Grundy County Affidavit of Deceased Joint Tenant Form

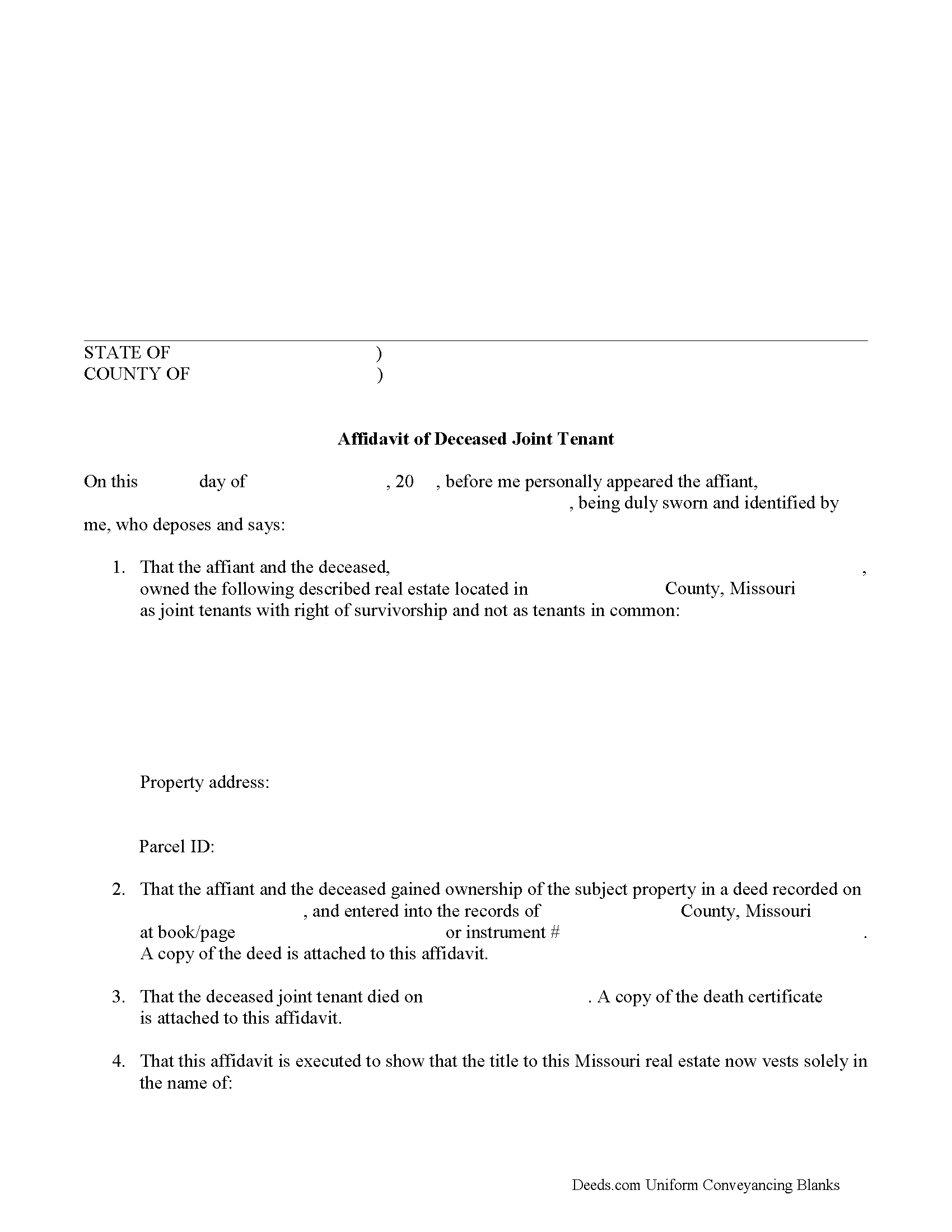

Grundy County Affidavit of Deceased Joint Tenant Form

Fill in the blank form formatted to comply with all recording and content requirements.

