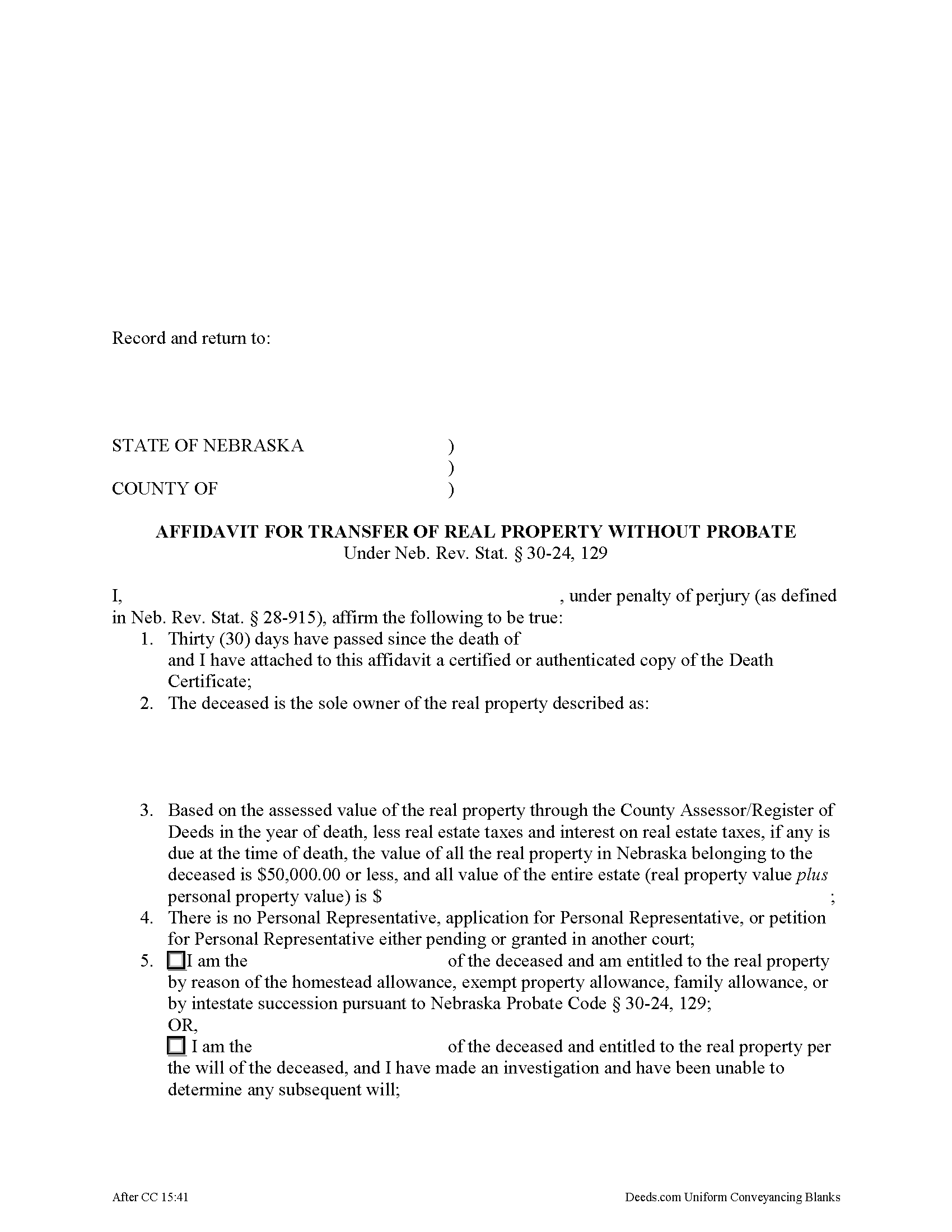

Adams County Affidavit for Transfer of Real Property without Probate Form

Adams County Affidavit for Transfer of Real Property without Probate Form

Fill in the blank form formatted to comply with all recording and content requirements.

