Simpson County Correction Deed Form (Mississippi)

All Simpson County specific forms and documents listed below are included in your immediate download package:

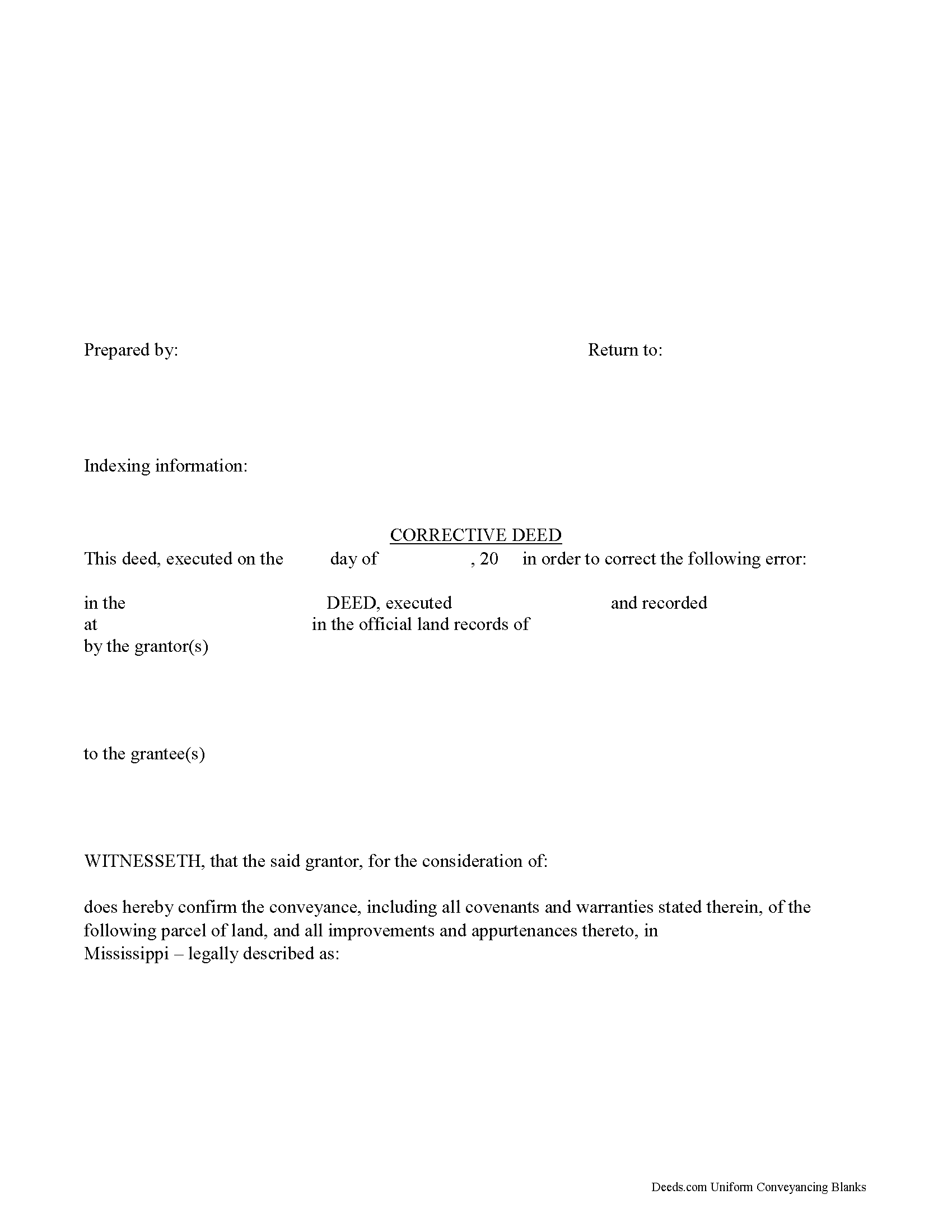

Corrective Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Simpson County compliant document last validated/updated 3/28/2025