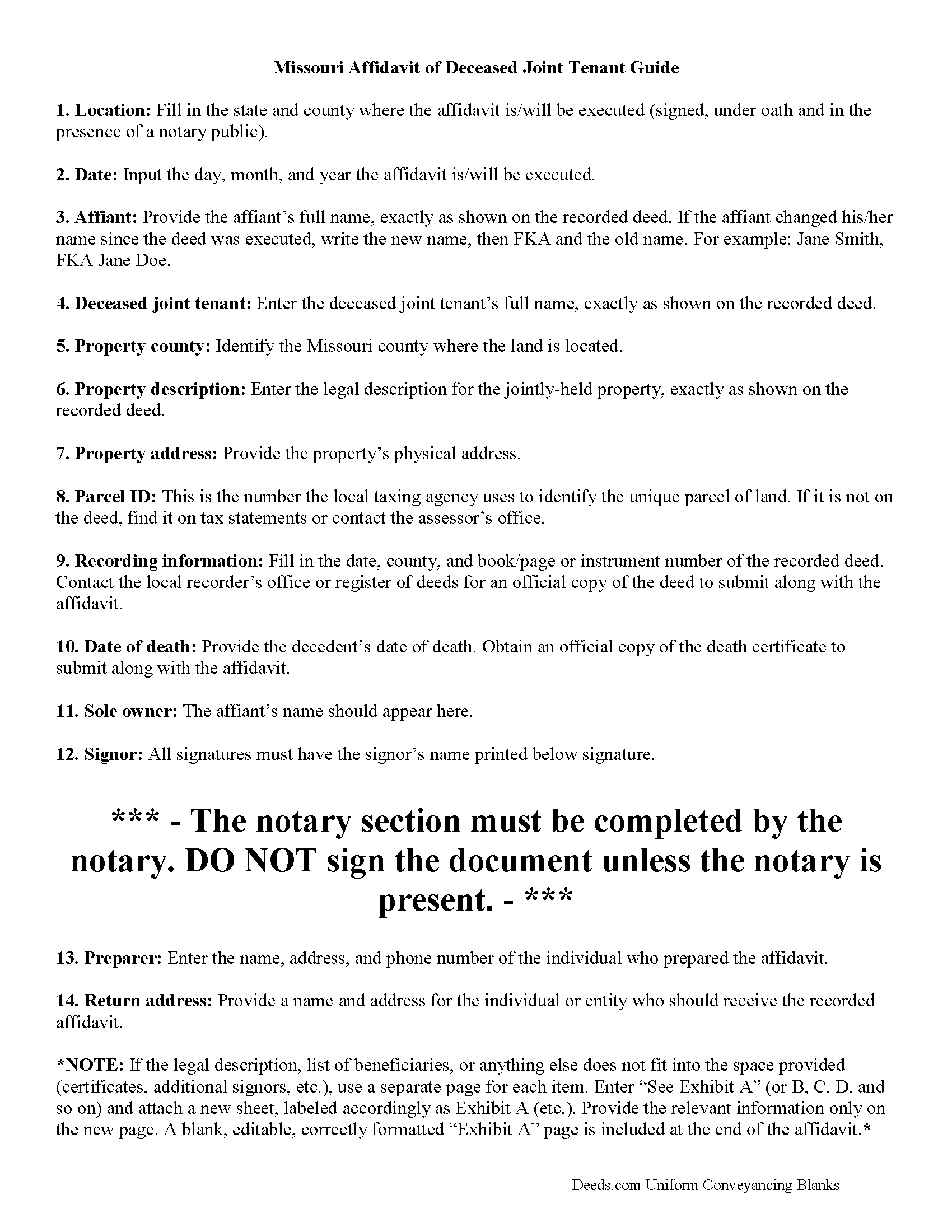

Grundy County Affidavit of Deceased Joint Tenant Guide

Line by line guide explaining every blank on the form.

