Cascade County Trustee Deed Form

Cascade County Trustee Deed Form

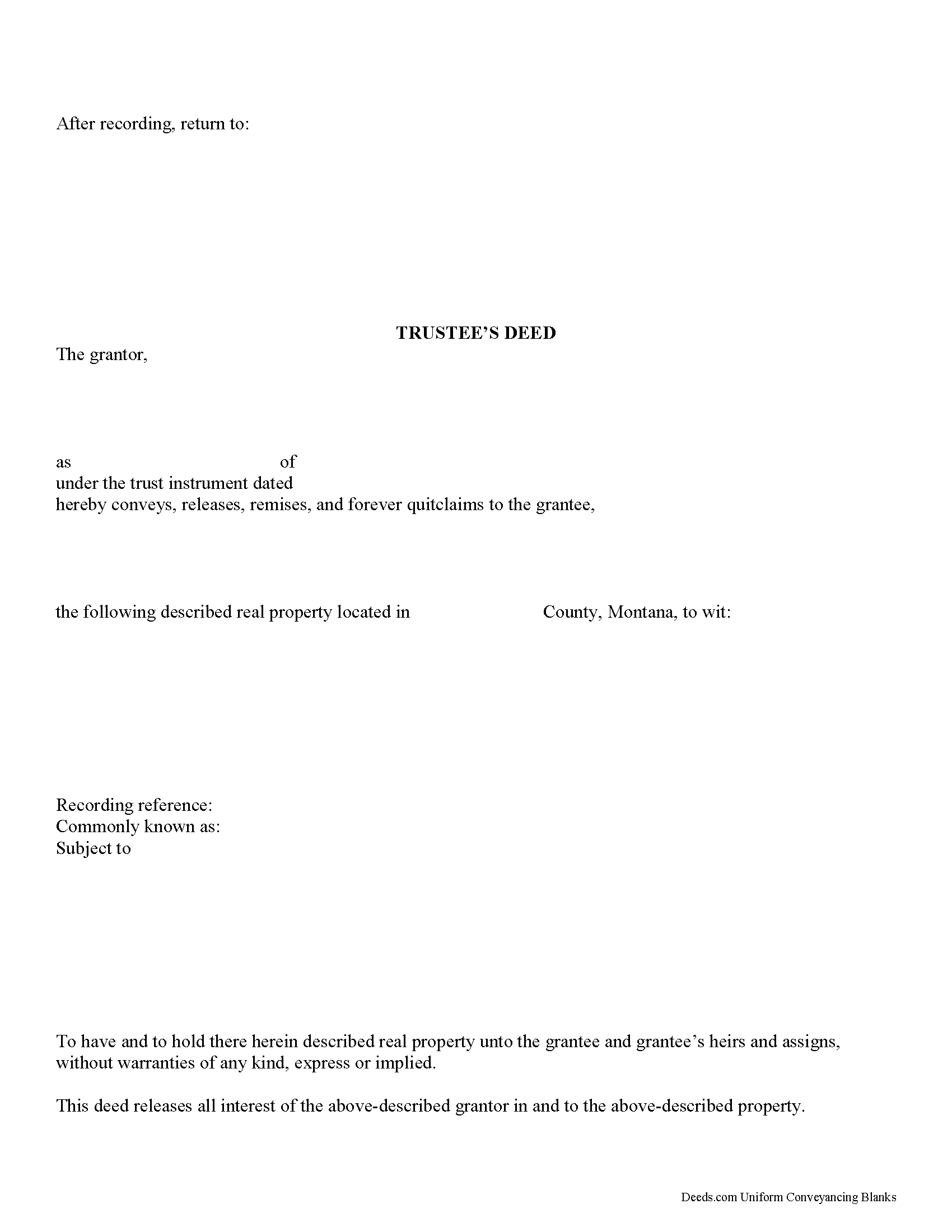

Fill in the blank form formatted to comply with all recording and content requirements.

