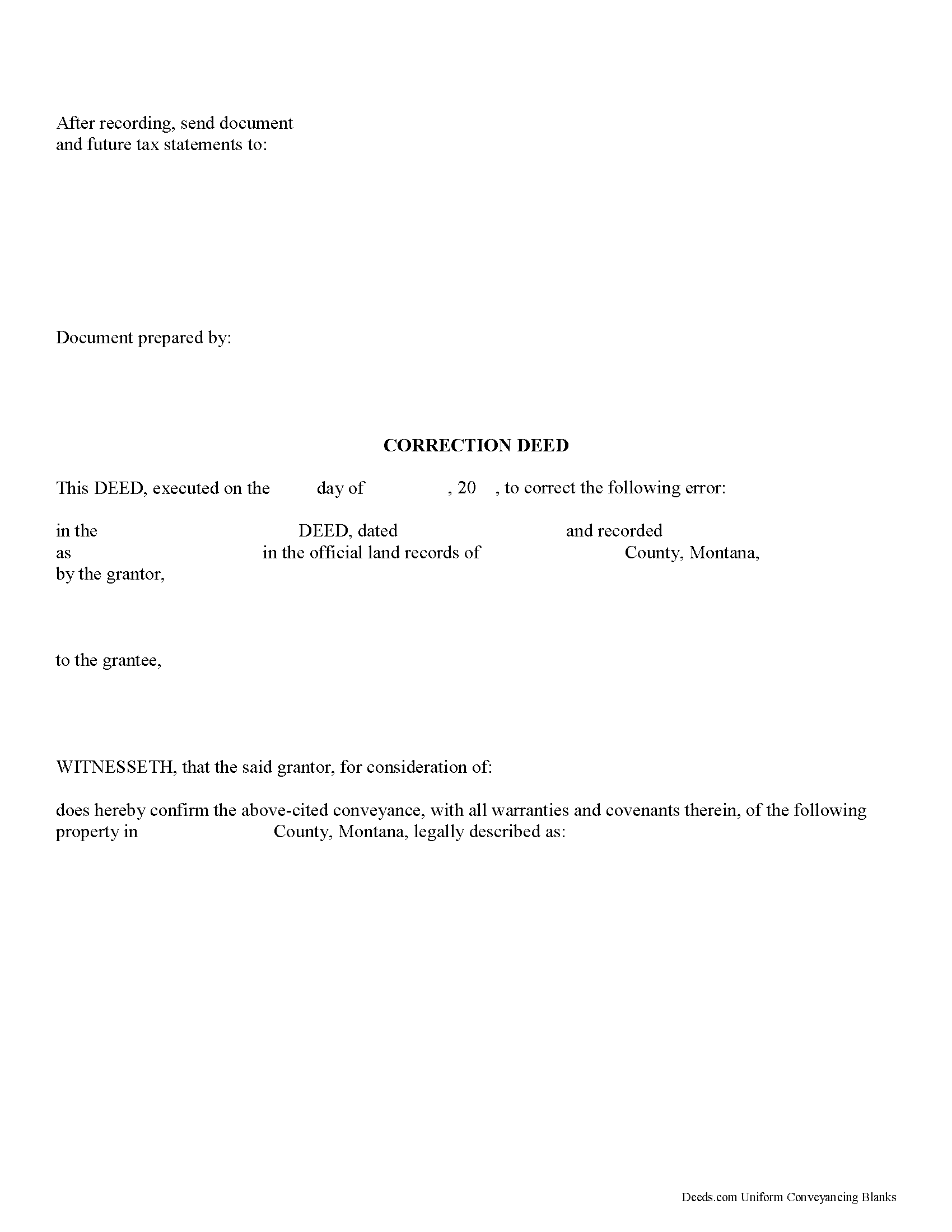

Lake County Correction Deed Form

Lake County Correction Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

