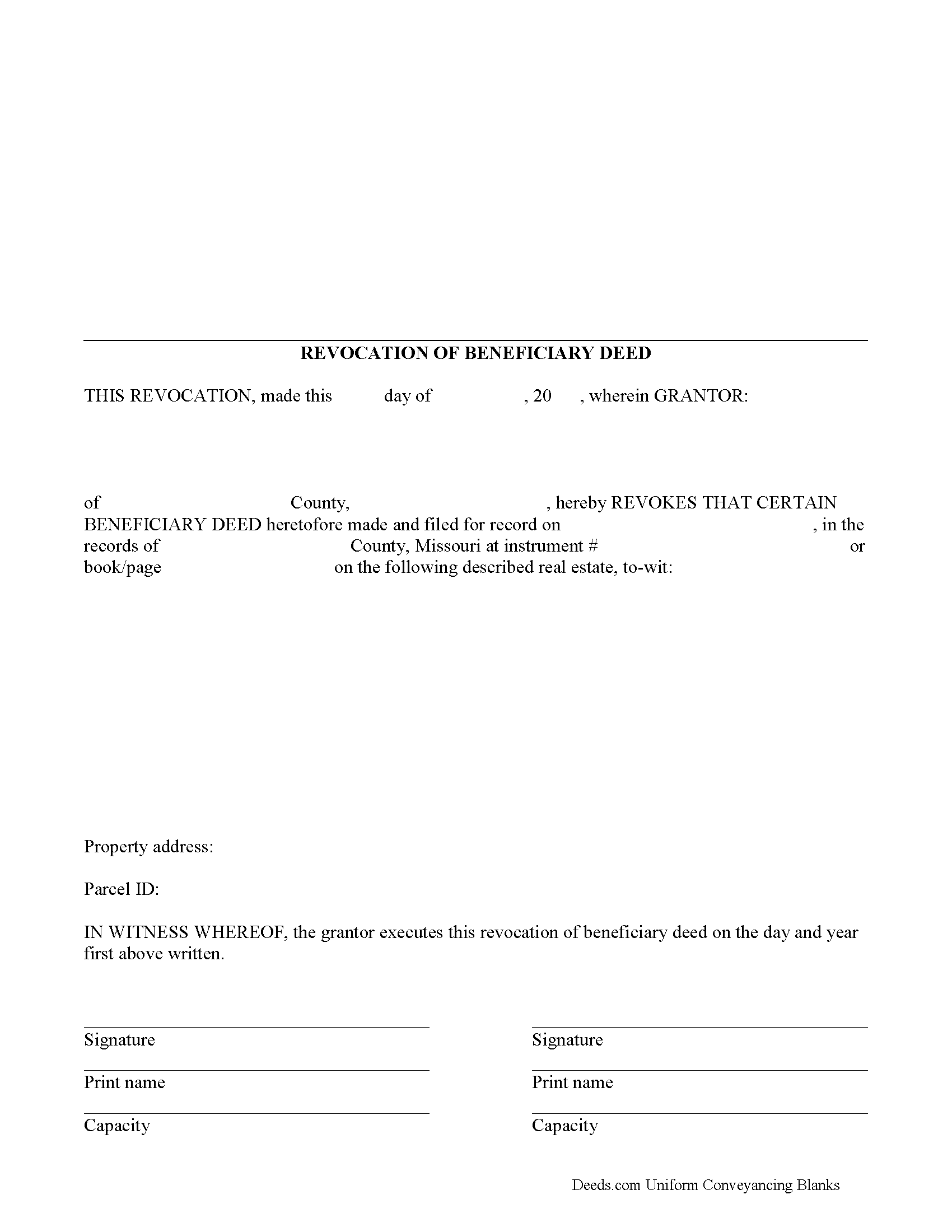

Lincoln County Revocation of Beneficiary Deed Form

Lincoln County Revocation of Beneficiary Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

