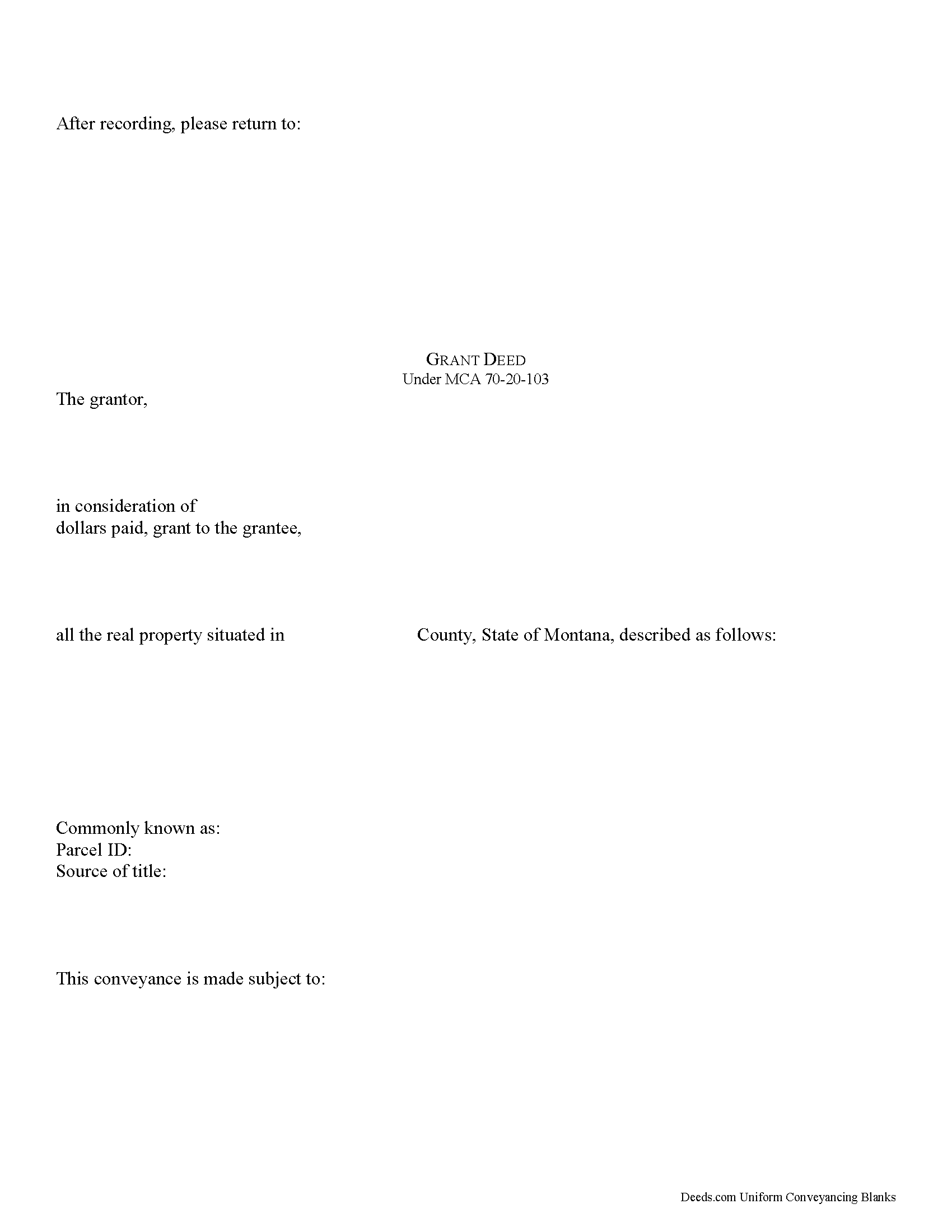

Flathead County Grant Deed Form

Flathead County Grant Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Flathead County Grant Deed Guide

Line by line guide explaining every blank on the form.