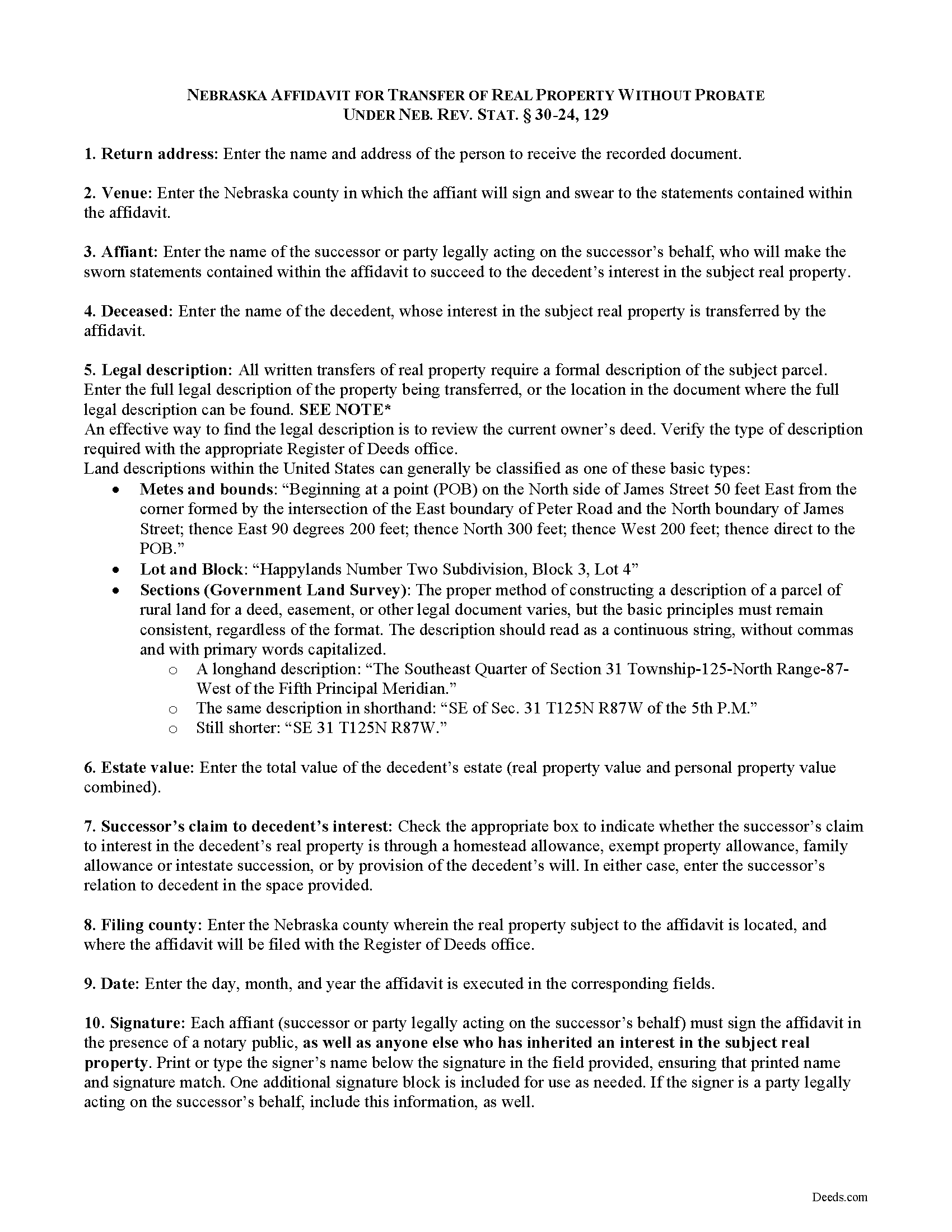

Adams County Affidavit for Transfer of Real Property without Probate Guide

Line by line guide explaining every blank on the form.

