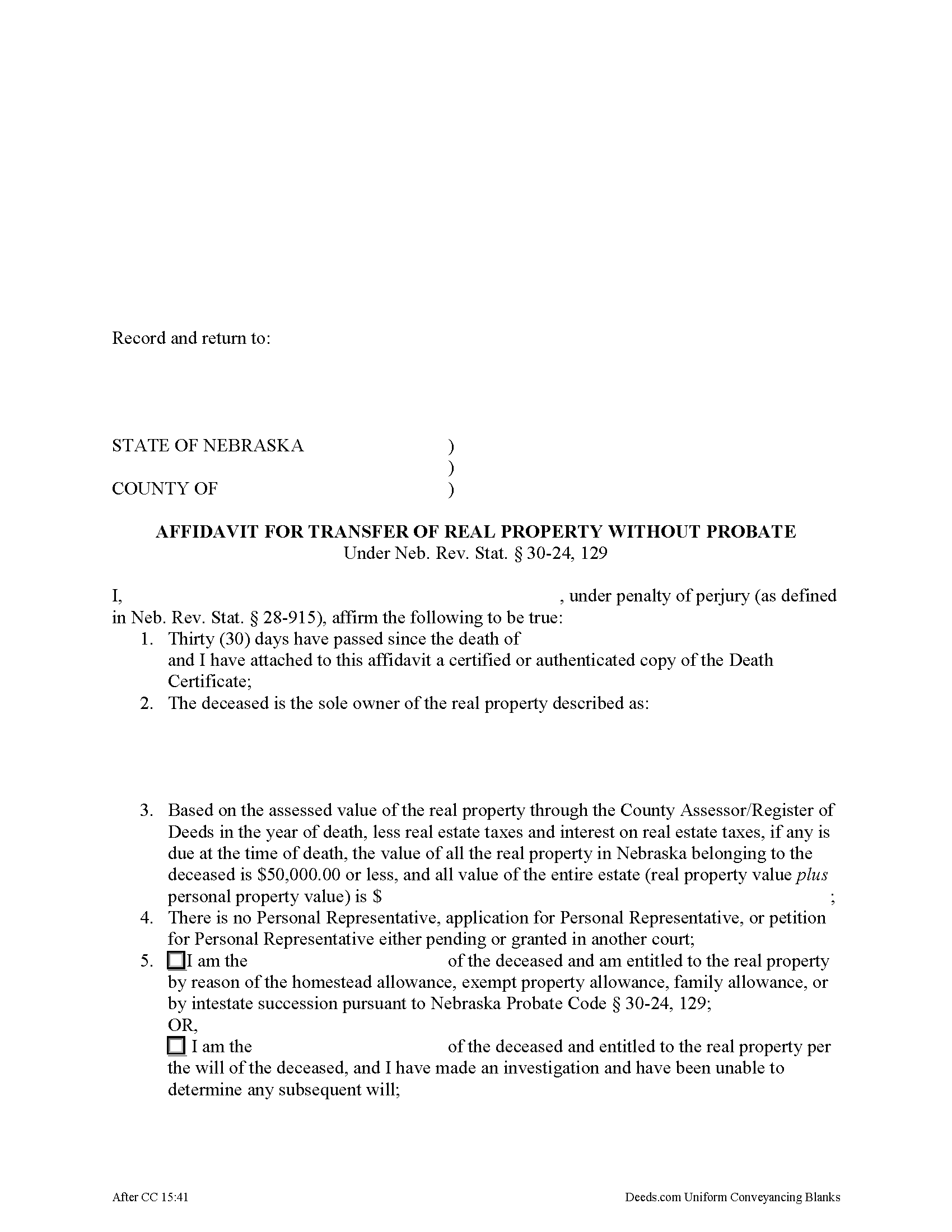

York County Affidavit for Transfer of Real Property without Probate Form

York County Affidavit for Transfer of Real Property without Probate Form

Fill in the blank form formatted to comply with all recording and content requirements.

