Lake County Substitution of Trustee and Deed of Full Reconveyance - for Trust Indenture/Deed of Trust Form

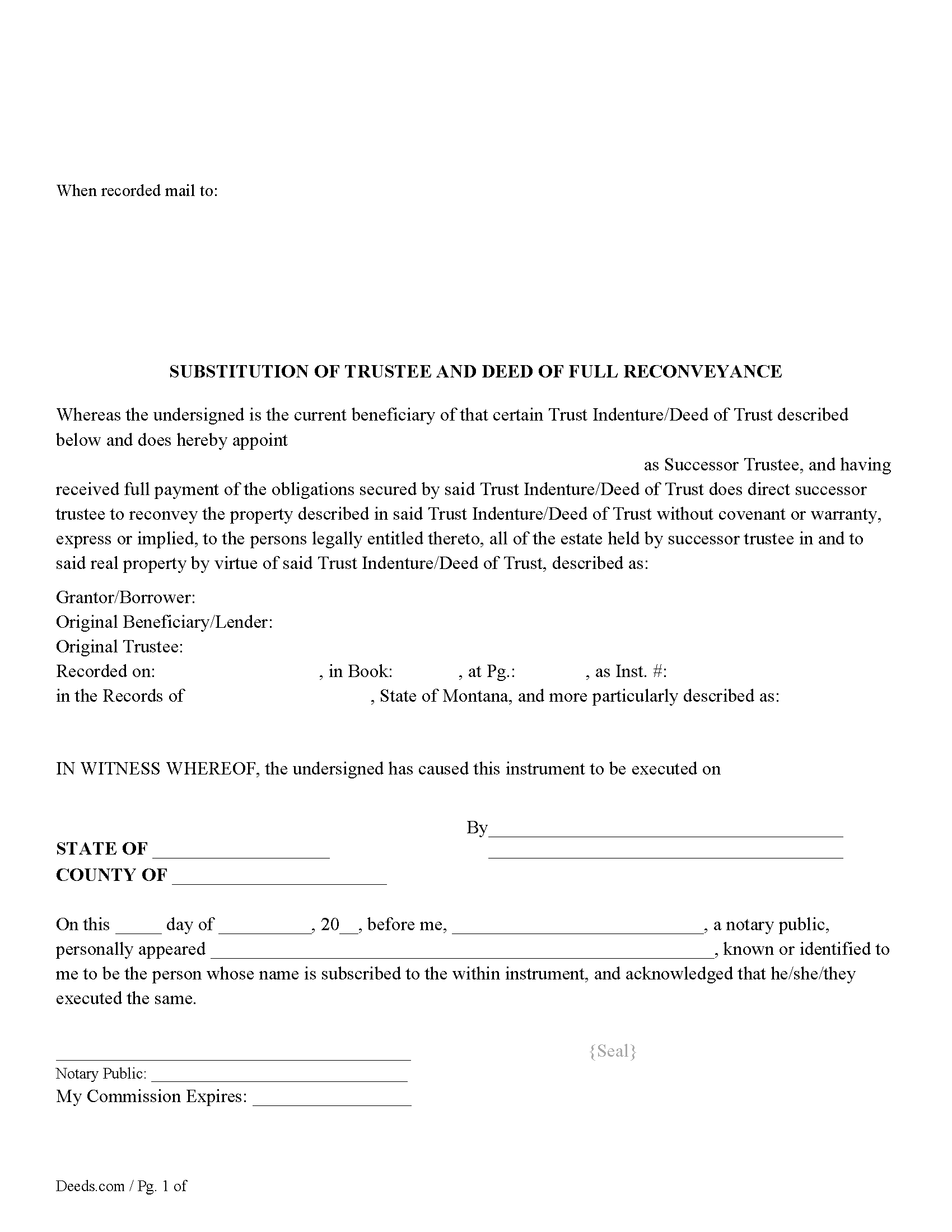

Lake County Substitution of Trustee and Deed of Full Reconveyance

Fill in the blank form formatted to comply with all recording and content requirements.

