Redwood County Quitclaim Deed Form

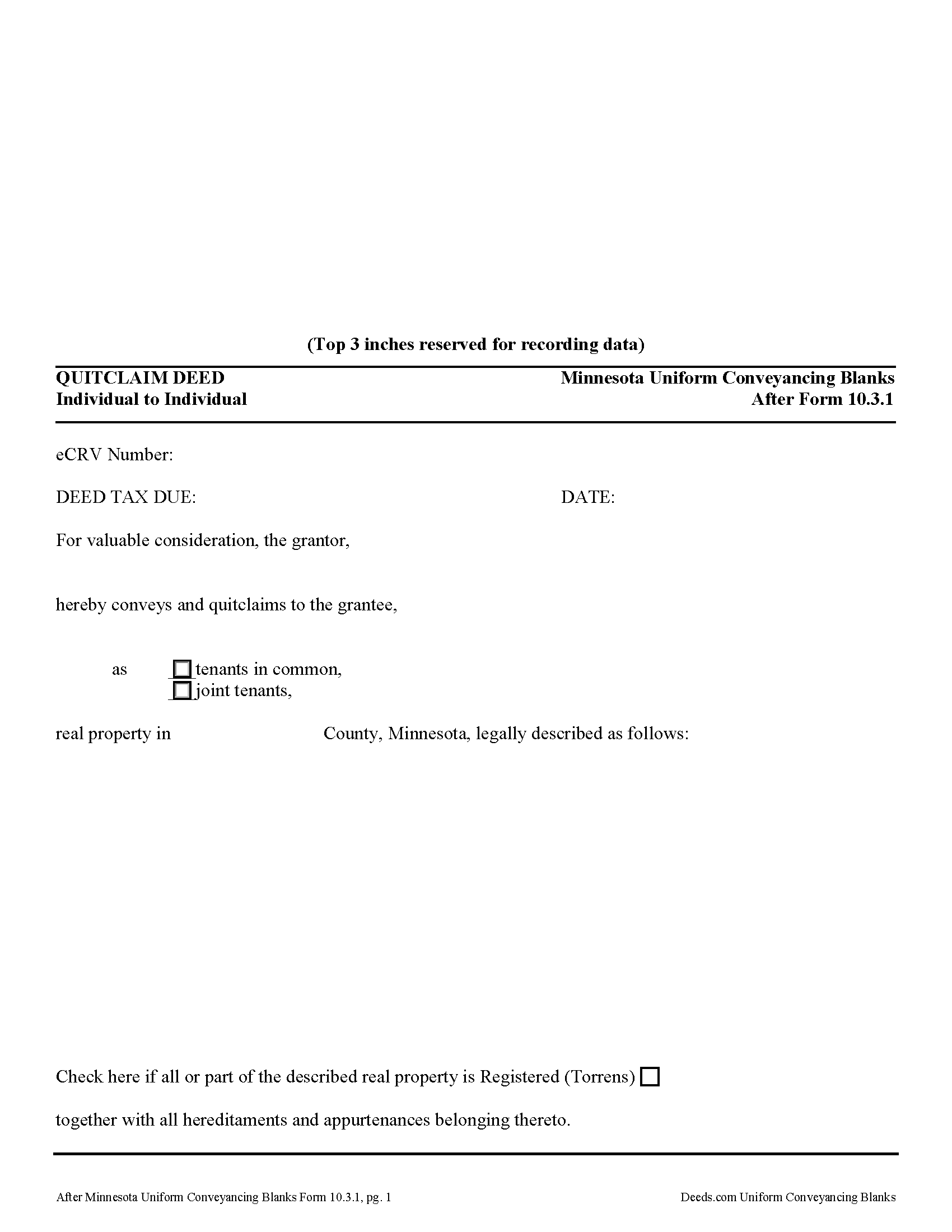

Redwood County Quitclaim Deed Form

Fill in the blank Quitclaim Deed form formatted to comply with all Minnesota recording and content requirements.

