Flathead County Affidavit of Deceased Joint Tenant Form

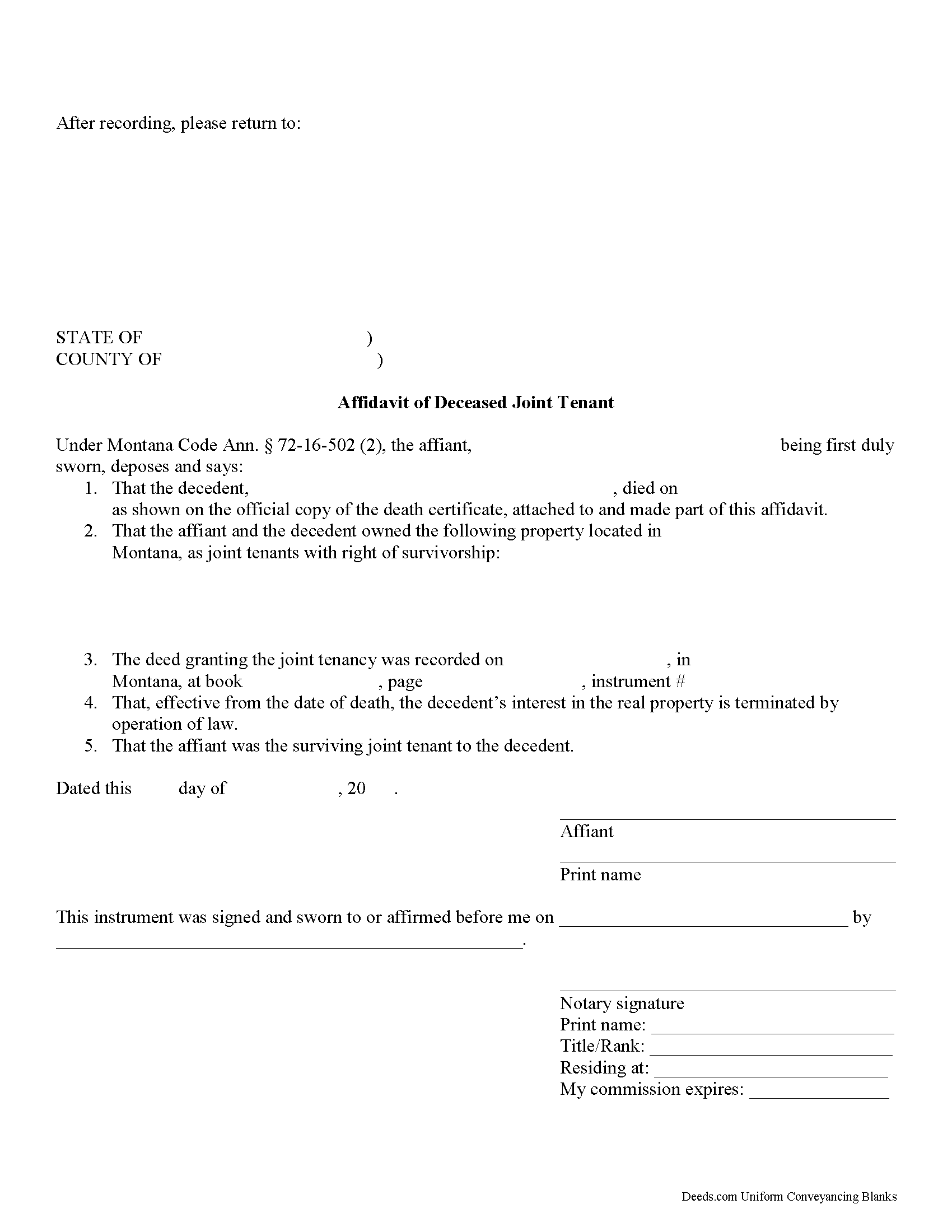

Flathead County Affidavit of Deceased Joint Tenant Form

Fill in the blank form formatted to comply with all recording and content requirements.

