Neshoba County Trustee Deed for Sale of Foreclosed Property Form

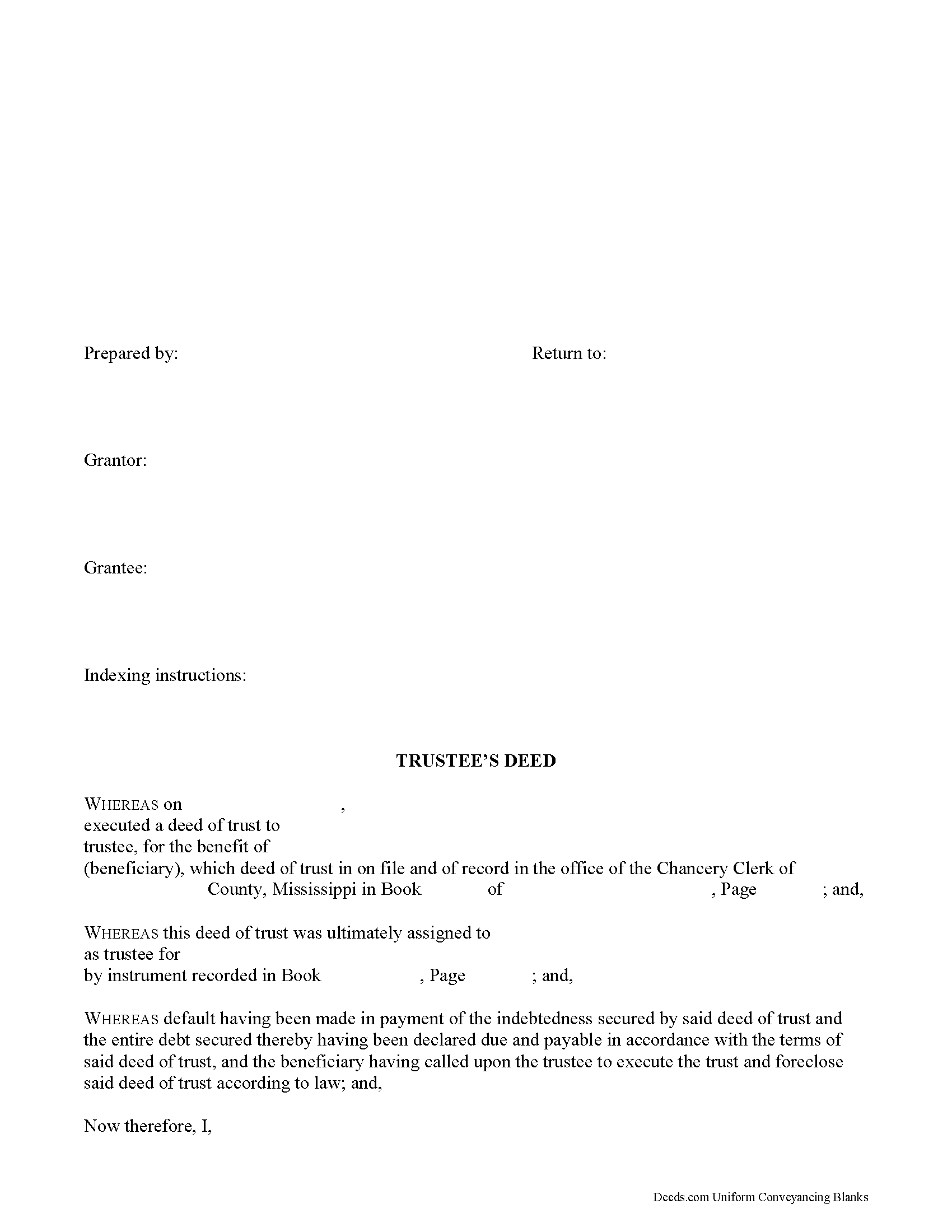

Neshoba County Trustee Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

