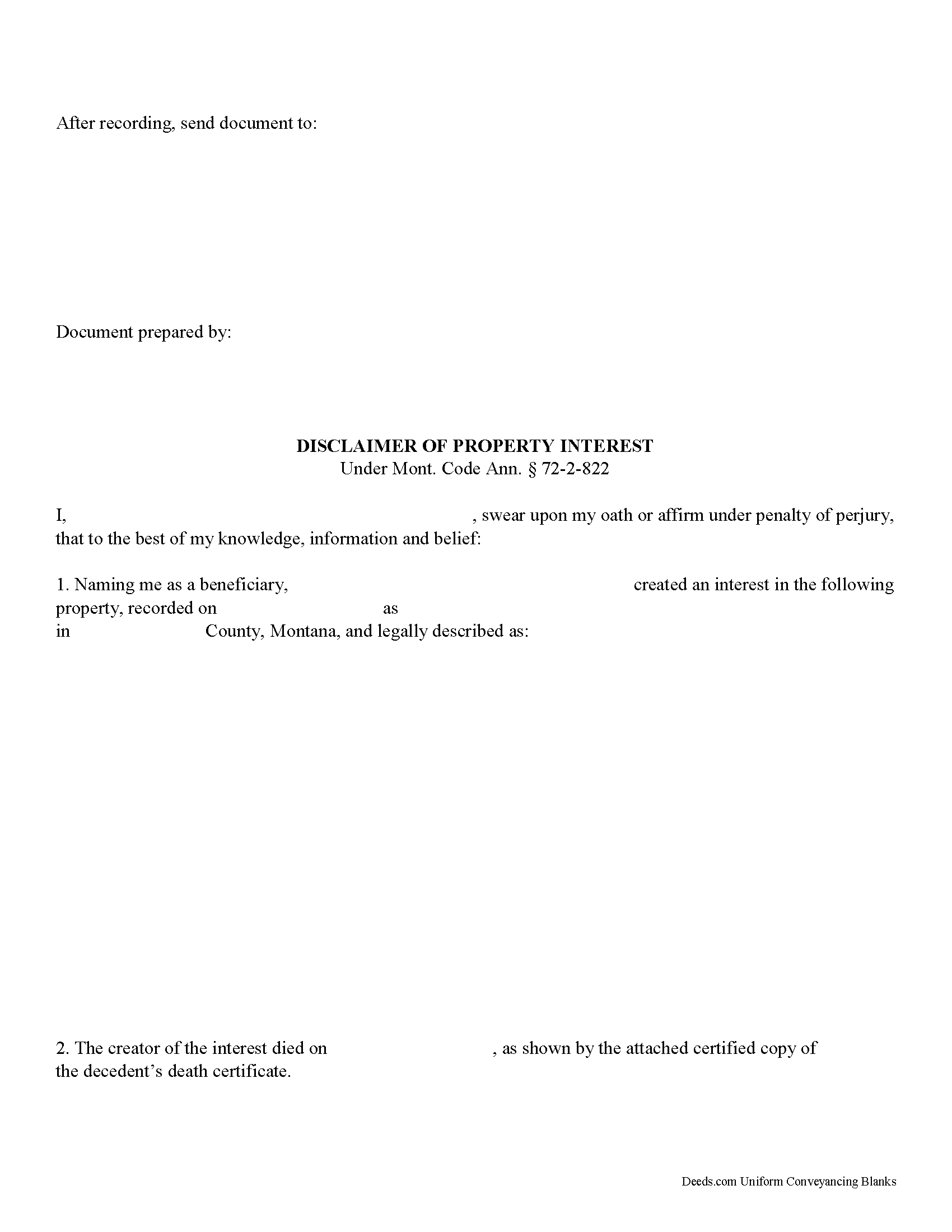

Lake County Disclaimer of Interest Form

Lake County Disclaimer of Interest Form

Fill in the blank form formatted to comply with all recording and content requirements.