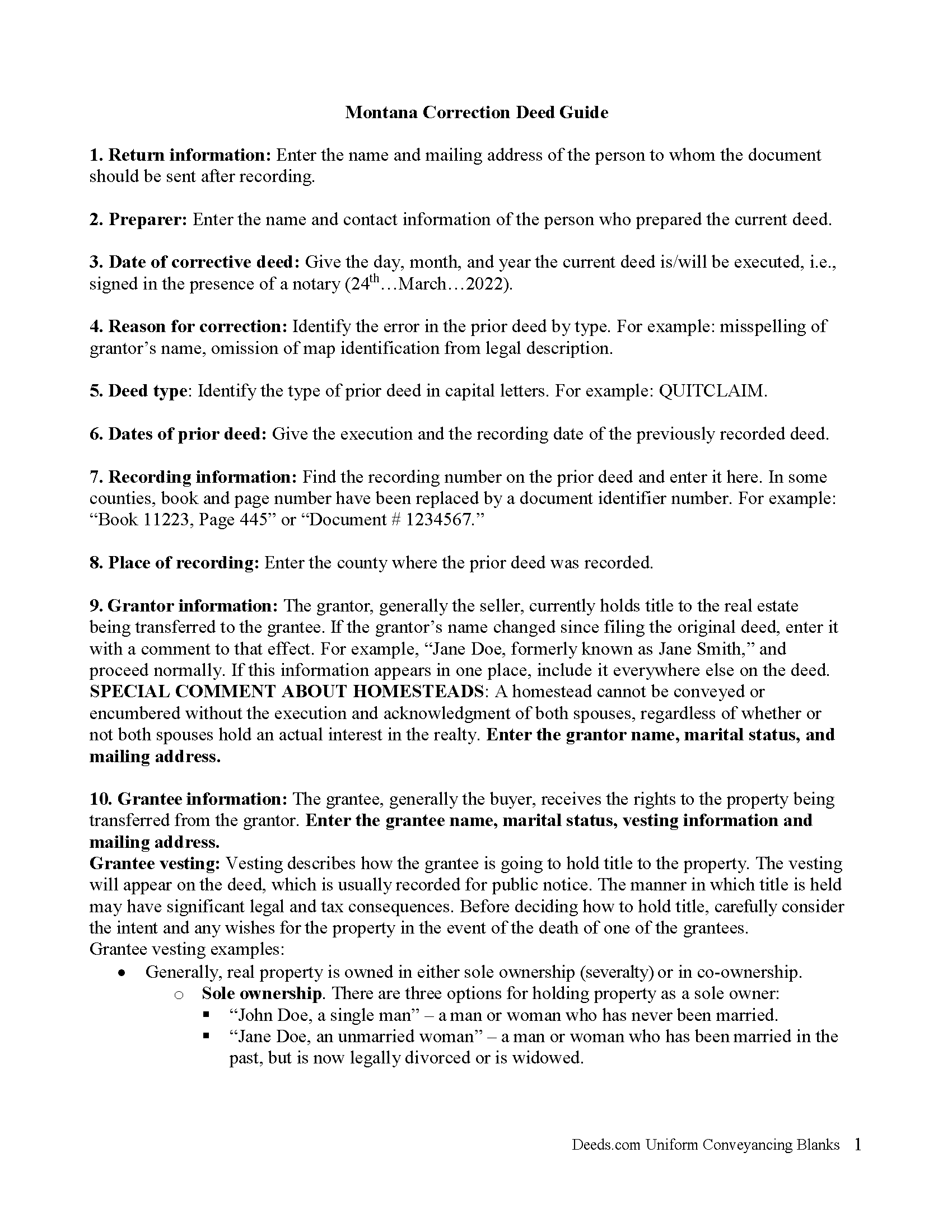

Lake County Correction Deed Guide

Line by line guide explaining every blank on the form.

