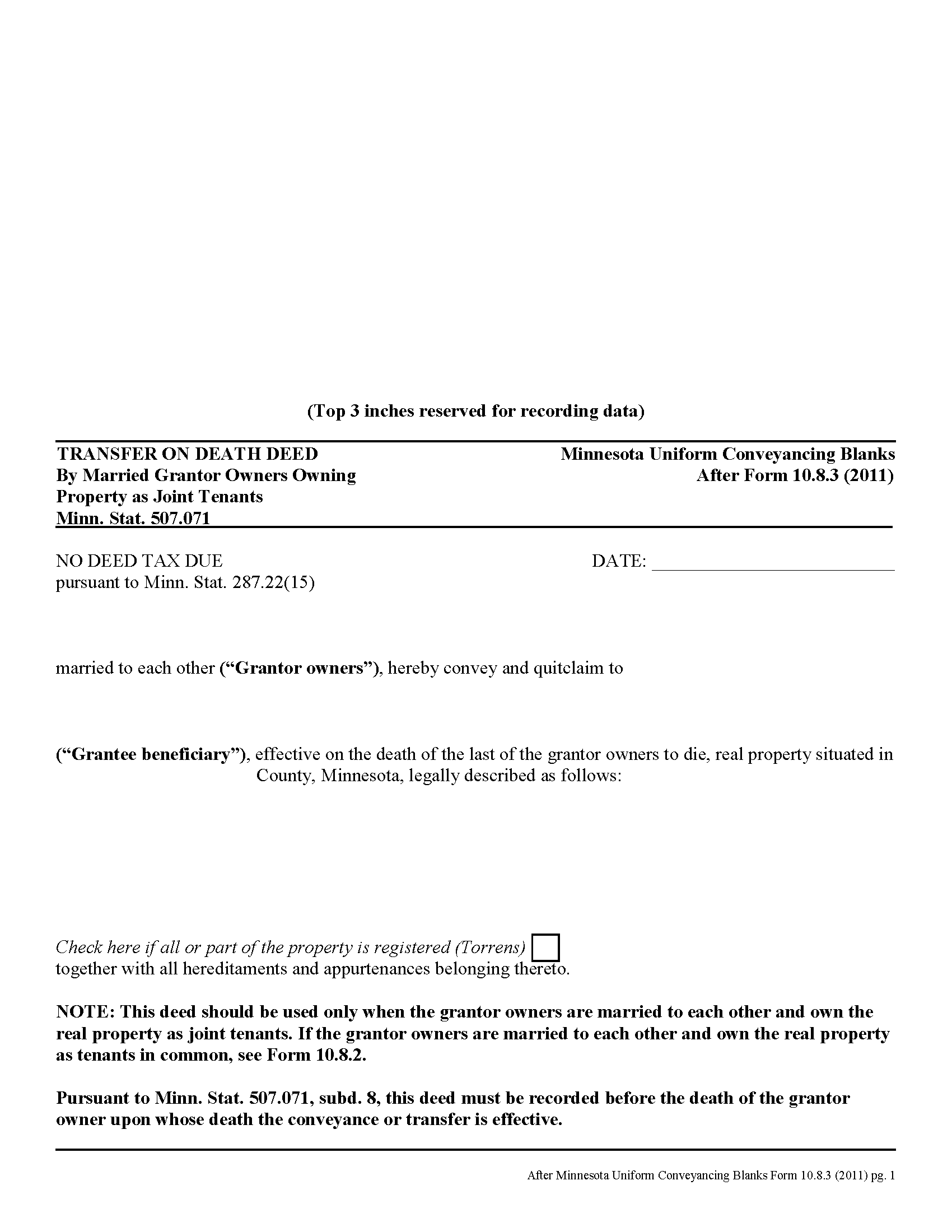

Jackson County Transfer on Death Deed by Married Joint Tenants Form

Jackson County Transfer on Death Deed by Married Joint Tenants Form

Fill in the blank Transfer on Death Deed by Married Joint Tenants form formatted to comply with all Minnesota recording and content requirements.