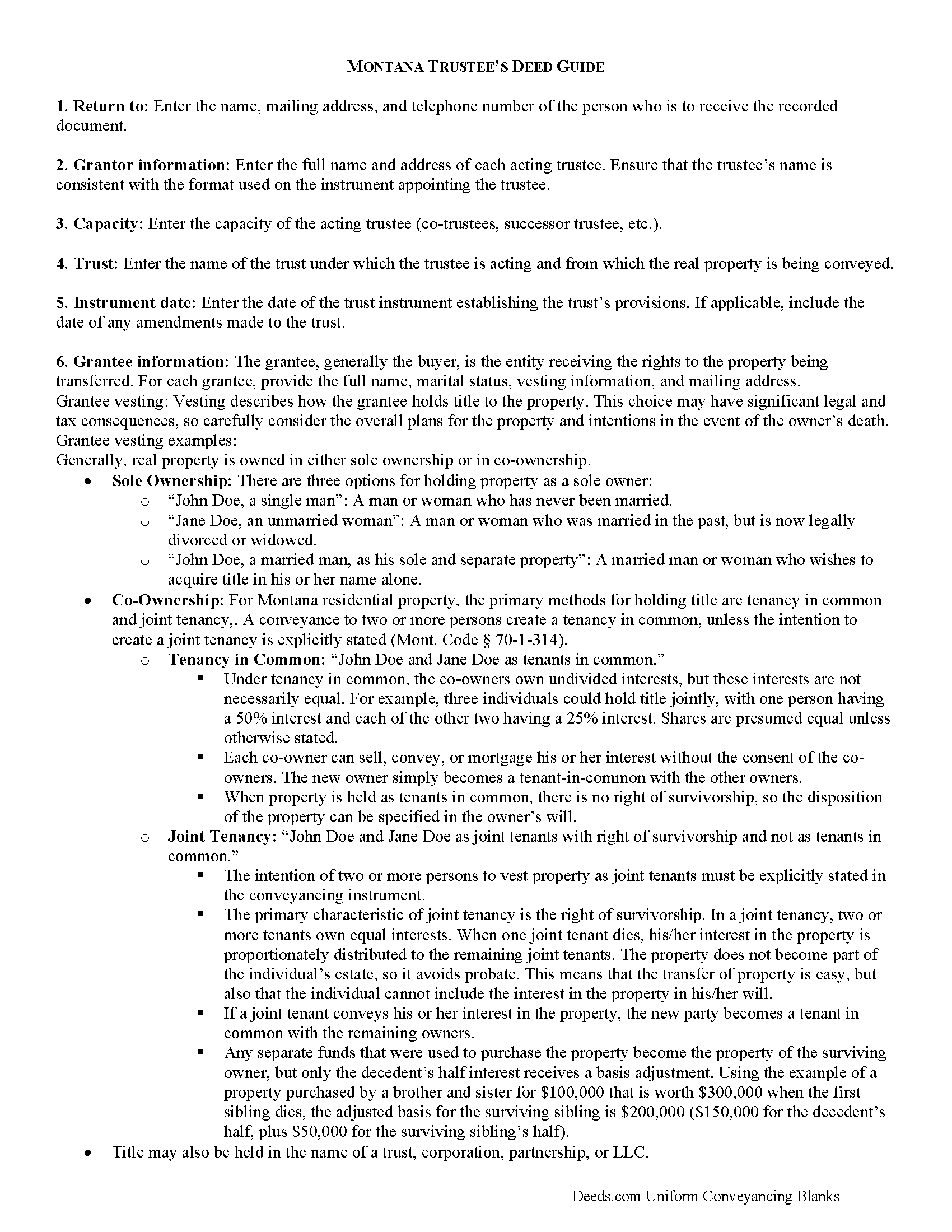

Cascade County Trustee Deed Guide

Line by line guide explaining every blank on the form.

