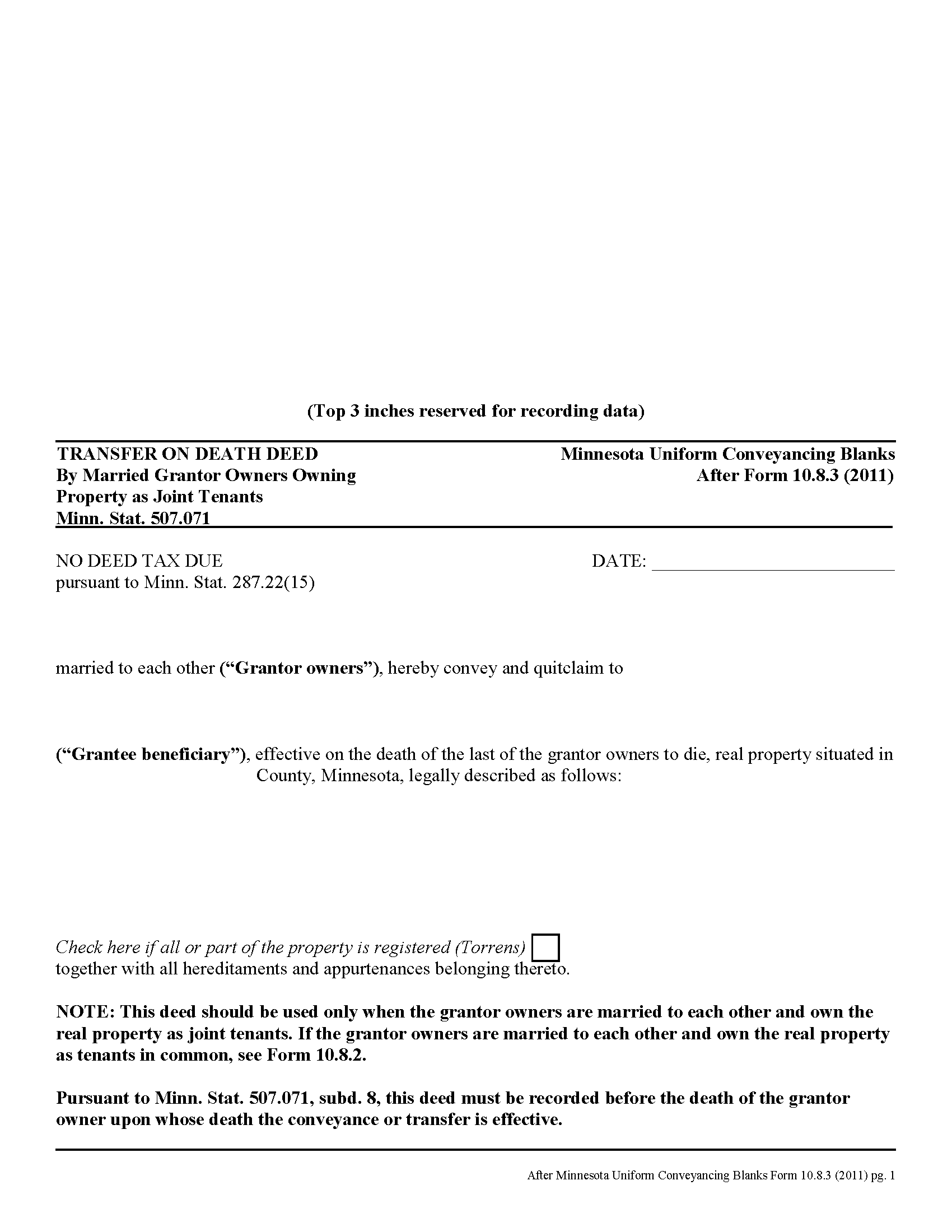

Martin County Transfer on Death Deed by Married Joint Tenants Form

Martin County Transfer on Death Deed by Married Joint Tenants Form

Fill in the blank Transfer on Death Deed by Married Joint Tenants form formatted to comply with all Minnesota recording and content requirements.

