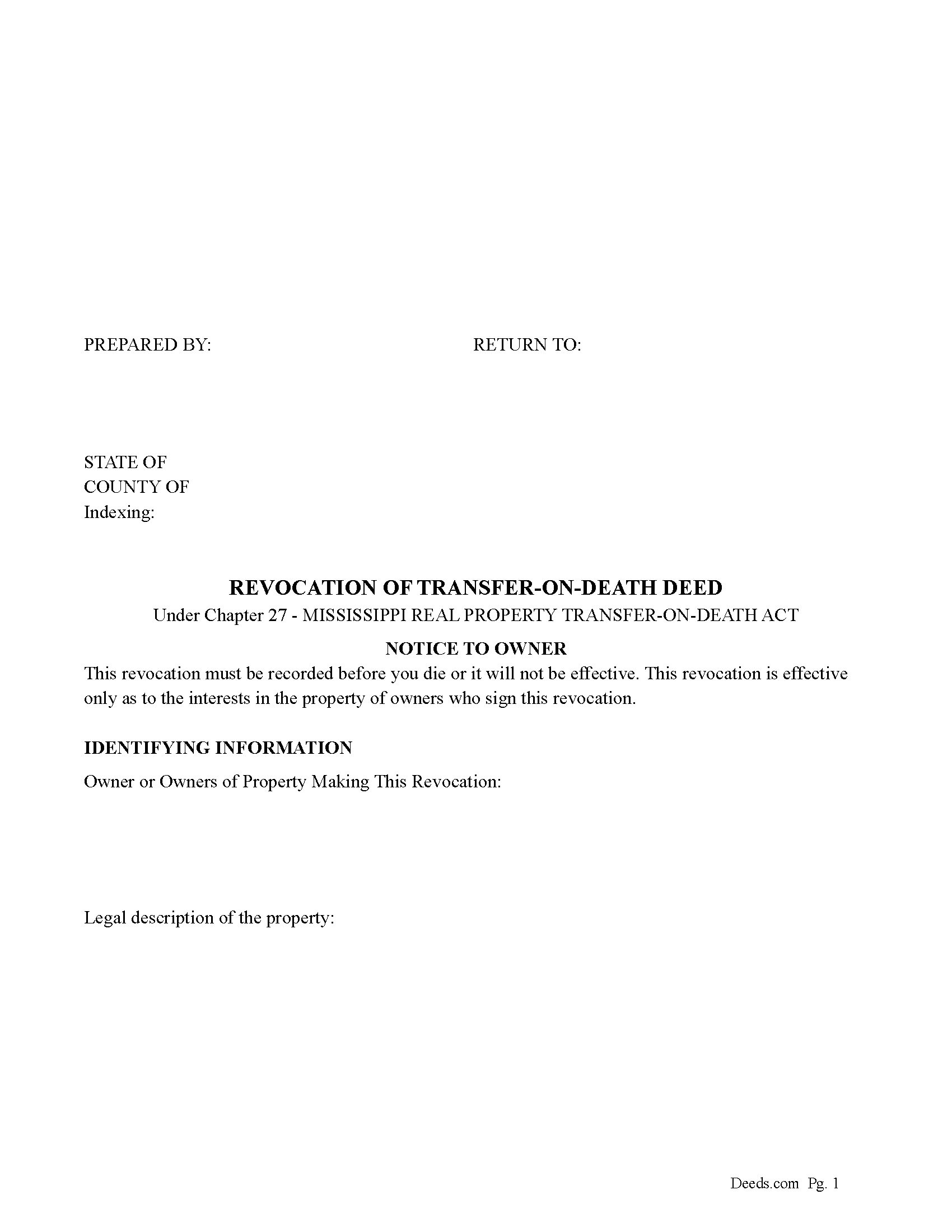

Amite County Revocation of Transfer on Death Deed Form

Amite County Revocation of Transfer on Death Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