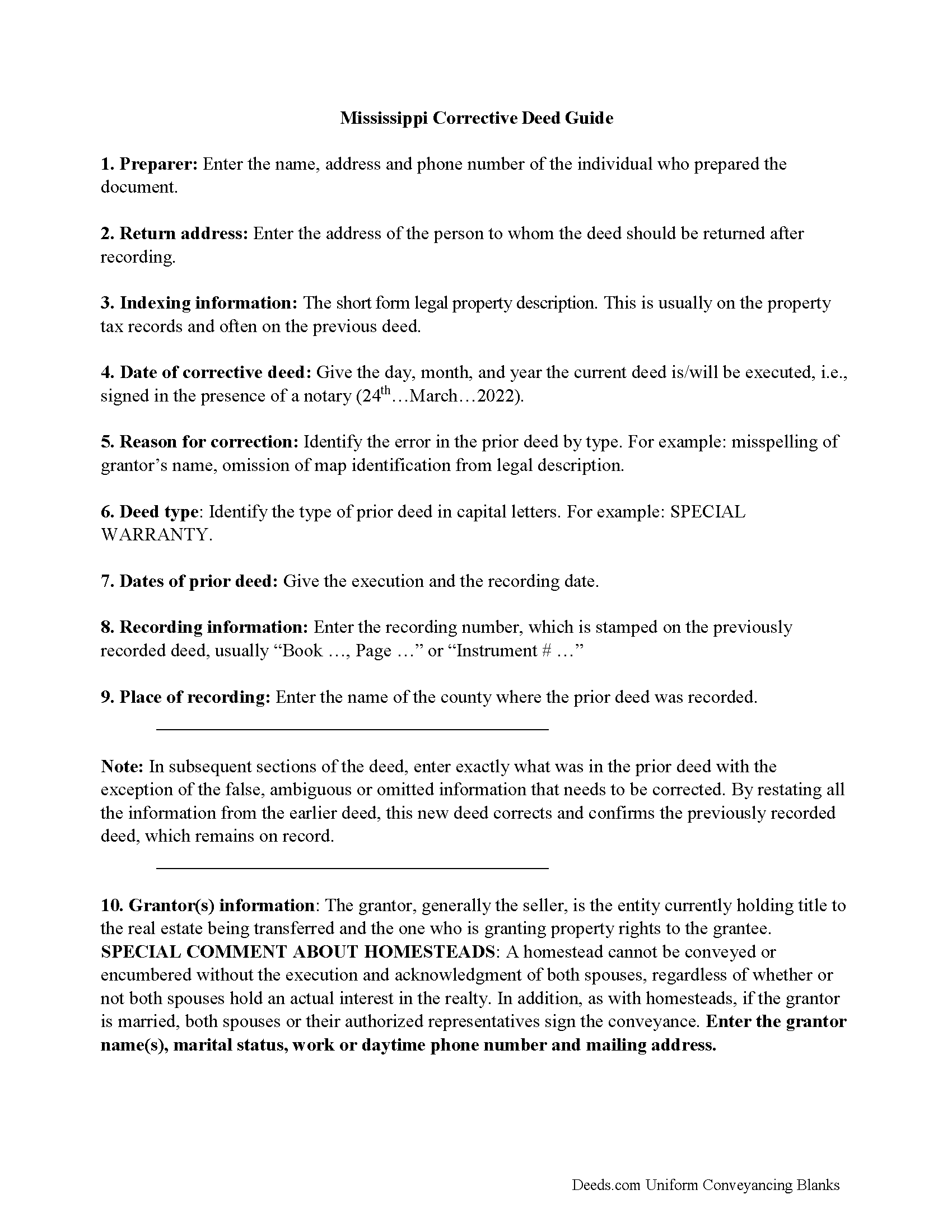

Correction Deed Guide

Line by line guide explaining every blank on the form.