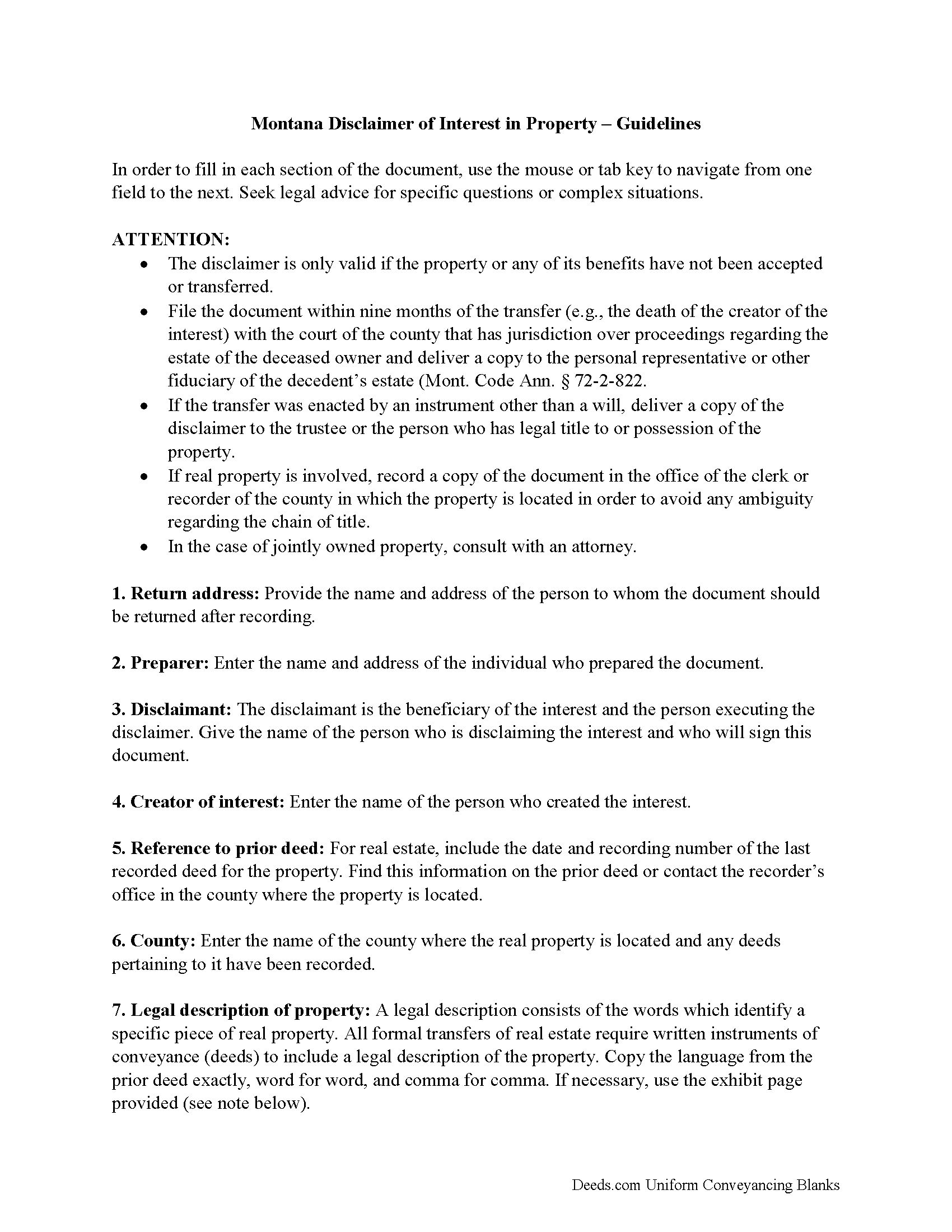

Lake County Disclaimer of Interest Guide

Line by line guide explaining every blank on the form.