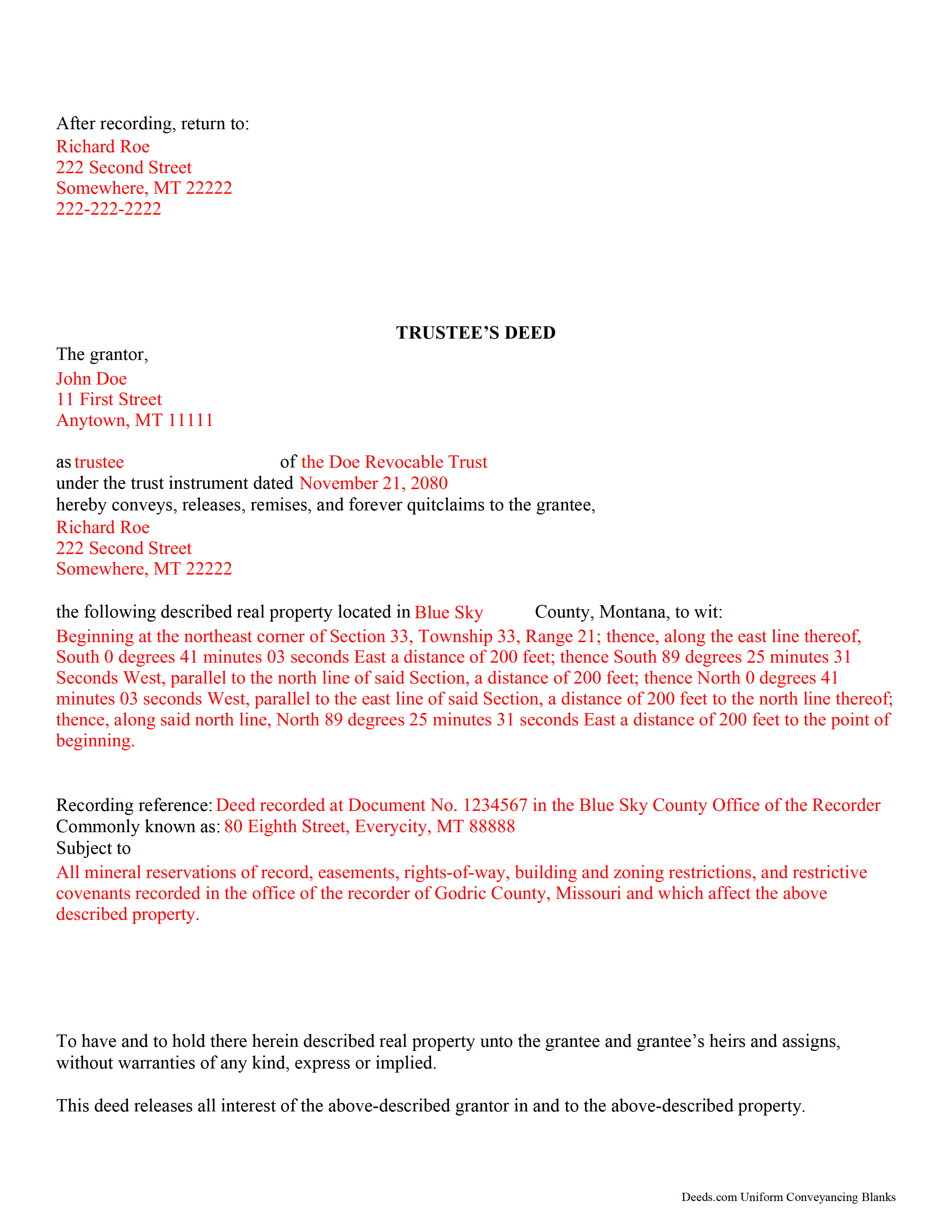

Cascade County Completed Example of the Trustee Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Montana and Cascade County documents included at no extra charge:

Where to Record Your Documents

Cascade County Clerk / Recorder

Great Falls, Montana 59401 / 59403

Hours: 7:00am - 5:00pm M-F

Phone: (406) 454-6801

Recording Tips for Cascade County:

- White-out or correction fluid may cause rejection

- Leave recording info boxes blank - the office fills these

- Ask about their eRecording option for future transactions

- Ask for certified copies if you need them for other transactions

- Have the property address and parcel number ready

Cities and Jurisdictions in Cascade County

Properties in any of these areas use Cascade County forms:

- Belt

- Black Eagle

- Cascade

- Fort Shaw

- Great Falls

- Malmstrom A F B

- Monarch

- Neihart

- Sand Coulee

- Simms

- Stockett

- Sun River

- Ulm

- Vaughn

Hours, fees, requirements, and more for Cascade County

How do I get my forms?

Forms are available for immediate download after payment. The Cascade County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Cascade County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Cascade County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Cascade County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Cascade County?

Recording fees in Cascade County vary. Contact the recorder's office at (406) 454-6801 for current fees.