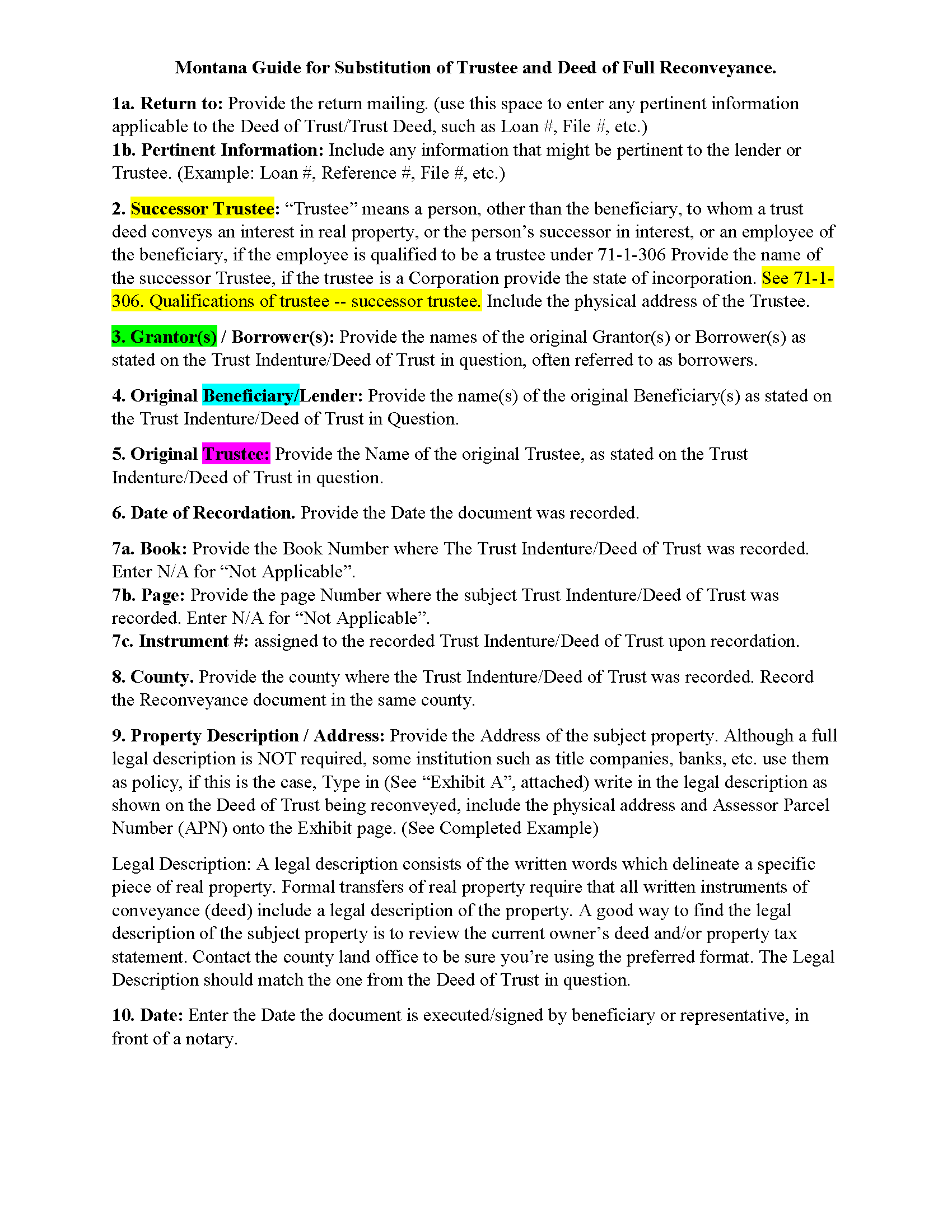

Lake County Substitution of Trustee and Deed of Full Reconveyance - Guidelines

Line by line guide explaining every blank on the form.