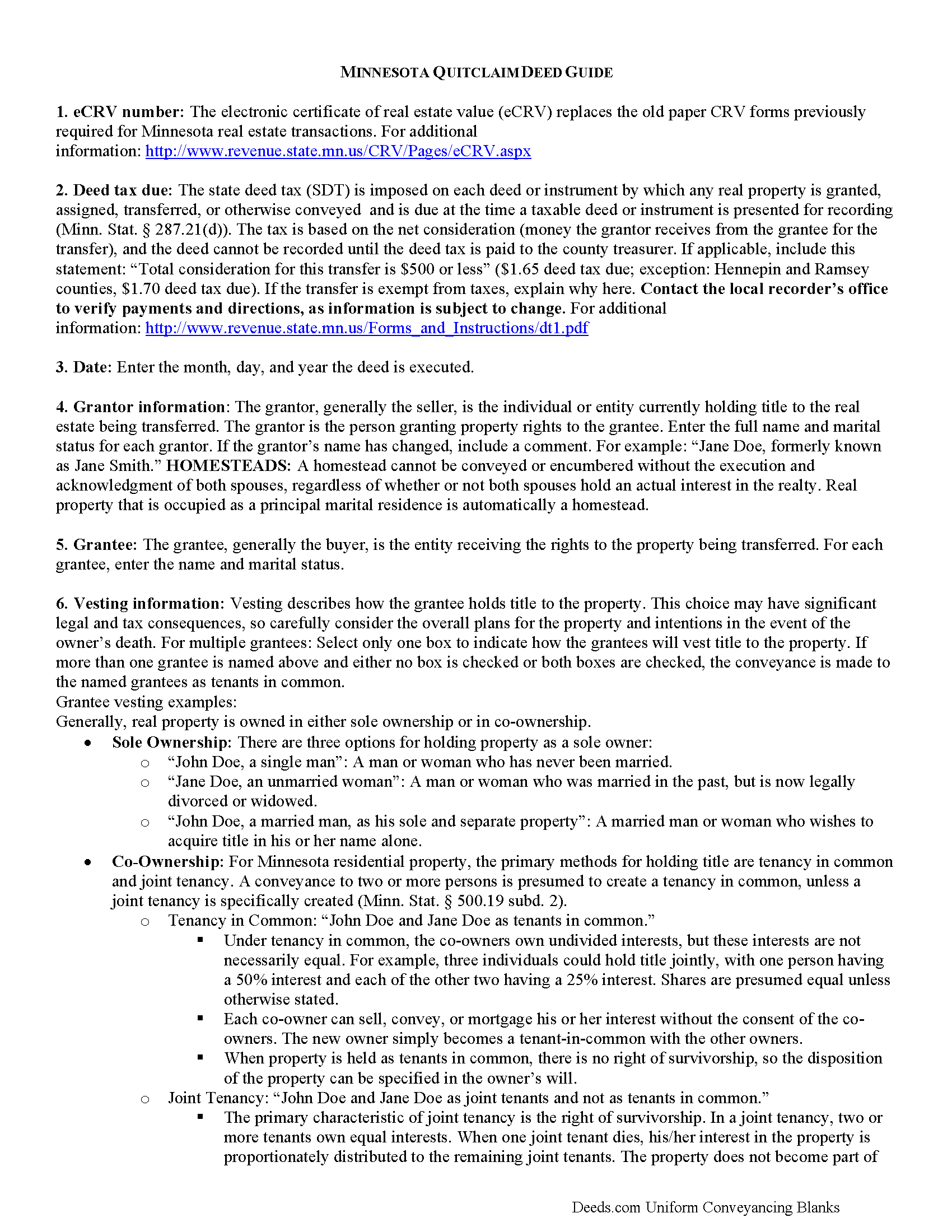

Redwood County Quitclaim Deed Guide

Line by line guide explaining every blank on the Quitclaim Deed form.

