Redwood County Transfer on Death Deed by Married Sole Owner Form

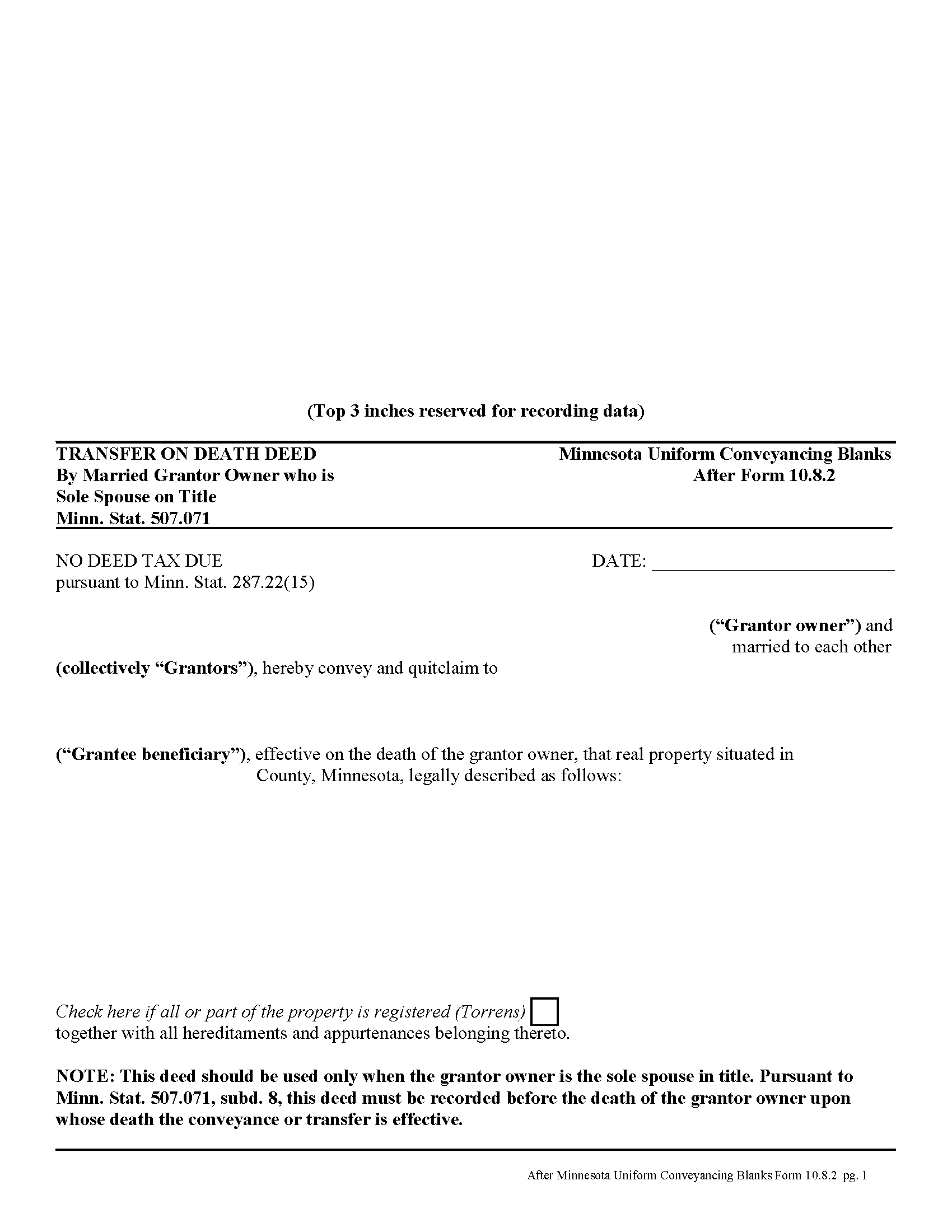

Redwood County Transfer on Death Deed by Married Sole Owner

Fill in the blank form formatted to comply with all recording and content requirements.

