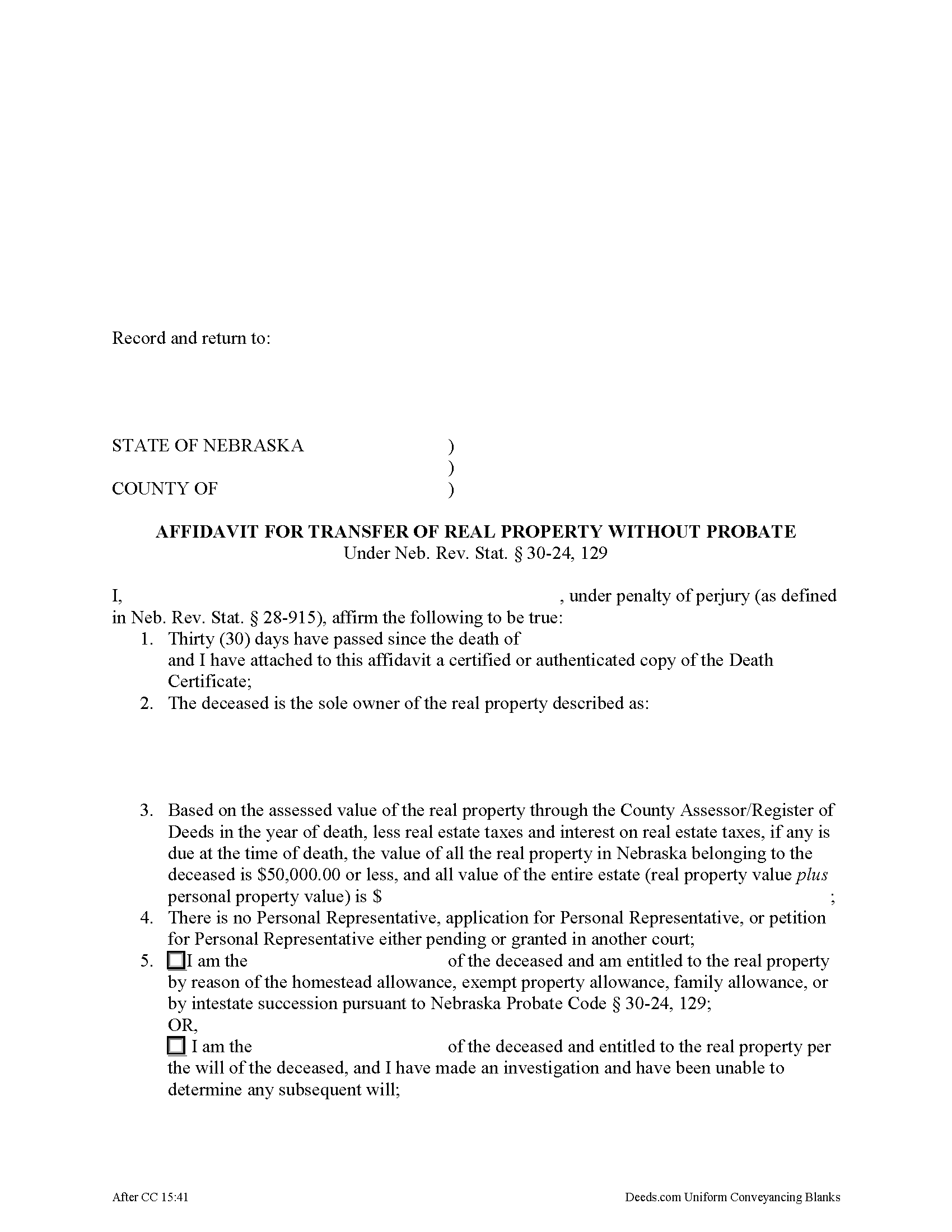

Pierce County Affidavit for Transfer of Real Property without Probate Form

Pierce County Affidavit for Transfer of Real Property without Probate Form

Fill in the blank form formatted to comply with all recording and content requirements.

