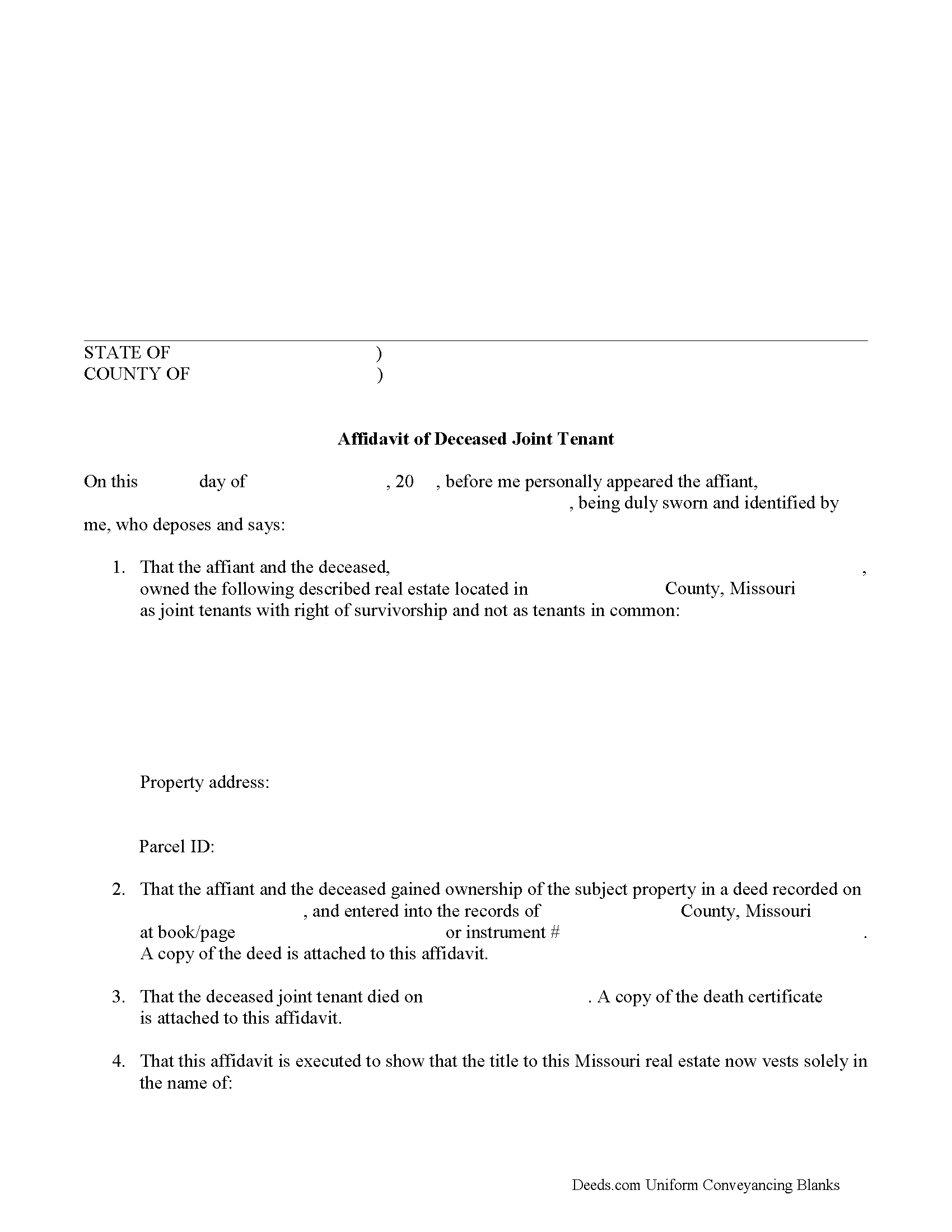

Audrain County Affidavit of Deceased Joint Tenant Form

Audrain County Affidavit of Deceased Joint Tenant Form

Fill in the blank form formatted to comply with all recording and content requirements.