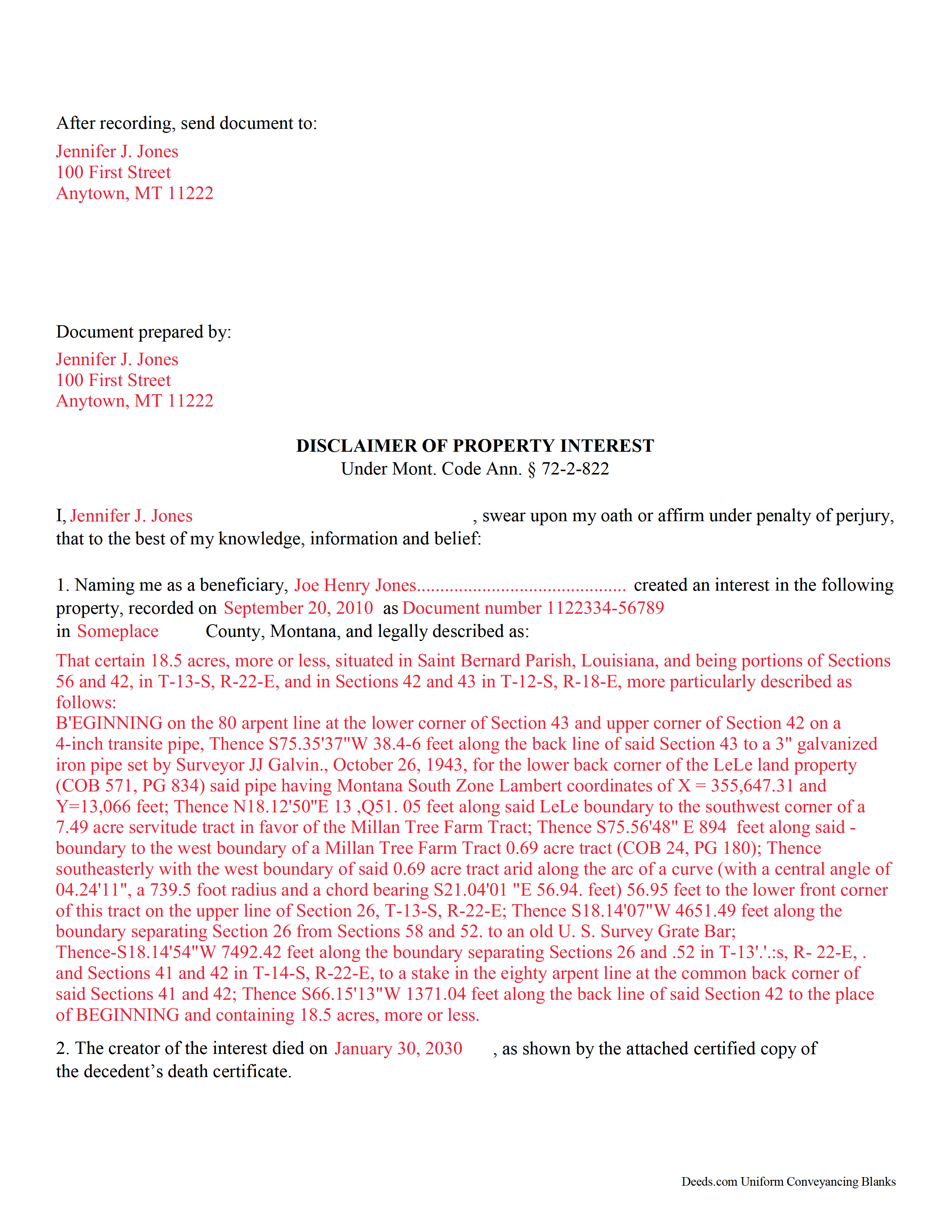

Lake County Completed Example of the Disclaimer of Interest Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Montana and Lake County documents included at no extra charge:

Where to Record Your Documents

Lake County Clerk / Recorder

Polson, Montana 59860

Hours: 8:00am-5:00pm M-F

Phone: (406) 883-7208 and 7210

Recording Tips for Lake County:

- Double-check legal descriptions match your existing deed

- Ask if they accept credit cards - many offices are cash/check only

- Both spouses typically need to sign if property is jointly owned

- Request a receipt showing your recording numbers

- Bring multiple forms of payment in case one isn't accepted

Cities and Jurisdictions in Lake County

Properties in any of these areas use Lake County forms:

- Arlee

- Big Arm

- Charlo

- Dayton

- Elmo

- Pablo

- Polson

- Proctor

- Ravalli

- Rollins

- Ronan

- Saint Ignatius

Hours, fees, requirements, and more for Lake County

How do I get my forms?

Forms are available for immediate download after payment. The Lake County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Lake County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Lake County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Lake County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Lake County?

Recording fees in Lake County vary. Contact the recorder's office at (406) 883-7208 and 7210 for current fees.

Questions answered? Let's get started!

Montana Disclaimer of Property Interest

Under the Montana Code, the beneficiary of an interest in property may disclaim the gift, either in part or in full (Mont. Code Ann. 72-2-822). Note that the option to disclaim is only available to beneficiaries who have not acted in any way to indicate acceptance or ownership of the interest (72-2-822).

TITLE 72. ESTATES, TRUSTS, AND FIDUCIARY RELATIONSHIPS

CHAPTER 2. UPC -- INTESTACY, WILLS, AND DONATIVE TRANSFERS

Part 8. General Provisions Concerning Probate and Nonprobate Transfers

Disclaimer Of Interest In Property

72-2-822.Disclaimer of interest in property. (1) In this section:

(a)"Future interest" means an interest that takes effect in possession or enjoyment, if at all, later than the time of its creation.

(b)"Time of distribution" means the time when a disclaimed interest would have taken effect in possession or enjoyment.

(2)Except for a disclaimer governed by 72-2-823 or 72-2-824, the following rules apply to a disclaimer of an interest in property:

(a)The disclaimer takes effect as of the time the instrument creating the interest becomes irrevocable, or, if the interest arose under the law of intestate succession, as of the time of the intestate's death.

(b)The disclaimed interest passes according to any provision in the instrument creating the interest providing for the disposition of the interest, should it be disclaimed, or of disclaimed interests in general.

(c)If the instrument does not contain a provision described in subsection (2)(b), the following rules apply:

(i)If the disclaimant is not an individual, the disclaimed interest passes as if the disclaimant did not exist.

