Texas County Beneficiary Deed Form

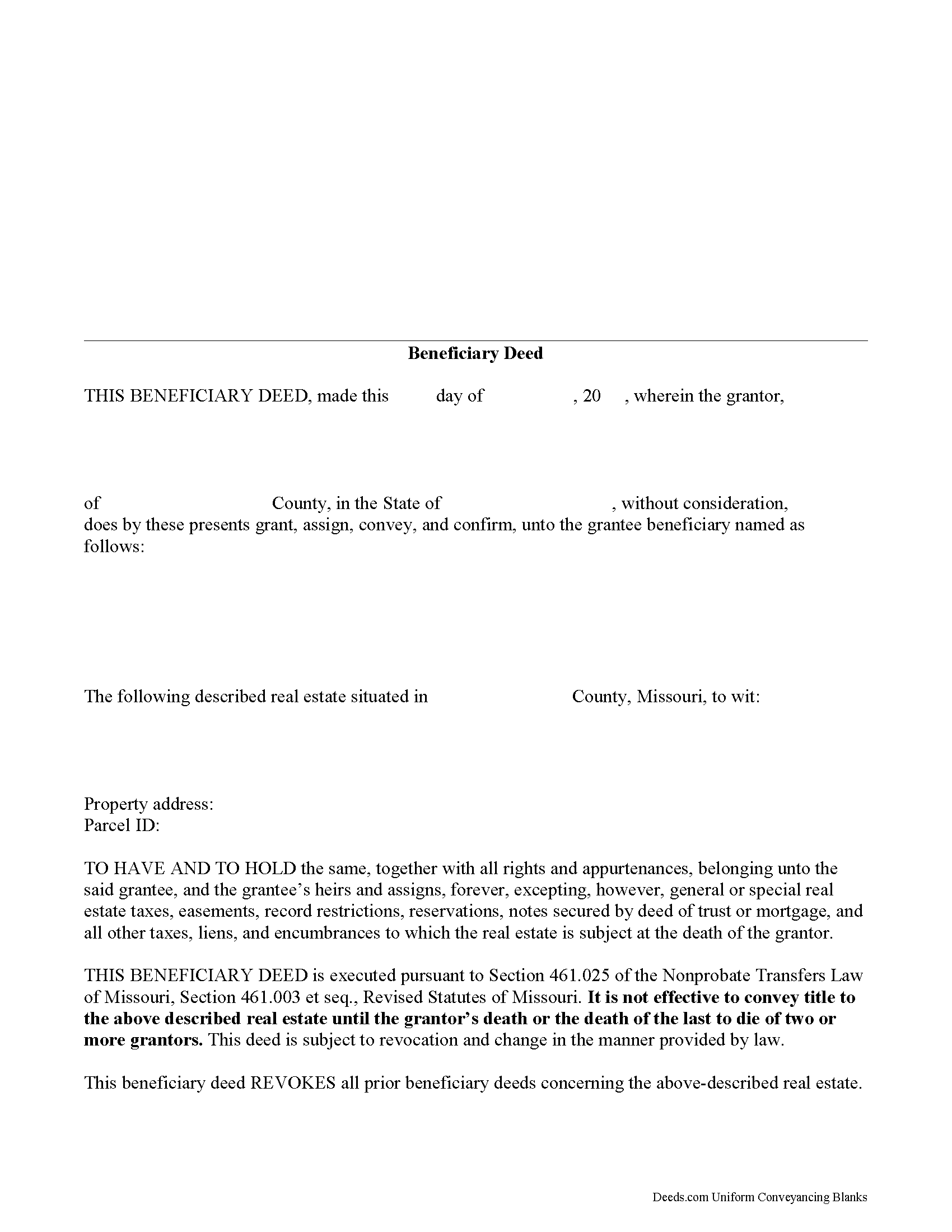

Texas County Beneficiary Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