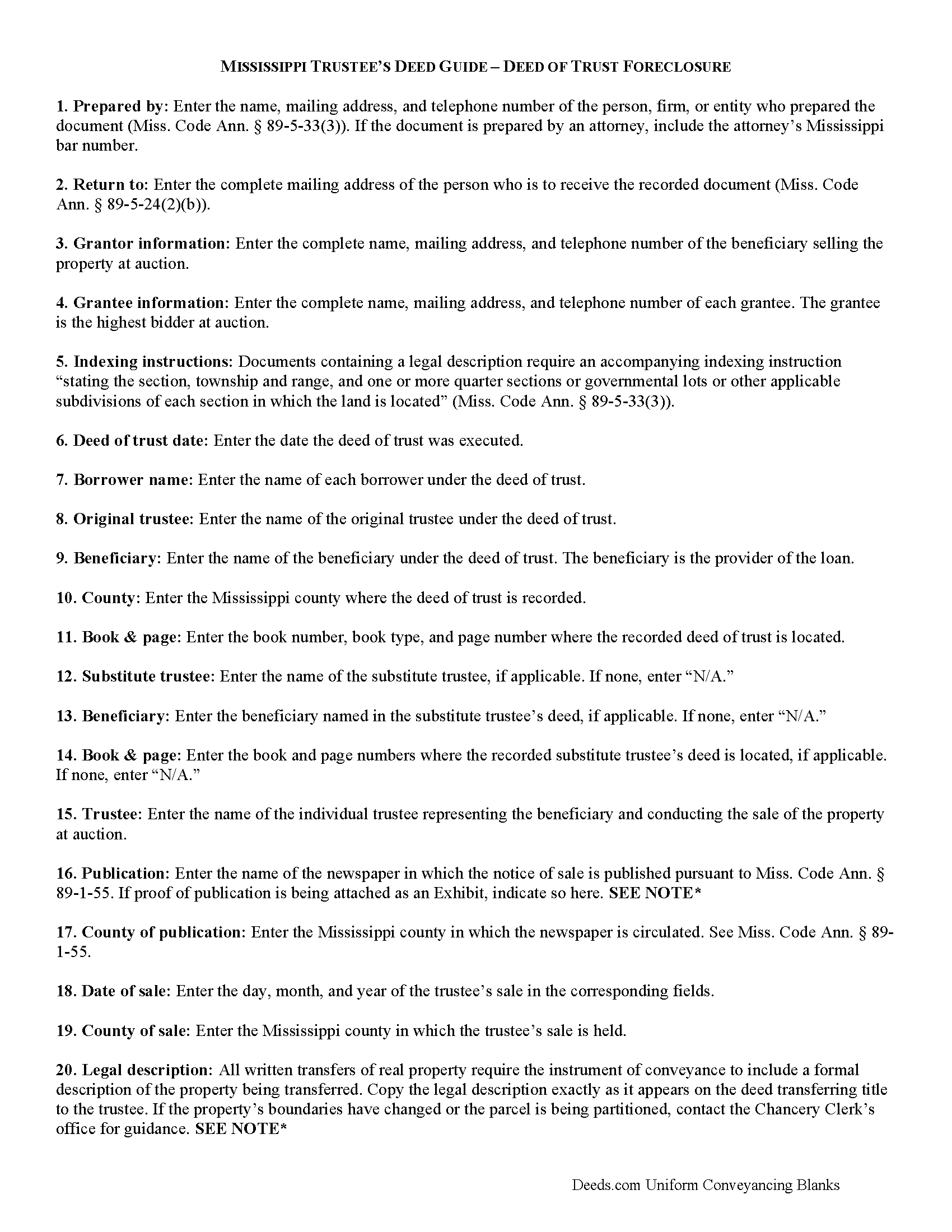

Neshoba County Trustee Deed Guide

Line by line guide explaining every blank on the form.