Questions answered? Let's get started!

Transferring Real Property from a Living Trust in Montana? Use a Trustee's Deed

In Montana, a trustee uses a trustee's deed to convey property held in a living trust. This trustee's deed is different from a trustee's deed to the purchaser at the trustee's sale.

A living trust is an estate planning tool that allows the trust maker to determine what happens to their assets upon death.

The living trust relationship involves three parties: the settlor (trust maker), who establishes the trust and funds it with assets (including real property); the trustee, who holds title to the property on behalf of the trust; and the beneficiary, who has a present or future interest in the property held in trust. The settlor is able to revoke a living trust up until his death, at which point the trust becomes irrevocable.

The trust is established by a trust instrument executed by the settlor. The instrument names the trustee -- whether an individual, multiple people, or a corporate trustee --, the beneficiaries, and the trust's terms or provisions. Because the trust cannot technically hold title, property transferred into it is titled in the name of the trustee on behalf of the trust.

The trustee's power to convey trust property is codified under the Montana Uniform Trust Code at 72-38-816(2). In Montana, the trustee's deed is a type of quitclaim deed, and so contains no warranties of title.

The deed names the acting trustee as the grantor, the trust's name and the date of the instrument establishing the trust, and, after recording, transfers title to the grantee. The document should meet all requirements of form and content for documents affecting real property in the state of Montana, including the legal description of the property being conveyed. The trustee must sign the deed in the presence of a notary public before recording.

If the recipient of a trustee's deed requests it, a trustee may also confirm his authority to enter into real property transactions by providing a recorded affidavit under Mont. Code Ann. 72-38-1111.

Contact an attorney with questions regarding living trusts and trustee's deeds in the State of Montana.

(Montana TD Package includes form, guidelines, and completed example)

Important: Your property must be located in Cascade County to use these forms. Documents should be recorded at the office below.

This Trustee Deed meets all recording requirements specific to Cascade County.

Our Promise

The documents you receive here will meet, or exceed, the Cascade County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Cascade County Trustee Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4592 Reviews )

Natasha M.

January 9th, 2024

Your forms, guides, sample deeds and submission process were accessible, easy to understand and simple. I also was pleasantly surprised by the efficiency, professionalism and ease of staff communicating with me after I uploaded the document to ensure the county accepted it. I will continue to use this website to record deeds. Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

Karl H.

January 5th, 2021

Still in process, but it is well explained. I would recommend it to anyone in Texas.

Thank you for your feedback. We really appreciate it. Have a great day!

Laurie B.

June 23rd, 2021

You have made this process so simple - I can see it would have been complicated and frustrating without Deeds.com. Thank you!

Thank you!

Jimmy W.

November 1st, 2024

Very thorough with plenty of instructions. Nice to be able to fill in the forms on my computer at my own pace and edit if needed. Jim

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Charlotte H.

July 16th, 2022

Easy to use and download. Everything we needed with a guide for accuracy.

Thank you!

Yvonne A.

April 25th, 2021

love your Deeds.com website...

Thank you!

Gregory G.

April 4th, 2019

Quick and Easy/Immediate Access after payment. Now seeking other forms needed ASAP! Thanks!

Thank you!

Susan N.

August 28th, 2022

Easy to use.

Thank you!

Jill M.

January 12th, 2019

This service gave me the information and guide I needed to file a Quitclaim Deed. I went through the process with no problems at all.

Thank you Jill, we appreciate your feedback.

David S.

August 2nd, 2019

The form was just what I needed for the Circuit Court and Land Records office. The additional information provided was very helpful as well.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kerry G.

June 6th, 2021

Could not be happier with the deeds here. Long time customer and never had a problem, they always have the right documents for what I need.

Thank you for the kind words Kerry. Have a great day!

Kristi T.

October 16th, 2020

This was so very easy and fast! Well worth the small fee. I will use this again if I have a need. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Richard W.

March 25th, 2019

Very nice web site with available forms. Being out of state we appreciated instruction sheet details. Rick and Jean Weber, Chicago

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Steve F.

July 9th, 2021

Fast Service, Easy to use. Highly Recommend!

Thank you!

Harry W B.

January 11th, 2021

This is a very valuable resource. It was user friendly and made transfer happen in a day!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!