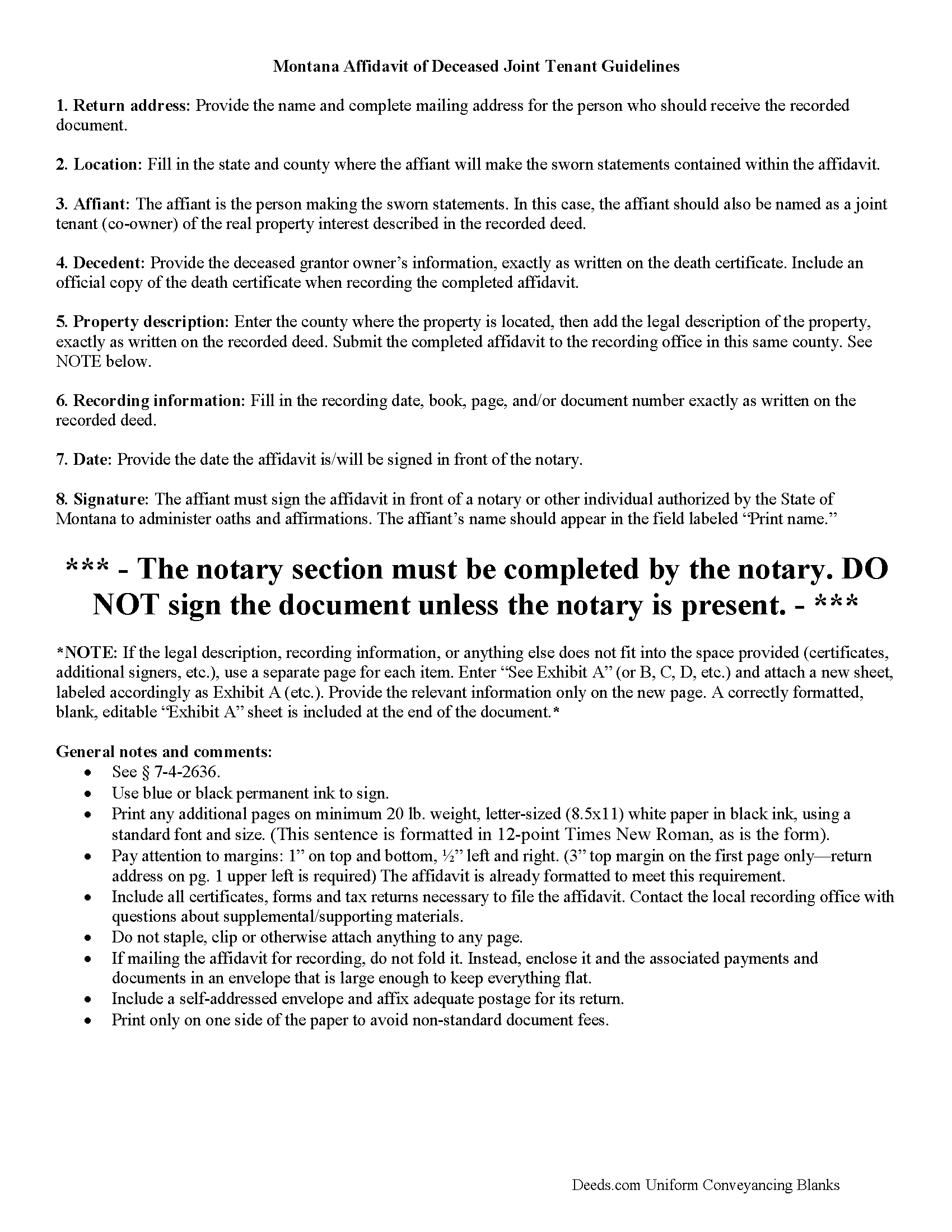

Flathead County Affidavit of Deceased Joint Tenant Guide

Line by line guide explaining every blank on the form.

