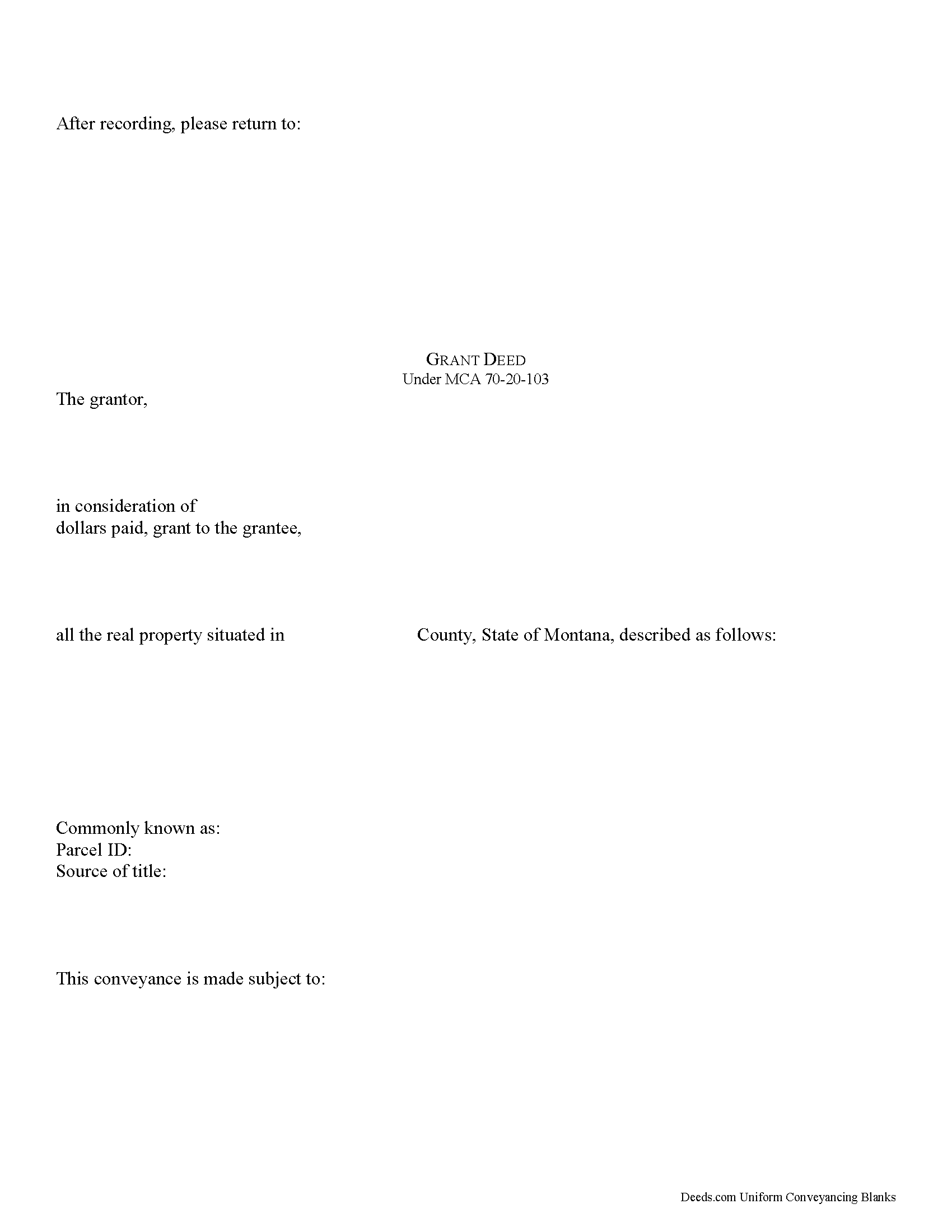

Sweet Grass County Grant Deed Form

Sweet Grass County Grant Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

