Kalkaska County Sworn Statement of Account Form (Michigan)

All Kalkaska County specific forms and documents listed below are included in your immediate download package:

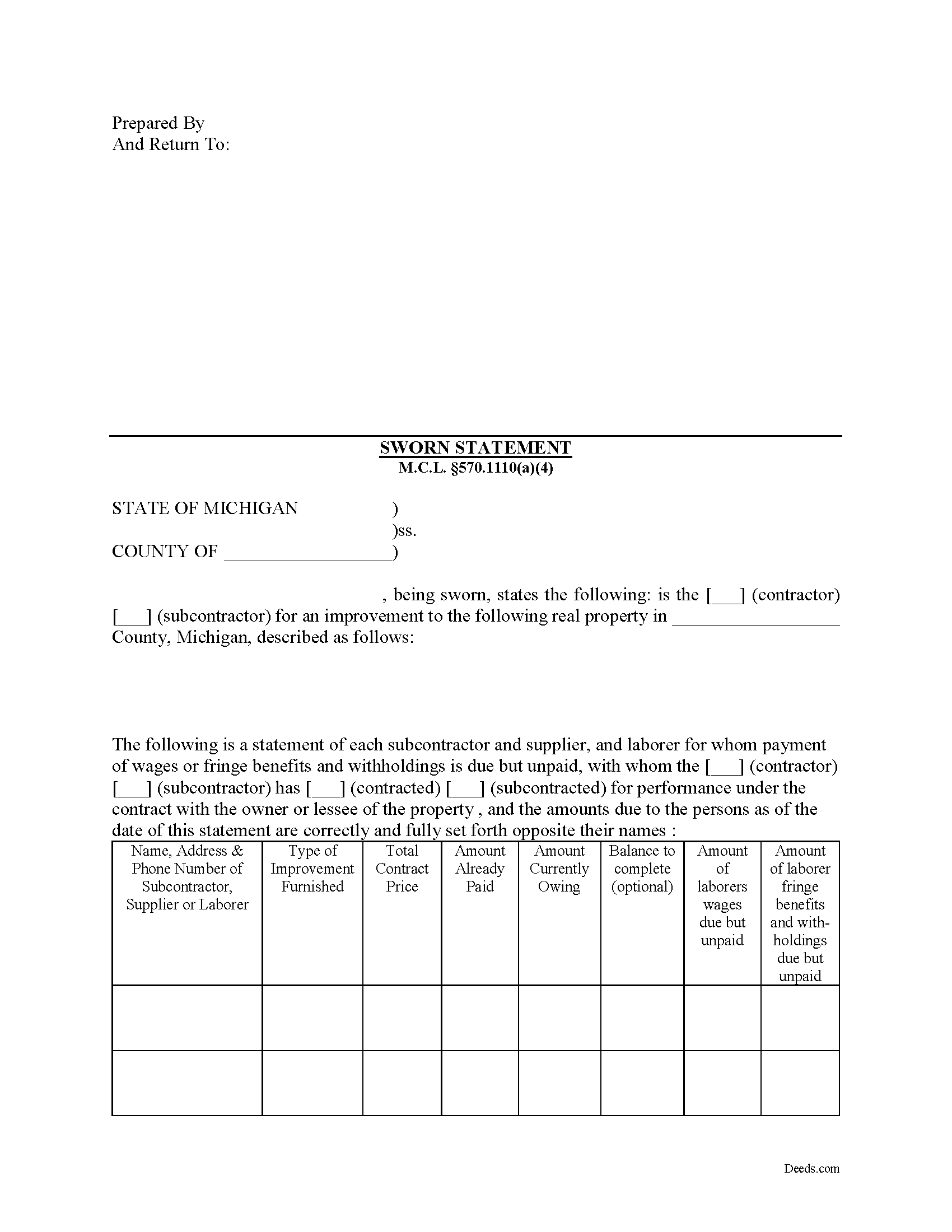

Sworn Statement of Account Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Kalkaska County compliant document last validated/updated 5/26/2025