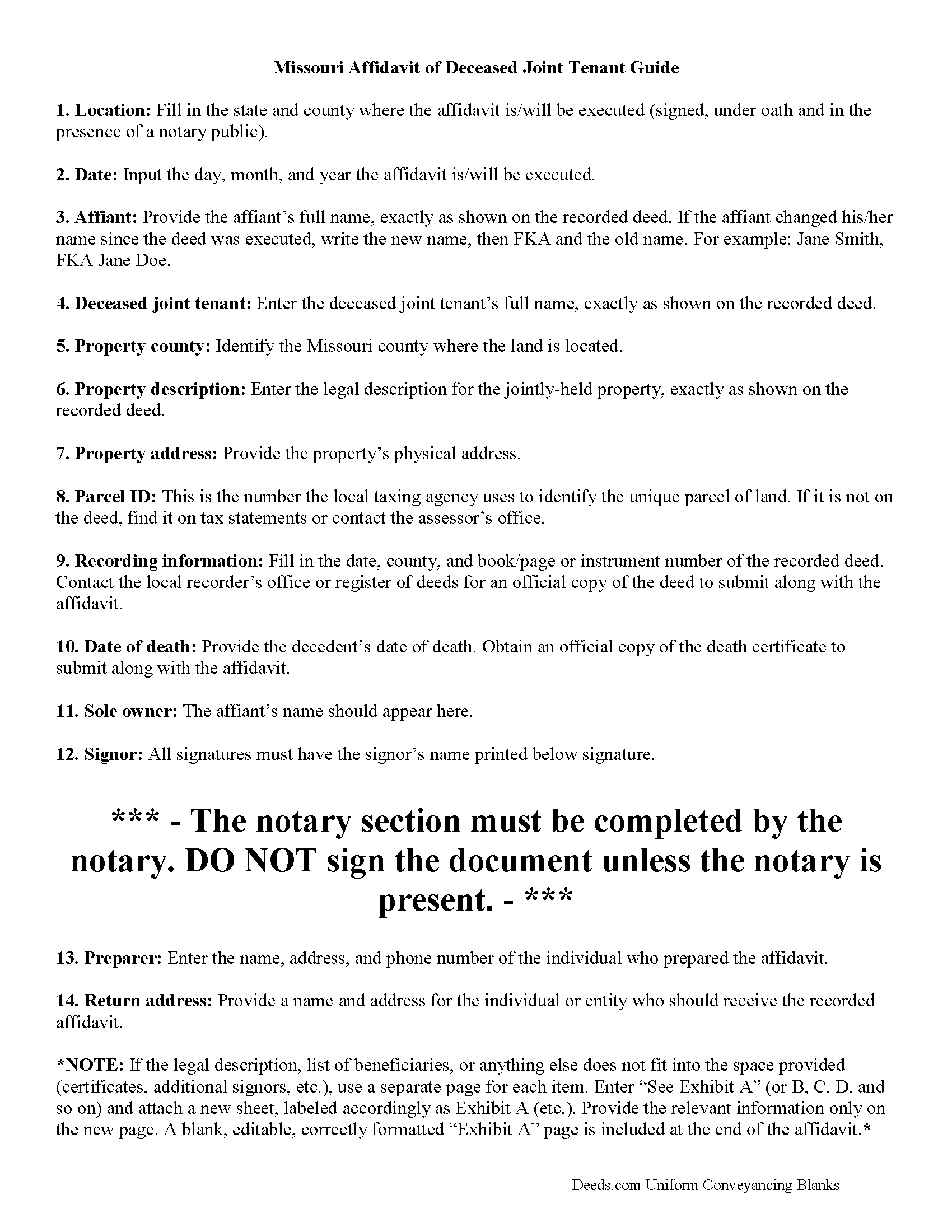

Audrain County Affidavit of Deceased Joint Tenant Guide

Line by line guide explaining every blank on the form.

