Carroll County Assignment of Deed of Trust Form (Mississippi)

All Carroll County specific forms and documents listed below are included in your immediate download package:

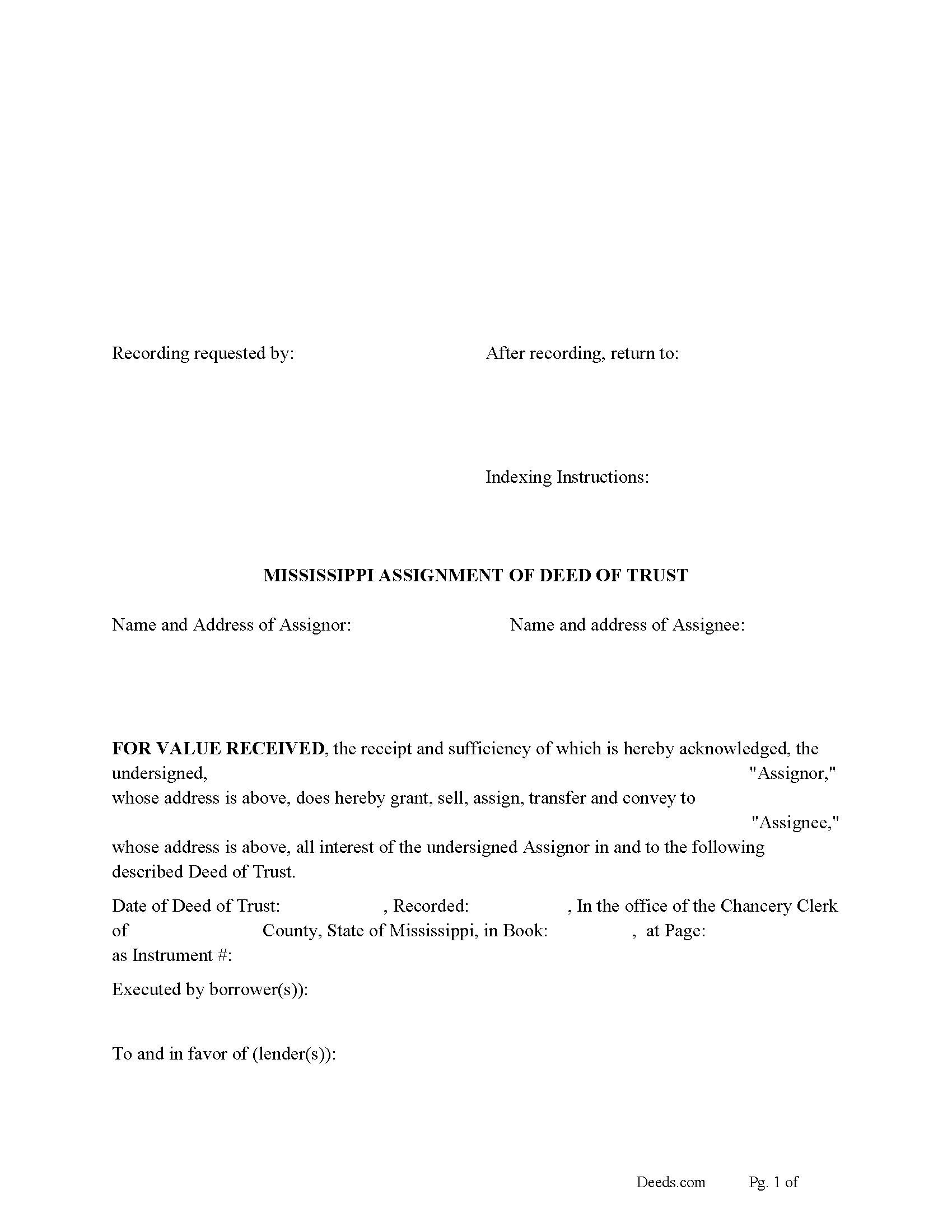

Assignment of Deed of Trust Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Carroll County compliant document last validated/updated 8/26/2024

Guidelines for Assignment of Deed of Trust

Line by line guide explaining every blank on the form.

Included Carroll County compliant document last validated/updated 9/19/2024

Completed Example of the Assignment of Deed of Trust Document

Example of a properly completed form for reference.

Included Carroll County compliant document last validated/updated 10/22/2024

Notice of Assignment of Deed of Trust Form

Fill in the blank form formatted to comply with content requirements.

Included Carroll County compliant document last validated/updated 10/7/2024

Notice of Assignment Guidelines

Line by line guide explaining every blank on the form.

Included Carroll County compliant document last validated/updated 6/21/2024

Completed Example of Notice of Assignment Document

Example of a properly completed form for reference.