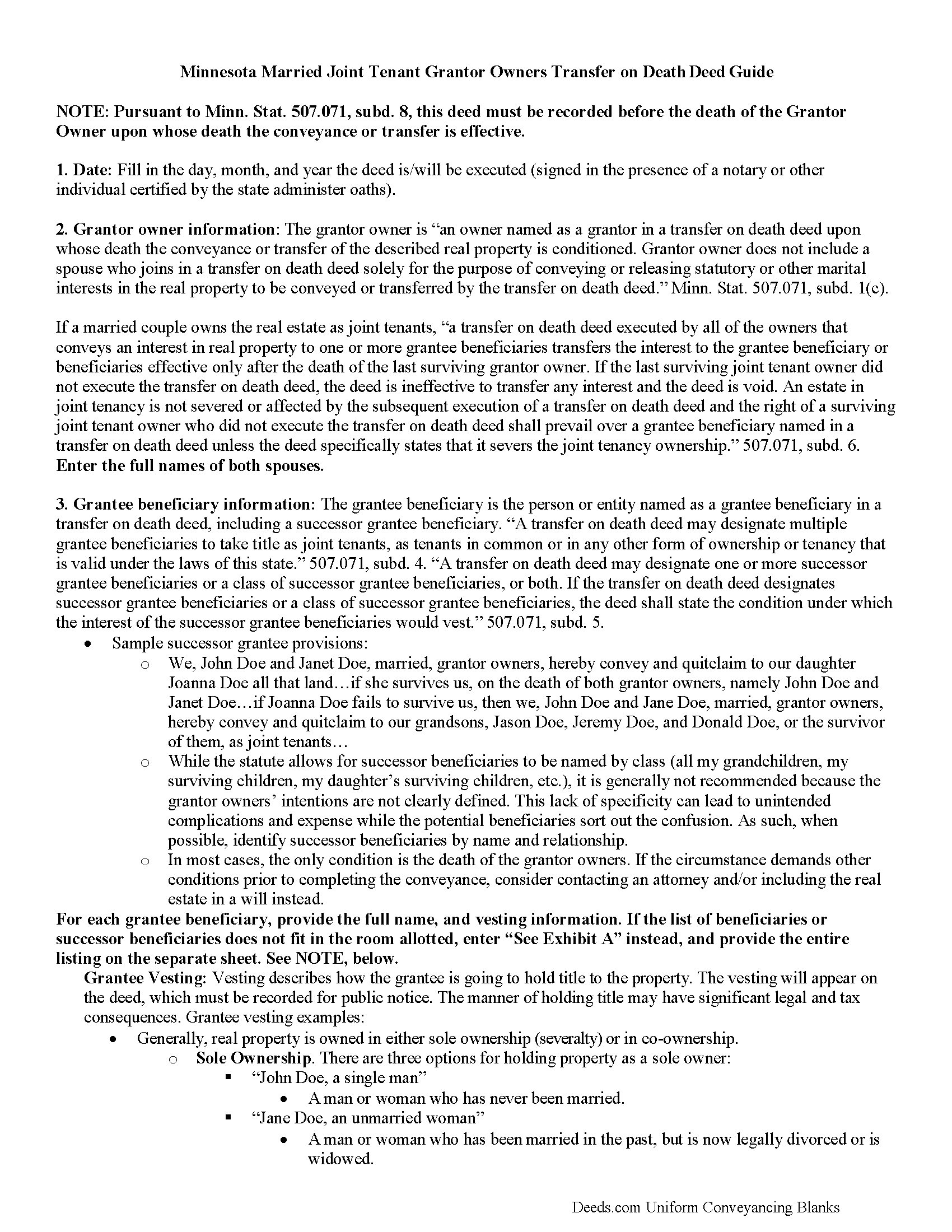

Martin County Transfer on Death Deed by Married Joint Tenants Guide

Line by line guide explaining every blank on the form.