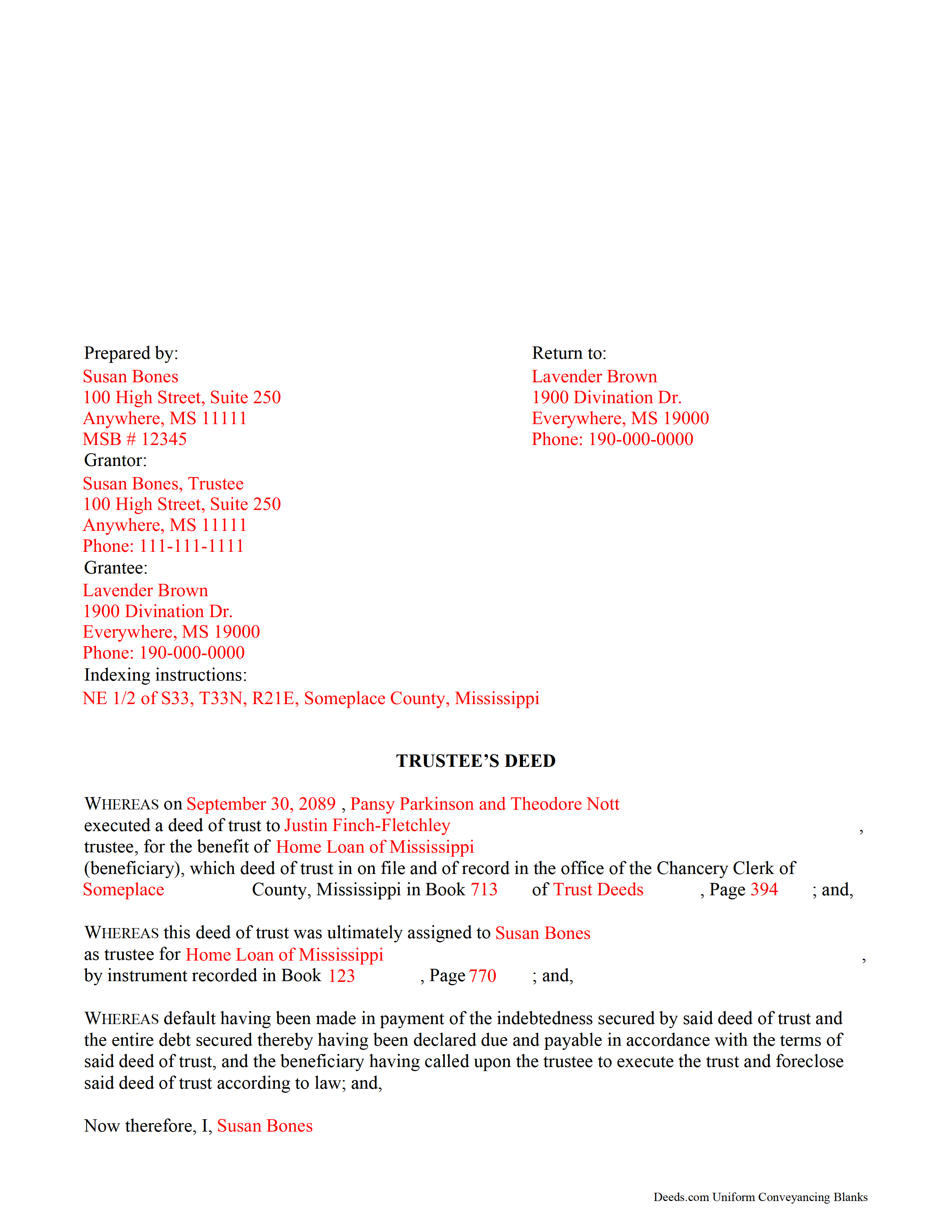

Neshoba County Completed Example of the Trustee Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Mississippi and Neshoba County documents included at no extra charge:

Where to Record Your Documents

Neshoba County Chancery Clerk

Philadelphia, Mississippi 39350

Hours: 8:00 to 5:00 M-F

Phone: (601) 656-3581

Recording Tips for Neshoba County:

- Bring your driver's license or state-issued photo ID

- Verify all names are spelled correctly before recording

- White-out or correction fluid may cause rejection

- Make copies of your documents before recording - keep originals safe

Cities and Jurisdictions in Neshoba County

Properties in any of these areas use Neshoba County forms:

- Philadelphia

- Union

Hours, fees, requirements, and more for Neshoba County

How do I get my forms?

Forms are available for immediate download after payment. The Neshoba County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Neshoba County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Neshoba County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Neshoba County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Neshoba County?

Recording fees in Neshoba County vary. Contact the recorder's office at (601) 656-3581 for current fees.

Questions answered? Let's get started!

The trustee's deed is used to convey real property after foreclosure and sale under a deed of trust. It takes its name from the executing party rather than from the type of warranty the deed contains. After conducting a trustee's sale at public auction, the trustee uses the deed to vest title to the property in the name of the highest bidder.

A deed of trust (alternately called a trust deed or a deed in trust) is a variation of a mortgage whereby a trustee holds legal title to property as security for the repayment of a loan. The borrower, called the trustor or grantor, executes the deed of trust to the trustee for the benefit of the lender, called the beneficiary. The trustee is generally an agent of the beneficiary.

Upon fulfillment of the terms of the deed of trust, the trustee revests the legal title in the name of the borrower (Miss. Code Ann. 89-1-49(1)). If the borrower breaches the conditions of the deed of trust, the beneficiary can instruct the trustee to initiate foreclosure proceedings. In Mississippi, "any deed of trust...may confer on the trustee...the power of sale"; this power must be conferred upon the trustee in the deed of trust in order for him/her to act upon it (Miss. Code Ann. 89-1-63(2)).