Included Simpson County compliant document last validated/updated 6/3/2025

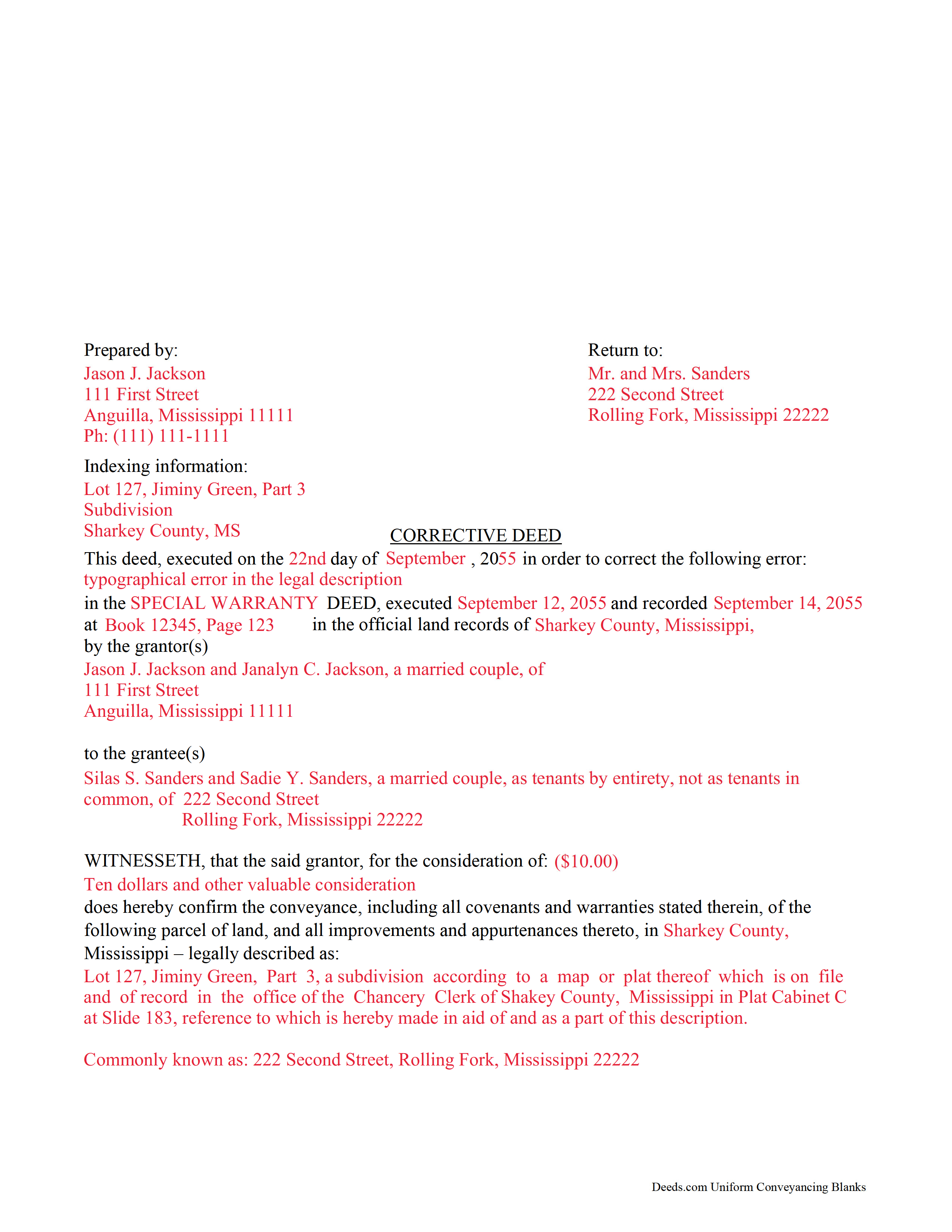

Completed Example of the Correction Deed Document

Example of a properly completed form for reference.

Included Simpson County compliant document last validated/updated 4/7/2025

The following Mississippi and Simpson County supplemental forms are included as a courtesy with your order:

When using these Correction Deed forms, the subject real estate must be physically located in Simpson County. The executed documents should then be recorded in the following office:

Simpson County Chancery Clerk

111 West Pine Ave / PO Box 367, Mendenhall, Mississippi 39114

Hours: 8:00 to 5:00 M-F

Phone: (601) 847-2626 press 1

Local jurisdictions located in Simpson County include:

- Braxton

- D Lo

- Harrisville

- Magee

- Mendenhall

- Pinola

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Simpson County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Simpson County using our eRecording service.

Are these forms guaranteed to be recordable in Simpson County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Simpson County including margin requirements, content requirements, font and font size requirements.