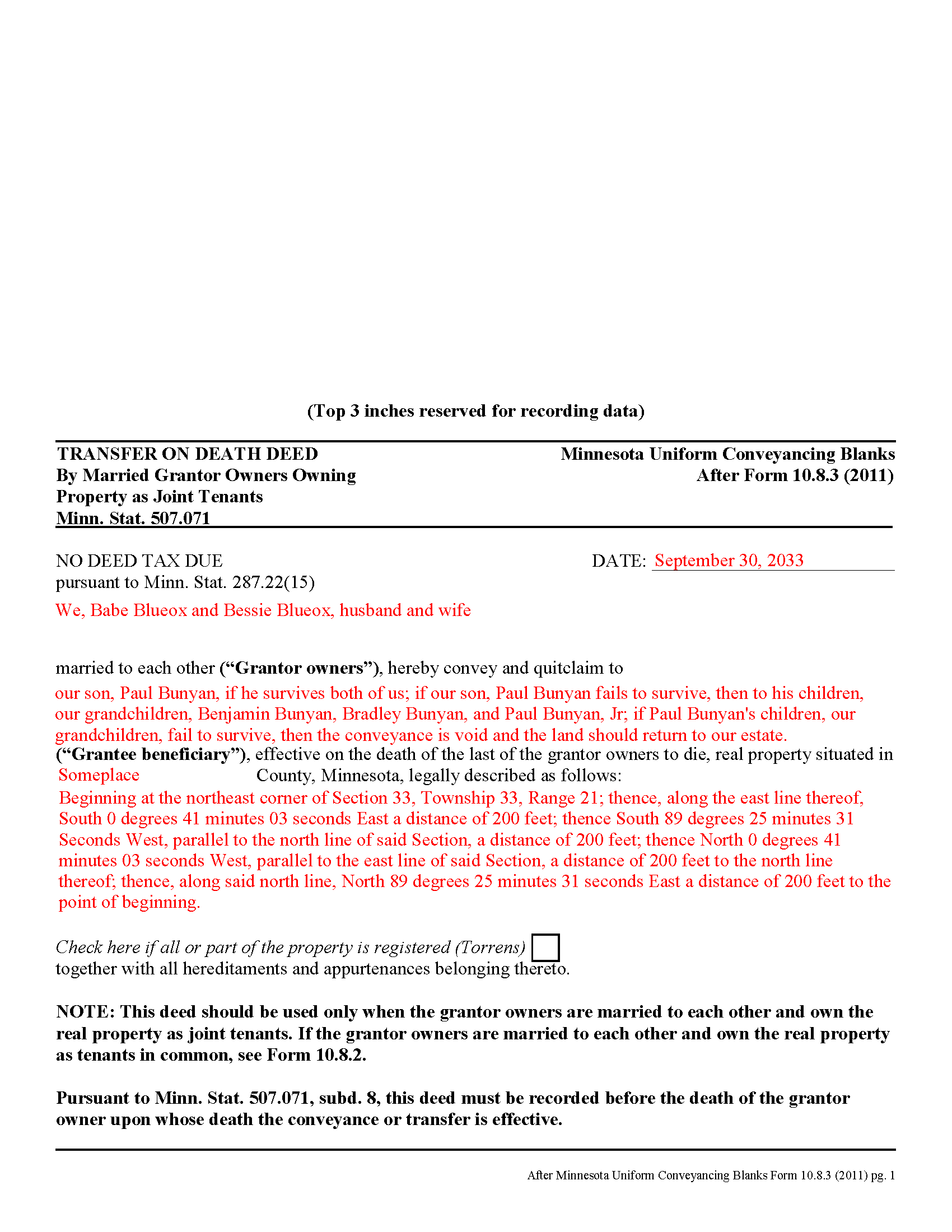

Martin County Completed Example of the Transfer on Death Deed by Married Joint Tenants Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Minnesota and Martin County documents included at no extra charge:

Where to Record Your Documents

Martin County Recorder

Fairmont, Minnesota 56031

Hours: 8:00am-5:00pm Monday through Friday

Phone: (507) 238-3213, 238-3254, 238-3255

Recording Tips for Martin County:

- Check that your notary's commission hasn't expired

- Both spouses typically need to sign if property is jointly owned

- Have the property address and parcel number ready

Cities and Jurisdictions in Martin County

Properties in any of these areas use Martin County forms:

- Ceylon

- Dunnell

- Fairmont

- Granada

- Northrop

- Ormsby

- Sherburn

- Trimont

- Truman

- Welcome

Hours, fees, requirements, and more for Martin County

How do I get my forms?

