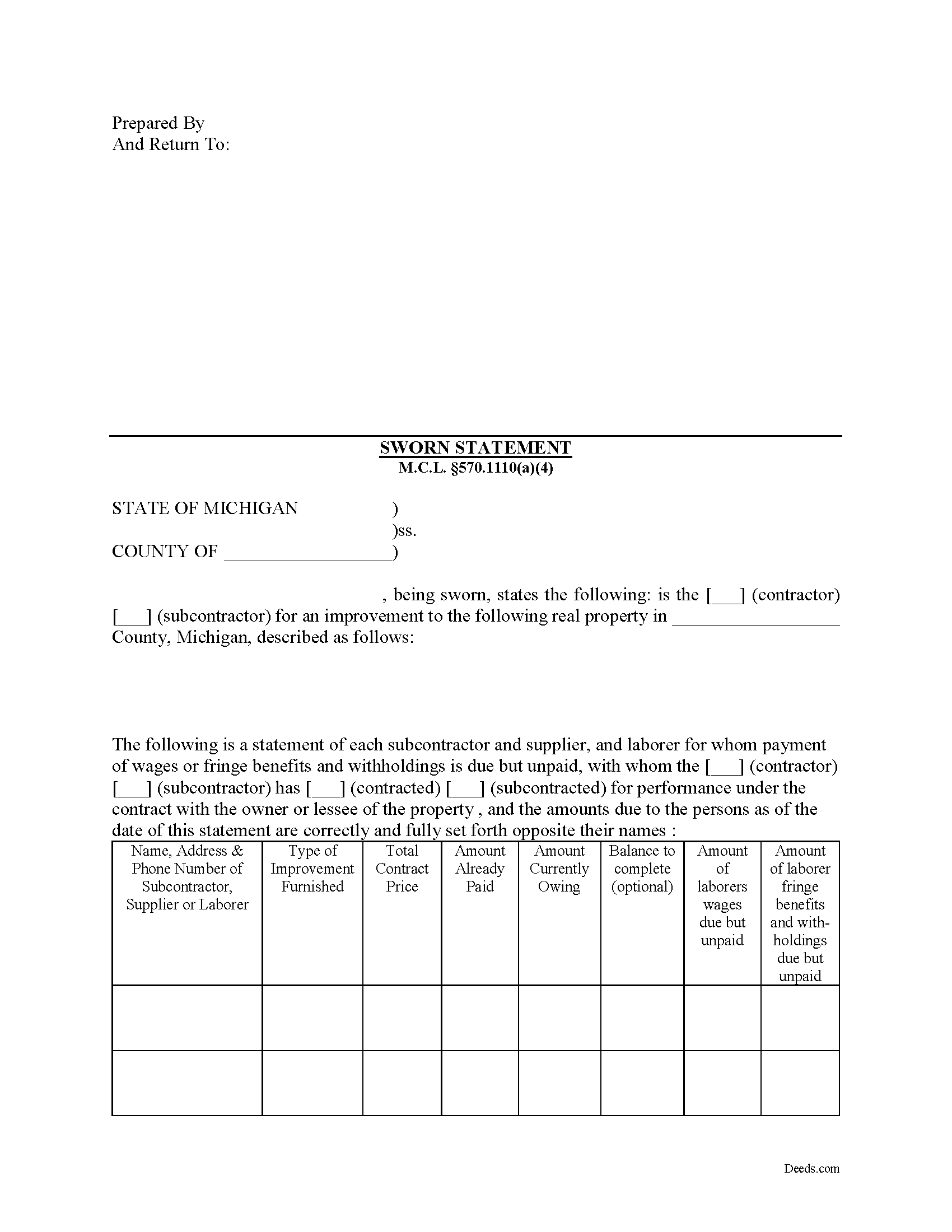

Huron County Sworn Statement of Account Form

Huron County Sworn Statement of Account Form

Fill in the blank form formatted to comply with all recording and content requirements.