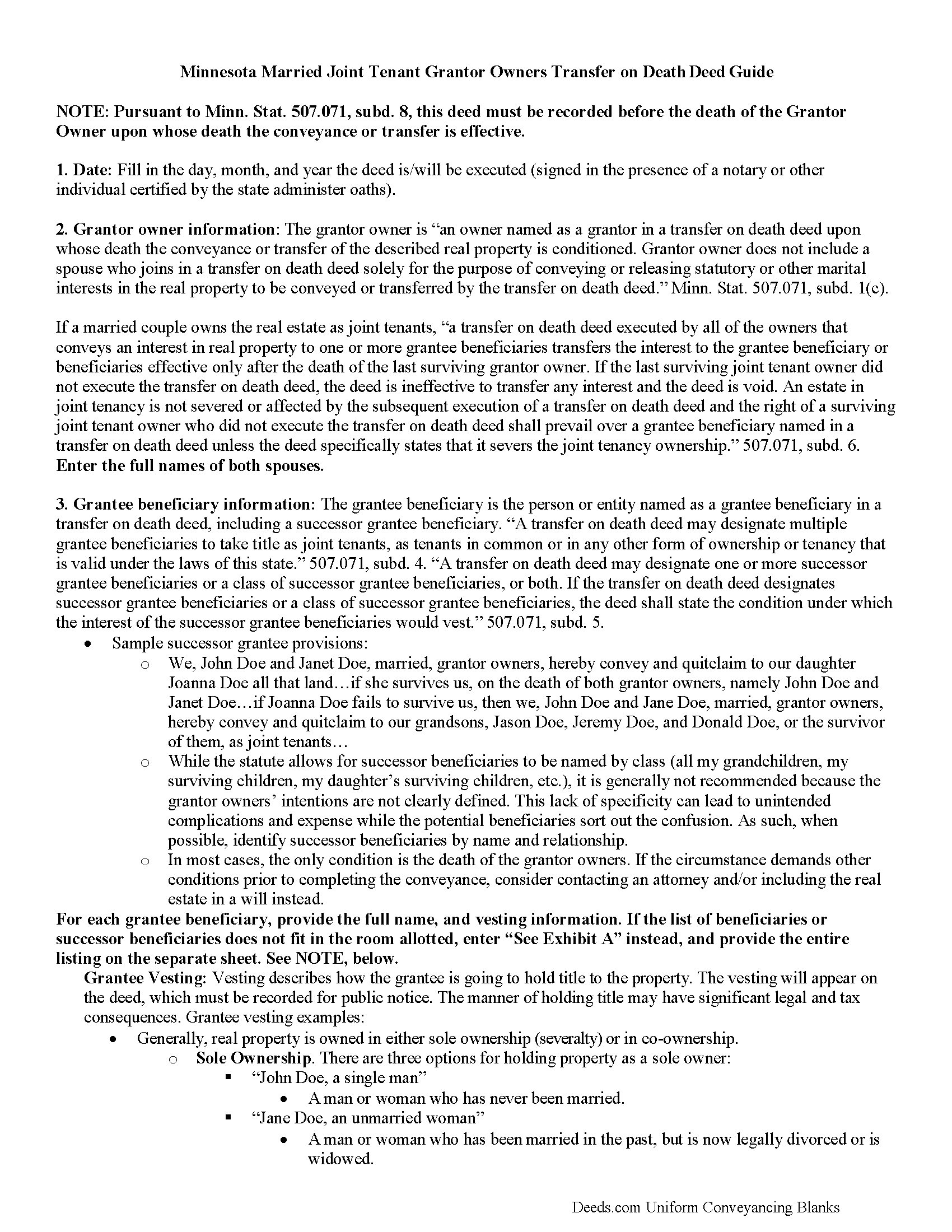

Jackson County Transfer on Death Deed by Married Joint Tenants Guide

Line by line guide explaining every blank on the form.