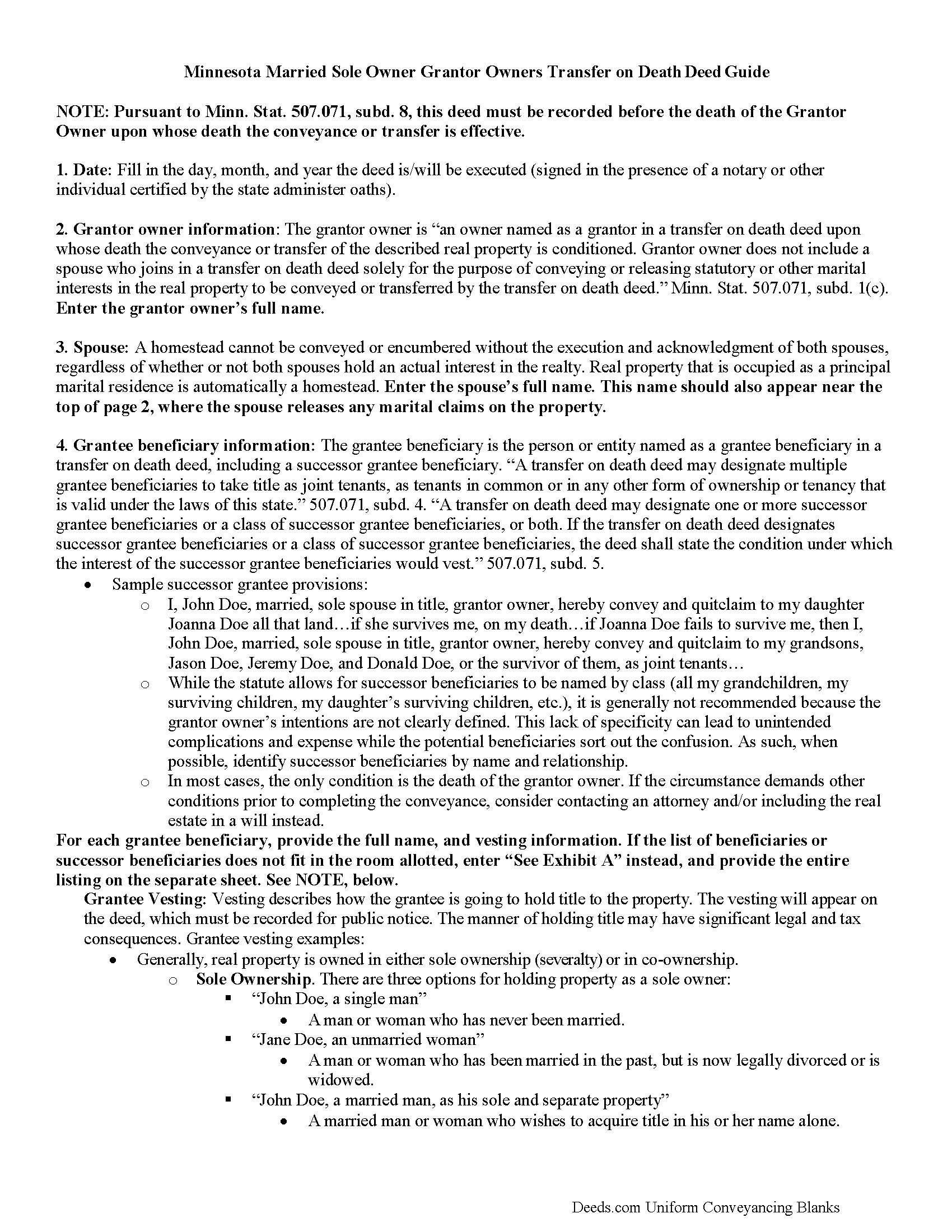

Redwood County Transfer on Death Deed by Married Sole Owner Guide

Line by line guide explaining every blank on the form.