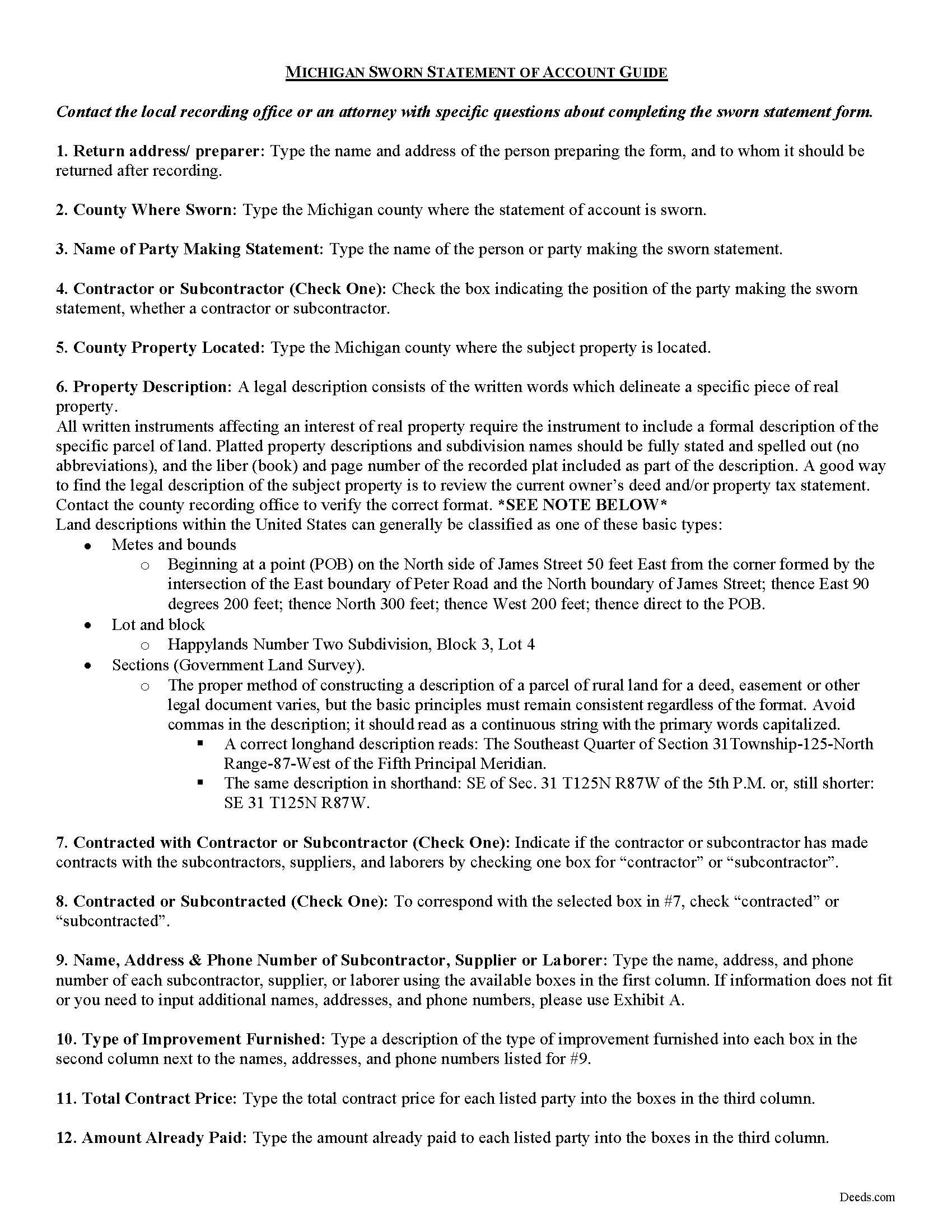

Sworn Statement of Account Guide

Line by line guide explaining every blank on the form.