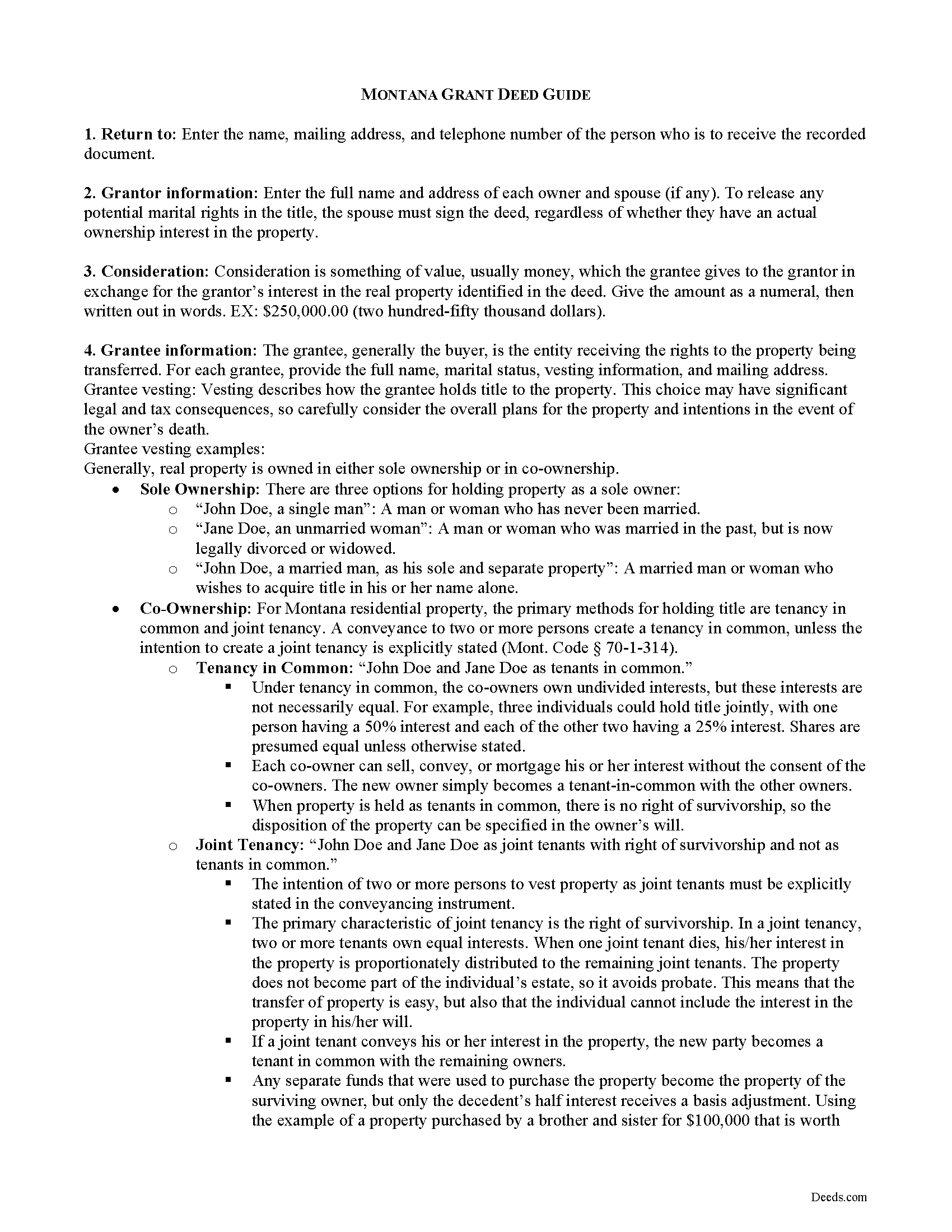

Sweet Grass County Grant Deed Guide

Line by line guide explaining every blank on the form.