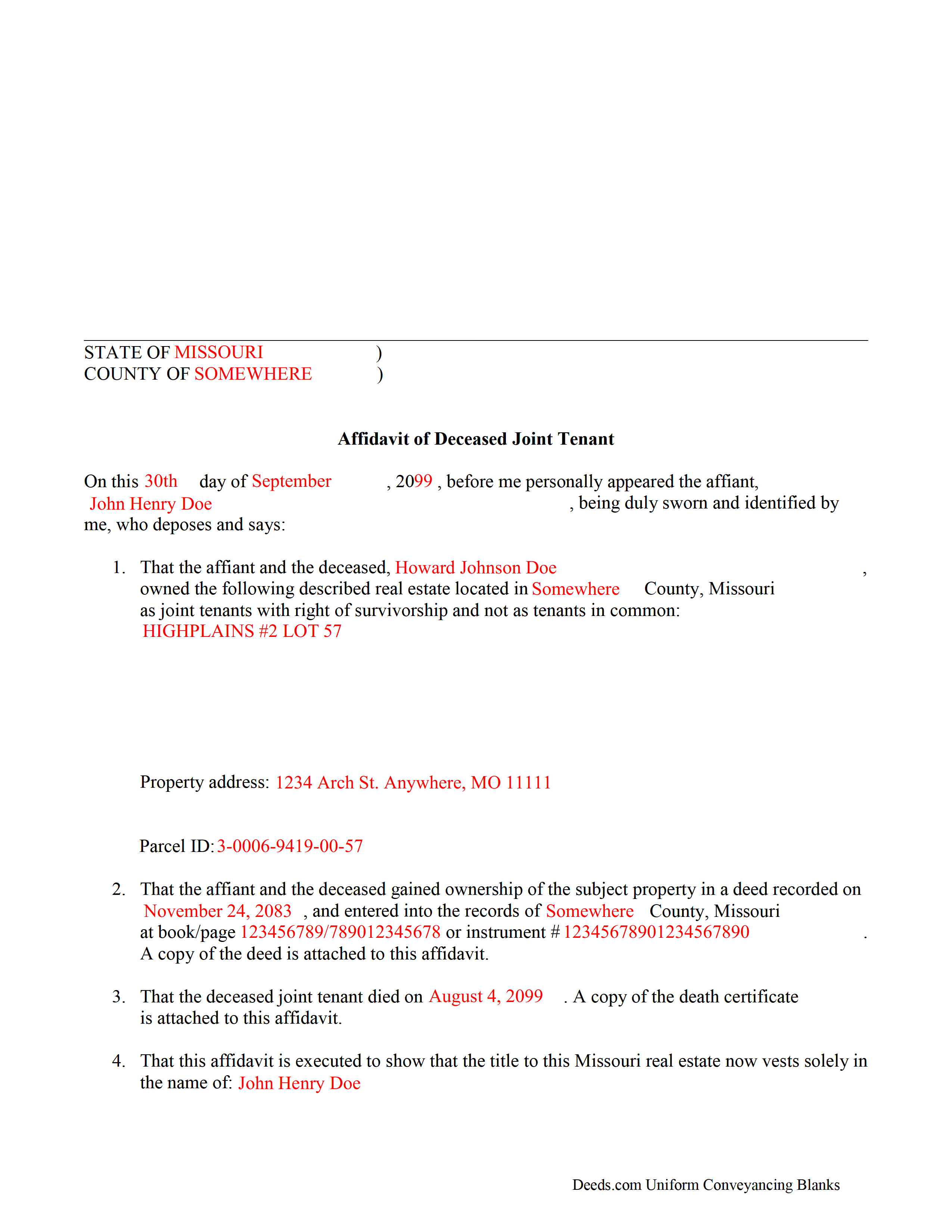

Audrain County Completed Example of the Affidavit of Deceased Joint Tenant Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Missouri and Audrain County documents included at no extra charge:

Where to Record Your Documents

Audrain County Recorder of Deeds

Mexico, Missouri 65265

Hours: 8:00am-5:00pm M-F

Phone: (573) 473-5830

Recording Tips for Audrain County:

- Verify all names are spelled correctly before recording

- Make copies of your documents before recording - keep originals safe

- Recorded documents become public record - avoid including SSNs

- If mailing documents, use certified mail with return receipt

Cities and Jurisdictions in Audrain County

Properties in any of these areas use Audrain County forms:

- Benton City

- Farber

- Laddonia

- Martinsburg

- Mexico

- Rush Hill

- Thompson

- Vandalia

Hours, fees, requirements, and more for Audrain County

How do I get my forms?

Forms are available for immediate download after payment. The Audrain County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Audrain County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Audrain County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Audrain County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Audrain County?

Recording fees in Audrain County vary. Contact the recorder's office at (573) 473-5830 for current fees.

Questions answered? Let's get started!

The process of removing a deceased joint tenant from a Missouri deed is fairly simple.