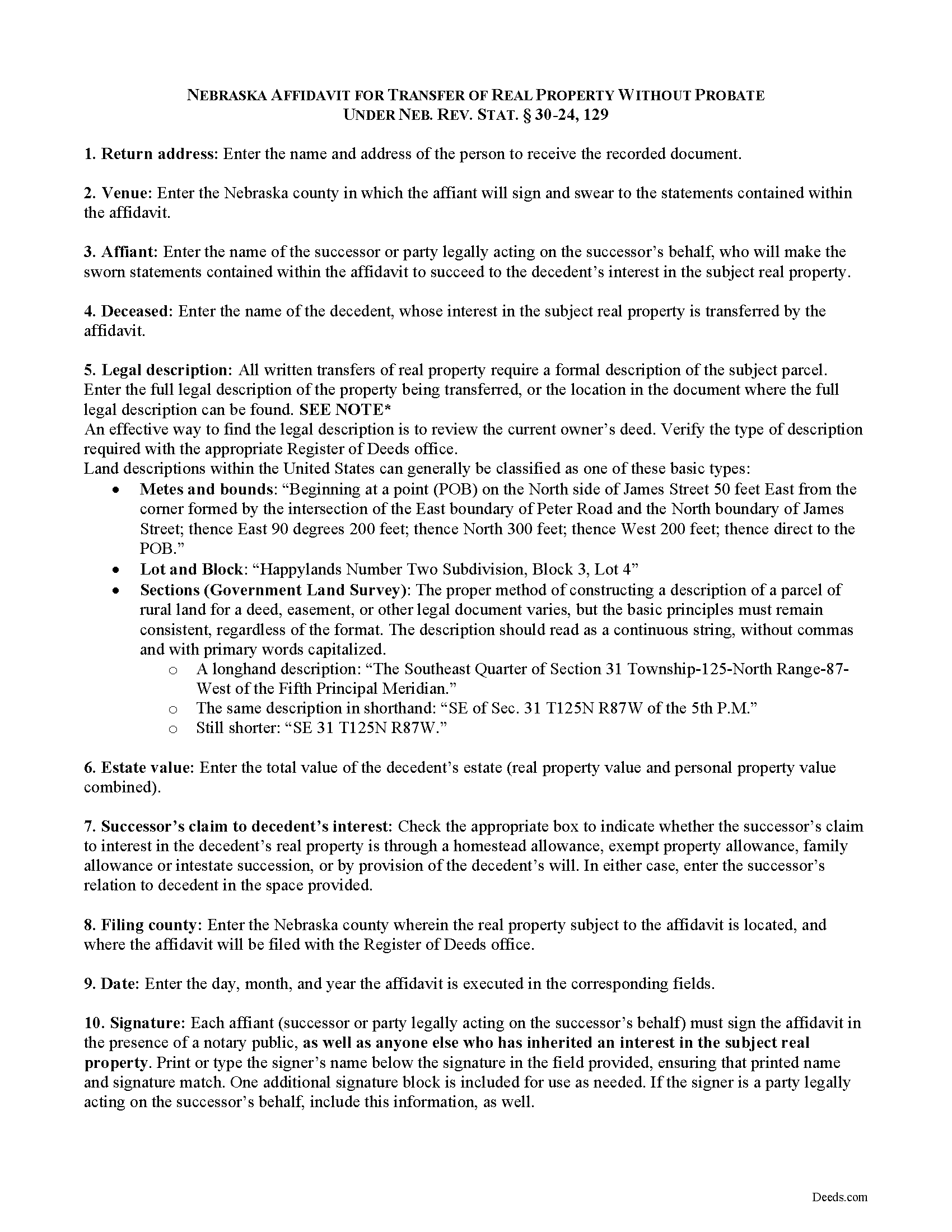

York County Affidavit for Transfer of Real Property without Probate Guide

Line by line guide explaining every blank on the form.