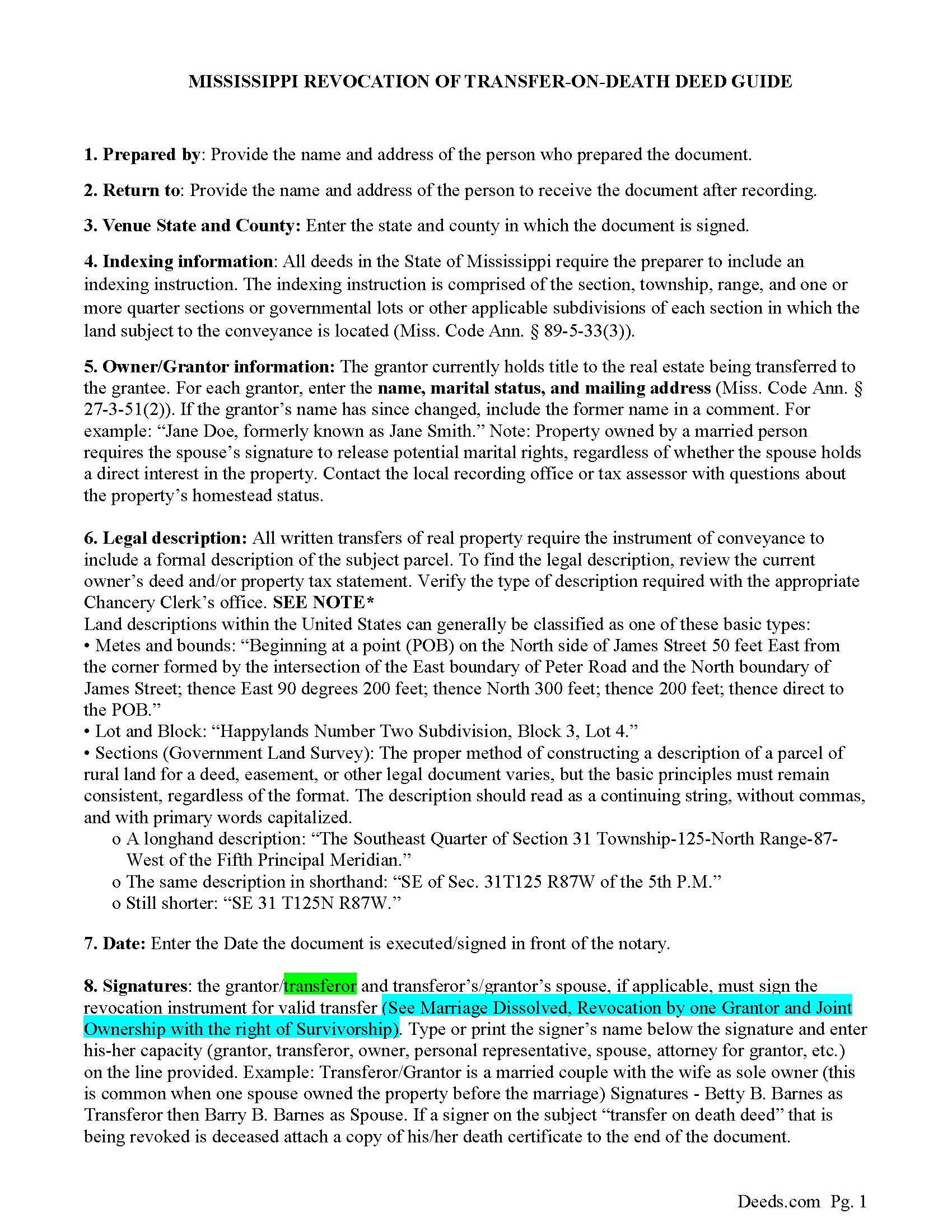

Amite County Guidelines for Revocation of Transfer on Death Deed

Line by line guide explaining every blank on the form.