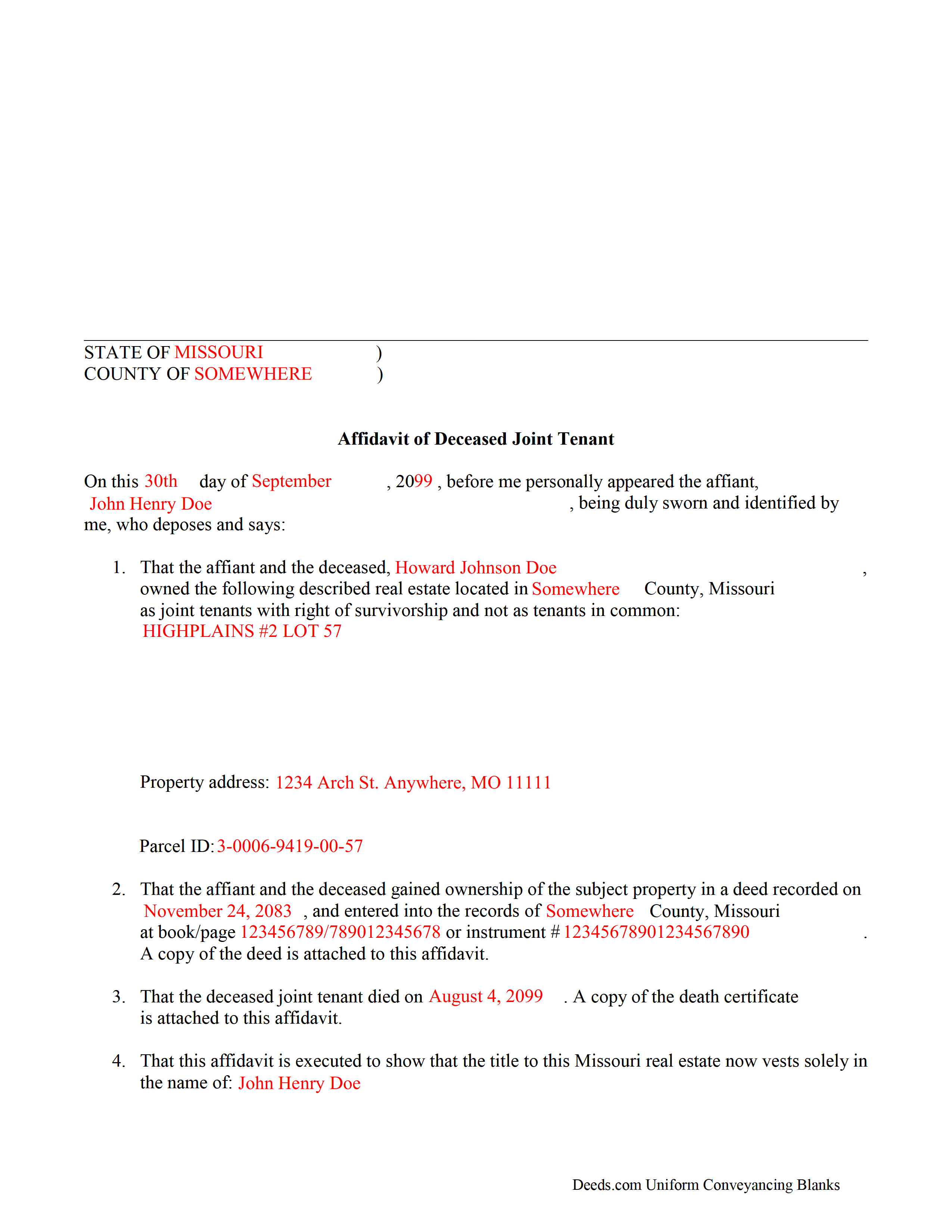

Grundy County Completed Example of the Affidavit of Deceased Joint Tenant Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Missouri and Grundy County documents included at no extra charge:

Where to Record Your Documents

Grundy County Recorder of Deeds

Trenton, Missouri 64683

Hours: 8:30 to 4:30 M-F

Phone: (660) 359-4040 Ext 7

Recording Tips for Grundy County:

- Bring your driver's license or state-issued photo ID

- Recording fees may differ from what's posted online - verify current rates

- Leave recording info boxes blank - the office fills these

- Have the property address and parcel number ready

Cities and Jurisdictions in Grundy County

Properties in any of these areas use Grundy County forms:

- Galt

- Laredo

- Spickard

- Trenton

Hours, fees, requirements, and more for Grundy County

How do I get my forms?

Forms are available for immediate download after payment. The Grundy County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Grundy County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Grundy County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Grundy County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Grundy County?