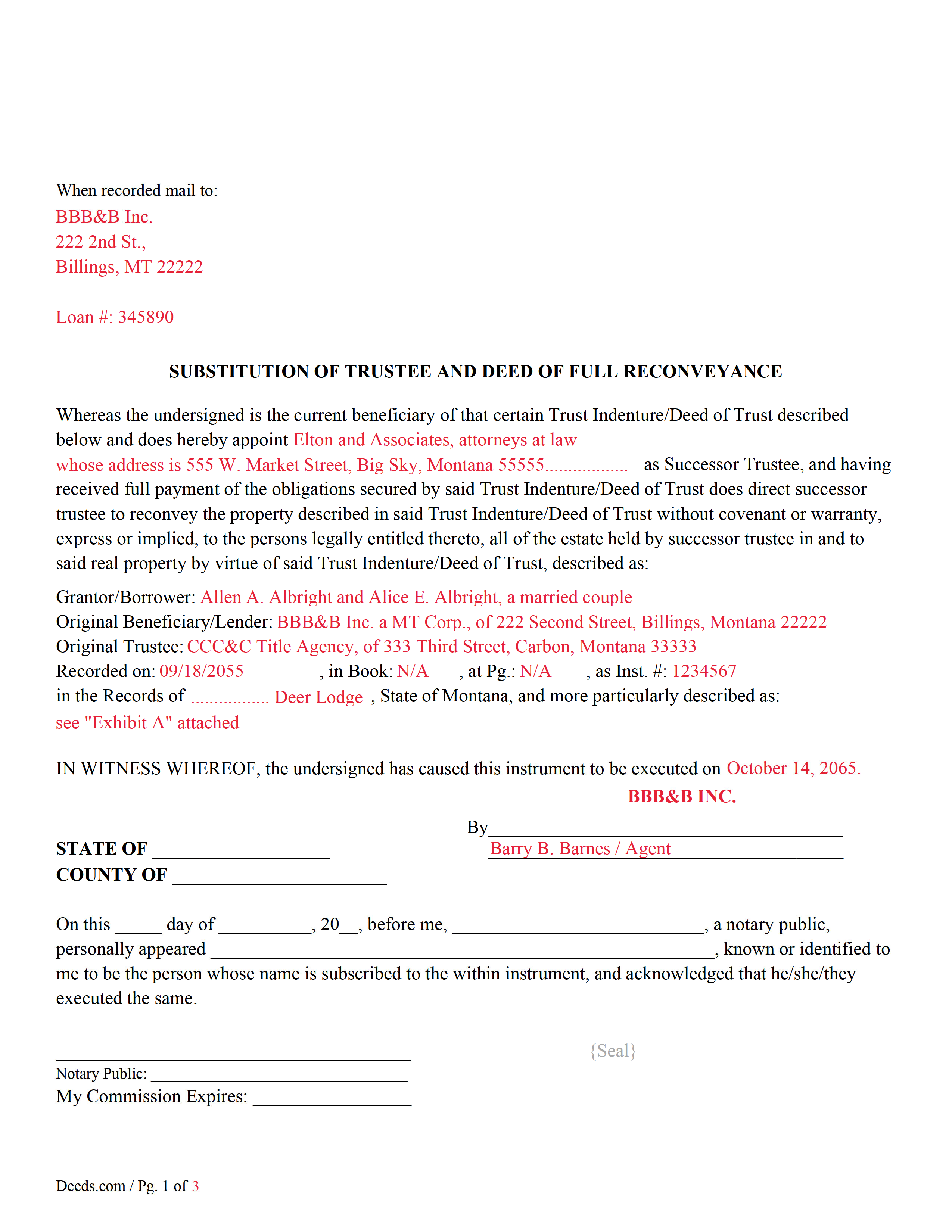

Lake County Substitution of Trustee and Deed of Full Reconveyance - Completed Example

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Montana and Lake County documents included at no extra charge:

Where to Record Your Documents

Lake County Clerk / Recorder

Polson, Montana 59860

Hours: 8:00am-5:00pm M-F

Phone: (406) 883-7208 and 7210

Recording Tips for Lake County:

- Documents must be on 8.5 x 11 inch white paper

- Bring extra funds - fees can vary by document type and page count

- Recorded documents become public record - avoid including SSNs

- Multi-page documents may require additional fees per page

Cities and Jurisdictions in Lake County

Properties in any of these areas use Lake County forms:

- Arlee

- Big Arm

- Charlo

- Dayton

- Elmo

- Pablo

- Polson

- Proctor

- Ravalli

- Rollins

- Ronan

- Saint Ignatius

Hours, fees, requirements, and more for Lake County

How do I get my forms?

Forms are available for immediate download after payment. The Lake County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Lake County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Lake County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Lake County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Lake County?

Recording fees in Lake County vary. Contact the recorder's office at (406) 883-7208 and 7210 for current fees.

Questions answered? Let's get started!

This form is initiated by the current beneficiary/lender, appoints a successor trustee who reconveys the Trust Indenture/Deed of Trust. This is typically performed when the loan/note has been paid in full/satisfied and the original trustee can't or won't reconvey the Trust Indenture/Deed of Trust in question.

71-1-306. Qualifications of trustee -- successor trustee.

(1) The trustee of a trust indenture under this part must be:

(a) an attorney who is licensed to practice law in Montana;

(b) a bank, trust company, or savings and loan association authorized to do business in Montana under the laws of Montana or the United States; or

(c) a title insurer or title insurance producer or agency authorized to do business in Montana under the laws of Montana.