Before the trustee can conduct a trustee's sale at public auction, preliminary requirements must be fulfilled under Mississippi law, including the publication of notice of sale in a local newspaper and posting of notice of sale at the county courthouse in the county where the subject property is located (Miss. Code Ann. 89-1-55). The deed then recites that the requirements for the posting of notice of sale under Miss. Code Ann. 89-1-55 have been met with proof of publication sometimes attached as an exhibit to the document.

Upon conclusion of the public auction, the trustee executes a trustee's deed to the highest and best bidder. The trustee conveys only such title as is vested in him/her as trustee under the deed of trust. The form's granting language contains implied covenants of seisin, against encumbrances (except for those named in the deed), and quiet enjoyment (Miss. Code Ann. 89-1-41).

Besides meeting the requirements of form and content for documents affecting real property in Mississippi, the trustee's deed requires the names of all parties to the deed of trust under which the property is being sold, as well as a reference to its place of recording (Miss. Code Ann. 89-1-53). If the trustee conducting the sale and executing the trustee's deed is a substitute trustee, the trustee's deed also requires a reference to the deed of substitution (same statute).

As with all conveyances in Mississippi, the deed requires a legal description of the property as well as indexing instructions. It should recite the name, address, telephone number, and bar number, if applicable, of the person who prepared the document. The trustee's signature must be witnessed in the presence of a notary public before submission for recording in the Office of the Chancery Clerk in the county in which the real property is located.

Consult a lawyer with any questions regarding trustee's deeds in Mississippi, as each situation is unique.

(Mississippi DFS Package includes form, guidelines, and completed example)

Important: Your property must be located in Neshoba County to use these forms. Documents should be recorded at the office below.

This Trustee Deed for Sale of Foreclosed Property meets all recording requirements specific to Neshoba County.

Our Promise

The documents you receive here will meet, or exceed, the Neshoba County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Neshoba County Trustee Deed for Sale of Foreclosed Property form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Bertha V. G.

May 17th, 2019

Great information and very easy to understand.

Thank you for your feedback. We really appreciate it. Have a great day!

John C N.

June 17th, 2023

Just the website I needed. Very detailed and efficient.

Thank you for taking the time to provide your feedback John, we really appreciate it. Have an amazing day!

james h.

June 15th, 2020

Service was quick and easy to use. I got not only the necessary forms, but instructions and sample forms filled out. Highly recommended.

Thank you!

Brad T.

November 9th, 2019

I didn't spend a lot of time there but seems to be a good site with a valuable service.

Thank you!

STEPHANIE S.

November 12th, 2020

The documents received and information provided to assist with the recording was exactly what was needed for a successful title transfer. I would highly recommend this site and will continue using it for future transactions.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Denise L.

August 4th, 2021

It was very easy to get the forms I needed which makes its so much easier than running back and forth. I shall be getting more forms very shortly

Thank you for your feedback. We really appreciate it. Have a great day!

Jennifer T.

September 29th, 2023

I got instant access to the exact forms I needed! The guide to completing the form was very thorough and easy to understand. I am very thankful for this service!

Thank you for the kind words Jennifer. We appreciate you!

Greg S.

August 19th, 2022

The Beneficiary Deed is easy to fill out, expecially with the examples/explanations provided. The only recommendation I would make is to state that the Parcel ID and the Assessor's ID are one in the same. I looked everywhere for something that mentions "Assessor's ID" in my paperwork to no avail. Upon calling the Maricopa Assessor's number in Maricopa I was told that they are the same.

Thank you for your feedback. We really appreciate it. Have a great day!

john c.

July 11th, 2021

Not impressed

Thank you!

Mack H.

July 16th, 2020

I got what I was looking for! Turned out well and like I thought it would.

Thank you!

Ronald T H.

June 21st, 2019

Wow ! Easy to use. Thanks Ron Holt

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Khadija K.

March 2nd, 2023

Great Service. Not only the required form, but also the state guidelines. Thank you for making it easy.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Philip S.

November 30th, 2021

This was our first time using Deeds.Com. We were tremendously impressed. The website works well, but the customer service really makes this organization special. The prompt, professional and knowledgeable responses to inquiries and recording issues was refreshing.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

James P.

July 28th, 2020

I wish I used this site more often. The format is pretty easy but the messages were invaluable and the staff were great. I was able to complete my transaction in a Covid environment from the security of my own home. Great service and tools!

Thank you for your feedback. We really appreciate it. Have a great day!

chris a.

February 17th, 2021

It was easy to complete the deed but on the third page I only need one signature in stead of 3 I need to delete 2 or put n//a in those blocks I will continue to use your services and have recommended it to others

Thank you for your feedback. We really appreciate it. Have a great day!