Included Kalkaska County compliant document last validated/updated 6/10/2025

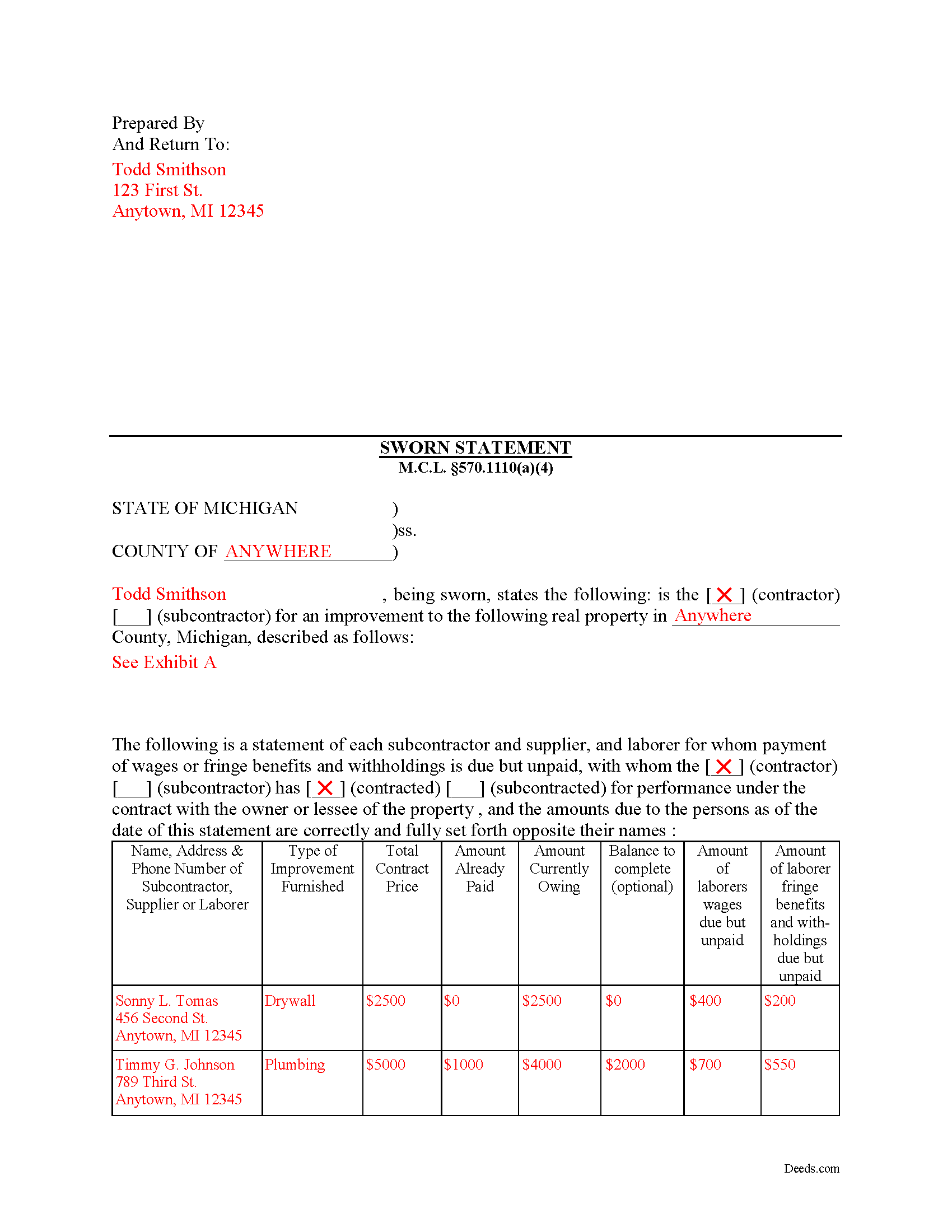

Completed Example of the Sworn Statement of Account Document

Example of a properly completed form for reference.

Included Kalkaska County compliant document last validated/updated 6/16/2025

The following Michigan and Kalkaska County supplemental forms are included as a courtesy with your order:

When using these Sworn Statement of Account forms, the subject real estate must be physically located in Kalkaska County. The executed documents should then be recorded in the following office:

Kalkaska County Register of Deeds

Administrative Bldg - 605 N Birch St, Kalkaska, Michigan 49646

Hours: 9:00am to 5:00pm Monday thru Friday

Phone: (231) 258-3315

Local jurisdictions located in Kalkaska County include:

- Fife Lake

- Kalkaska

- Rapid City

- South Boardman

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Kalkaska County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Kalkaska County using our eRecording service.

Are these forms guaranteed to be recordable in Kalkaska County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Kalkaska County including margin requirements, content requirements, font and font size requirements.

Can the Sworn Statement of Account forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Kalkaska County that you need to transfer you would only need to order our forms once for all of your properties in Kalkaska County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Michigan or Kalkaska County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Kalkaska County Sworn Statement of Account forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Using a Sworn Statement of Account in Michigan

A Sworn Statement of Account is an itemized list containing the names and identifying information for all the parties that have provided improvements, materials or labor and an accounting of the money that is owed to them.

Under Michigan law, a contractor must provide a sworn statement to the owner or lessee in each of the following circumstances: (a) when payment is due to the contractor from the owner or lessee or when the contractor requests payment from the owner or lessee, or (b) when a demand for the sworn statement has been made by or on behalf of the owner or lessee. M.C.L. 570.1110(1). A subcontractor must provide a sworn statement to the owner or lessee upon request by or on behalf of the owner or lessee. M.C.L. 570.1110(2). Subcontractors must also provide a sworn statement to the contractor when payment is due to the subcontractor from the contractor or when the subcontractor requests payment from the contractor. M.C.L. 570.1110(3).

The sworn statement must list each subcontractor and supplier with whom the person issuing the sworn statement has contracted relative to the improvement to the real property. M.C.L. 570.1110(4). It must also contain a list of laborers with whom the person issuing the sworn statement has contracted with, and for whom payment for wages or fringe benefits and withholdings are due but unpaid, along with an itemized amount of such wages or fringe benefits and withholdings. Id.

The contractor or subcontractor is not required to list in the sworn statement material furnished by the contractor or subcontractor out of his or her own inventory that was not purchased specifically for performing the contract. M.C.L. 570.1110(5).