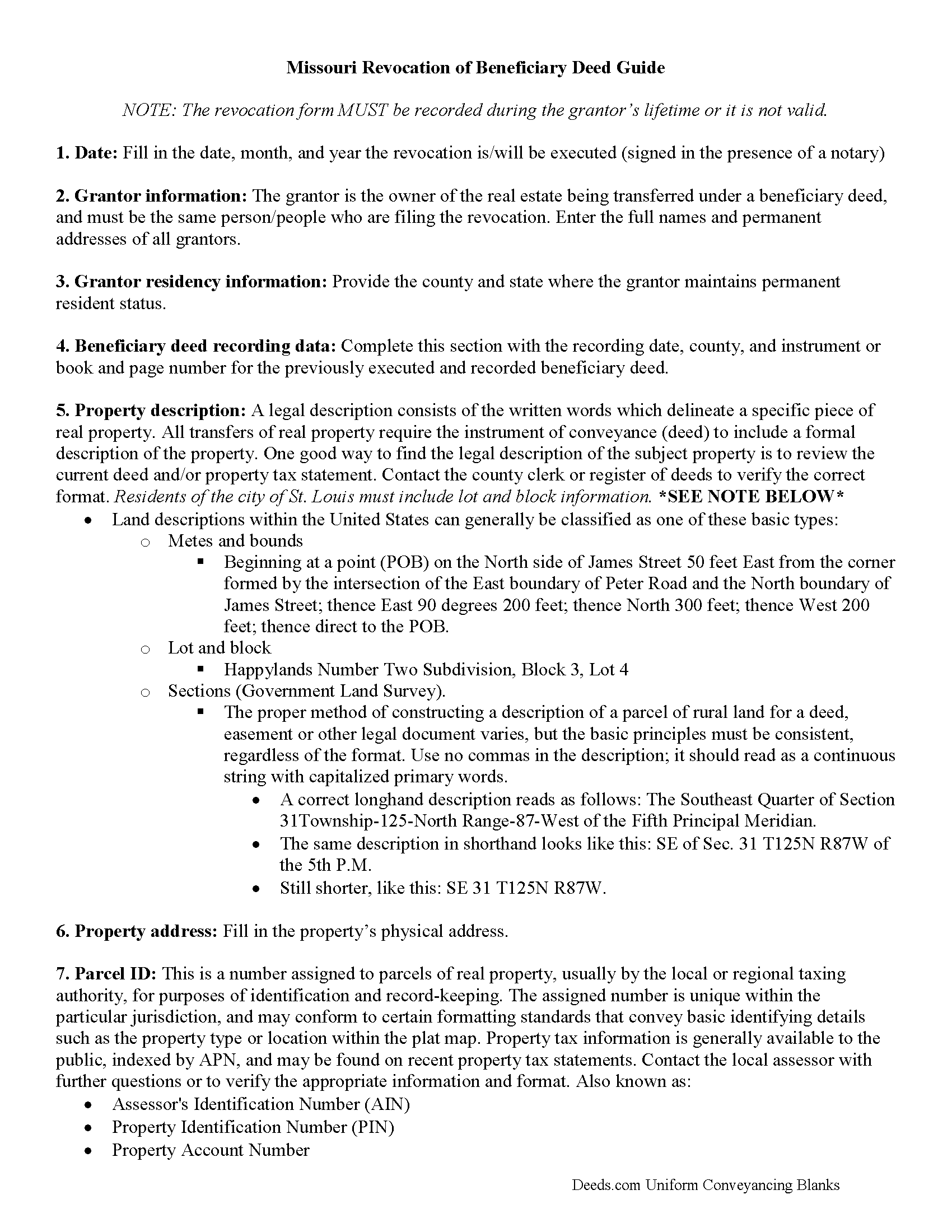

Lincoln County Revocation of Beneficiary Deed Guide

Line by line guide explaining every blank on the form.