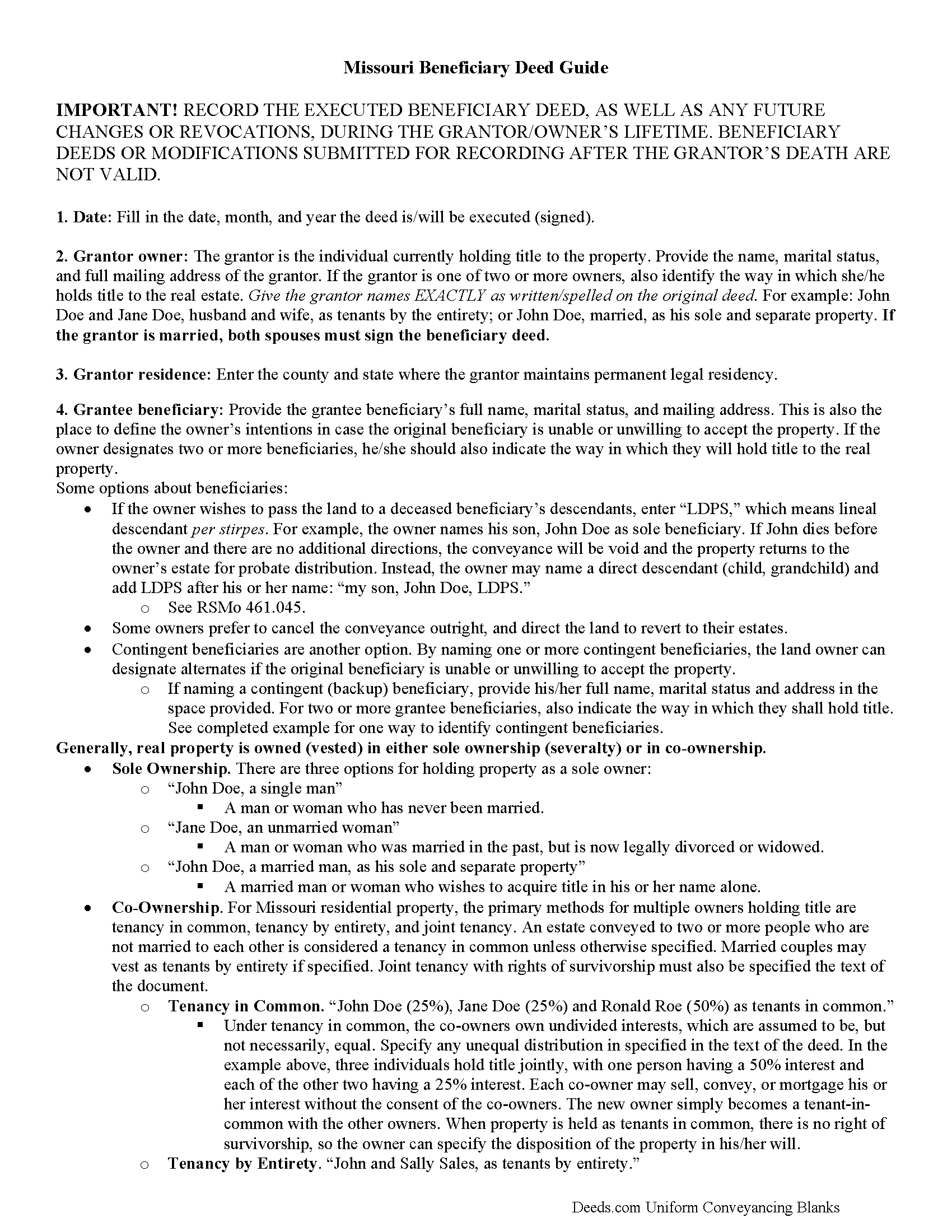

Texas County Beneficiary Deed Guide

Line by line guide explaining every blank on the form.