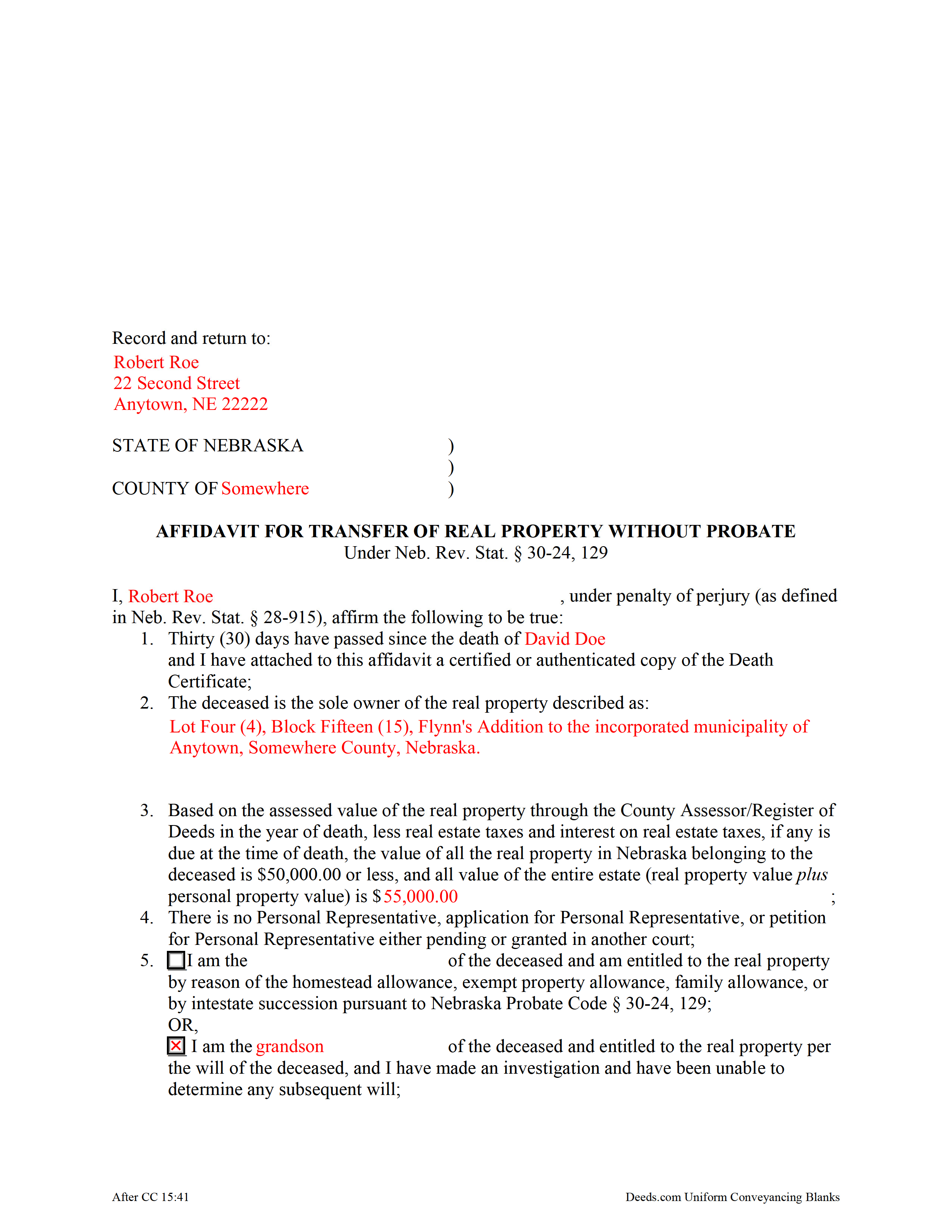

Adams County Completed Example of the Affidavit of Transfer of Real Property w/o Probate Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Nebraska and Adams County documents included at no extra charge:

Where to Record Your Documents

Adams County Register of Deeds

Hastings , Nebraska 68901

Hours: 9:00am to 5:00pm M-F

Phone: (402) 461-7148

Recording Tips for Adams County:

- White-out or correction fluid may cause rejection

- Double-check legal descriptions match your existing deed

- Recording fees may differ from what's posted online - verify current rates

Cities and Jurisdictions in Adams County

Properties in any of these areas use Adams County forms:

- Ayr

- Hastings

- Holstein

- Juniata

- Kenesaw

- Roseland

Hours, fees, requirements, and more for Adams County

How do I get my forms?

Forms are available for immediate download after payment. The Adams County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Adams County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Adams County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Adams County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Adams County?

Recording fees in Adams County vary. Contact the recorder's office at (402) 461-7148 for current fees.