When two or more property owners hold title as joint tenants with right of survivorship, and one co-owner dies, the surviving owners share the decedent's interest in the land by function of law, and outside of the probate process.

Even though the transfer of ownership rights is, in theory, automatic, it makes sense to formalize the change in title. One way to accomplish this is by completing and recording an affidavit of deceased joint tenant document, accompanied by official copies of the recorded deed showing the joint tenancy and the deceased owner's death certificate. His/her name will still appear on the deed, but the records will show that the property rights were transferred to the surviving owner.

To remove the decedent's name altogether, execute a new deed showing both joint tenants as grantors and only the survivor as a grantee. For example: "John Doe (deceased) and Richard Roe, as joint tenants with right of survivorship, convey to Richard Roe as sole owner." Present the new deed along with the affidavit of surviving joint tenant or submit it for recording on its own at a later date.

By following this procedure, the survivor helps to maintain a clear chain of title (ownership history), which will simplify future transactions relating to the property.

(Missouri Affidavit of DJT Package includes form, guidelines, and completed example)

Important: Your property must be located in Audrain County to use these forms. Documents should be recorded at the office below.

This Affidavit of Deceased Joint Tenant meets all recording requirements specific to Audrain County.

Our Promise

The documents you receive here will meet, or exceed, the Audrain County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Audrain County Affidavit of Deceased Joint Tenant form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4583 Reviews )

John Q.

June 26th, 2020

I downloaded the forms, which was very easy, and filled them out with the help of the very helpful instructions! I was able to go down to my court house and file the forms within 24 hours of downloading! I am at peace knowing my son's will avoid a lot of headaches when I pass because my property deed will transfer to them without probate court TOD !!!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Max P.

February 26th, 2021

Excellent. Timely. Efficient. Smooth. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Elizabeth B.

October 26th, 2023

Your site provided all I needed. Thank you!

It was a pleasure serving you. Thank you for the positive feedback!

Jean K.

February 25th, 2021

The website worked fine and I would have been happy to pay the extra money except the deed I needed was "not available". Ended up calling the courthouse anyway.

Thank you for your feedback. We really appreciate it. Have a great day!

Judy F.

May 27th, 2022

The site was easy to use, I just wasn't sure which of all these documents I needed.

Thank you!

Nikie U.

September 10th, 2021

This was my first time using this service and it worked smoothly and efficiently and I will definitely use them again.

Thank you for your feedback. We really appreciate it. Have a great day!

Mary D.

July 13th, 2021

So far, understanding the process involved to get these forms was simple. I would like to have known or received some information as to charges for filing these documents. Or, be directed to a place that lists charges.

Thank you for your feedback. We really appreciate it. Have a great day!

Angel C.

September 28th, 2022

Solid forms hitting all the marks (statutory requirements) Fairly simple to accomplish what I was looking to do with minimal research. Would certainly use again when needed.

Thank you!

Shirley T.

April 14th, 2021

Quit Claim deed for North Carolina did not include all of the information I needed (two separate notary sections), but I was able to re-create another notary section in Word, and then insert it in the appropriate place after printing both documents. Otherwise, the document worked as described.

Thank you for your feedback. We really appreciate it. Have a great day!

Hanne R.

November 17th, 2020

excellent

Thank you!

Muhamed H.

February 3rd, 2022

Nice!

Thank you!

Joseph S.

November 27th, 2023

THIS IS MY FIRST EXPERIENCE WITH DEEDS.COM. I DLED THE ESTATE DEED FORM THAT I HOPE WILL GO THROUGH OK WITH THE COUNTY. IT WILL BE SOMETIME UNTIL I HAVE IT FILLED IN AND ALL THE NAMES IN, NORARIZED AND FILED. CAN I RECONTACT YOU FOLKS IF THERE IS A PROBLEM? THANK YOU, JOE SEUBERT

We are motivated by your feedback to continue delivering excellence. Thank you!

Dana P.

October 6th, 2020

Thank you for making a difficult time a little easier. The forms are easy to download and complete and the Guide is very helpful.

Thank you for your feedback. We really appreciate it. Have a great day!

Idiat A.

January 20th, 2023

Service was fast and easy to use. But let documents appear clearer next time.

Thank you for your feedback. We really appreciate it. Have a great day!

Eric S.

August 11th, 2020

Very easy and efficient to use. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!