Can the Correction Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Simpson County that you need to transfer you would only need to order our forms once for all of your properties in Simpson County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Mississippi or Simpson County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Simpson County Correction Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Use the corrective deed to amend a previously recorded warranty, special warranty, or quitclaim deed with an error that could affect future title transfer.

A corrective deed is, in effect, an explanation and correction of an error in a prior instrument. As such, it passes no title, but only reiterates and confirms the prior conveyance. It should be executed from the original grantor to the original grantee, and it needs to be recorded in order to be legally valid.

The corrective deed must reference the original conveyance it is correcting by type of error, date of execution and recording, and recording number and location. Beyond that, it restates the information given in the prior deed, thus serving as its de facto replacement. The prior deed, which constitutes the actual conveyance of title, remains on record and will receive a marginal cross-reference to the subsequent recording of a corrective deed.

Deeds of correction are most appropriate for minor errors and omissions in the original deed, such as misspelled names, omission of marital status, or typos in the legal description. More substantial changes, such as adding a name to the title or adding/subtracting a portion of land to the legal description of the property, usually require a new deed of conveyance instead of a mere corrective deed. When in doubt, seek legal counsel to determine the most appropriate instrument for a case that involves such a material change.

(Mississippi CD Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Simpson County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Simpson County Correction Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4563 Reviews )

JAMES D.

July 10th, 2025

Slick as can be and so convenient.rnrnWorked like a charm

Thank you for your feedback. We really appreciate it. Have a great day!

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.rn

We are delighted to have been of service. Thank you for the positive review!

Robert F.

June 30th, 2025

Breeze.... It feels silly to hire an attorney to do this for just one beneficiary. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Sue S.

December 22nd, 2021

Great site easy to use and the documents are great!

Thank you for your feedback. We really appreciate it. Have a great day!

Scott S.

November 20th, 2020

This is the best resource I have found for documents related to beneficiary deeds!

Thank you!

LIsa B.

January 27th, 2023

Deeds.com made this process of electronic document recording so easy! The communication was quick, friendly, helpful and efficient. I am out of state and have administrative items to handle for my father who has Alzheimer's. Deeds.com is a great service. I highly recommend them, and will use them again when the time comes.

Thank you!

Mary B.

December 1st, 2021

Great job, Deeds.com! I'm a retired lawyer, and I'm liking what I see. Well done.

Thank you!

Eleanor E.

September 20th, 2019

Not knowing I could down load these forms, I first went to the local recording office thinking I could get info on the forms I needed. I was told that obviously you dont know what you are doing so find someone who does. This snippy clerk obviously didnt know the forms were accessible on line; either that or she was needing to feel her phony superiority.

Thank you for your feedback. We really appreciate it. Have a great day!

Jim F.

April 9th, 2024

Site was easy to navigate and helped me to quickly locate the documents I was searching for. Thank you!

Your appreciative words mean the world to us. Thank you.

Nancy O.

August 6th, 2023

Have not actually filed as yet but package seems to answer all my questions and believe this will be a walk in the park instead a a headache or expensive endeavor. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Kenneth R.

October 12th, 2021

Thank you. After searching for the correct forms and instructions on my county website, and finding nothing, I was very pleased with the Pinal County, AZ, acceptable forms and instructions I was able to download at a very reasonable cost from Deeds.com.

Thank you!

Abram A.

February 26th, 2019

Very easy to navigate around and to obtain desired forms and service.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Peggy D.

August 26th, 2021

Very helpful in finding the information for me. Quick response.

Very easy to use the forms.

Thank you for your feedback. We really appreciate it. Have a great day!

Jenni R.

April 19th, 2023

Dry convenient and had just the form I needed and included directions, filled out sample form and other resources. Will recommend and use again if needed.

Thank you for your feedback. We really appreciate it. Have a great day!

Toni M.

June 24th, 2019

I liked having the forms. Some may need to know they can look at the legal Description from online county records, then type up in Word document line by line, the degree sign in Word program is achieved by using alt and 248 on number pad. Then on the form page one write SEE Exibit A and title your Word program description as Exibit A. Goes without saying the legal description should be looked over many times and it is easier to do so if you format your Word the same lineage as the legal description online which is usually not text which is why you have to retype it.

Thank you for your feedback. We really appreciate it. Have a great day!