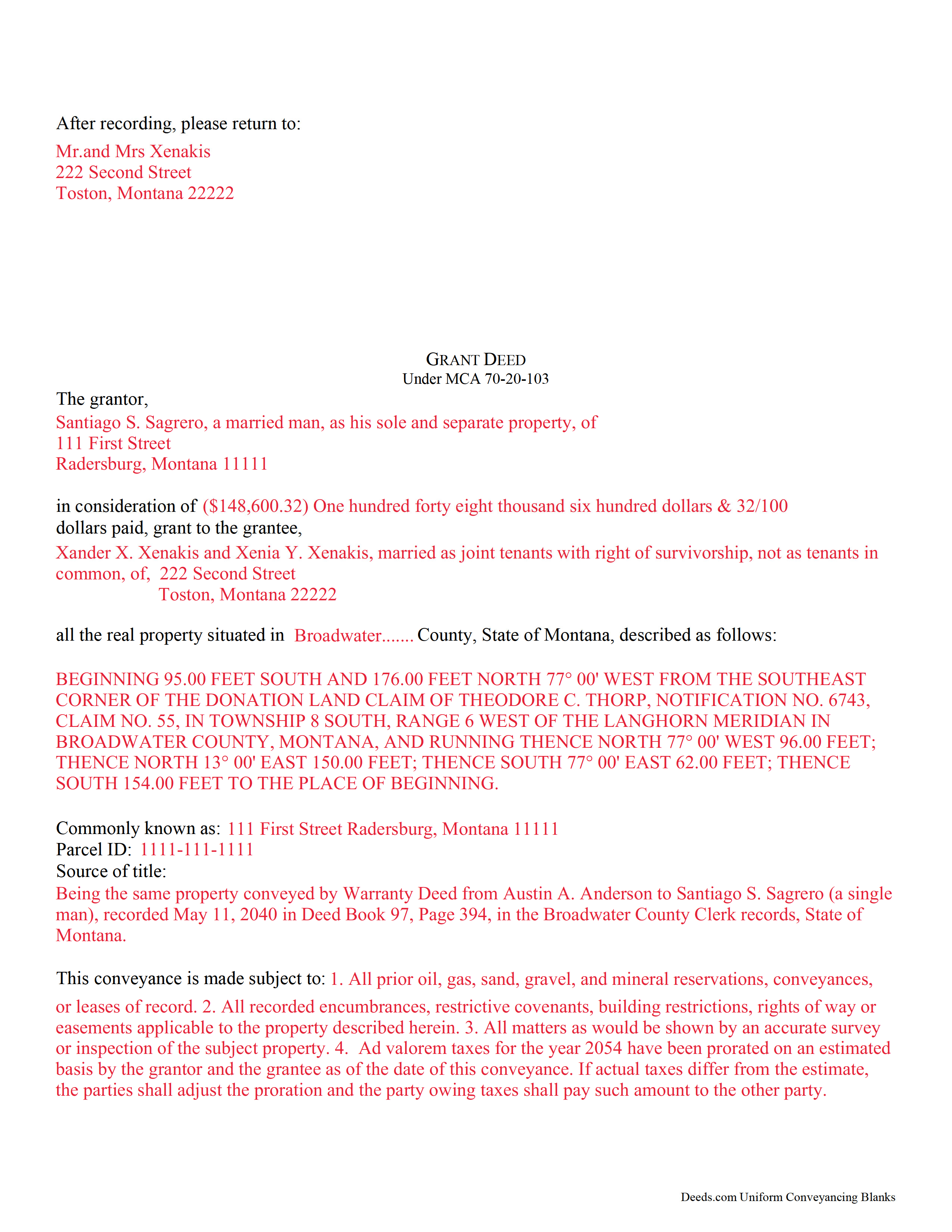

Sweet Grass County Completed Example of the Grant Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Montana and Sweet Grass County documents included at no extra charge:

Where to Record Your Documents

Sweet Grass County Clerk / Recorder

Big Timber, Montana 59011

Hours: 8:00 to 5:00 M-F

Phone: (406) 932-5152

Recording Tips for Sweet Grass County:

- Double-check legal descriptions match your existing deed

- Ask about their eRecording option for future transactions

- Avoid the last business day of the month when possible

- Bring extra funds - fees can vary by document type and page count

Cities and Jurisdictions in Sweet Grass County

Properties in any of these areas use Sweet Grass County forms:

- Big Timber

- Greycliff

- Mc Leod

- Melville

Hours, fees, requirements, and more for Sweet Grass County

How do I get my forms?

Forms are available for immediate download after payment. The Sweet Grass County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Sweet Grass County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Sweet Grass County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Sweet Grass County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Sweet Grass County?

Recording fees in Sweet Grass County vary. Contact the recorder's office at (406) 932-5152 for current fees.

Questions answered? Let's get started!

Real property can be transferred with an instrument in writing, which can be a grant, bill of sale, or a conveyance. A grant deed can be used in Montana to transfer title to real property. The Montana Code Annotated provides a general form for conveyances that can be used for a grant deed in this state (70-20-103). A grant deed includes covenants that the grantor has not conveyed the same property to any person other than the grantor and that the estate is free from any encumbrances done, made, or suffered by the grantor. A transfer of real property in Montana will pass all the easements attached to the property and will create in favor thereof an easement to use other real property of the person whose estate is transferred in the same manner and to the same extent as such property was obviously and permanently used by the person whose estate is transferred for the benefit thereof at the time the transfer was agreed upon or completed (70-20-308).