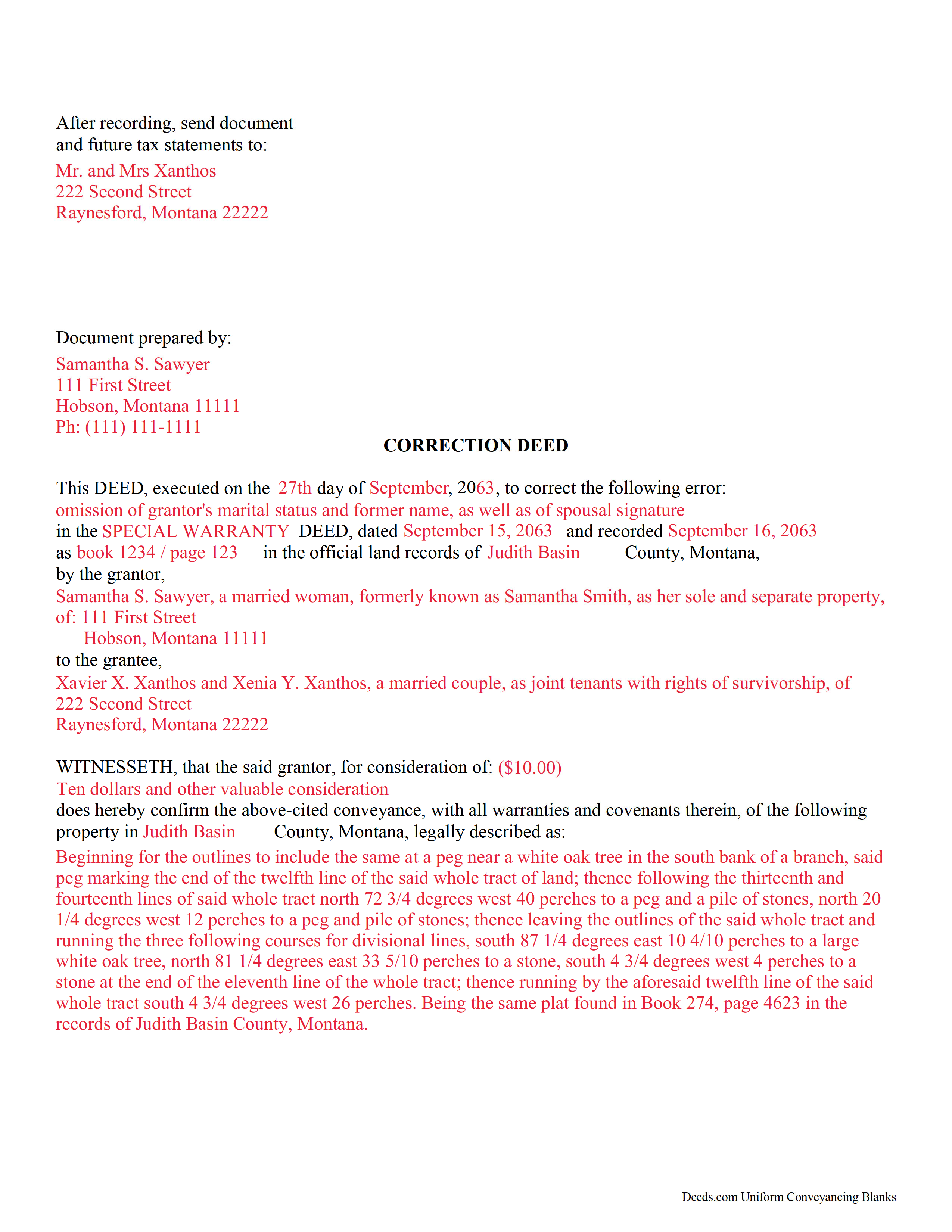

Lake County Completed Example of the Correction Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Montana and Lake County documents included at no extra charge:

Where to Record Your Documents

Lake County Clerk / Recorder

Polson, Montana 59860

Hours: 8:00am-5:00pm M-F

Phone: (406) 883-7208 and 7210

Recording Tips for Lake County:

- Bring your driver's license or state-issued photo ID

- Double-check legal descriptions match your existing deed

- White-out or correction fluid may cause rejection

Cities and Jurisdictions in Lake County

Properties in any of these areas use Lake County forms:

- Arlee

- Big Arm

- Charlo

- Dayton

- Elmo

- Pablo

- Polson

- Proctor

- Ravalli

- Rollins

- Ronan

- Saint Ignatius

Hours, fees, requirements, and more for Lake County

How do I get my forms?