(ii)If the disclaimant is an individual, except as otherwise provided in subsections (2)(c)(iii) and (2)(c)(iv), the disclaimed interest passes as if the disclaimant had died immediately before the time of distribution.

(iii)If by law or under the instrument, the descendants of the disclaimant would share in the disclaimed interest by any method of representation had the disclaimant died before the time of distribution, the disclaimed interest passes only to the descendants of the disclaimant who survive the time of distribution.

(iv)If the disclaimed interest would pass to the disclaimant's estate had the disclaimant died before the time of distribution, the disclaimed interest instead passes by representation to the descendants of the disclaimant who survive the time of distribution. If no descendant of the disclaimant survives the time of distribution, the disclaimed interest passes to those persons, including the state but excluding the disclaimant, and in such shares as would succeed to the transferor's intestate estate under the intestate succession law of the transferor's domicile had the transferor died at the time of distribution. However, if the transferor's surviving spouse is living but is remarried at the time of distribution, the transferor is deemed to have died unmarried at the time of distribution.

(d)Upon the disclaimer of a preceding interest, a future interest held by a person other than the disclaimant takes effect as if the disclaimant had died or ceased to exist immediately before the time of distribution, but a future interest held by the disclaimant is not accelerated in possession or enjoyment.

A disclaimer is irrevocable and binding for the disclaiming/renouncing party and his or her creditors, so be sure to consult an attorney when in doubt about the drawbacks and benefits. If the interest arises out of jointly-owned property, seek legal advice as well.

(Montana DOI Package includes form, guidelines, and completed example)

Important: Your property must be located in Lake County to use these forms. Documents should be recorded at the office below.

This Disclaimer of Interest meets all recording requirements specific to Lake County.

Our Promise

The documents you receive here will meet, or exceed, the Lake County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Lake County Disclaimer of Interest form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

John U.

April 24th, 2020

It's too early for me to tell because I just uploaded the document today and it hasn't been recorded yet. However, I will say that the website is very user friendly so assuming that everything goes as planned, this is a great service.

Thank you!

Jeane W.

April 13th, 2024

I needed to add my partner to my warranty deed and deeds.com made it easy to understand what form I needed, attached a great explanation of the form and a sample of the form filled out. Couldn't be happier. In fact I'm researching a Revocable Transfer on Death Deed now and they've given me the confidence to rewrite my own will on my own.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Maureen F.

January 27th, 2021

Forms were delivered quickly and were easily filled out. State specific!

Thank you!

Jason James H.

January 17th, 2019

Th forms were correct, exactly what I needed.

Thanks Jason, we appreciate the feedback.

Michelle A.

January 5th, 2025

deeds.com is user-friendly and very easy to navigate. Guides, samples, and free supplement forms are available for every State and are frequently updated. The cost is economical. I recommend these products

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Nancy O.

August 6th, 2023

Have not actually filed as yet but package seems to answer all my questions and believe this will be a walk in the park instead a a headache or expensive endeavor. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Robert P.

November 3rd, 2020

Overall, your website was straightforward and easy to navigate. I was able to accomplish what I needed to do very quickly. If needed again, I would certainly use and recommend others to use deeds.com.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sandrs T.

August 27th, 2020

It would be good to be able to print several documents at 1 time by highlighting them in the list without having to do one document at a time.

Thank you for your feedback. We really appreciate it. Have a great day!

Nina L.

April 13th, 2023

I needed a specific form. I found it, printed it and saved myself $170 because I didn't need a lawyer. Thank you

Thank you for your feedback. We really appreciate it. Have a great day!

DENNIS M.

January 18th, 2023

very simple and complete

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Nina F.

September 23rd, 2020

My experience could not have been better. Easy to communicate with, even though I'm largely ignorant of technical problem-solving. I may be addle-minded with 83 years on earth, but I think they actually cared about solving my problem and were sorry it was beyond their territory. Truly extra nice.

Thank you for your feedback. We really appreciate it. Have a great day!

Nancy H.

May 31st, 2019

Easy to use site. Would continue to go to for future needs.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Barbara W.

June 9th, 2021

Easy website to navigate. Found the form I needed within seconds. Thank you

Thank you for your feedback. We really appreciate it. Have a great day!

Donna J.

June 29th, 2019

Doesn't have samples pertaining to me. Still searching for correct wording forGRANTORS (plural) so its legally written.

Thank you for your feedback. We really appreciate it. Have a great day!

Ronald P.

July 24th, 2025

Forms easy to download but experienced problems trying to type in my information into the forms. Then when I went to print a form, Adobe wanted to charge me for printing. I ended up printing the blank forms and then filling them out manually.

Thank you, Ronald. We're glad you found the forms easy to download, though we're sorry to hear about the printing and fill-in experience. Our forms are designed to be fillable and printable using free software like Adobe Reader. If you ever run into issues, our support team is happy to help!