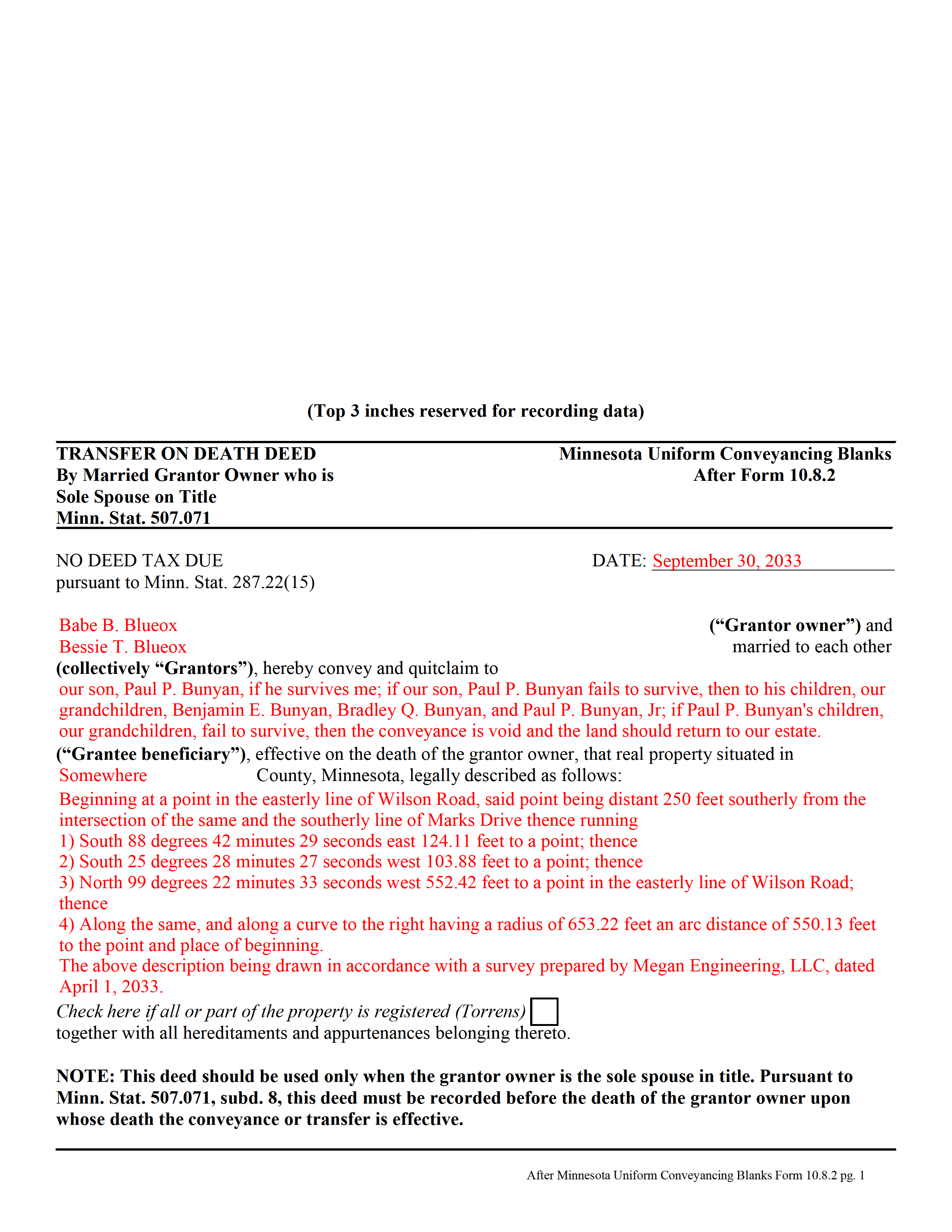

Redwood County Completed Example of the Transfer on Death Deed by Married Sole Owner Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Minnesota and Redwood County documents included at no extra charge:

Where to Record Your Documents

Redwood County Recorder

Redwood Falls, Minnesota 56283

Hours: 8:00am to 4:30pm Monday through Friday

Phone: (507) 637-4032

Recording Tips for Redwood County:

- Documents must be on 8.5 x 11 inch white paper

- Both spouses typically need to sign if property is jointly owned

- Ask about their eRecording option for future transactions

- Mornings typically have shorter wait times than afternoons

Cities and Jurisdictions in Redwood County

Properties in any of these areas use Redwood County forms:

- Belview

- Clements

- Lamberton

- Lucan

- Milroy

- Morgan

- Redwood Falls

- Revere

- Sanborn

- Seaforth

- Vesta

- Wabasso

- Walnut Grove

- Wanda

Hours, fees, requirements, and more for Redwood County

How do I get my forms?