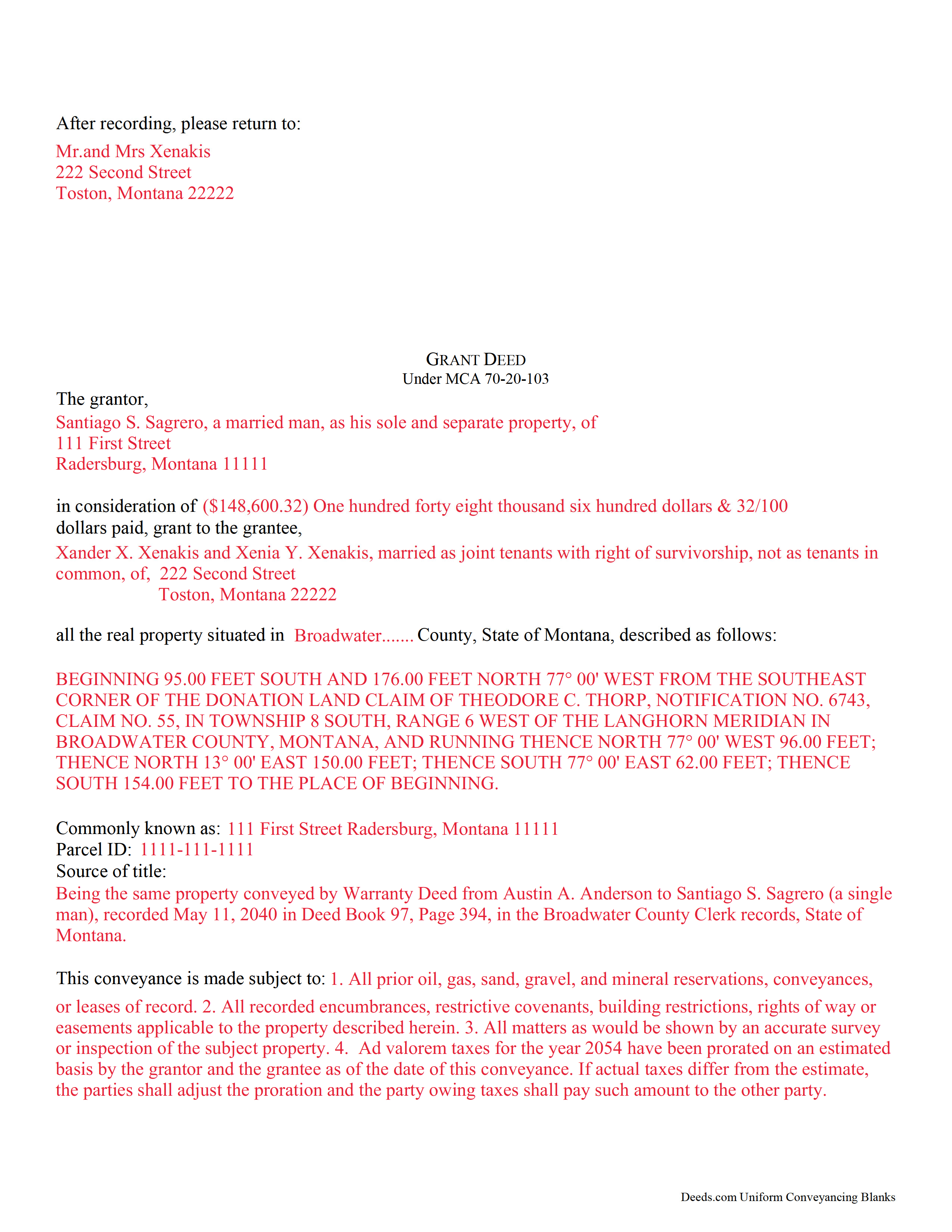

Flathead County Completed Example of the Grant Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Montana and Flathead County documents included at no extra charge:

Where to Record Your Documents

Flathead County Clerk / Recorder

Kalispell, Montana 59901-5420

Hours: 8:00am to 5:00pm M-F

Phone: (406) 758-5526

Recording Tips for Flathead County:

- White-out or correction fluid may cause rejection

- Bring extra funds - fees can vary by document type and page count

- Recording fees may differ from what's posted online - verify current rates

- Leave recording info boxes blank - the office fills these

- Request a receipt showing your recording numbers

Cities and Jurisdictions in Flathead County

Properties in any of these areas use Flathead County forms:

- Bigfork

- Columbia Falls

- Coram

- Essex

- Hungry Horse

- Kalispell

- Kila

- Lake Mc Donald

- Lakeside

- Marion

- Martin City

- Olney

- Polebridge

- Somers

- West Glacier

- Whitefish

Hours, fees, requirements, and more for Flathead County

How do I get my forms?

Forms are available for immediate download after payment. The Flathead County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Flathead County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Flathead County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Flathead County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Flathead County?

Recording fees in Flathead County vary. Contact the recorder's office at (406) 758-5526 for current fees.

Questions answered? Let's get started!

Real property can be transferred with an instrument in writing, which can be a grant, bill of sale, or a conveyance. A grant deed can be used in Montana to transfer title to real property. The Montana Code Annotated provides a general form for conveyances that can be used for a grant deed in this state (70-20-103). A grant deed includes covenants that the grantor has not conveyed the same property to any person other than the grantor and that the estate is free from any encumbrances done, made, or suffered by the grantor. A transfer of real property in Montana will pass all the easements attached to the property and will create in favor thereof an easement to use other real property of the person whose estate is transferred in the same manner and to the same extent as such property was obviously and permanently used by the person whose estate is transferred for the benefit thereof at the time the transfer was agreed upon or completed (70-20-308).