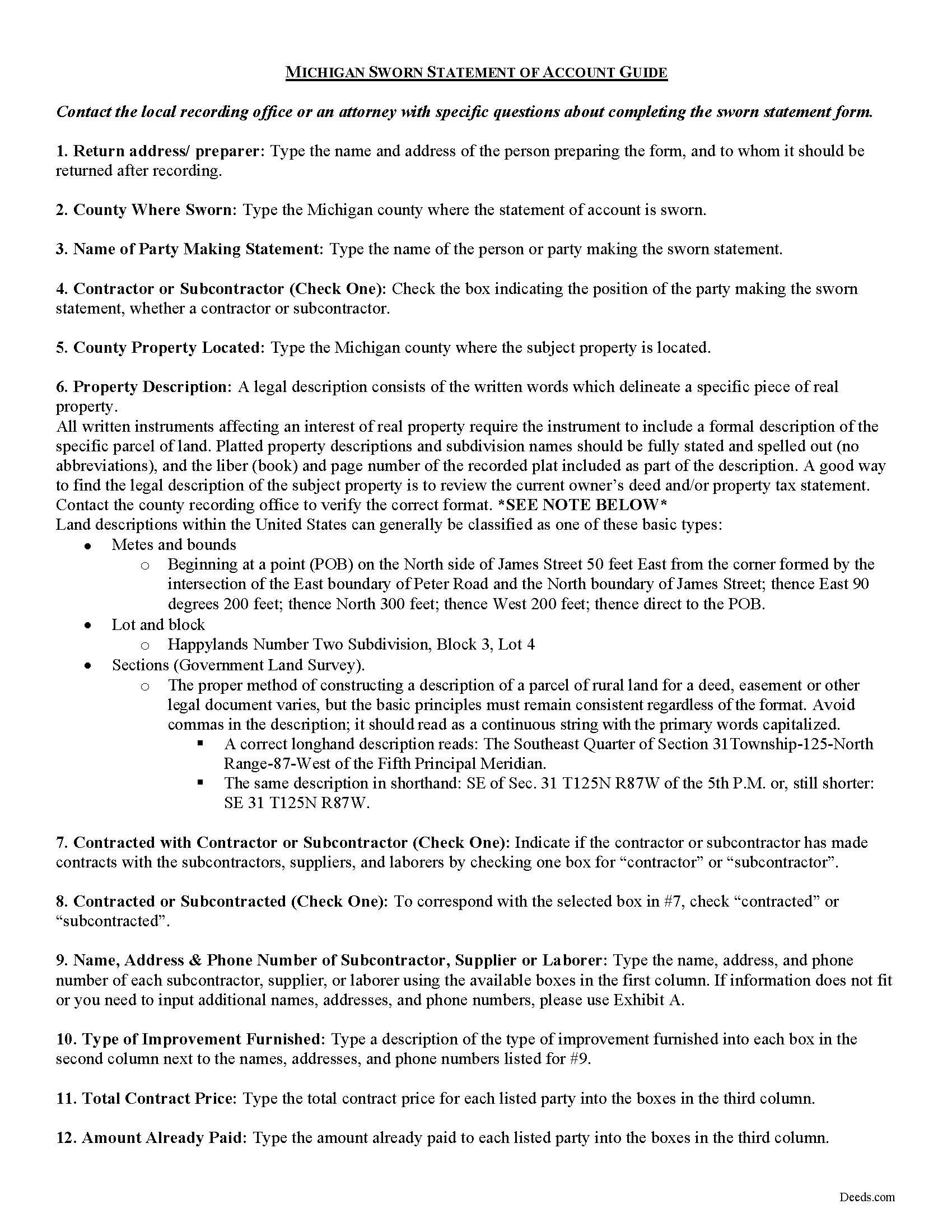

Huron County Sworn Statement of Account Guide

Line by line guide explaining every blank on the form.