Forms are available for immediate download after payment. The Redwood County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Redwood County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Redwood County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Redwood County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Redwood County?

Recording fees in Redwood County vary. Contact the recorder's office at (507) 637-4032 for current fees.

Questions answered? Let's get started!

In Minnesota, transfer on death deeds are governed by Minn. Stat. 507.071.

While the statute provides a basic form, as well as overall content requirements, the state authorized the development of uniform conveyance documents for some specific situations. One such situation occurs when a married property owner holds sole title to the real estate he or she wishes to convey with a transfer on death deed. A correctly-completed basic statutory form is valid in most cases, but because the owner's husband or wife may be able to claim spousal interest in the property, these deeds require the spouse to sign a statement releasing any marital rights. Without this release, the non-probate transfer on death may not occur, and the property could revert to the deceased owner's estate for probate distribution instead. To prevent such unintended outcomes, there is a special deed for this circumstance.

This transfer on death deed form is for use ONLY by married grantor owners who are the sole spouse on the property's title.

As with other transfer on death deeds, this form must be executed and RECORDED during the grantor owner's lifetime.

(Minnesota TOD Deed by Married Sole Owner Package includes form, guidelines, and completed example)

Important: Your property must be located in Redwood County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Deed by Married Sole Owner meets all recording requirements specific to Redwood County.

Our Promise

The documents you receive here will meet, or exceed, the Redwood County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Redwood County Transfer on Death Deed by Married Sole Owner form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Michael S.

August 7th, 2024

So convenient.

Knowing our customers are happy is our top priority. Thank you for the wonderful feedback!

Susan M.

July 13th, 2019

I was able to download a lot of forms that I need, will be going back to day to search for records so I can fill in the blanks. A great website for forms - It was easy to find what I needed and download! Thanks!!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Maggie C.

April 29th, 2020

Easy to use fantastic website. Immediately found the Sheriff's Deed I needed.

Thank you!

Russell B.

March 15th, 2023

complete package as promised at a very reasonable cost. Easy forms to complete. Thank you. Definitely 5 stars!!!

Thank you for your feedback. We really appreciate it. Have a great day!

Jon W.

September 16th, 2021

Useless for me. My deed could not be pulled. After investigation, I got a copy online directly from WV for $3. No one but editors of this will ever see this. Shame.

Thank you for your feedback. We really appreciate it. Have a great day!

Wanda R.

January 22nd, 2019

Very satisfied with the ease of using your database. Excellent place to get help with deeds.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Patrick R.

August 25th, 2023

I was satisfied and would refer this website to others.

Thank you for your feedback. We really appreciate it. Have a great day!

Leadon N.

July 9th, 2022

Forms were easy to find, print, and complete.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joseph E.

January 15th, 2023

At first I didn't trust all the 5 star reviews. So, I contacted lawyers to check their prices. The price being well over one hundred dollars made my mind up. I gave it a go, the form isn't hard and the directions are easy to follow. 5/5

Thank you for your feedback. We really appreciate it. Have a great day!

dorothy f.

March 27th, 2019

Thank you, for help.

Anytime Dorothy, have a great day.

Timmy S.

December 18th, 2019

The form gave me a perfect place to start. I was looking for something regarding time-shares, so the form was not perfect, but the register of deeds worked with me to get it right. I would not have even been able to start without the form from deeds.com

Thank you for your feedback. We really appreciate it. Have a great day!

Catherine R.

August 7th, 2019

What a great way to put my mind at ease. It was easy to fill out and printed out nicely.

Thank you for your feedback. We really appreciate it. Have a great day!

CAROL C.

July 30th, 2020

Deeds.com is very user friendly and quite simple to use. Customer service is also prompt in responding to any inquiry. I have been pleased with them since I began using them over 3-years ago.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

julie S.

June 24th, 2022

I love this company!! Excellent customer service and quick!! Thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Tod F.

August 9th, 2019

In 15 minutes I had my out of state documents. I am very pleased with the ease of acquiring them. I will definitely be using Deeds.com again if the need arises.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!