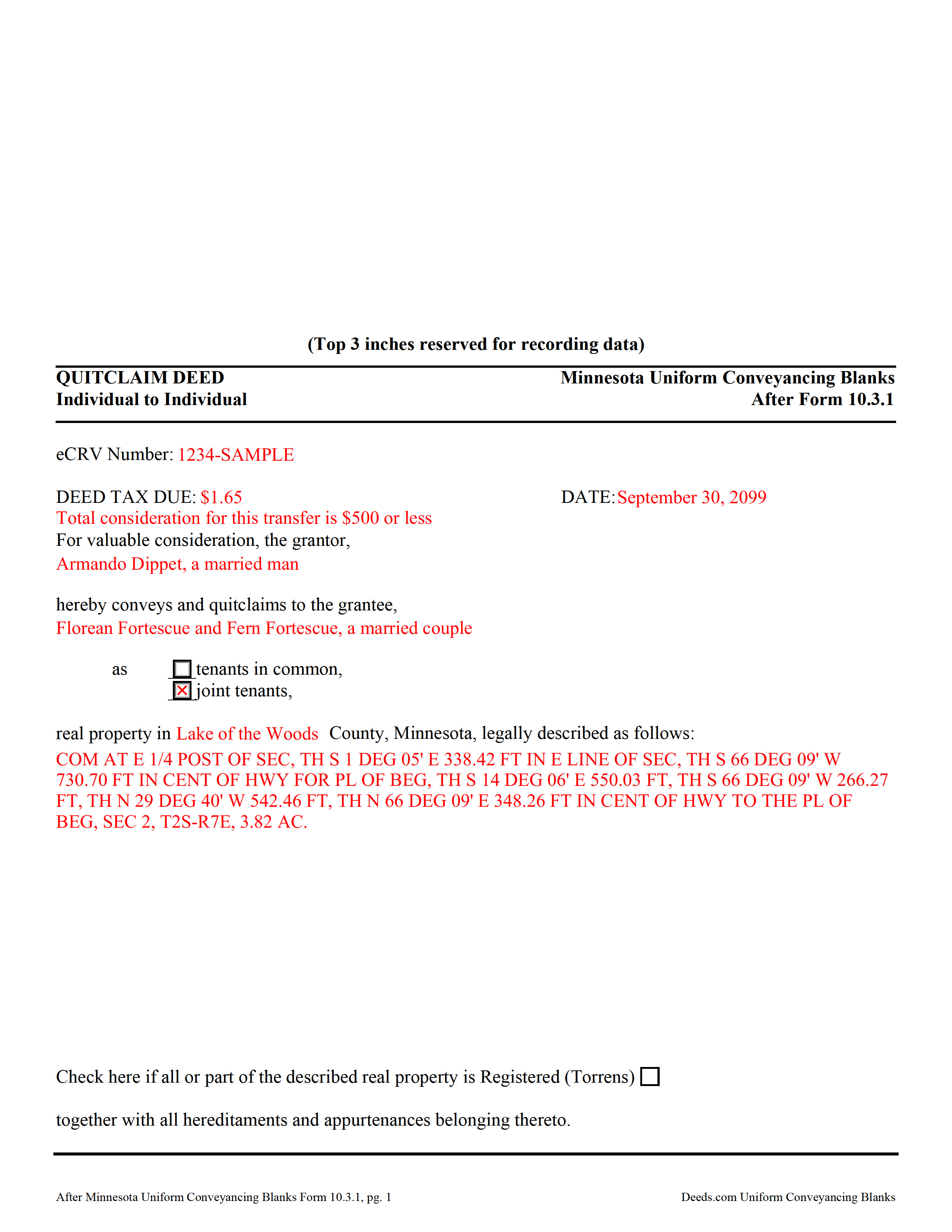

Redwood County Completed Example of the Quitclaim Deed Document

Example of a properly completed Minnesota Quitclaim Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Minnesota and Redwood County documents included at no extra charge:

Where to Record Your Documents

Redwood County Recorder

Redwood Falls, Minnesota 56283

Hours: 8:00am to 4:30pm Monday through Friday

Phone: (507) 637-4032

Recording Tips for Redwood County:

- Double-check legal descriptions match your existing deed

- Check that your notary's commission hasn't expired

- White-out or correction fluid may cause rejection

- Leave recording info boxes blank - the office fills these

Cities and Jurisdictions in Redwood County

Properties in any of these areas use Redwood County forms:

- Belview

- Clements

- Lamberton

- Lucan

- Milroy

- Morgan

- Redwood Falls

- Revere

- Sanborn

- Seaforth

- Vesta

- Wabasso

- Walnut Grove

- Wanda

Hours, fees, requirements, and more for Redwood County

How do I get my forms?

Forms are available for immediate download after payment. The Redwood County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Redwood County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Redwood County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Redwood County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Redwood County?

Recording fees in Redwood County vary. Contact the recorder's office at (507) 637-4032 for current fees.

Questions answered? Let's get started!

The quitclaim deed from individual to individual (Minnesota Conveyancing Blanks Form 10.3.1) is "sufficient to pass all the estate which the grantor could convey by deed of bargain and sale" in Minnesota (Minn. Stat. 507.06).