Forms are available for immediate download after payment. The Lake County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Lake County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Lake County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Lake County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Lake County?

Recording fees in Lake County vary. Contact the recorder's office at (406) 883-7208 and 7210 for current fees.

Questions answered? Let's get started!

Use the correction deed to correct an error in a previously recorded deed of conveyance in Montana.

Correcting an error in a recorded deed helps prevent problems that might arise when the current owner tries to sell the property. The best method for correction is to prepare and record a new document, a so-called correction deed. This document does not convey title; instead, it confirms the prior conveyance of the property.

Apart from supplying the correct information, the new deed must state the reason for correcting, and it must reference the prior deed by title, date, and recording number. The original grantor must sign again, thus confirming the conveyance to the same grantee. Generally, corrective deeds are used to address minor errors in a deed, such as typos, accidentally omitted suffixes or middle initials in names, and other minor omissions. When in doubt about the gravity of an error, consult with a lawyer.

For certain changes, a correction deed may not be appropriate. Adding or removing a grantee, for example, or altering the manner in which title is held, or making material changes to the legal description, especially deleting a portion of the originally transferred property, may all require a new deed of conveyance instead of a correction deed. When correcting the legal description, both grantor and grantee should sign the corrective instrument to avoid any doubt regarding the conveyed property.

(Montana CD Package includes form, guidelines, and completed example)

Important: Your property must be located in Lake County to use these forms. Documents should be recorded at the office below.

This Correction Deed meets all recording requirements specific to Lake County.

Our Promise

The documents you receive here will meet, or exceed, the Lake County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Lake County Correction Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Cedric W.

January 2nd, 2021

This process was very easy to go through, from beginning to end. It was fast, precise and got the job done without me having to leave my computer. If opportunities arise, I will definitely use deeds.com again.

Thank you for your feedback. We really appreciate it. Have a great day!

Johnette E.

May 22nd, 2019

Easy and quick to use!!

Thank you!

jim g.

June 4th, 2020

so far so good. was hoping to have the recorded document already. i need the recorded document by friday, june 5th for my city approval. anyway you can please get it to me tomorrow. thanks, jim

Thank you!

Silvana M.

April 10th, 2020

This is a great service, I was worried about my NOC and Liens being filed in this terrible time!!! Happy I have this service Deeds.com!!!

Thank you for your feedback. We really appreciate it. Have a great day!

Jean T.

January 3rd, 2024

It's wonderful that these forms are easily accessible!

Thank you for your feedback. We really appreciate it. Have a great day!

Virginia K.

October 24th, 2021

Easy to use instructions and fast service delivery. I was kept up to date on the status of my filing.

Thank you!

Fred B.

May 19th, 2020

Great site and very easy to use. I will be using this for all of my search and form requirements.

Thank you for your feedback. We really appreciate it. Have a great day!

Katherine M.

October 6th, 2022

Easy smooth process to get a legal Maine template - thanks for providing

Thank you for your feedback. We really appreciate it. Have a great day!

Richard E.

January 3rd, 2019

Very easy. I copied each doc separately. Is there a way to copy the all docs at once into a folder? Thanks for being there. Rich

Thank you for the feedback Richard. Currently there is no way to download all of the documents at once but we'll definitely look into it. Have a great day!

Elexis C.

November 14th, 2019

Easy, fast & amazing descriptions of all forms needed.

Thank you!

Pouya N.

November 6th, 2020

THEY ARE AWSOME. MAKE IT REALLY EASY AND EFFICIENT TO WORK. THANK YOU

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robin G.

August 28th, 2020

Easy to navigate! Will use your services again!

Thank you!

Cameron M.

June 6th, 2023

This service is amazing. Always same day recording. Quick and easy. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Teresa R.

May 7th, 2022

FANTASTIC. Sometimes we think know something, glad I found out I was wrong before it was too late.

Thank you!

Thomas M.

May 20th, 2021

Thomas hopefully these are the correct forms I need wish me luck

Thank you!