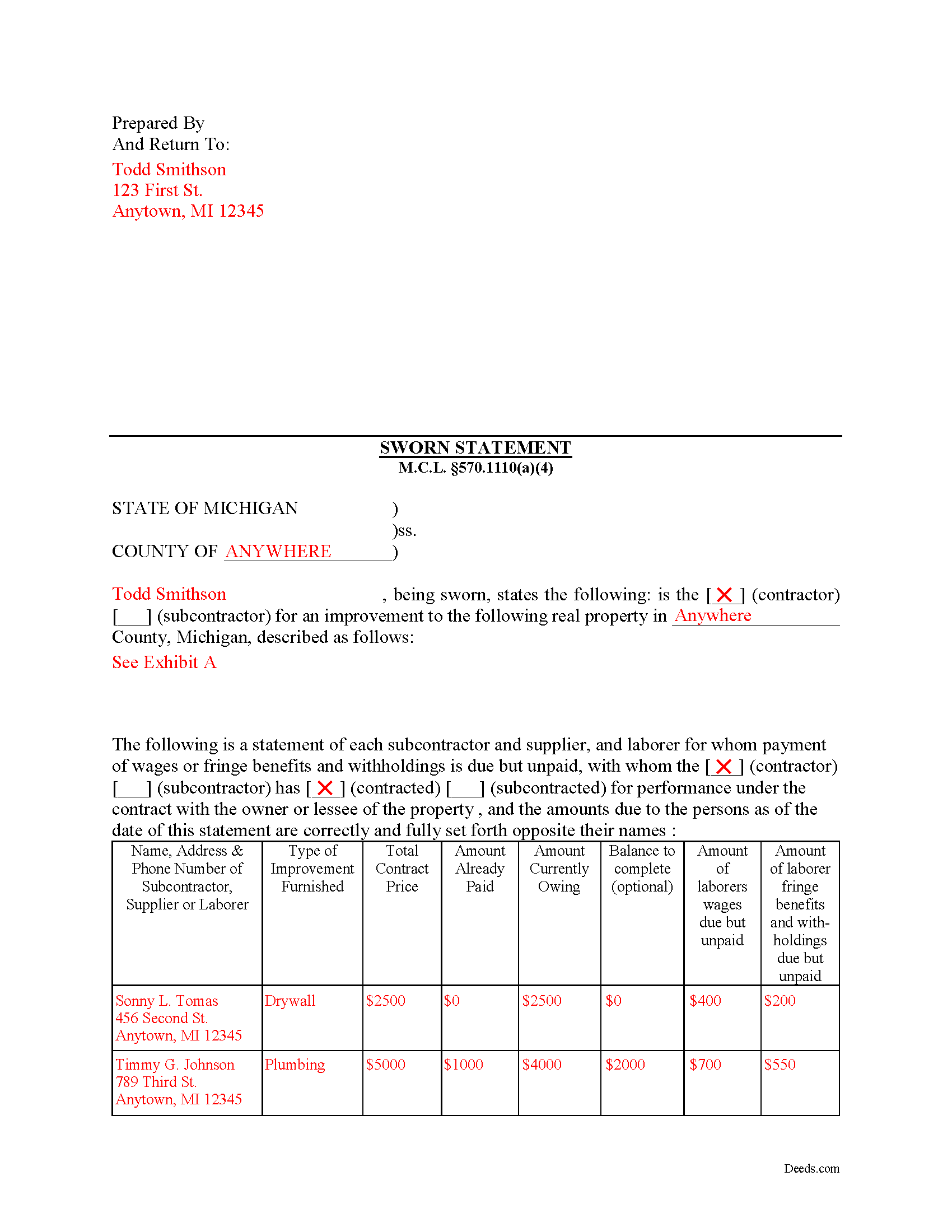

Huron County Completed Example of the Sworn Statement of Account Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Michigan and Huron County documents included at no extra charge:

Where to Record Your Documents

Huron County Register of Deeds

Bad Axe, Michigan 48413

Hours: 8:30 a.m. - 5:00 p.m. Monday - Friday

Phone: (989) 269-9941

Recording Tips for Huron County:

- Ensure all signatures are in blue or black ink

- Documents must be on 8.5 x 11 inch white paper

- Request a receipt showing your recording numbers

- Bring extra funds - fees can vary by document type and page count

- Make copies of your documents before recording - keep originals safe

Cities and Jurisdictions in Huron County

Properties in any of these areas use Huron County forms:

- Bad Axe

- Bay Port

- Caseville

- Elkton

- Filion

- Harbor Beach

- Kinde

- Owendale

- Pigeon

- Port Austin

- Port Hope

- Ruth

- Sebewaing

- Ubly

Hours, fees, requirements, and more for Huron County

How do I get my forms?

Forms are available for immediate download after payment. The Huron County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Huron County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Huron County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Huron County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Huron County?

Recording fees in Huron County vary. Contact the recorder's office at (989) 269-9941 for current fees.

Questions answered? Let's get started!

Using a Sworn Statement of Account in Michigan

A Sworn Statement of Account is an itemized list containing the names and identifying information for all the parties that have provided improvements, materials or labor and an accounting of the money that is owed to them.

Under Michigan law, a contractor must provide a sworn statement to the owner or lessee in each of the following circumstances: (a) when payment is due to the contractor from the owner or lessee or when the contractor requests payment from the owner or lessee, or (b) when a demand for the sworn statement has been made by or on behalf of the owner or lessee. M.C.L. 570.1110(1). A subcontractor must provide a sworn statement to the owner or lessee upon request by or on behalf of the owner or lessee. M.C.L. 570.1110(2). Subcontractors must also provide a sworn statement to the contractor when payment is due to the subcontractor from the contractor or when the subcontractor requests payment from the contractor. M.C.L. 570.1110(3).