Recording fees in Grundy County vary. Contact the recorder's office at (660) 359-4040 Ext 7 for current fees.

Questions answered? Let's get started!

The process of removing a deceased joint tenant from a Missouri deed is fairly simple.

When two or more property owners hold title as joint tenants with right of survivorship, and one co-owner dies, the surviving owners share the decedent's interest in the land by function of law, and outside of the probate process.

Even though the transfer of ownership rights is, in theory, automatic, it makes sense to formalize the change in title. One way to accomplish this is by completing and recording an affidavit of deceased joint tenant document, accompanied by official copies of the recorded deed showing the joint tenancy and the deceased owner's death certificate. His/her name will still appear on the deed, but the records will show that the property rights were transferred to the surviving owner.

To remove the decedent's name altogether, execute a new deed showing both joint tenants as grantors and only the survivor as a grantee. For example: "John Doe (deceased) and Richard Roe, as joint tenants with right of survivorship, convey to Richard Roe as sole owner." Present the new deed along with the affidavit of surviving joint tenant or submit it for recording on its own at a later date.

By following this procedure, the survivor helps to maintain a clear chain of title (ownership history), which will simplify future transactions relating to the property.

(Missouri Affidavit of DJT Package includes form, guidelines, and completed example)

Important: Your property must be located in Grundy County to use these forms. Documents should be recorded at the office below.

This Affidavit of Deceased Joint Tenant meets all recording requirements specific to Grundy County.

Our Promise

The documents you receive here will meet, or exceed, the Grundy County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Grundy County Affidavit of Deceased Joint Tenant form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

candy h.

June 18th, 2020

service was great!

Thank you!

Andrew D.

August 12th, 2019

I was very pleased with the entire package we received. It will certainly make my job easier.

Thank you for your feedback. We really appreciate it. Have a great day!

Judy F.

May 27th, 2022

The site was easy to use, I just wasn't sure which of all these documents I needed.

Thank you!

Arthur M.

February 25th, 2021

Efficient and easy to use. Thanks.

Thank you!

Willard V.

May 11th, 2025

While it's nice to get all the forms and info in one package for a reasonable cost, the fixed format of the form does not allow for a lengthy meet and bounds property description for real property. Also, the Cover Sheet has big fillable sections with no instructions about what's supposed to go there. I tried the "Contact Us" link, but all it does is spin saying it's trying verify the security of my connection. Looks like I;m going to have to create my own deed in MS Word instead of just filling in the blacks of the PDF file that I downloaded. Bummer!

Your feedback is a crucial part of our dedication to ongoing improvement. Thank you for your insightful comments.

Michael L.

April 6th, 2022

Thumbs up. Very pleased with service. Easy process.

Thank you!

IVAN G.

September 4th, 2020

This Guys are accurate and FAST, Thanks Staff- KVH.!!!! you were awesome!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

James R.

November 14th, 2019

Really Easy site to navigate!

Thank you James, have a great day!

Susan H.

September 1st, 2020

Best idea ever for completing an on-line government form. And it came with instructions!!!!! Thank you, Gadsden County.

Thank you!

Geneen C.

August 4th, 2022

Love this site. The form directions are easy and I finished in less than an hour! Totally recommend it.

Thank you for your feedback. We really appreciate it. Have a great day!

Joanne D.

May 14th, 2020

Loved your easy to follow instructions along with the paperwork forms that I was looking for. Would highly suggest this service to everyone. You should share this platform with other counties!! Extremely helpful

Thank you!

AJ H.

April 30th, 2019

What a wonderful service to offer! Very impressed, and grateful for the forms and instructions!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Susan N.

August 28th, 2022

Easy to use.

Thank you!

Griselle M.

April 9th, 2020

Great service - it was my first time using the service and really recommend it. Due to COVID-19, my County Recorder's Office is closed and I was able to create the document using their vast templates, notarize it, and upload it into the system. The recording process took about 7 working days which is not bad considering that most people are working remotely. I will share this website and its many resources with my relatives and friends.

Thank you Griselle, glad we could help.

Jolene K.

June 6th, 2022

The forms were easy to download and use. I'm satisfied with it. The sample and the instructions were very helpful.

Thank you!