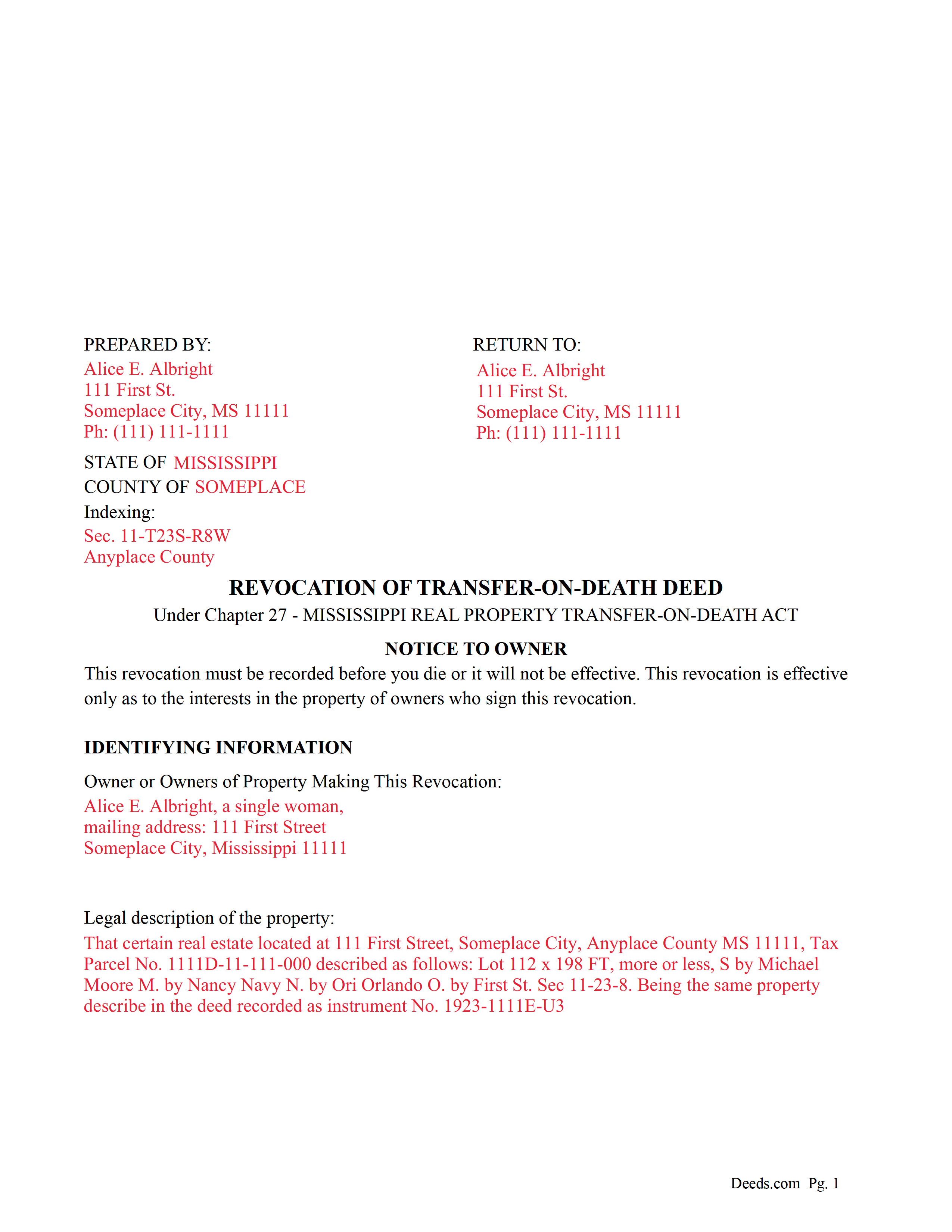

Amite County Completed Example of a Revocation of Transfer on Death Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Mississippi and Amite County documents included at no extra charge:

Where to Record Your Documents

Amite County Chancery Clerk

Liberty, Mississippi 39645-0680

Hours: 8:30 to 4:30 M-F

Phone: (601) 657-8022

Recording Tips for Amite County:

- Ask if they accept credit cards - many offices are cash/check only

- White-out or correction fluid may cause rejection

- Check that your notary's commission hasn't expired

- Recording fees may differ from what's posted online - verify current rates

- Check margin requirements - usually 1-2 inches at top

Cities and Jurisdictions in Amite County

Properties in any of these areas use Amite County forms:

- Crosby

- Gloster

- Liberty

- Smithdale

Hours, fees, requirements, and more for Amite County

How do I get my forms?

Forms are available for immediate download after payment. The Amite County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Amite County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Amite County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Amite County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Amite County?

Recording fees in Amite County vary. Contact the recorder's office at (601) 657-8022 for current fees.