Questions answered? Let's get started!

Record the affidavit under the Nebraska Probate 30-24,129 to transfer a decedent's real property without probate when certain criteria are met. The affidavit must be recorded in each county in which the real property described within the affidavit is located, along with a certified copy of the decedent's death certificate.

The affiant, or person executing the affidavit, is the successor in interest to the decedent's real property described in the affidavit, or an agent legally acting on the successor's behalf.

Statutory requirements stipulate that the affidavit state that total value of the decedent's real estate interests is $50,000.00 or less; thirty (30) days have passed since the decedent's death, as evidenced by a certified copy of the death certificate; there is no personal representative or pending petition for appointment of a personal representative; the successor is entitled to receive the property through a homestead, exempt property, or family allowance, or by devise or intestate succession; the successor has made an investigation and was unable to determine a subsequent will; and no other person has a right to the interest of the subject property. In addition, the successor's relationship to the decedent, the total value of the decedent's estate, and a complete legal description of the subject parcel is required. Each successor in interest to the subject property must sign the affidavit in the presence of a notary public.

See https://supremecourt.nebraska.gov/self-help/estates/affidavit-transfer-real-property-without-probate for more information. Consult an attorney with questions regarding affidavits to collect real property outside of probate, or any other issue related to probate or decedent's property in Nebraska.

(Nebraska Affidavit Package includes form, guidelines, and completed example)

Important: Your property must be located in Adams County to use these forms. Documents should be recorded at the office below.

This Affidavit for Transfer of Real Property without Probate meets all recording requirements specific to Adams County.

Our Promise

The documents you receive here will meet, or exceed, the Adams County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Adams County Affidavit for Transfer of Real Property without Probate form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Deanie F.

June 27th, 2019

Very happy with the product and really appreciated being able to get it on line.

Thanks for the kind words Deanie. We appreciate you, glad we could help!

April C.

May 18th, 2021

Spot on forms and process. YMMV but way more efficient and cost effective than contacting an ambulance... attorney.

Thank you!

Christopher B.

January 13th, 2021

Process went smoothly and will use for my next recording. Only area for improvement would be to provide the ability for the user to delete and replace uploaded documents.

Thank you for your feedback. We really appreciate it. Have a great day!

Sara Beth M B.

August 14th, 2020

great service!!!!! wish this service was listed on the Washoe County Recorder website so people who aren't companies could find it.

Thank you for your feedback. We really appreciate it. Have a great day!

John v.

November 13th, 2019

I don't have any experience with real estate legal forms and these were fairly easy to understand. The guide helped a bunch and the information provided on the site filled in any gaps. Overall I would definitely use again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sandra M.

November 17th, 2019

The forms were easy to use but there was a software issue that made it impossible to get the county name to appear on the form in the correct place. It made the deed look a little sloppy

Thank you!

Charles S.

July 2nd, 2021

Easy to set up and fast service.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

kathy d.

March 20th, 2019

very easy make sense instructions. Thank you.

Thank you for your feedback Kathy. Have an amazing day!

Kim H.

October 17th, 2020

Great site. quick turnaround and communication. I needed an exception that they told me I needed and where to get the info within hours. I returned warranty deed with exception and the deed was recorded the same day! Great turnaround!

Thank you for your feedback. We really appreciate it. Have a great day!

NORA F.

May 19th, 2020

The guide was so helpful, really made filing out the form easy. Thanks!

Thank you for your feedback. We really appreciate it. Have a great day!

Brian W.

February 1st, 2020

Easy, but it would be nice if there was an option for font size. It looks tiny, like 6 or 8.

Thank you for your feedback. We really appreciate it. Have a great day!

JAY W.

June 17th, 2021

ok

Thank you!

Gary G.

November 4th, 2020

I'm glad I found this service . Very useful. Time saving

Thank you for your feedback. We really appreciate it. Have a great day!

Ron B.

September 16th, 2020

Most complete and affordable documents that I was able to locate online. Excellent printed out presentation. Very professional. More than happy with results.

Thank you!

Nola B.

May 18th, 2021

I like the form except the title should be ENHANCED LIFE ESTATE DEED and not Quit Claim Deed

Thank you for your feedback. We really appreciate it. Have a great day!