The sworn statement must list each subcontractor and supplier with whom the person issuing the sworn statement has contracted relative to the improvement to the real property. M.C.L. 570.1110(4). It must also contain a list of laborers with whom the person issuing the sworn statement has contracted with, and for whom payment for wages or fringe benefits and withholdings are due but unpaid, along with an itemized amount of such wages or fringe benefits and withholdings. Id.

The contractor or subcontractor is not required to list in the sworn statement material furnished by the contractor or subcontractor out of his or her own inventory that was not purchased specifically for performing the contract. M.C.L. 570.1110(5).

Treat requests for a sworn statement seriously. If a contractor fails to provide a sworn statement to the owner or lessee before recording the contractor's claim of lien, the contractor's construction lien is not invalid. M.C.L. 570.1110(9). However, the contractor is not entitled to any payment, and a complaint, cross-claim, or counterclaim may not be filed to enforce the construction lien, until the sworn statement has been provided. Id. Along the same line, if a subcontractor fails to provide a sworn statement to the owner, the subcontractor's construction lien is valid. M.C.L. 570.1110(10). However, a complaint, cross-claim, or counterclaim may not be filed to enforce the construction lien until the sworn statement has been provided. Id.

Because the statement is "sworn," there are strict penalties for falsification. A contractor or subcontractor who desires to draw money and gives or causes to be given to any owner or lessee a sworn statement that is false, with intent to defraud, is guilty of a crime. M.C.L. 570.1110(11).

This article is provided for informational purposes only and should not be relied on as a substitute for the advice of an attorney. If you have any questions about using a sworn statement of account form, please consult with a licensed Michigan attorney.

Important: Your property must be located in Huron County to use these forms. Documents should be recorded at the office below.

This Sworn Statement of Account meets all recording requirements specific to Huron County.

Our Promise

The documents you receive here will meet, or exceed, the Huron County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Huron County Sworn Statement of Account form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4580 Reviews )

Tracey B.

January 7th, 2019

Has no problems at all, everything was perfect. TB

Thanks Tracey, we appreciate your feedback.

SUSAN B.

September 16th, 2024

THE PROCEDURE IN GETTING THIS MECHANICS LIEN PROCESSED HAS SO FAR BEEN RELATIVELY SIMPLY - BETTER THAN HAVING TO WAIT ON MAIL OR GO IN PERSON TO GET RECORDED

We are delighted to have been of service. Thank you for the positive review!

Garrett R.

May 24th, 2022

I am a real estate attorney in CA. These Wyoming model deeds look too basic and barely adequate: no usual name and address at the top for tax statements and who recorded it. Some old fashioned legalese that only obfuscates. I won't use them. Your background info was good though.

Thank you for your feedback. We really appreciate it. Have a great day!

Alan M.

December 3rd, 2021

The packet I downloaded was complete and useful, and process was not unduly opaque. However, I would have liked to download the whole packet, about 6 files, all at one go. Still, the forms provided the complete solution to my situation.

Thank you for your feedback. We really appreciate it. Have a great day!

Leslie P.

October 16th, 2021

Fantastic deed forms, formatting was spot on, nice not to have to worry about it considering how picky our clerk is. Great job you guys and gals!

Thank you for the kind words Leslie!

Terrell W.

January 27th, 2021

Was a little hard to find the form but once I did everything worked well

Thank you for your feedback. We really appreciate it. Have a great day!

Lori G.

May 21st, 2020

thank you for all your help and patience. I would highly recommend Deeds.com to everyone. Sincerely, Lori G.

Thank you!

Larry B.

September 30th, 2020

Clear Directions; worked well.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Terry W.

September 10th, 2020

Loved it no recurring fees easy to use your app

Thank you!

Mary W.

June 25th, 2020

Easy to access and good instructions. Where to mail would be the only thing I would add.

Thank you for your feedback. We really appreciate it. Have a great day!

Lillian F.

September 13th, 2019

Very well satisfy with my results. I could not ask for better service d

Thank you for your feedback. We really appreciate it. Have a great day!

SHALINI W.

August 24th, 2020

Exceptionally easy to use. Very user friendly. Would highly recommend.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Donald W.

December 8th, 2019

Could not have been any easier to download the quit claim forms. The provided instructions and samples look to be helpful. Only have to set aside the time to fill out. Thanks

Thank you!

Beverly D.

April 15th, 2021

Very User friendly site

Thank you for your feedback. We really appreciate it. Have a great day!

Emmy M.

August 20th, 2020

I loved using this process to record my deeds. it was fast and everytime I sent a message I received a response very quickly. I am so glad they have this option. for the extra $15 to have the convenience to do it from home and not worry about finding parking, etc. so well worth it!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!