(2) The beneficiary may appoint a successor trustee at any time by filing for record, in the office of the clerk and recorder of each county in which the trust property or some part of the trust property is situated, a substitution of trustee. The substitution must identify the trust indenture by stating the names of the original parties to the trust indenture and the date of recordation and the book and page where the information is recorded, must state the name and mailing address of the new trustee, and must be executed and acknowledged by all of the beneficiaries designated in the trust indenture or their successors in interest. From the time the substitution is filed for record, the new trustee is vested with all the power, duties, authority, and title of the trustee named in the trust indenture and of any successor trustee.

71-1-307 Reconveyance upon performance -- liability for failure to reconvey (1) Upon performance of the obligation secured by the trust indenture, the trustee, upon written request of the beneficiary or servicer, shall reconvey the interest in real property described in the trust indenture to the grantor. If the obligation is performed and the beneficiary or servicer refuses to request reconveyance or the trustee refuses to reconvey the property within 90 days of the request, the beneficiary, servicer, or trustee who refuses is liable to the grantor for the sum of $500 and all actual damages resulting from the refusal to reconvey.

(2) If a beneficiary or servicer has received a notice of intent to reconvey pursuant to 71-1-308 and has not timely requested a reconveyance or has not objected to the reconveyance within the 90-day period established in 71-1-308, the beneficiary or servicer is liable to the title insurer or title insurance producer for the sum of $500 and all damages resulting from the failure.

(3) In an action by a grantor, title insurer, or title insurance producer to collect any sums due under this section, the court shall award attorney fees and costs to the prevailing party.

For use in Montana only.

Important: Your property must be located in Lake County to use these forms. Documents should be recorded at the office below.

This Substitution of Trustee and Deed of Full Reconveyance - for Trust Indenture/Deed of Trust meets all recording requirements specific to Lake County.

Our Promise

The documents you receive here will meet, or exceed, the Lake County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Lake County Substitution of Trustee and Deed of Full Reconveyance - for Trust Indenture/Deed of Trust form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Dakota H.

December 19th, 2021

Brilliant idea. Beats working with an attorney who charges $250+ per hour. Thanks.

Thank you!

Diyang W.

January 12th, 2025

Very Good Product. Provided a lot of good info to assist people to DIY various Deed

We are grateful for your engagement and feedback, which help us to serve you better. Thank you for being an integral part of our community.

David T.

May 4th, 2025

Deeds.com made the experience of filing an Affidavit of Heirship in the public records of Logan County, Arkansas painless. Their process was easy to navigate, and they provided clear and immediate communication at every step. Highly recommended.

Thank you, David, for your kind words and thoughtful review! We’re so glad to hear that your experience filing an Affidavit of Heirship in Logan County, Arkansas, was smooth and stress-free. Our goal is to make these important processes as easy and transparent as possible, and it’s great to know our communication and platform met your expectations. We truly appreciate your recommendation and are here if you ever need assistance again.

Donna D.

March 20th, 2020

Easy to use. Good information. Would use again.

Thank you!

Patricia D.

January 5th, 2019

I looked around for forms and came to this site. I had to do 15 deeds and this form was very useful to completing that. Very impressed. Thanks

Thank you for your feedback. We really appreciate it. Have a great day!

Thomas M.

July 26th, 2021

The process of finding exactly what was needed was pretty painless.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

RICHARD MANUEL F.

January 26th, 2023

I never could even think to solve an important issue involving even overseas individuals without even a lawyer within 24 h. This service works for real and I'll keep using it from now for any future needs, referring to and proposing it as a legitimate, trusted real Optimus service. I'm extremely satisfied and being a Public Official myself I got to say that these guys have really impressed me!

Thank you!

Maria Lucy A.

August 5th, 2020

Very good service. Directions were easy to follow to obtain the document I needed.

Thank you!

LuAnn F.

September 8th, 2022

Simple and quick access to the form I needed

Thank you!

Earl L.

February 13th, 2019

Fair!

Thank you!

Margaret S.

March 16th, 2020

Great experience, quick and easy, thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

Cynthia H.

February 20th, 2023

The entire process was simple and easy, from purchasing, downloading and saving the documents.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

DONALD S.

March 11th, 2020

Using the Administrators Deed, pay attention to "Exhibit A". The blank will allow you to type a full legal description BUT it will not save it. Use "Exhibit A" to type the legal description. The form was great and I filed it this morning with no problems.

Thank you for your feedback. We really appreciate it. Have a great day!

Clinton M.

January 8th, 2020

Very informative. I submitted my form.The county accepted it. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

Richard H.

October 5th, 2022

Excellent service, very user friendly

Thank you!