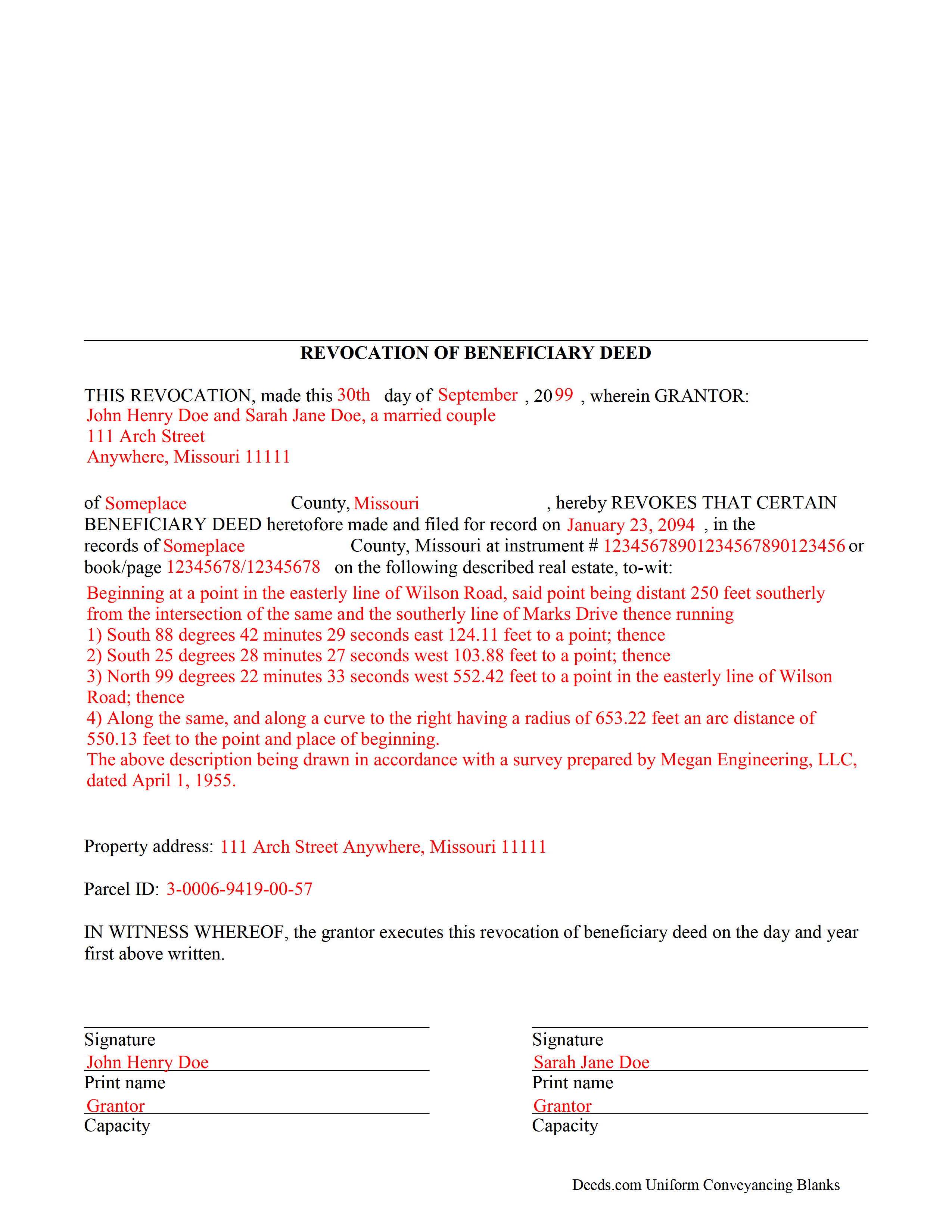

Lincoln County Completed Example of the Revocation of Beneficiary Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Missouri and Lincoln County documents included at no extra charge:

Where to Record Your Documents

Lincoln County Recorder of Deeds

Troy, Missouri 63379

Hours: 8:00am to 4:30pm M-F / Same-day recording until 4:00pm

Phone: (636) 528-0325

Recording Tips for Lincoln County:

- Double-check legal descriptions match your existing deed

- Make copies of your documents before recording - keep originals safe

- Ask about their eRecording option for future transactions

- Bring extra funds - fees can vary by document type and page count

- Ask for certified copies if you need them for other transactions

Cities and Jurisdictions in Lincoln County

Properties in any of these areas use Lincoln County forms:

- Elsberry

- Foley

- Hawk Point

- Moscow Mills

- Old Monroe

- Olney

- Silex

- Troy

- Truxton

- Whiteside

- Winfield

Hours, fees, requirements, and more for Lincoln County

How do I get my forms?

Forms are available for immediate download after payment. The Lincoln County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Lincoln County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Lincoln County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Lincoln County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Lincoln County?

Recording fees in Lincoln County vary. Contact the recorder's office at (636) 528-0325 for current fees.

Questions answered? Let's get started!