In order to have a grant deed recorded in Montana, it must be in writing, signed by the grantor or the grantor's lawful agent authorized in writing, and acknowledged or proved. The execution of the deed must be acknowledged as defined in 1-5-602 of the Montana Code Annotated or proved by a subscribing witness, which also must be notarized (70-21-203). Grant deeds can be acknowledged in other states in accordance with MAC 1-5-606, and they will be valid for recordation in Montana. A Realty Transfer Certificate must accompany all applicable grant deeds when they are presented for recording (15-7-305).

All real estate deeds, including grant deeds, should be recorded in the county where the property is located in order to provide constructive notice of the contents thereof to subsequent purchasers and mortgagees (70-21-302). If the property is located in more than one county and the deed has been recorded in either of such counties, a certified copy of the deed can be recorded in the other county where the rest of the property is located (70-21-201). If a grant deed is not recorded, it will be valid only between the parties to it and those who have notice thereof (70-21-102). Additionally, the deed will be void against any subsequent purchaser or encumbrancer of the same real property or part thereof in good faith and for a valuable consideration whose conveyance is first duly recorded (70-21-304). A deed will take effect so as to vest the interest intended to be transferred only upon the grantor's delivery of it (70-1-508).

(Montana GD Package includes form, guidelines, and completed example)

Important: Your property must be located in Sweet Grass County to use these forms. Documents should be recorded at the office below.

This Grant Deed meets all recording requirements specific to Sweet Grass County.

Our Promise

The documents you receive here will meet, or exceed, the Sweet Grass County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Sweet Grass County Grant Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4574 Reviews )

Rip V.

October 5th, 2022

Found the forms I needed but had to type these out my self in Word since these forms do not allow any information to be saved. I understand you want this to be proprietary information but you failed to deliver a usable product. I printed this template and built my own in microsoft word. Good examples and instructions with poor execution. I lost hours of typing and nearly lost real estate deals due to these documents not being in a format ready to use. Will be using another service next time or buying these as guides alone.

Thank you for taking the time to leave your feedback. Sorry to hear of the struggle you had using our forms. We will look into the issues you reported to see what we can do to provide a better product. For your trouble we have provided a full refund of your order.

Joan L. W.

June 9th, 2021

Excellent Service

Thank you!

Joan E S.

June 10th, 2022

appreciate the ease of finding a group of forms without the need for a lawyer--the time and expense--for a basic transfer of joint tenancy following a death.

Thank you!

Annette H.

April 7th, 2022

Clear directions. Giving a sample filled-in set of forms was great! Economical cost. Will refer others & use Deeds.com again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Cathaleen P.

April 26th, 2021

Excellent service and very easy to process. Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

John S.

May 20th, 2023

Easy to use website and reasonably priced forms. I recommend it.

Thank you for the kind words John.

Narcedalia G.

December 4th, 2023

Easy to use quick responses with accurate information and great customer service. No need to say more!

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Christina P.

July 28th, 2023

Fantastic!! The gals at Deeds really seem to have their stuff together! Great Forms, easy, exhaustive, and most importantly... accepted at the recorder the FIRST TIME!

Thank you so much for your review! Your feedback is highly appreciated, and we look forward to assisting you again in the future!

Donna J.

June 29th, 2019

Doesn't have samples pertaining to me. Still searching for correct wording forGRANTORS (plural) so its legally written.

Thank you for your feedback. We really appreciate it. Have a great day!

Samuel J M.

December 14th, 2018

I needed to prepare a Correction Warranty Deed and have not done so in years. I ordered your form and modified it to fit my situation. Saved me a lot of time. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Joyce B.

April 29th, 2021

Thanks, the documents were easy to follow and complete.

Thank you for your feedback. We really appreciate it. Have a great day!

Cindi S.

December 16th, 2018

I asked for a letter of testamentary form and this is what I got. Not at all what I was hoping for. Just spent $20 for nothing. Very disappointed.

Thank your or your feedback. We are sorry to hear of the disappointment caused when you ordered our Colorado Personal Representative Deed of Distribution hoping you would receive something entirely different. We have corrected your mistake by canceling your order and payment. Have a wonderful day.

Melody P.

February 23rd, 2021

Thanks again for such excellent service, and always a pleasure!

Thank you!

XIN Y.

June 14th, 2022

Great e-Recording service. Fast and convenient! All done in the comfort of my home. Love it!!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sue D.

November 28th, 2019

Great program

Thank you!