Lincoln County Quitclaim Deed from Individual to Joint Tenants Form

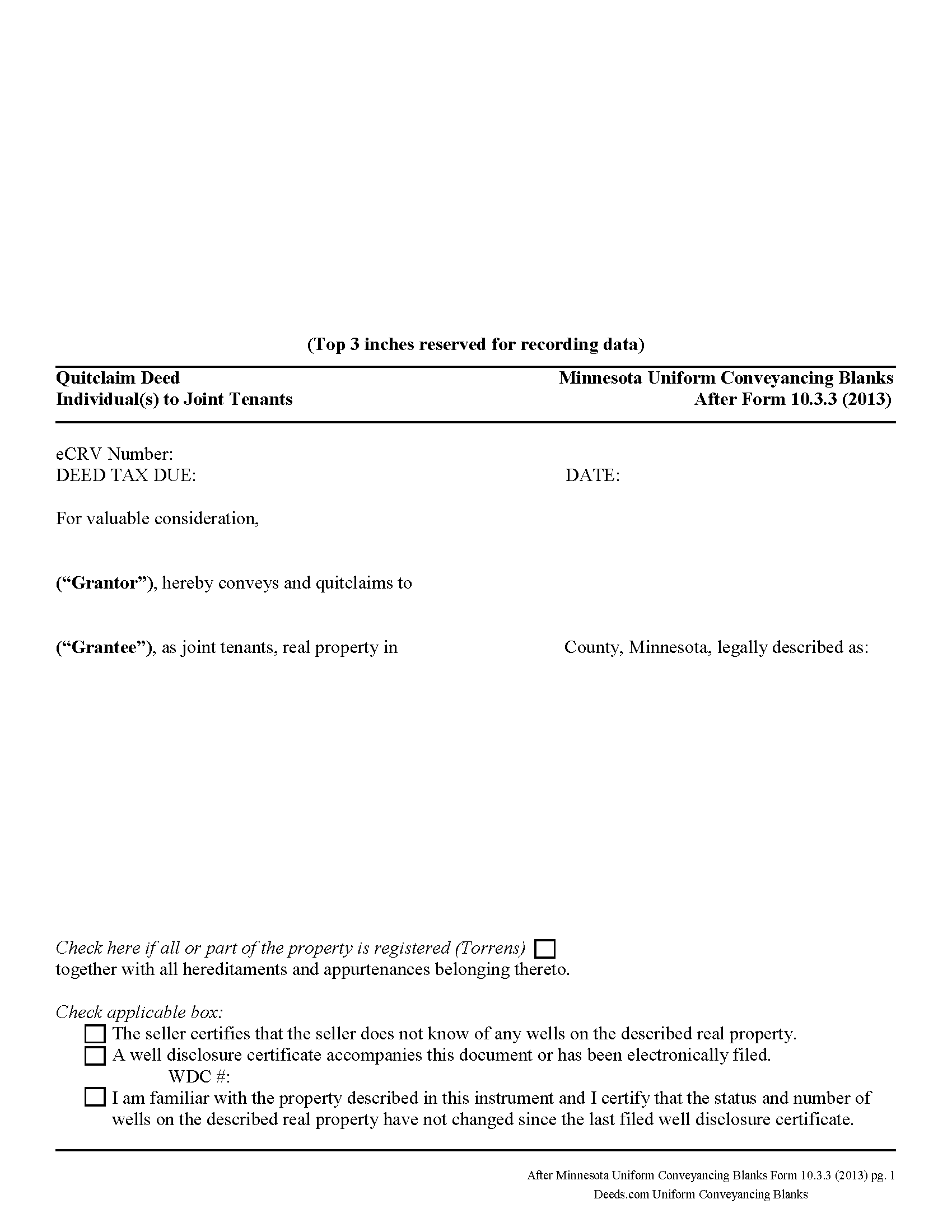

Lincoln County Quitclaim Deed from Individual to Joint Tenants Form

Fill in the blank Quitclaim Deed from Individual to Joint Tenants form formatted to comply with all Minnesota recording and content requirements.