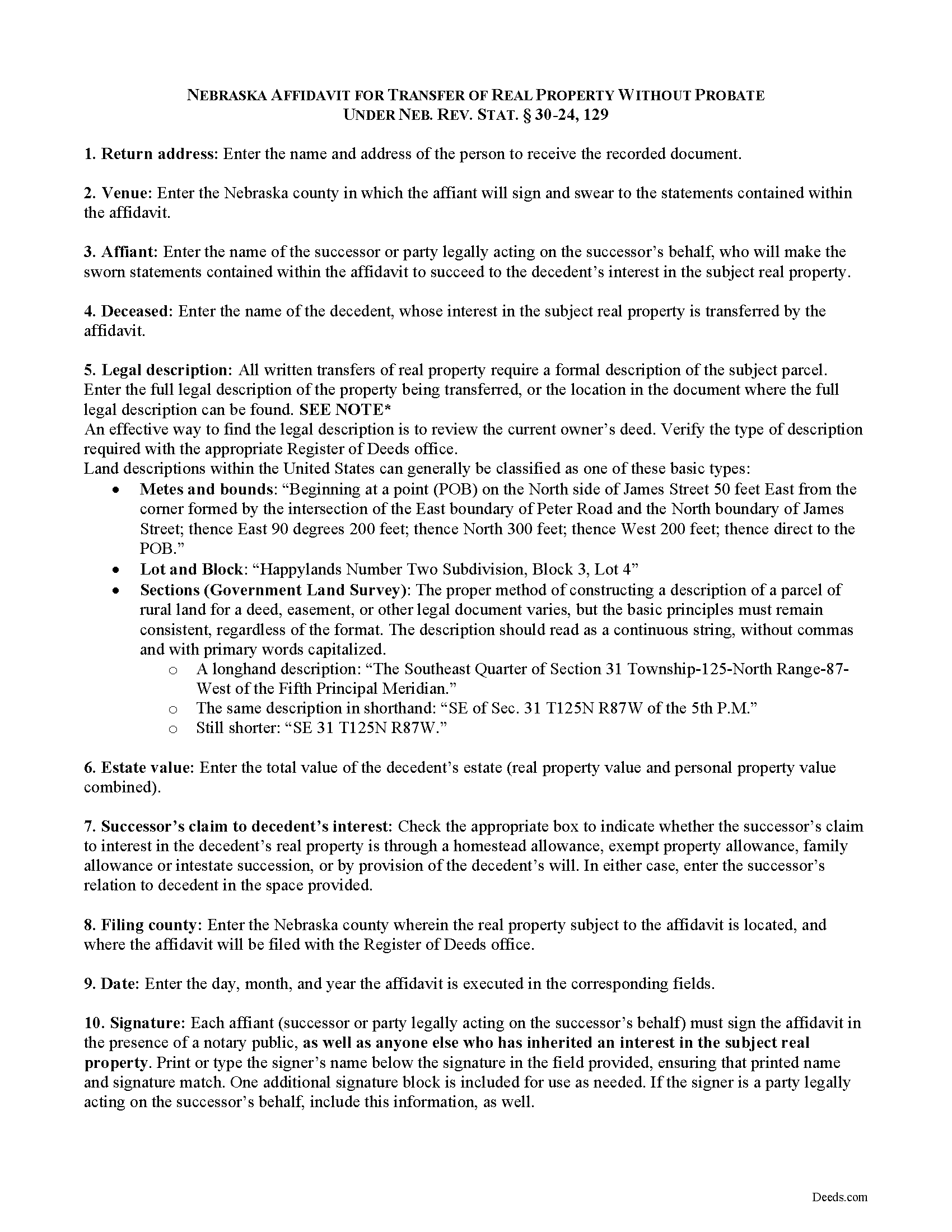

Pierce County Affidavit for Transfer of Real Property without Probate Guide

Line by line guide explaining every blank on the form.