In order to have a grant deed recorded in Montana, it must be in writing, signed by the grantor or the grantor's lawful agent authorized in writing, and acknowledged or proved. The execution of the deed must be acknowledged as defined in 1-5-602 of the Montana Code Annotated or proved by a subscribing witness, which also must be notarized (70-21-203). Grant deeds can be acknowledged in other states in accordance with MAC 1-5-606, and they will be valid for recordation in Montana. A Realty Transfer Certificate must accompany all applicable grant deeds when they are presented for recording (15-7-305).

All real estate deeds, including grant deeds, should be recorded in the county where the property is located in order to provide constructive notice of the contents thereof to subsequent purchasers and mortgagees (70-21-302). If the property is located in more than one county and the deed has been recorded in either of such counties, a certified copy of the deed can be recorded in the other county where the rest of the property is located (70-21-201). If a grant deed is not recorded, it will be valid only between the parties to it and those who have notice thereof (70-21-102). Additionally, the deed will be void against any subsequent purchaser or encumbrancer of the same real property or part thereof in good faith and for a valuable consideration whose conveyance is first duly recorded (70-21-304). A deed will take effect so as to vest the interest intended to be transferred only upon the grantor's delivery of it (70-1-508).

(Montana GD Package includes form, guidelines, and completed example)

Important: Your property must be located in Flathead County to use these forms. Documents should be recorded at the office below.

This Grant Deed meets all recording requirements specific to Flathead County.

Our Promise

The documents you receive here will meet, or exceed, the Flathead County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Flathead County Grant Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Rex M.

February 21st, 2019

fulfilled all NC requirements

Thank you!

Kendrick S.

May 29th, 2020

Really solid system for determining what may prevent your documents from being accepted. I love the comments section allowing for fluid communication. I only wish there were automated emails for all those communications and once documents were accepted, but I did receive a couple personally-generated emails regarding the progress instructing me to check the site.

Thank you for your feedback. We really appreciate it. Have a great day!

Donna C.

April 1st, 2022

Easy to use.

Thank you!

terrance G.

February 11th, 2025

Excellent Service, with quick turnaround times.

Thank you for your positive words! We’re thrilled to hear about your experience.

Rebecca G.

May 25th, 2022

Very user friendly. Forms professional and acceptable to state applicable to. Appreciate the sample & instructions.

Thank you for your feedback. We really appreciate it. Have a great day!

Keyuna C.

April 25th, 2020

Speedy process, they provided me with the exact documents that I needed.

Thank you!

wendy w.

October 19th, 2022

Excellent

Thank you!

John B.

July 15th, 2021

I bought a Quitclaim Deed package for Fayette County, Kentucky, to transfer my house into a Living Trust that I had set up previously. Creating my Quitclaim Deed was pretty straightforward, using the form, the instructions, and the sample Quitclaim Deed. I signed my Quitclaim Deed at a nearby Notary Public, then took it to the Fayette County Clerk's office to be recorded. The clerk there asked me to make two small changes to the Quitclaim Deed, which she let me do in pen on the spot: * In the signature block for the receiver of the property, filled in "Capacity" as "Grantee as Trustee ______________________________ Living Trust". * In the notary's section, changed "were acknowledged before me" to "were acknowledged and sworn to before me".

Thank you for your feedback. We really appreciate it. Have a great day!

Kerry H.

January 31st, 2019

Good experience - Just what I needed

Thank you Kerry, have an awesome day!

Ira S.

June 8th, 2022

Hi, 1. I need a password to be able to copy and paste from the deed. 2. It would be more convenient if all documents could be downloaded together. Ira

Thank you for your feedback. We really appreciate it. Have a great day!

Kristina R.

March 27th, 2020

Fast and friendly service. I will use Deeds.com again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Nicolette C.

March 3rd, 2025

Deeds.com was a wealth of information and easy to navigate through the myriad of forms to choose from. During a time of family tragedy, this site was a valuable resource to complete necessary paperwork and ensure assets were in proper names and titles.

We are sincerely grateful for your feedback and are committed to providing the highest quality service. Thank you for your trust in us.

Reliant Roofers, Inc. N.

September 20th, 2023

Great communication. Quick response. deeds.com is timely and efficient.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

LINDA J M.

November 18th, 2019

NO PROBLEMS. I LIKE THE DEED DOCUMENT AND INSTRUCTIONS. MADE IT EASY.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Gene K.

April 24th, 2019

I am still in the trial stage. I am an older lawyer. Any help I can get is worth it. Once you get used to the format and data fill in the deed thing is excellent. Very professional if not a little slow. I have only done three deeds in one state so I will have to see how it goes. I like the product and their attitude towards pleasing the customer. We'll see when I try the recording part.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!