Forms are available for immediate download after payment. The Martin County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Martin County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Martin County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Martin County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Martin County?

Recording fees in Martin County vary. Contact the recorder's office at (507) 238-3213, 238-3254, 238-3255 for current fees.

Questions answered? Let's get started!

In Minnesota, transfer on death deeds are governed by Minn. Stat. 507.071.

While the statute provides a basic form, as well as overall content requirements, the state authorized the development of uniform conveyance documents for some specific situations. Transfer on death deeds are useful estate planning tools for those who wish to pass real estate down to designated beneficiaries, outside of the probate process.

Mistakes or omissions in such deeds can force the property back into the estate and subject it to probate distribution, despite the grantor owner's best intentions. For example, the rules for joint tenants who wish to convey property with a transfer on death deed are found in 507.071, subd. 6. A correctly-completed basic statutory form is effective in many cases, but because joint tenants are often married to one another, and to ensure that all the required information is included, there is a special deed for this circumstance.

This transfer on death deed form is for use ONLY by married grantor owners who hold title as joint tenants.

As with other transfer on death deeds, this form must be executed and RECORDED during the grantor owner's lifetime.

(Minnesota TOD Deed by Married JT Package includes form, guidelines, and completed example)

Important: Your property must be located in Martin County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Deed by Married Joint Tenants meets all recording requirements specific to Martin County.

Our Promise

The documents you receive here will meet, or exceed, the Martin County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Martin County Transfer on Death Deed by Married Joint Tenants form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Giuseppina M.

October 23rd, 2024

Love to work with your company

It was a pleasure serving you. Thank you for the positive feedback!

John L B.

November 2nd, 2020

I ordered the Deed package for my state of NJ and the county I needed to prepare the documents. I was able to complete everything that is required to close on an investment property. Fast easy with step by step instructions no matter your situation. Definitely will recommend to family & friends. Save $ instead of paying others to do the same thing you can do yourself.

Thank you for your feedback. We really appreciate it. Have a great day!

Timothy G.

May 16th, 2023

Very happy with the cost and with the speed in which the deed was recorded.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Elizabeth W.

February 9th, 2023

would have been smart to give each pdf a name instead of unintelligible numbers...

Thank you for your feedback. We really appreciate it. Have a great day!

Wes C.

March 26th, 2022

The forms are easy to use and the examples and guidance are easy to understand and follow.

Thank you for your feedback. We really appreciate it. Have a great day!

Ryan E.

May 4th, 2023

Great customer service. I was surprised by the attention to detail that went into reviewing my documents and value provided by deeds.com. Definitely recommend.

Thank you for your feedback. We really appreciate it. Have a great day!

Stephen D.

January 15th, 2019

Very good hope to use in the future.

Thank you for your feedback. We really appreciate it. Have a great day!

Kristy T.

March 21st, 2019

Using your site made gifting personal property (land) so quick and easy. The forms were presented ready to complete and included detailed instructions. The "completed form" example was helpful. I definitely recommend your site to anyone who does not wish to pay expensive lawyer fees.

Thank you Kristy, we appreciate your feedback

Gloria C.

January 6th, 2021

AMazing service. Fast and affordable.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Dennis H.

June 26th, 2019

Thank you for this program. It will help in the future. Dennis Holt

Thank you!

Christopher B.

January 13th, 2021

Process went smoothly and will use for my next recording. Only area for improvement would be to provide the ability for the user to delete and replace uploaded documents.

Thank you for your feedback. We really appreciate it. Have a great day!

Nicole w.

July 22nd, 2022

Awesome and very fast service!!!

Thank you!

Darrell C.

March 26th, 2022

Excellent Service

Thank you!

Pietrina P.

December 18th, 2020

Recording with Deeds.com was a seamless experience. Communications were timely, clear and professional. When I had a question, I received a prompt email reply. Overall an excellent experience

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Vita L.

January 28th, 2021

A coworker recommended this service to me and I was hesitant to try it. Turned out to be a life saver, they filed my document in 24 hours. No standing in line and no confusing government websites to navigate.

Thank you!