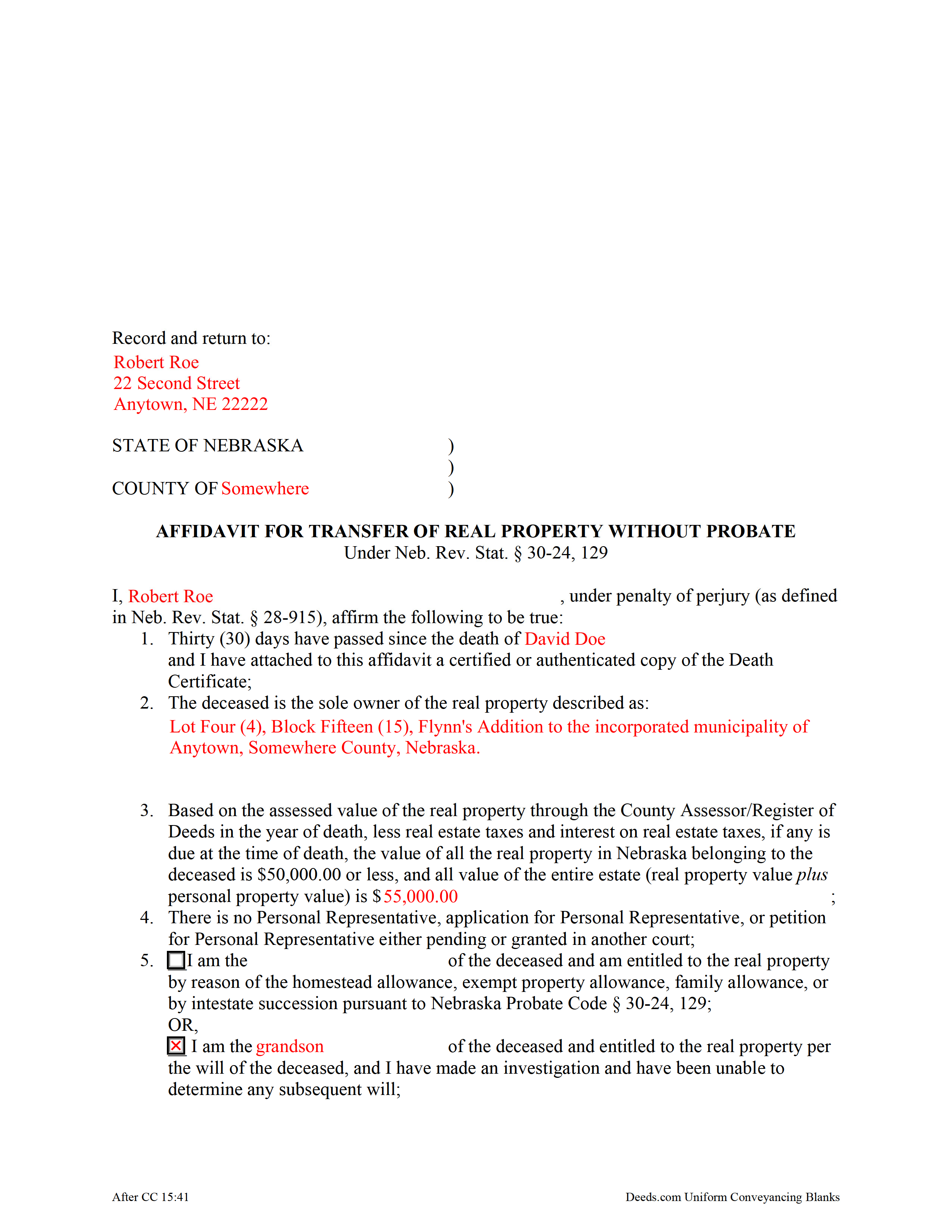

Pierce County Completed Example of the Affidavit of Transfer of Real Property w/o Probate Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Nebraska and Pierce County documents included at no extra charge:

Where to Record Your Documents

Pierce County Register of Deeds

Pierce, Nebraska 68767

Hours: 8:30 to 4:30 M-F

Phone: (402) 329-4225

Recording Tips for Pierce County:

- Verify all names are spelled correctly before recording

- Documents must be on 8.5 x 11 inch white paper

- Make copies of your documents before recording - keep originals safe

- Bring extra funds - fees can vary by document type and page count

Cities and Jurisdictions in Pierce County

Properties in any of these areas use Pierce County forms:

- Hadar

- Mclean

- Osmond

- Pierce

- Plainview

Hours, fees, requirements, and more for Pierce County

How do I get my forms?

Forms are available for immediate download after payment. The Pierce County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Pierce County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Pierce County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Pierce County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Pierce County?

Recording fees in Pierce County vary. Contact the recorder's office at (402) 329-4225 for current fees.

Questions answered? Let's get started!

Record the affidavit under the Nebraska Probate 30-24,129 to transfer a decedent's real property without probate when certain criteria are met. The affidavit must be recorded in each county in which the real property described within the affidavit is located, along with a certified copy of the decedent's death certificate.

The affiant, or person executing the affidavit, is the successor in interest to the decedent's real property described in the affidavit, or an agent legally acting on the successor's behalf.

