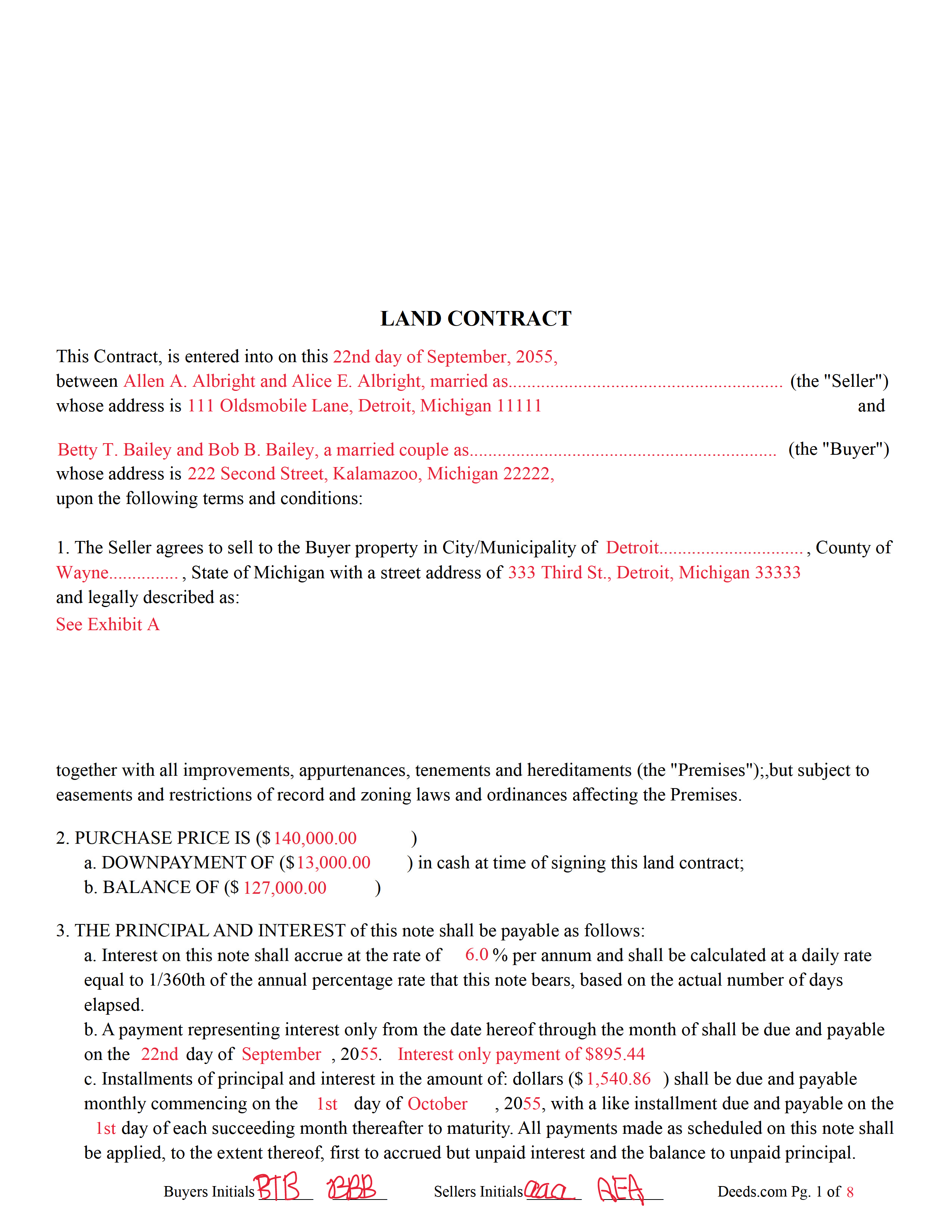

Allegan County Completed Example of the Land Contract Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Michigan and Allegan County documents included at no extra charge:

Where to Record Your Documents

Register of Deeds

Allegan, Michigan 49010

Hours: 8:00am - 5:00pm M-F

Phone: (269) 673-0390

Recording Tips for Allegan County:

- Check margin requirements - usually 1-2 inches at top

- Leave recording info boxes blank - the office fills these

- Multi-page documents may require additional fees per page

Cities and Jurisdictions in Allegan County

Properties in any of these areas use Allegan County forms:

- Allegan

- Bradley

- Burnips

- Dorr

- Douglas

- Fennville

- Glenn

- Hamilton

- Hopkins

- Martin

- Moline

- Otsego

- Plainwell

- Pullman

- Saugatuck

- Shelbyville

- Wayland

Hours, fees, requirements, and more for Allegan County

How do I get my forms?

Forms are available for immediate download after payment. The Allegan County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Allegan County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Allegan County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Allegan County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Allegan County?

Recording fees in Allegan County vary. Contact the recorder's office at (269) 673-0390 for current fees.

Questions answered? Let's get started!

A land contract is a written legal contract used to purchase real estate; it is typically used in owner/seller financing. Once recorded it (shall have the same force and effect, as to subsequent encumbrancers and purchasers, as the recording of deeds and mortgages as now provided by law.) (565.354 section 4)

565.358 Land contract mortgage; document; form; execution, acknowledgement, and

recording; identification of encumbered interest; perfection of mortgage; priority.

Sec. 8.

(1) Any document that would be sufficient to constitute a real estate mortgage upon an interest in

real property shall constitute a land contract mortgage upon the vendor's or vendee's interest.

(2) A land contract mortgage shall be in a form and shall be executed, acknowledged, and recorded in the same manner as provided for real estate mortgages.

(3) A land contract mortgage need not specifically identify the interest encumbered as a vendor's or vendee's interest.

(4) A land contract mortgage that is recorded in the manner provided for real estate mortgages is perfected for all purposes, without filing, under the uniform commercial code, 1962 PA 172, MCL 440.1101 to 440.11102, any notice to the nonmortgaging vendor or the nonmortgaging vendee or the taking of possession of the original land contract document or otherwise. A land contract mortgage perfected in accordance with this section takes priority as a matter of law over all other mortgages, liens, security, or other interests in such vendor's or vendee's interests except those as to which a real estate mortgage would be subordinate.

565.359 Land contract mortgage; enforcement; foreclosure; additional remedies.

Sec. 9. (1) A land contract mortgage may be enforced in accordance with any existing procedure for the enforcement of a real estate mortgage, including, without limitation, foreclosure by advertisement and judicial foreclosure. Upon completion of a foreclosure by advertisement or judicial foreclosure of a land contract mortgage and the expiration of the applicable redemption period, the successful bidder at foreclosure shall succeed to all of the mortgaged interests of the respective foreclosed vendor or vendee.

(2) Other rights and remedies that may be available to a real estate mortgagee, including, without

limitation, future advance mortgages, assignments of rents, or receiverships may, in a proper case, be applied in favor of a land contract mortgagee.

(3) All remedies that existed before the effective date of sections 6 to 11 shall continue to apply. However, a land contract mortgage made pursuant to this act may, at the option of the land contract mortgagee, also be enforced as provided in this act.

Use this form for vacant land, residential housing, apartments/rental property, small commercial and condominiums.

For a Discharge of Land Contract, see Discharge of Mortgage form.

(Michigan LC Package includes form, guidelines, and completed example) For use in Michigan only.

Important: Your property must be located in Allegan County to use these forms. Documents should be recorded at the office below.

This Land Contract meets all recording requirements specific to Allegan County.

Our Promise

The documents you receive here will meet, or exceed, the Allegan County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Allegan County Land Contract form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4580 Reviews )

Munir S.

August 2nd, 2024

Good service. Easy to use, responsive, fast, and fairly priced. First time user, will continue to use it for future needs. Recommend.

Thank you for your positive words! We’re thrilled to hear about your experience.

Mary B.

February 8th, 2023

Your information was orderly and very clear and helpful. Thanks!

Thank you for your feedback. We really appreciate it. Have a great day!

Gail D.

October 22nd, 2024

Very concise and thorough website. Easily navigated and easily affordable.