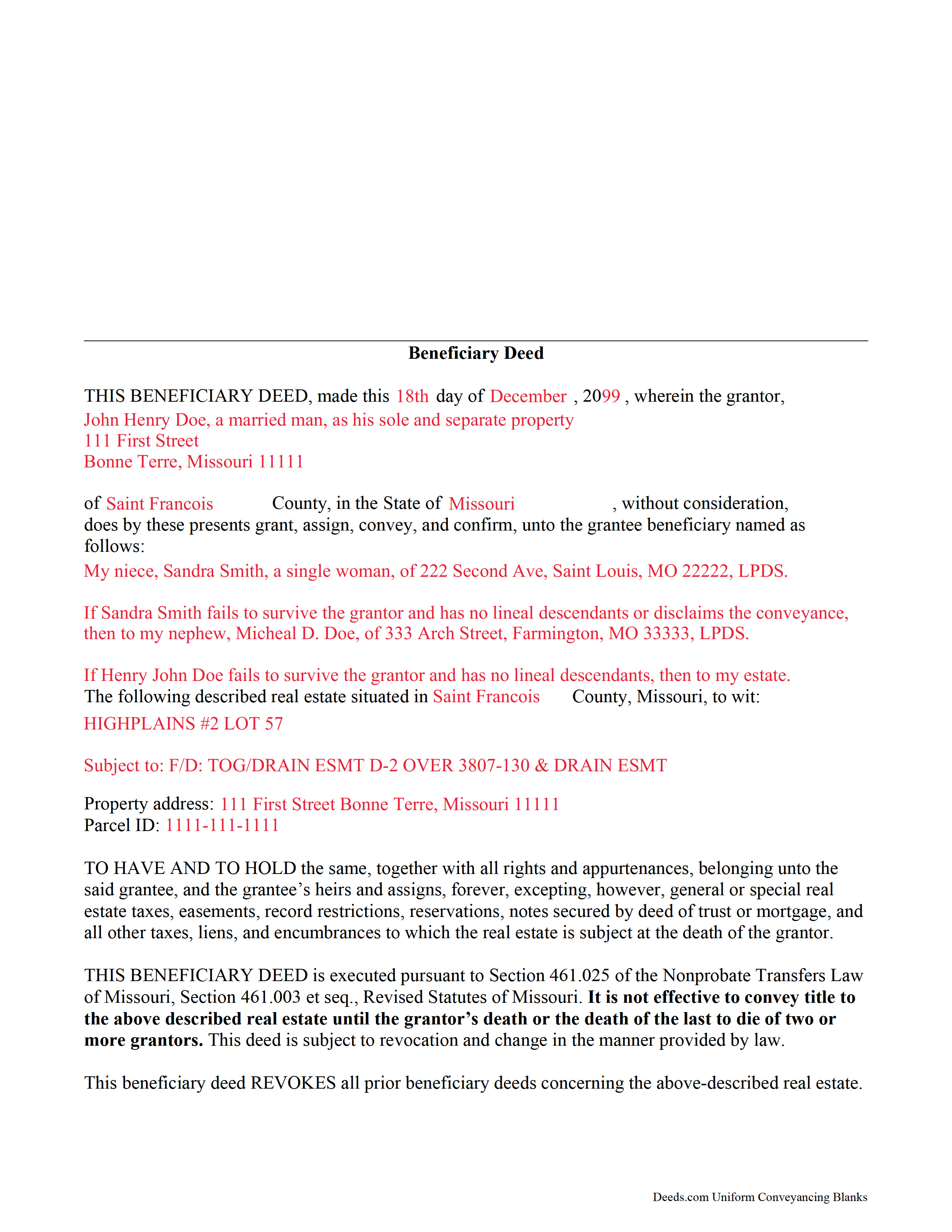

Texas County Completed Example of the Beneficiary Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Missouri and Texas County documents included at no extra charge:

Where to Record Your Documents

Texas County Recorder of Deeds

Houston, Missouri 65483

Hours: 8:00 to 12:00 & 12:30 to 4:30 M-F

Phone: (417) 967-8438

Recording Tips for Texas County:

- Ensure all signatures are in blue or black ink

- Bring your driver's license or state-issued photo ID

- Avoid the last business day of the month when possible

Cities and Jurisdictions in Texas County

Properties in any of these areas use Texas County forms:

- Bucyrus

- Cabool

- Elk Creek

- Eunice

- Hartshorn

- Houston

- Huggins

- Licking

- Plato

- Raymondville

- Roby

- Solo

- Success

- Summersville

- Yukon

Hours, fees, requirements, and more for Texas County

How do I get my forms?

Forms are available for immediate download after payment. The Texas County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Texas County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Texas County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Texas County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Texas County?

Recording fees in Texas County vary. Contact the recorder's office at (417) 967-8438 for current fees.

Questions answered? Let's get started!

Enacted in 1989, the Missouri Nonprobate Transfers Law (Sections 461.003 et seq, Revised Statutes of Missouri (2012)) allows those who own real property in Missouri the option of conveying real property after death, but without the need for probate distribution.