Treat requests for a sworn statement seriously. If a contractor fails to provide a sworn statement to the owner or lessee before recording the contractor's claim of lien, the contractor's construction lien is not invalid. M.C.L. 570.1110(9). However, the contractor is not entitled to any payment, and a complaint, cross-claim, or counterclaim may not be filed to enforce the construction lien, until the sworn statement has been provided. Id. Along the same line, if a subcontractor fails to provide a sworn statement to the owner, the subcontractor's construction lien is valid. M.C.L. 570.1110(10). However, a complaint, cross-claim, or counterclaim may not be filed to enforce the construction lien until the sworn statement has been provided. Id.

Because the statement is "sworn," there are strict penalties for falsification. A contractor or subcontractor who desires to draw money and gives or causes to be given to any owner or lessee a sworn statement that is false, with intent to defraud, is guilty of a crime. M.C.L. 570.1110(11).

This article is provided for informational purposes only and should not be relied on as a substitute for the advice of an attorney. If you have any questions about using a sworn statement of account form, please consult with a licensed Michigan attorney.

Our Promise

The documents you receive here will meet, or exceed, the Kalkaska County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Kalkaska County Sworn Statement of Account form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4562 Reviews )

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.rn

We are delighted to have been of service. Thank you for the positive review!

Robert F.

June 30th, 2025

Breeze.... It feels silly to hire an attorney to do this for just one beneficiary. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Pauline C.

June 29th, 2025

Everything that was stated to be included in my order was complete. Very satisfied

Thank you for your positive words! We’re thrilled to hear about your experience.

Jennifer J.

March 21st, 2022

I have to admit this process was a scary one but you have made it very clear and simple to follow along with. I felt their virtual hand holding, that is how user friendly it is. Thank you for being top notch.

Thank you!

Monica T.

January 8th, 2025

Super easy to use. Very pleased. The turn around time was very fast. I have another one pending.rnThank you!

We are grateful for your feedback and looking forward to serving you again. Thank you!

Johanna R.

April 21st, 2022

As soon as payment was received the forms were downloaded, printed and were useable. The guide was helpful and I was able to get my forms filled out and filed with no problem here in Linn County Oregon. I would recommend the site to anyone.

Thank you for your feedback. We really appreciate it. Have a great day!

Jackqueline S.

August 25th, 2020

I received my property deed quickly. All pertinent information required was received in less than 30 minutes.

Thank you for your feedback. We really appreciate it. Have a great day!

Charles S.

May 11th, 2025

It's useful to have forms specific to the County as well as the State. The examples are also helpful, but it would be even more helpful to see an example of a complete and successfully filed package. I will go the County Recorder's Office to see if I can find an example there.

Your insights are invaluable to us and help us strive for better service. Thank you for taking the time to share your thoughts.

Joy N.

February 22nd, 2024

As a real estate professional, I've had the opportunity to use various legal form providers over the years, but none have matched the quality and user-friendliness of Deeds.com's real estate legal forms.

The forms themselves are comprehensive, up-to-date, and in line with current real estate laws and regulations, which is paramount in our field. The clarity and thoroughness of the documentation ensured that I could complete with confidence, knowing that every detail was covered.

I wholeheartedly recommend their services and look forward to continuing our partnership.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Jacquelyn W.

February 4th, 2022

Great site with great info. Almost made the job seamless but form would not adjust to my longer than usual legal description -- I ended up having to recreate the form in word processing software (Libre). But could not have done it without the guidelines.

Thank you!

Ben C.

December 8th, 2024

Easy and Quick,Thanks

Thank you for your feedback. We really appreciate it. Have a great day!

Gary K.

November 15th, 2019

Straightforward and pretty easy to use. The only downside is that there is no way to contact them directly. The number on the website is answered only by a voicemail with no return calls.

Pricing seems fair compared to other services and much more efficient that filing "over the counter."

Thank you for your feedback. We really appreciate it. Have a great day!

Lori G.

October 28th, 2020

This was so easy and seemless. I wish I had found deeds.com for eRecording sooner! I submitted my documents from the comfort of my office, they were great about communicating in a timely manner with updates. The next day I had copies of my recorded documents! I would highly recommend deeds.com!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lori M.

March 6th, 2021

So easy to use. The directions are very clear.

Thank you!

Michael T.

October 17th, 2019

Good site. Two things to note.

1. The Documentary Transfer Tax Exemption sheet, the word "computer" is used when I think it should be "computed" Error in state form?

2. The California Trust Guide could have a watermark which is less distracting. Kind of hard to read the print with the DEEDS.COM logo so prominent.

Thank you for your feedback. We really appreciate it. Have a great day!