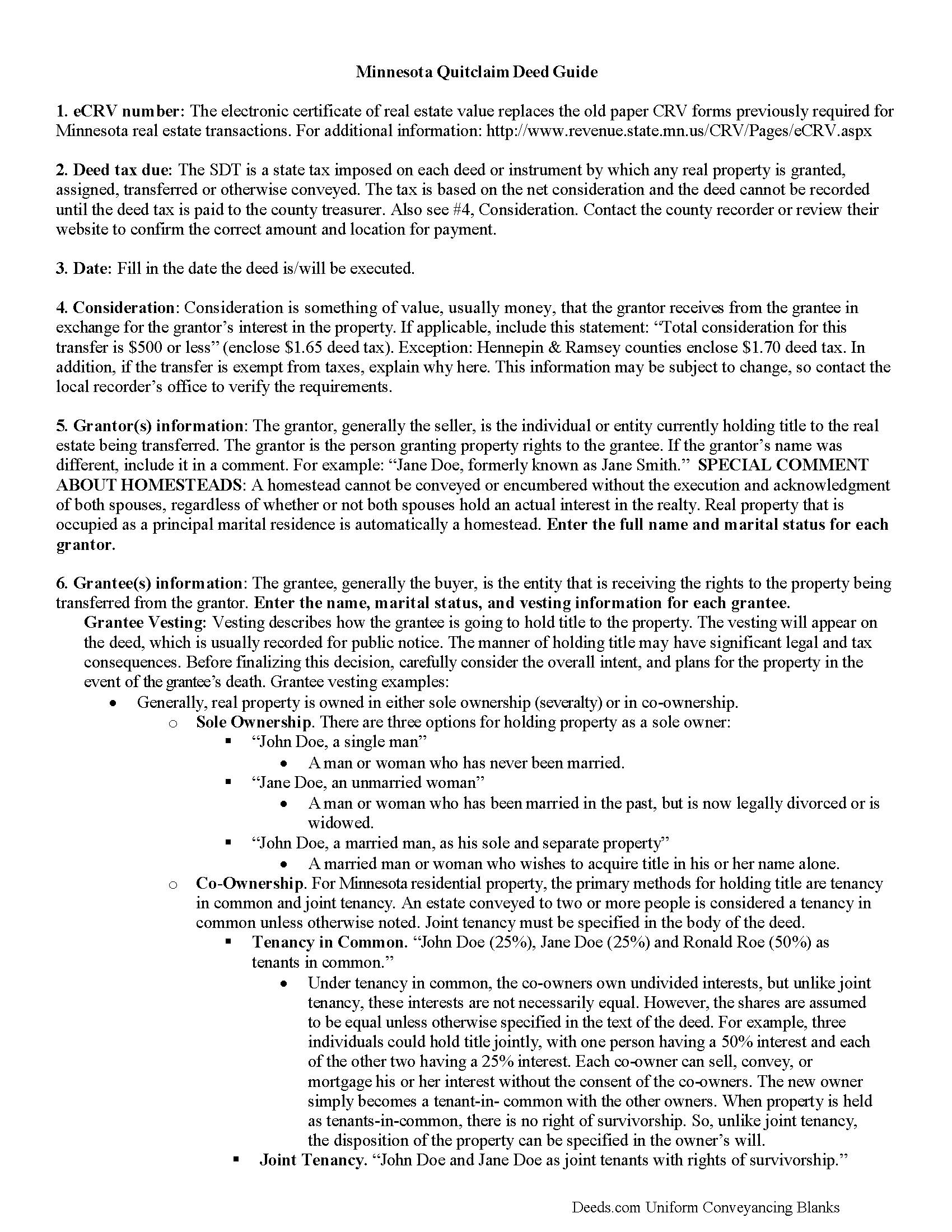

Lincoln County Quitclaim Deed from Individual to Joint Tenants Guide

Line by line guide explaining every blank on the Quitclaim Deed from Individual to Joint Tenants form.