One distinctive feature of this useful estate planning tool is its flexibility. The grantor retains absolute ownership of and control over the Missouri real estate, with the freedom to sell, rent, mortgage, or otherwise use the land at will with no penalty for waste or obligation to inform the named beneficiary. He or she may also change details about beneficiaries or even revoke the beneficiary deed outright by executing and recording a new document containing the updated information. For the beneficiary deed and any related changes or revocations to be valid, however, the deed must be recorded during the grantor's lifetime.

This flexibility is possible because the transfer of ownership is incomplete. There is no statutory obligation to notify grantees of their beneficiary status, so there is typically no consideration (something of value, usually money) paid for the potential future interest in the real estate. The transfer of ownership rights is completed when the grantor dies and the beneficiary records the appropriate documentation.

Overall, Missouri beneficiary deeds are a simple and effective estate planning tool for individuals who want to pass on real property rights outside of the probate process. Even so, it is essential to review how executing a beneficiary deed might impact taxes, as well as eligibility for local, state, and federal benefits and asset-based programs.

(Missouri BD Package includes form, guidelines, and completed example)

Important: Your property must be located in Texas County to use these forms. Documents should be recorded at the office below.

This Beneficiary Deed meets all recording requirements specific to Texas County.

Our Promise

The documents you receive here will meet, or exceed, the Texas County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Texas County Beneficiary Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Laurel D.

October 7th, 2020

This is a great service. I can't believe how fast my document was recorded!

Thank you for your feedback. We really appreciate it. Have a great day!

Tiqula D.

July 14th, 2021

Deeds.com is beyond convenient! It's a wonderful service for all your recording needs. The service is beyond fast and professional. Easy as 1 2 3....

Thank you for your feedback. We really appreciate it. Have a great day!

Lanette H.

September 9th, 2020

I liked getting the forms but I was charged twice for some reason. I'm not sure what happened with that. Can you reimburse me? Thank you. Lanette

Thank you for your feedback Lanette. In review, it looks like your first payment was declined, second one was approved and processed. What you are seeing is one payment and a hold placed by your financial institution for the declined attempt. We are not sure why they do this but the hold usually falls off after a few day depending on their policy. If you have further questions about this you can contact your financial institution and they will explain. Have a great day.

MARY LACEY M.

May 28th, 2025

Deeds.com has become a great assistant to our firm! The service is of highest quality and consistently helpful to our law firm in its recording needs. It's summer in Arizona and no one I know wants to drive to downtown Phoenix to record a property deed so think I will add "grateful" to my praise.

Thank you, Mary! We appreciate your kind words and are glad to help make recording easier — especially when it means avoiding a summer trip to downtown Phoenix. We’re grateful for your continued trust.

Sean M.

January 2nd, 2023

This was exactly what I needed. For $25-$30 it gave me the formatted document I needed and made it so easy to input the info. I wouldn't recommend it to someone who has no clue what they're doing, but for somebody who knows all the info and just needs a formatted page to input it onto, this is perfect.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Charles F.

January 15th, 2021

I am happy with the document but did not know that it would still have to go before the court. Thought it could be handled by the recorder of deeds.

Thank you for your feedback. We really appreciate it. Have a great day!

Nancy C.

July 14th, 2019

Amazing every that you need right at your fingertips. Extremely easy to navigate and very informative. I would highly recommend this site!!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Judy A D.

March 26th, 2022

It was quick and easy.

Thank you!

terrence h.

October 14th, 2023

Professional

Thank you!

DAVID E.

January 2nd, 2025

Very professional and knowledgeable. Great communication.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Theresa M.

June 5th, 2020

Deeds.com was simple to use and had a quick turnaround. Saved me so much time hunting around on the internet and recorder's office website to try and figure out the process. would definitely use again!

Thank you!

Stephen M.

May 14th, 2023

Easy to sign up and create an account. Lots of options.

Thank you!

Robert B.

January 4th, 2021

Very easy to use.

Thank you for your feedback. We really appreciate it. Have a great day!

ELIZABETH M.

January 10th, 2020

Great service! Training was fast and we went over very detail.

Thank you!

William L.

May 10th, 2023

This is an initial review of Deeds.Com and the ordering process for their Quit Claim package for Virginia. The ordering process was very easy and the price seems reasonable for what you get. I have reviewed and downloaded all my forms, but have not used them yet. Thus far I am pleased with the product and the process. E-Recording service is also offered, but I have not used that yet either. At this writing, I can whole-heartedly recommend Deeds.Com.

Thank you for your feedback. We really appreciate it. Have a great day!