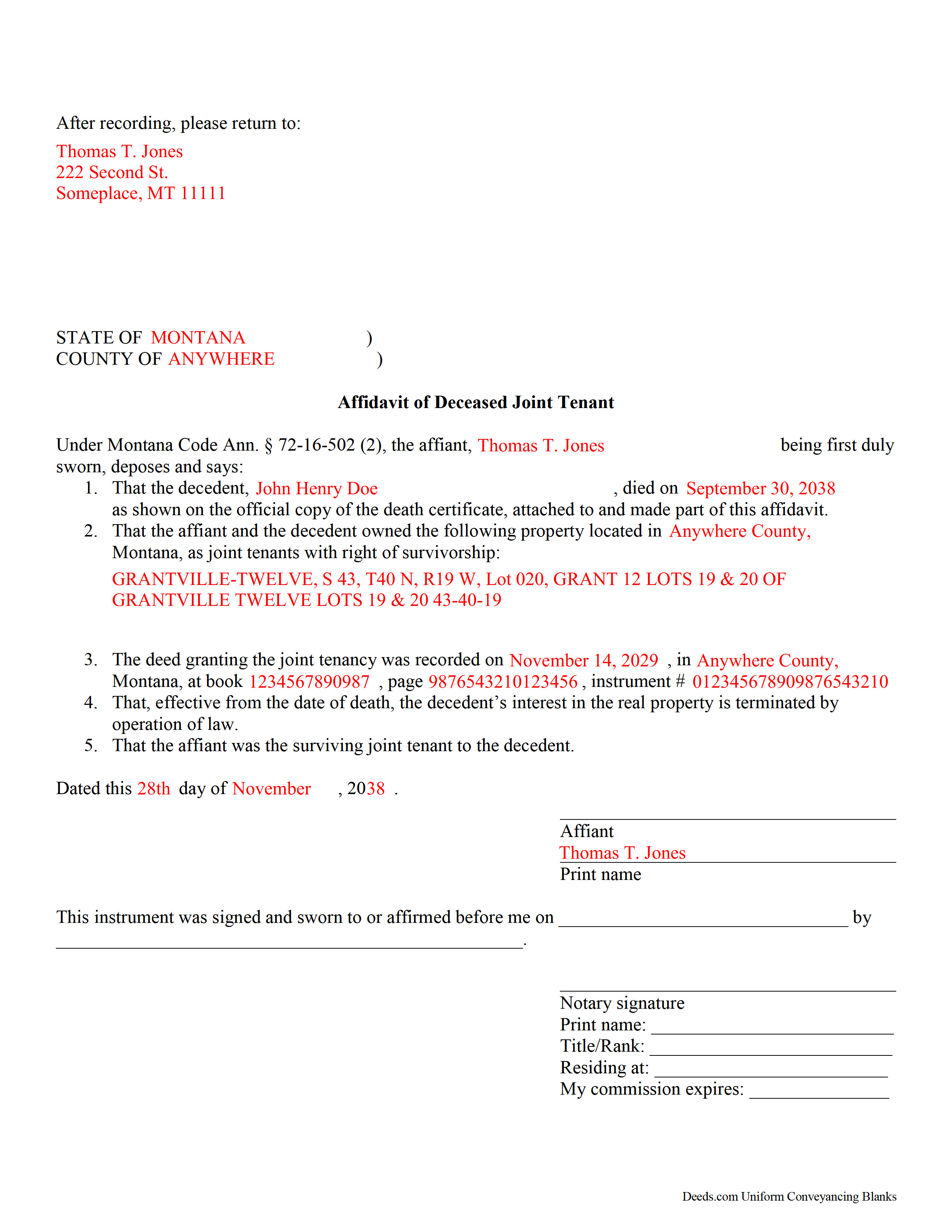

Flathead County Completed Example of the Affidavit of Deceased Joint Tenant Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Montana and Flathead County documents included at no extra charge:

Where to Record Your Documents

Flathead County Clerk / Recorder

Kalispell, Montana 59901-5420

Hours: 8:00am to 5:00pm M-F

Phone: (406) 758-5526

Recording Tips for Flathead County:

- Ask if they accept credit cards - many offices are cash/check only

- Make copies of your documents before recording - keep originals safe

- Recorded documents become public record - avoid including SSNs

- Both spouses typically need to sign if property is jointly owned

Cities and Jurisdictions in Flathead County

Properties in any of these areas use Flathead County forms:

- Bigfork

- Columbia Falls

- Coram

- Essex

- Hungry Horse

- Kalispell

- Kila

- Lake Mc Donald

- Lakeside

- Marion

- Martin City

- Olney

- Polebridge

- Somers

- West Glacier

- Whitefish

Hours, fees, requirements, and more for Flathead County

How do I get my forms?