One of the many useful aspects of the Nonprobate Transfers Law of Missouri (RSMo Sections 461.003 to 461.081) is the option to revoke a previously recorded beneficiary deed. Revocation is specifically addressed in RSMo 431.033. The option to revoke is possible for several reasons: the grantor is not required to notify the beneficiary of the potential future interest; there is no consideration given in exchange for property rights; and the transfer of ownership is not completed until the grantor or grantors have all died. As a result, the named beneficiary has no actual interest in the real estate.

A grantor on a beneficiary deed may change or revoke beneficiary designations at will, and with no obligation to the individuals named as beneficiaries on the deed. To accomplish this, the original grantor (or grantors) may record a signed, notarized notice of revocation with the same office that accepted the original beneficiary deed. While effective, real estate that is not re-conveyed under a new beneficiary deed reverts back to the grantor's estate at his/her death, and is then distributed via the probate process. Alternately, the grantor may execute a new beneficiary deed, designating someone else as the beneficiary. Recording the new deed removes the prior beneficiary's name and replaces it, identifying the current beneficiary's information.

Note that any change in beneficiary designation must be executed and submitted for recordation during the grantor's lifetime.

(Missouri Revocation of BD Package includes form, guidelines, and completed example)

Important: Your property must be located in Lincoln County to use these forms. Documents should be recorded at the office below.

This Revocation of Beneficiary Deed meets all recording requirements specific to Lincoln County.

Our Promise

The documents you receive here will meet, or exceed, the Lincoln County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Lincoln County Revocation of Beneficiary Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Kimberly B.

September 22nd, 2020

Absolutely recommend Deeds.com! The process to recording your document is explained step by step. If you have any questions, you just send a message and almost instantly a staff member will reply. Super quick processing. I uploaded my document late Friday afternoon, it was reviewed by Deeds.com staff and sent to the county for recording on Monday. By Tuesday, my document was successfully recorded by the County Recorder's Office and a copy of my recorded document was available for me, as well!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Gina G.

April 17th, 2024

This service is fantastic! Took a few tries to scan the document correctly, but their patience and quick turn around made this a far better experience than going to the County myself.

We are delighted to have been of service. Thank you for the positive review!

April C.

May 18th, 2021

Spot on forms and process. YMMV but way more efficient and cost effective than contacting an ambulance... attorney.

Thank you!

Audra M.

December 28th, 2020

It was easy to e-record and will/would recommend it to everyone.

Thank you for your feedback. We really appreciate it. Have a great day!

Bruce B.

April 30th, 2020

Worked great and was easy to use

Thanks Bruce, glad we could help.

Michael H.

April 8th, 2020

Very responsive and thorough. Glad to have found such a great company for our recording needs.

Thank you!

Raymond R C.

September 10th, 2019

Old document deeds were not available and my cost was returned. Was referred to another location and was able to get some help there.

Thank you for your feedback. We really appreciate it. Have a great day!

Garrett R.

May 24th, 2022

I am a real estate attorney in CA. These Wyoming model deeds look too basic and barely adequate: no usual name and address at the top for tax statements and who recorded it. Some old fashioned legalese that only obfuscates. I won't use them. Your background info was good though.

Thank you for your feedback. We really appreciate it. Have a great day!

Alan K.

September 4th, 2020

All I needed was a simple Certificate of Trust. Deeds.com had a template for exactly what I needed. I didn't have to make an appt with an attorney, wait for one to be available, nor pay a ridiculous amount for a standardized document. Super easy.

Thank you for your feedback. We really appreciate it. Have a great day!

Rico J.

November 3rd, 2021

Plenty of great information.

Thank you!

ROBERT K.

April 12th, 2021

It was so easy to obtain the necessary documents.

Thank you for your feedback. We really appreciate it. Have a great day!

Elizabeth M.

August 18th, 2021

So fare easy and straight forward

Thank you for your feedback. We really appreciate it. Have a great day!

Devra R.

May 30th, 2022

A refreshingly easy service to use. They offer auxiliary forms as a courtesy. Theres no "gotcha" capitalism. You pay the reasonable fee and the needed forms are accessible instantly to download. I've used it twice so far and it worked perfectly!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Janet R.

September 2nd, 2019

Thanks great site

Thank you!

Rita T.

November 30th, 2022

This is the first time I use this site, and it was very easy and user friendly. I was able to fill out what i needed with the help of their example. quick download. like it. The price was reasonable. Definitely will use again. Highly recommend!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!