Included Carroll County compliant document last validated/updated 7/22/2024

The following Mississippi and Carroll County supplemental forms are included as a courtesy with your order:

When using these Assignment of Deed of Trust forms, the subject real estate must be physically located in Carroll County. The executed documents should then be recorded in one of the following offices:

Carroll County Chancery Clerk

600 Lexington St / PO Box 60, Carrollton, Mississippi 38917

Hours: 8:30 to 4:30 M-F

Phone: (662) 237-9274

Second District

234 West Main St / PO Box 6, Okolona, Mississippi 39176

Hours: 9:00am to 4:00 pm M-F

Phone: (662) 464-5476

Local jurisdictions located in Carroll County include:

- Carrollton

- Coila

- Mc Carley

- North Carrollton

- Sidon

- Vaiden

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Carroll County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Carroll County using our eRecording service.

Are these forms guaranteed to be recordable in Carroll County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Carroll County including margin requirements, content requirements, font and font size requirements.

Can the Assignment of Deed of Trust forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Carroll County that you need to transfer you would only need to order our forms once for all of your properties in Carroll County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Mississippi or Carroll County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Carroll County Assignment of Deed of Trust forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Use this form to transfer a Deed of Trust to another party. The holder of the Deed of Trust becomes the Assignor and transfers rights to the Assignee, this is usually done when a Deed of Trust has been sold. An Assignment of Deed of Trust (secured by a Deed of Trust or other lien of record, shall be entered on the margin of the record of the lien or said assignment shall be acknowledged and filed for record.) (Except as provided in Section 89-5-37) (89-5-17). [The assignment or transfer of a secured indebtedness need not be filed for record nor entered on the margin of the record if the holder thereof is represented by an agent, trustee or the like disclosed as beneficiary in the mortgage or deed of trust.] [MS Code 89-5-37]

Current Borrowers must be notified of the assignment. Notification consists of contact information of the new creditor, recording dates, recording instrument numbers, changes in loan, etc. Included are "Notice of Assignment of Deed of Trust" forms.

The Truth and lending act requires that borrowers be notified when their Deed of Trust has been sold, transferred, or assigned to a new creditor. Generally, within 30 days to avoid up to $2,000.00 in statutory damages, plus reasonable attorney's fees. Systematic violations can reach up $500,000.00.

(Mississippi Assignment of DOT Package includes form, guidelines, and completed example) For use in Mississippi only.

Our Promise

The documents you receive here will meet, or exceed, the Carroll County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Carroll County Assignment of Deed of Trust form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4417 Reviews )

Giuseppina M.

October 24th, 2024

Fast, reliable excellent service

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Stacey H.

October 23rd, 2024

This was my first time using Deeds.com and I was very impressed on the professionalism and the expediency of the recording. Will definitely be using them again. rnrnStacey H.

Your satisfaction with our services is of utmost importance to us. Thank you for letting us know how we did!

Giuseppina M.

October 23rd, 2024

Love to work with your company

It was a pleasure serving you. Thank you for the positive feedback!

Michael M.

June 19th, 2019

Deeds.com had what I needed at the time that I needed it. Thank you very much.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Patricia W.

December 16th, 2019

Easy to use with the itemized instruction.

Thank you for your feedback. We really appreciate it. Have a great day!

Jeremiah W.

August 2nd, 2020

Very helpful information and great forms.

Thank you for your feedback. We really appreciate it. Have a great day!

Barbara E.

April 4th, 2019

Fast efficient, just what I needed.

Thank you so much Barbara. We appreciate your feedback.

Stacey S.

January 27th, 2022

The system was easy to use and download my documents but the way the packages are set up it was confusing and I wish there was a way to delete an item from a package if you make a mistake.

Thank you for your feedback. We really appreciate it. Have a great day!

Suzanne A.

February 25th, 2024

The purchase and download from Deeds.com were pleasantly straightforward. The actual of filing not so obvious in our case.

Your insights are invaluable to us and help us strive for better service. Thank you for taking the time to share your thoughts.

mary s.

July 30th, 2021

It would help if pages of a document indicated 1 of 3 etc. When I downloaded the TOD guide I got a 4th page though it only showed 3 on the screen.

Thank you for your feedback. We really appreciate it. Have a great day!

Alan S.

April 28th, 2020

Great job! Fast and easy. Terrific communications.

Thank you!

James W.

February 27th, 2021

We were able to find deceased parents' deed.

Thank you!

Lucinda E.

October 14th, 2019

I thought this form was great and easy to complete but the instructions were unclear as to whether the grantee- beneficiaries needed to sign and notarize their signatures as well. It did not appear to be the case but it would be helpful if the instructions spelled this out better.

Thank you for your feedback. We really appreciate it. Have a great day!

Brenda B.

January 6th, 2019

Excellent transaction.

Thank you Brenda.

Sheryl L.

December 1st, 2021

EZ to use program....was able to print all forms ordered. I expect to go back to to use recording ability. Instructions are easily followed...would be nice to have confirmation included but they are available to purchase. Hope for successful recording of TOD affidavit. Pretty good value...attorney quoted well over the price I paid for package.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!