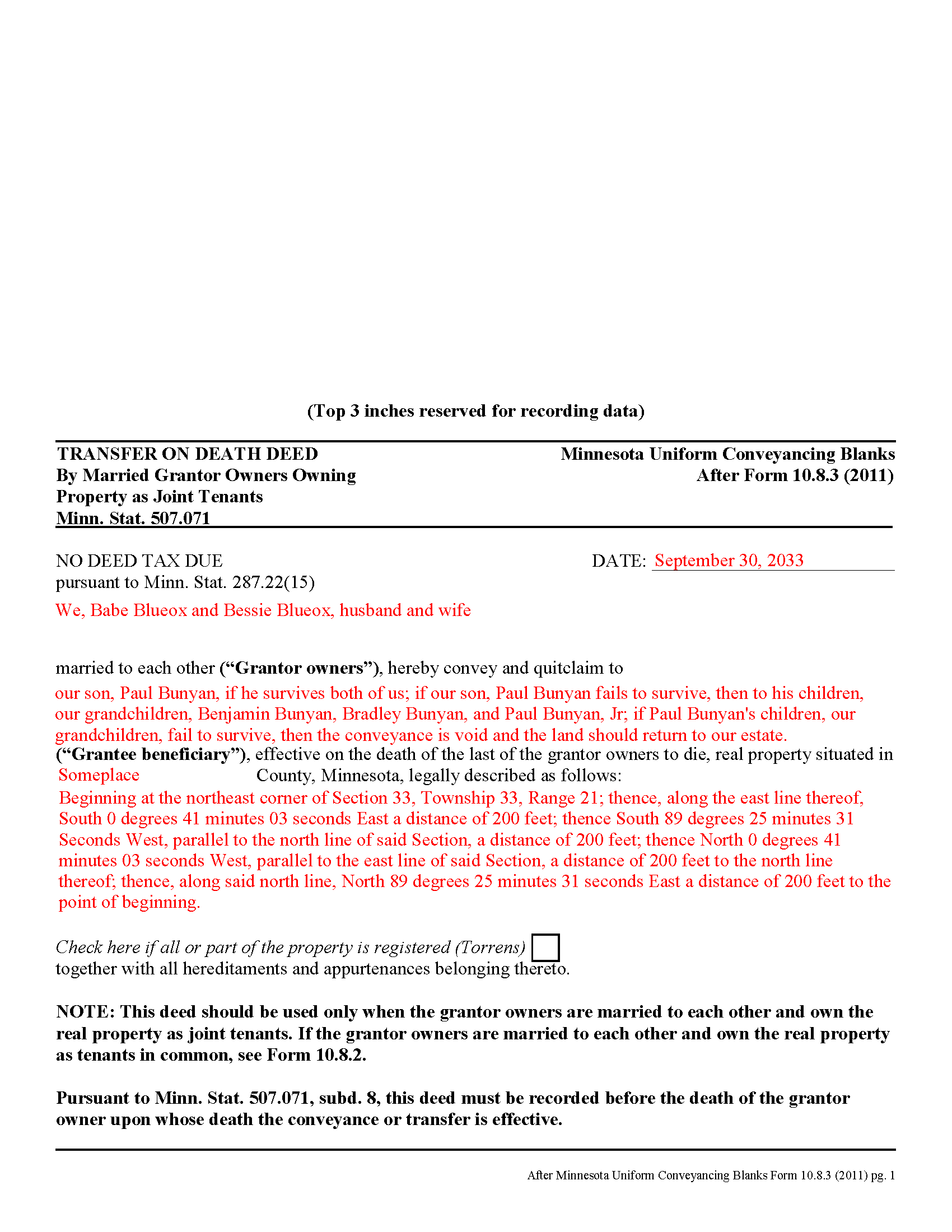

Jackson County Completed Example of the Transfer on Death Deed by Married Joint Tenants Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Minnesota and Jackson County documents included at no extra charge:

Where to Record Your Documents

Jackson County Recorder

Jackson, Minnesota 56143

Hours: 8:30 to 4:30 Monday through Friday

Phone: (507) 847-2580

Recording Tips for Jackson County:

- Bring your driver's license or state-issued photo ID

- Make copies of your documents before recording - keep originals safe

- Verify the recording date if timing is critical for your transaction

Cities and Jurisdictions in Jackson County

Properties in any of these areas use Jackson County forms:

- Alpha

- Heron Lake

- Jackson

- Lakefield

- Okabena

Hours, fees, requirements, and more for Jackson County

How do I get my forms?