The deed conveys to the named grantee "all right, title, and interest of the grantor in the premises described," and does not extend to any after-acquired title ( 507.07). A quitclaim deed contains no warranties of title. For this reason, the quitclaim deed is often used in divorce or other transactions between family members.

Requirements of the form include the names and marital status of each grantor and grantee and a complete legal description of the property subject to transfer. All grantors or grantors' authorized representatives and joining spouses must sign the deed. A state deed tax, the amount of which is cited on the face of the deed is levied on the amount of consideration made for the transfer, and must be paid before the deed can be recorded.

Minnesota requires an electronic certificate of real estate value and a well disclosure statement for all sales of real property.

Ensure the deed meets document recording standards ( 507.093) before submitting to the recorder's office (or registrar's office, for Torrens land). Consult a lawyer with any questions related to quitclaim deeds or other real property transfers.

(Minnesota QCD Package includes form, guidelines, and completed example)

Important: Your property must be located in Redwood County to use these forms. Documents should be recorded at the office below.

This Quitclaim Deed meets all recording requirements specific to Redwood County.

Our Promise

The documents you receive here will meet, or exceed, the Redwood County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Redwood County Quitclaim Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Rebecca K.

January 12th, 2022

I was able to find EXACTLY what I was looking for in just a couple minutes, plus a helpful guide, all for less than $30. I was very impressed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Christopher B.

January 13th, 2021

Process went smoothly and will use for my next recording. Only area for improvement would be to provide the ability for the user to delete and replace uploaded documents.

Thank you for your feedback. We really appreciate it. Have a great day!

Michael S.

May 13th, 2023

I'll give you a review. YOur deeds are way, way, TOO EXPENSIVE Michael Spinks, Attorney

Thank you for your feedback. We're sorry to hear that you're dissatisfied with our pricing.

We take pride in the quality of our products, and our prices reflect the costs involved in sourcing, producing, and ensuring the high standards we've set. It's a balancing act between affordability and maintaining these standards.

We're aware that everyone has a budget to consider, and we're constantly working on optimizing our pricing. However, we won't compromise the quality of our products for the sake of cutting costs. We believe in fair value, and we hope our customers do too.

Thomas G.

March 16th, 2020

A few parts are confusing'.Like sending Tax statements to WHO ?/ The rest is simple I hope.Have not tried to record yet

Thank you!

donald h.

August 1st, 2022

good, however, I haven't figured out how to save my filled out form

Thank you for your feedback. We really appreciate it. Have a great day!

Gretchen R.

November 13th, 2019

I can't think of any suggestions for improvement. The documents I needed were readily available. Thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Charles C.

July 8th, 2021

Easy to use. Good price. I like that it came with instructions and an example.

Thank you for your feedback. We really appreciate it. Have a great day!

RICHARD M.

May 12th, 2020

After a little glitch due to heavy volume at the County Recorder, my document was recorded. County Recorder was closed to public access at the office (due to the coronavirus issues) so all documents were either mailed to them or sent in electronically. Deeds.com was very efficient at their end with very quick responses to my questions and concerns. I would definitely use their services again.

Thank you for your feedback. We really appreciate it. Have a great day!

Tammy L.

August 20th, 2025

Very Poor and useles, a scam, don't waste your money, those templates are useless and do Not give you Any valid,proper, meeningful wording to use, did Not Help me, nothing more than what a 5th grader can come up with as far as wording or example..I feel I was riped off and this is a total scam... nothing useful

We appreciate all feedback, even when it’s critical. Thousands of customers have successfully used our documents, but they are not for everyone. These are reviewed, fill-in-the-blank templates that provide the wording and structure required by law. Some situations call for more personalized guidance or hand-holding than templates alone can provide, and in those cases an attorney may be the better option.

Randi J.

September 8th, 2020

Everything was so easy and self explanatory and very inexpensive. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

Thomas W.

February 4th, 2020

The serevice was fast and accurate. I would highly recommend Deeds.com to my friends and associates.

Thank you!

Delroy S.

July 2nd, 2019

Simple and complete. I found all the forms and Instructions I was looking for. Thank You.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Justin S.

September 2nd, 2022

Very useful information

Thank you!

David B.

May 16th, 2024

Prompt review and submission of documents could be an appropriate tagline for this business. The attention to detail and rapid response makes the company a great go to for servicing needs related to deeds.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Betty A.

March 2nd, 2022

You've made it very easy to download the form I needed. Thank you.

Thank you!