Questions answered? Let's get started!

Use this form to revoke or partially revoke a previously recorded Revocable Transfer on Death Deed.

Section 91-27-21 - Revocation by instrument authorized; revocation by act not permitted

(a) Subject to subsections (d) and (e), an instrument is effective to revoke a recorded transfer-on-death deed, or any part of it, if the instrument:

(1) Is one (1) of the following:

(A) A subsequent transfer-on-death deed that revokes the preceding transfer-on-death deed or part of the deed expressly or by inconsistency; or

(B) Except as provided by subsection (b), an instrument of revocation that expressly revokes the transfer-on-death deed or part of the deed;

(2) Is acknowledged by the transferor after the acknowledgment of the deed being revoked; and

(3) Is recorded before the transferor's death in the official records of the chancery clerk of the county where the deed being revoked is recorded.

(b) A will does not revoke or supersede a transfer-on-death deed.

(c) If a marriage between the transferor and a designated beneficiary is dissolved after a transfer-on-death deed is recorded, a final judgment of the court dissolving the marriage operates to revoke the transfer-on-death deed as to that designated beneficiary.

(d) If a transfer-on-death deed is made by more than one (1) transferor, revocation by a transferor does not affect the deed as to the interest of another transferor who does not make that revocation.

(e) A transfer-on-death deed made by joint owners with right of survivorship is revoked only if it is revoked by all of the living joint owners.

(f) This section does not limit the effect of an inter vivos transfer of the real property.

(Mississippi Revocation of TODD Package includes form, guidelines, and completed example) For use in Mississippi only.

Important: Your property must be located in Amite County to use these forms. Documents should be recorded at the office below.

This Revocation of Transfer on Death Deed meets all recording requirements specific to Amite County.

Our Promise

The documents you receive here will meet, or exceed, the Amite County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Amite County Revocation of Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4580 Reviews )

Pamela L.

November 10th, 2019

The packet was very comprehensive and easy to use (I had just one question that wasn't clearly explained). II appreciate that the forms are kept up to date.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Raymond N.

September 7th, 2023

The process of obtaining the forms that I wanted was very easy and the cost reasonable. The site is easy to follow and explains everything. Thank you for being here.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jack B.

May 2nd, 2020

The service was fast, but I didn't learn about the results until I logged in. I would have liked to get email when the report was finished.

Thank you for your feedback. We really appreciate it. Have a great day!

Sherri S.

March 30th, 2021

Easy to access forms, and reasonably priced. I'll definitely use again in the future.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Andrew H.

November 11th, 2020

Very efficient does what it says on the box.

Thank you!

Thomas W.

September 15th, 2019

A great way to access form knowledge

Thank you!

Kevin E.

May 15th, 2019

Great app works very well thank you very much

Thank you!

sheila B.

August 19th, 2021

awesome

Thank you!

Robert W.

January 5th, 2019

The forms were as I expected them to be. The guide was very helpful. Overall very good.

Thanks Robert. We appreciate your feedback.

WAYNE C.

July 11th, 2021

Wonderful forms, been coming here for years (since 2012) for my deed forms and they have never failed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Samantha W.

March 5th, 2022

Great place to get the forms you need. The instructions were clear and made it easy to complete. Pricing was great, especially compared to similar providers.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jennifer S.

September 4th, 2021

We liked the ease of filling out our document in a professional layout.

Thank you for your feedback. We really appreciate it. Have a great day!

Casey W.

September 9th, 2022

Excellent service, quick and right to the point, without a monthly subscription! Perfect for filers of single documents! Thanks!

Thank you for your feedback. We really appreciate it. Have a great day!

Linda P.

October 26th, 2020

Very informative. It was very helpful.

Thank you!

MARY LACEY M.

May 28th, 2025

Deeds.com has become a great assistant to our firm! The service is of highest quality and consistently helpful to our law firm in its recording needs. It's summer in Arizona and no one I know wants to drive to downtown Phoenix to record a property deed so think I will add "grateful" to my praise.

Thank you, Mary! We appreciate your kind words and are glad to help make recording easier — especially when it means avoiding a summer trip to downtown Phoenix. We’re grateful for your continued trust.