Forms are available for immediate download after payment. The Jackson County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Jackson County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Jackson County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Jackson County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Jackson County?

Recording fees in Jackson County vary. Contact the recorder's office at (507) 847-2580 for current fees.

Questions answered? Let's get started!

In Minnesota, transfer on death deeds are governed by Minn. Stat. 507.071.

While the statute provides a basic form, as well as overall content requirements, the state authorized the development of uniform conveyance documents for some specific situations. Transfer on death deeds are useful estate planning tools for those who wish to pass real estate down to designated beneficiaries, outside of the probate process.

Mistakes or omissions in such deeds can force the property back into the estate and subject it to probate distribution, despite the grantor owner's best intentions. For example, the rules for joint tenants who wish to convey property with a transfer on death deed are found in 507.071, subd. 6. A correctly-completed basic statutory form is effective in many cases, but because joint tenants are often married to one another, and to ensure that all the required information is included, there is a special deed for this circumstance.

This transfer on death deed form is for use ONLY by married grantor owners who hold title as joint tenants.

As with other transfer on death deeds, this form must be executed and RECORDED during the grantor owner's lifetime.

(Minnesota TOD Deed by Married JT Package includes form, guidelines, and completed example)

Important: Your property must be located in Jackson County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Deed by Married Joint Tenants meets all recording requirements specific to Jackson County.

Our Promise

The documents you receive here will meet, or exceed, the Jackson County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Jackson County Transfer on Death Deed by Married Joint Tenants form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4591 Reviews )

John M.

September 16th, 2022

Easy to use site with a good selection of documents

Thank you!

David N.

August 29th, 2020

It worked well for me. Now I need the actual lien form

Thank you!

KELLY S.

May 31st, 2022

Thank you for being here. very easy to understand and your site is great. I will always use you.

Thank you for your feedback. We really appreciate it. Have a great day!

Daniel R.

August 26th, 2020

It all looked pretty easy to navigate. Forms are just now downloaded so I'll see how opening, filling-out goes. I'm encouraged. Thanks

Thank you for your feedback. We really appreciate it. Have a great day!

Michael A.

November 14th, 2020

Customer service was poor. I felt like I had to debate the representative to provide guidance and assistance. They acted as though I knew the process, the documents involved, etc. At the same time, they asked me to confirm which documents or at least pages needed to be filed. I was leaning of Deeds.com for their expertise.

Thank you!

laura s.

February 2nd, 2023

thanks for providing my with exactly what I needed, almost instantly!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robert T.

June 10th, 2021

Thanks to Deeds.com, our law office was able to get the deed of trust filed without having to run around town wasting gas and they were very efficient and quick with getting it done in a timely manner.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Djala C.

November 18th, 2019

my experience was excellent.

Thank you!

Terralynn J.

July 18th, 2019

I was very pleased to find ONLINE, Deed Revision Document(s) and their explanation. I ordered these document Forms, downloaded them and Printed them. Now, I will be able to fill them out in the privacy of my home. Instructions were also included, how to file this new Deed, after I complete it and have it Notarized. This has saved me time and emotional stress following the death of my husband. THANK YOU.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Moving Forward V.

October 13th, 2023

Great Service!

Thank you!

Deneene C.

April 17th, 2020

Was a great help to me. I'm very pleased .

Thank you!

Roy C.

January 25th, 2021

Great Product no problems filing

Thank you for your feedback. We really appreciate it. Have a great day!

Karen L.

October 3rd, 2022

Good service could give a little more detail on where to location some of the information needed. Overall fairly simply to use.

Thank you for your feedback. We really appreciate it. Have a great day!

Ashley D.

March 4th, 2021

Was able to print my documents immediately. Documents included deed form, a guide, a sample document, etc. Very helpful!

Thank you for your feedback. We really appreciate it. Have a great day!

Jeanette S.

September 3rd, 2020

Your site was easy to figure out after a few mistakes on my part. Messages were returned quickly. Very convenient for our recording of documents. I will recommend using this method for recording in future. Thank you for working fast in our recording.

Thank you for your feedback. We really appreciate it. Have a great day!