Forms are available for immediate download after payment. The Flathead County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Flathead County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Flathead County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Flathead County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Flathead County?

Recording fees in Flathead County vary. Contact the recorder's office at (406) 758-5526 for current fees.

Questions answered? Let's get started!

Montana's Affidavit of Deceased Joint Tenant

The Montana Affidavit of Deceased Joint Tenant form is appropriate for use by a surviving joint tenant, as identified on a recorded real property deed.

Montana Code Annotated defines how joint tenancy is created at Section 70-20-105 and the associated right of survivorship at 70-20-310.

Under 72-16-503, to formally initiate the process of perfecting the title, the surviving owner should complete and record an affidavit containing those matters required by 7-4-2613(1)(c). Among other details, this document should identify the parties, the property, and the recording information. Also include an official copy of the deceased owner's death certificate.

Submit the affidavit and any other necessary paperwork to the clerk and recorder for each county in which the real property or any part of the property is located.

This is an important step because it contributes to a clear chain of title (ownership history), which should, in turn, make future sales of the property less complex. It also serves as public notice of the change in the property's status.

Each case is unique, however, so contact an attorney for complex situations or with specific questions.

(Montana Affidavit of DJT Package includes form, guidelines, and completed example)

Important: Your property must be located in Flathead County to use these forms. Documents should be recorded at the office below.

This Affidavit of Deceased Joint Tenant meets all recording requirements specific to Flathead County.

Our Promise

The documents you receive here will meet, or exceed, the Flathead County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Flathead County Affidavit of Deceased Joint Tenant form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Valerie C.

May 1st, 2022

Thanks

Thank you!

Sun H.

January 16th, 2024

It was great working with deeds.com. I needed to record quickclaim deed and the staff was very responsive and communicative throughout the process where I needed to modify the documents repeated. Thank you for making the recording much easy by setting up the e-recording service!

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Malissa B.

May 1st, 2024

Fast response and quick delivery love it!

It was a pleasure serving you. Thank you for the positive feedback!

Deborah C.

February 1st, 2019

I would recommend these forms to others.

Thank you!

Harley N.

August 25th, 2022

Well thought out and user friendly website. The forms were easily fillable as well.

Thank you for your feedback. We really appreciate it. Have a great day!

Leonard H.

November 21st, 2019

Just perfect for what I needed. Made the property transfer very easy.

Thank you!

ANGELA S.

February 13th, 2020

My E-deed was not excepted by the county, so I had to snail mail the documents to the recorders office. Will probably not use this site again, as it did not fulfill my purpose, but would recommend to those who do not have complicated forms.

Thank you for your feedback. We really appreciate it. Have a great day!

THOMAS P.

September 11th, 2020

This site is excellent and makes everything so much easier. 5 star platform.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jose D.

January 27th, 2021

A little difficult in the beginning but with the messaging back and forth it was very simple and fast. Thank you for your help.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Gerald M.

November 25th, 2021

So easy to do. The examples and guides are well worth the few $$ this cost. Highly recommend!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

THOMAS C.

June 25th, 2020

Very fast service

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ricardo M.

December 30th, 2021

easy to use

Thank you!

Shane J.

April 21st, 2020

Easy to use and quickly filed documents!

Thank you!

Scott S.

June 18th, 2021

Awesome service. I'm impressed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

CYNTHIA W.

April 12th, 2023

My deed has now been recorded. Thank you so very much. I saved about $120.00 by doing this with your document service. Thankfully, I heard about you from a friend and did not go with my Title Company that wanted a fee that seems outrageous because of how simple it was to do. I will definitely "advertise" this service to others.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!