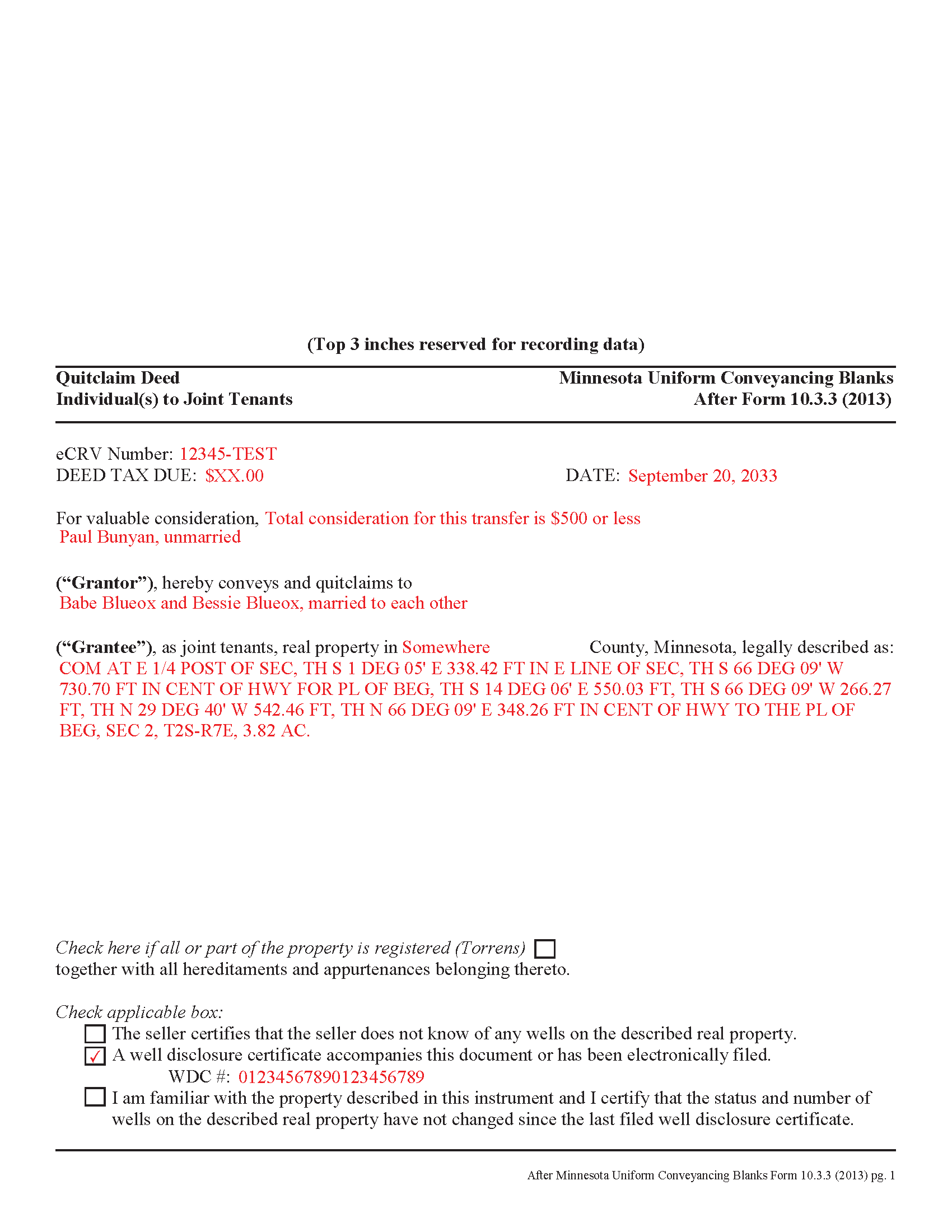

Lincoln County Completed Example of the Quitclaim Deed from Individual to Joint Tenants Document

Example of a properly completed Minnesota Quitclaim Deed from Individual to Joint Tenants document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Minnesota and Lincoln County documents included at no extra charge:

Where to Record Your Documents

Lincoln County Recorder

Ivanhoe, Minnesota 56142

Hours: 8:30 to 4:30 Monday through Friday

Phone: 507-694-1019

Recording Tips for Lincoln County:

- Ensure all signatures are in blue or black ink

- Double-check legal descriptions match your existing deed

- Recorded documents become public record - avoid including SSNs

- Recording early in the week helps ensure same-week processing

Cities and Jurisdictions in Lincoln County

Properties in any of these areas use Lincoln County forms:

- Arco

- Hendricks

- Ivanhoe

- Lake Benton

- Tyler

Hours, fees, requirements, and more for Lincoln County

How do I get my forms?

Forms are available for immediate download after payment. The Lincoln County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Lincoln County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Lincoln County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Lincoln County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Lincoln County?

Recording fees in Lincoln County vary. Contact the recorder's office at 507-694-1019 for current fees.

Questions answered? Let's get started!