Statutory requirements stipulate that the affidavit state that total value of the decedent's real estate interests is $50,000.00 or less; thirty (30) days have passed since the decedent's death, as evidenced by a certified copy of the death certificate; there is no personal representative or pending petition for appointment of a personal representative; the successor is entitled to receive the property through a homestead, exempt property, or family allowance, or by devise or intestate succession; the successor has made an investigation and was unable to determine a subsequent will; and no other person has a right to the interest of the subject property. In addition, the successor's relationship to the decedent, the total value of the decedent's estate, and a complete legal description of the subject parcel is required. Each successor in interest to the subject property must sign the affidavit in the presence of a notary public.

See https://supremecourt.nebraska.gov/self-help/estates/affidavit-transfer-real-property-without-probate for more information. Consult an attorney with questions regarding affidavits to collect real property outside of probate, or any other issue related to probate or decedent's property in Nebraska.

(Nebraska Affidavit Package includes form, guidelines, and completed example)

Important: Your property must be located in Pierce County to use these forms. Documents should be recorded at the office below.

This Affidavit for Transfer of Real Property without Probate meets all recording requirements specific to Pierce County.

Our Promise

The documents you receive here will meet, or exceed, the Pierce County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Pierce County Affidavit for Transfer of Real Property without Probate form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Wanda L.

July 30th, 2020

Really nice and helped with more information.

Thank you for your feedback. We really appreciate it. Have a great day!

Barbara E.

April 4th, 2019

Fast efficient, just what I needed.

Thank you so much Barbara. We appreciate your feedback.

DEBBY G.

January 12th, 2023

I was so confused on how to complete the form. But I followed the instructions and used the example and got it done.

Thank you for your feedback. We really appreciate it. Have a great day!

Quinn R.

April 3rd, 2023

DEEDS.COM IS THE BEST WAY TO E-RECORD DEEDS. THEY ARE FAST, POLITE AND A FANTASTIC DEAL FOR THE SERVICE THAT THEY OFFER!!!

Thank you!

Jimmy P.

November 20th, 2024

They sent me everything I would need to do this. Easy purchase -Easy download. Great!! I'll be back here for all my document needs.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kathleen M.

July 21st, 2021

Wow, this was a breeze!! Best experience and fast. Great way to record documents in a matter of minutes. I recommend Deeds.com for anyone who needs to record documents quickly and conveniently.

Thank you for your feedback. We really appreciate it. Have a great day!

Ron D.

January 14th, 2019

No choice since the county does not seem to provide info you supplied.

Thank Ron, have a great day!

Sheryl C.

July 28th, 2021

Very Very helpful easy to navigate the guides and examples were great and informative. Great to have will be using for future transactions.

Thank you for your feedback. We really appreciate it. Have a great day!

Elizabeth F.

February 14th, 2022

This was great other than exemption codes did not populate and I couldn't refer to it.

Thank you for your feedback. We really appreciate it. Have a great day!

Tracy M.

July 9th, 2020

The form is easy to use. However, the quit claim deed form seems to be for parcel of land, because the word "real property" is not in the form.

Thank you for your feedback. We really appreciate it. Have a great day!

Joseph B.

March 30th, 2021

Awesome!

Thank you!

Denise L.

February 3rd, 2025

Using the Gift Deed form from Deeds.com, along with the example and instructions thy provided, saved me at least $200 in legal fees and saved me time as well!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

michael b.

June 26th, 2020

Your web site is very user friendly and easy to navigate I was very pleased with the experience

Thank you!

Michael W.

January 25th, 2022

I needed a quitclaim deed to transfer ownership of a home. An attorney wanted $400.00 to file the deed. I downloaded a blank deed for my area from deeds.com. I received it instantly. (Small fee) it came with instructions and a template. I filled it out and submitted it to the County Clerks office.it was simple and I saved a lot of money. There may be other forms you need, check with whoever you are submitting the deed. You'll have additional fees, but that is up to the municipality in which you reside. It will be helpful if you have the latest deed on file. It was much easier than I thought. This is an easy website to navigate through and it is 100% legitimate. I recommend Deeds.com.

Thank you for your feedback. We really appreciate it. Have a great day!

Daniel S.

November 7th, 2022

Easy to access documents.

Thank you for your feedback. We really appreciate it. Have a great day!