Knowing our customers are happy is our top priority. Thank you for the wonderful feedback!

D. Jeffrey C.

June 10th, 2024

Generally I find the process works well, and the support personnel on the other end are usually fairly helpful.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Laurie F.

February 24th, 2019

I am so glad I found Deeds.com. You had exactly what I needed and made it easy to download. I have bookmarked you in the event of further inquiry. Thank you.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

joseph p.

December 23rd, 2019

As i am not very computer ready,i had one heck of a time filling,printing,and copying this document.But with your patience and understanding of older ways,WE DID IT SUCCESSFULLY.Thank you for your time.I will recommend this site to all that inquire

Thank you for your feedback. We really appreciate it. Have a great day!

Andrew T.

December 19th, 2023

The process was incredibly simple from start to finish. Someone from the team even sent a message to double check part of my document was filled out correctly. Will be bringing my business here in the future!

It was a pleasure serving you. Thank you for the positive feedback!

A. S.

February 27th, 2019

First, I am glad that you gave a blank copy, an example copy, and a 'guide'. It made it much easier to do. Overall I was very happy with your products and organization... however, things got pretty confusing and I have a pretty 'serious' law background in Real Estate and Civil law. With that said, I spent about 10+ hours getting my work done, using the Deed of Trust and Promissory note from you and there were a few problems: First, it would be FANTASTIC if you actually aligned your guide to actually match the Deed or Promissory Note. What I mean is that if the Deed says 'section (E)' then your guide shouldn't be 'randomly' numbered as 1,2,3, for advice/instructions, but should EXACTLY match 'section (E)'. Some places you have to 'hunt' for what you are looking for, and if you did it based on my suggestion, you wouldn't need to 'hunt' and it would avoid confusion. 2nd: This one really 'hurt'... you had something called the 'Deed of Trust Master Form' yet you had basically no information on what it was or how to use it. The only information you had was a small section at the top of the 'Short Form Deed of Trust Guide'. Holy Cow, was that 'section' super confusing. I still don't know if I did it correctly, but your guide says only put a return address on it and leave the rest of the 16 or so page Deed of Trust beneath it blank... and then include your 'Deed of Trust' (I had to assume the short form deed that I had just created) as part of it. I had to assume that I had to print off the entire 17 page or so title page and blank deed. I also had to assume that the promissory note was supposed to be EXHIBIT A or B on the Short Form Deed. It would be great if someone would take a serious look at that short section in your 'Short Form Deed of Trust Guide' and realize that those of us using your products are seriously turning this into a county clerk to file and that most of us, probably already have a property that has an existing Deed... or at least can find one in the county records if necessary... and make sure that you make a distinction between the Deed for the property that already exists, versus the Deed of Trust and Promissory note that we are trying to file. Thanks.

Thank you for your feedback. We'll have staff review the document for clarity. Have a great day!

Peter & Bonnie Higgins H.

July 29th, 2021

We were very pleased with the advice and forms provided. We were able to complete our special project. Just what we were looking for. I give you 41/2 stars

Thank you!

Johannah H.

May 20th, 2022

Deeds.com made my experience recording a Deed in Weld County, CO so easy! The representative went above and beyond by assisting me with the preparation of a high-quality digital document for recording. Highly Recommend!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Denise B.

September 3rd, 2020

Quick and easy!

Thank you Denise. We appreciate you.

Dianne M.

June 30th, 2023

I find the resources on this website so helpful. The service is outstanding. Thank you.

Thank you!

Timothy C.

January 6th, 2022

The process was all very clear and easy -- pay the fee online and download the state and county forms onto my computer. I will do as instructed for the Revocable Transfer on Death Deed, then update my review after I file this with the office of the Sandoval County (New Mexico) Clerk.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Neil S.

January 3rd, 2019

Very impressive. The only change I would suggest is a smaller font on the title.

Thank you for your feedback. We really appreciate it. Have a great day!

Susan N.

July 29th, 2020

Very easy to use and I received the information in a timely manner. I will use this service again.

Thank you!