Minnesota's real estate deeds are governed by Minn. Stat. 507, which contains the basic form and requirements for lawful conveyance of property. A quitclaim deed is used in Minnesota real estate transactions where the grantor agrees that "such instrument, duly executed, shall be a conveyance to the grantee, the grantee's heirs and assigns, of all right, title, and interest of the grantor in the premises described, but shall not extend to after acquired title, unless words expressing such intention be added." (507.07). In other words, a quitclaim deed generally transfers only the grantor's current interest, if any, in the property at the time of the deed's execution.

While properly completed statutory form may suffice in many situations, they leave the possibility for errors based on incorrect or missing information. To reduce confusion about the information needed for different real estate transactions, Minnesota suggests guidelines for uniform conveyancing forms, each with a specific purpose. See Minn. Stat. 507.09-507.14.

This quitclaim deed form, specifically intended for real property transfers from individual owner(s) to joint tenants, matches the format, content, and requirements set forth in the most recent update.

(Minnesota QCD Ind to JT Package includes form, guidelines, and completed example)

Important: Your property must be located in Lincoln County to use these forms. Documents should be recorded at the office below.

This Quitclaim Deed from Individual to Joint Tenants meets all recording requirements specific to Lincoln County.

Our Promise

The documents you receive here will meet, or exceed, the Lincoln County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Lincoln County Quitclaim Deed from Individual to Joint Tenants form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Matthew C.

March 29th, 2022

Your Transfer on Death Deed is fine and you have plenty of information about that part. But where is the Confirmatory Deed that is required in many jurisdictions in order to actually pass ownership of a property when the Transfer on Death Deed becomes effective? IT IS MISSING!!

Thank you for your feedback. We really appreciate it. Have a great day!

Christopher M.

February 5th, 2024

Awesome company. Fast, friendly, professional.

We are delighted to have been of service. Thank you for the positive review!

Gabriel R.

August 24th, 2022

So far the service seems good, simple to use. One criticism, the password change feature should require the user to re-enter their old password, new password, and re-enter the new password to make sure there is no typos. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Sarah H.

December 11th, 2020

Very helpful and great price

Thank you!

Cindy H.

January 16th, 2021

It was easy and quick. Such a pleasure to use since we live out of town. So convenient. Definitely would recommend.

Thank you for your feedback. We really appreciate it. Have a great day!

Richard R.

April 16th, 2021

Deeds.com got the job done. My deed was successfully recorded.

Thank you for your feedback. We really appreciate it. Have a great day!

Gary O.

March 11th, 2019

Easy to use,makes things easier,Thanks! Great Idea!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Stephanie P.

December 9th, 2020

So far Deeds.com has done everything they say they'll do and very promptly.

Thank you for your feedback. We really appreciate it. Have a great day!

Kimberly B.

September 22nd, 2020

Absolutely recommend Deeds.com! The process to recording your document is explained step by step. If you have any questions, you just send a message and almost instantly a staff member will reply. Super quick processing. I uploaded my document late Friday afternoon, it was reviewed by Deeds.com staff and sent to the county for recording on Monday. By Tuesday, my document was successfully recorded by the County Recorder's Office and a copy of my recorded document was available for me, as well!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Don B.

November 2nd, 2020

This was my first experience with Deeds. Web site instructions are detailed and easy to understand. This was a smooth process. Highly recommend to anyone.

Thank you for your feedback. We really appreciate it. Have a great day!

Sherrl F.

June 3rd, 2021

I had a excellent experience using DEEDS.COM. Very clear directions and site was easy to use. I paid the fee to have my deed electronically filed and it was done the day I requested it be filed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Bobby W.

January 3rd, 2019

The site delivered just what it promised - I needed a specific deed formatted for a specific county/state, and they delivered it at a great price. One note for improvement - it is not intuitively obvious that I could go back and re-download if necessary and this caused me stress, but a follow up email alleviated this. Great service!

Thank you for the kind words Bobby, have a great day!

Connie P.

January 16th, 2024

Easy, fast, responsive. My document was filed and posted in just a matter of days.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

Frank S.

March 28th, 2025

ALL THE DEED DOCUMENTS ARE ALL EXCELLENT AND ADDITIONAL DOCUMENTS REGARDING COMPLETING THE DOCUMENTS!!! EXCELLENT!!

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

TIFFANY C.

May 20th, 2020

It would be nice if the notary State was fillable, we are having to notarize in another State. Also, need more room to add 2 beneficiaries with two different addresses.

Thank you for your feedback. We really appreciate it. Have a great day!