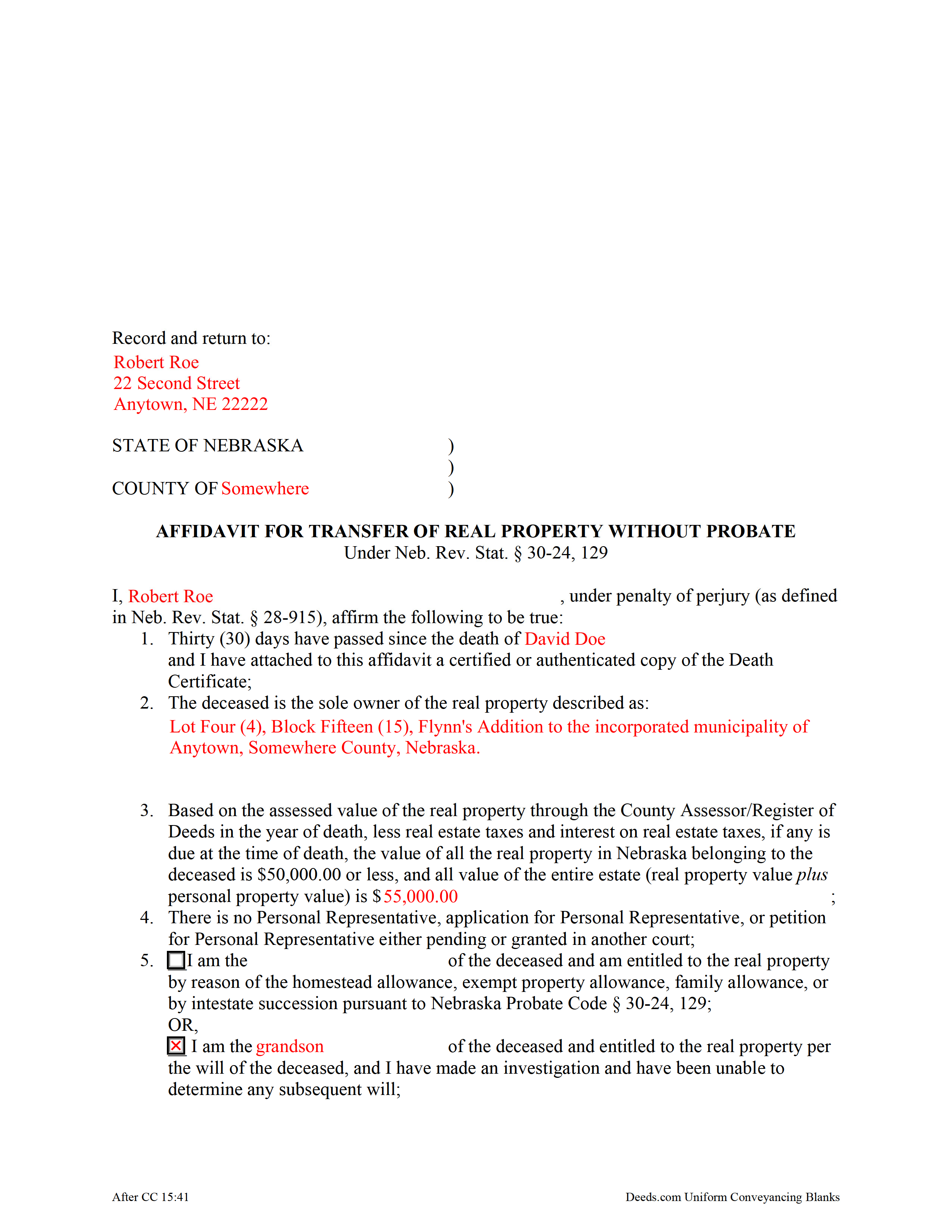

York County Completed Example of the Affidavit of Transfer of Real Property w/o Probate Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Nebraska and York County documents included at no extra charge:

Where to Record Your Documents

York County Register of Deeds

York, Nebraska 68467

Hours: 8:00am to 4:00pm Mon-Thu; Fri until 3:30pm

Phone: (402) 362-7759

Recording Tips for York County:

- Ensure all signatures are in blue or black ink

- White-out or correction fluid may cause rejection

- Request a receipt showing your recording numbers

Cities and Jurisdictions in York County

Properties in any of these areas use York County forms:

- Benedict

- Bradshaw

- Gresham

- Henderson

- Mc Cool Junction

- Waco

- York

Hours, fees, requirements, and more for York County

How do I get my forms?

Forms are available for immediate download after payment. The York County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in York County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by York County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in York County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in York County?

Recording fees in York County vary. Contact the recorder's office at (402) 362-7759 for current fees.

Questions answered? Let's get started!

Record the affidavit under the Nebraska Probate 30-24,129 to transfer a decedent's real property without probate when certain criteria are met. The affidavit must be recorded in each county in which the real property described within the affidavit is located, along with a certified copy of the decedent's death certificate.

The affiant, or person executing the affidavit, is the successor in interest to the decedent's real property described in the affidavit, or an agent legally acting on the successor's behalf.

Statutory requirements stipulate that the affidavit state that total value of the decedent's real estate interests is $50,000.00 or less; thirty (30) days have passed since the decedent's death, as evidenced by a certified copy of the death certificate; there is no personal representative or pending petition for appointment of a personal representative; the successor is entitled to receive the property through a homestead, exempt property, or family allowance, or by devise or intestate succession; the successor has made an investigation and was unable to determine a subsequent will; and no other person has a right to the interest of the subject property. In addition, the successor's relationship to the decedent, the total value of the decedent's estate, and a complete legal description of the subject parcel is required. Each successor in interest to the subject property must sign the affidavit in the presence of a notary public.

See https://supremecourt.nebraska.gov/self-help/estates/affidavit-transfer-real-property-without-probate for more information. Consult an attorney with questions regarding affidavits to collect real property outside of probate, or any other issue related to probate or decedent's property in Nebraska.

(Nebraska Affidavit Package includes form, guidelines, and completed example)

Important: Your property must be located in York County to use these forms. Documents should be recorded at the office below.

This Affidavit for Transfer of Real Property without Probate meets all recording requirements specific to York County.

Our Promise

The documents you receive here will meet, or exceed, the York County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your York County Affidavit for Transfer of Real Property without Probate form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Jubal T.

November 27th, 2024

This is the most comprehensive, helpful real estate tool I have seen. I was at first worried because the 330# didn’t have live operators but I received messages in my account as quickly as a conversation had by text and was able to download a deed and record it the same day in a county 1,300 miles away. Highly recommended!

We are sincerely grateful for your feedback and are committed to providing the highest quality service. Thank you for your trust in us.

Kenia B.

August 31st, 2020

Very convenient and efficient. I will recommend it, definitely.

Thank you!

Raymond N.

September 7th, 2023

The process of obtaining the forms that I wanted was very easy and the cost reasonable. The site is easy to follow and explains everything. Thank you for being here.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

DOYCE F.

September 25th, 2019

Very helpful.Thank you

Thank you!

KIMTIEN L.

April 5th, 2022

VERY GOOD INFORMATION ESPECIALLY FOR ME WHO IS IN CALIFORNIA AND OWN PROPERTY IN FLORIDA.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Patricia And James J.

January 1st, 2019

No review provided.

Thank you for your feedback. We really appreciate it. Have a great day!

Jeane W.

April 13th, 2024

I needed to add my partner to my warranty deed and deeds.com made it easy to understand what form I needed, attached a great explanation of the form and a sample of the form filled out. Couldn't be happier. In fact I'm researching a Revocable Transfer on Death Deed now and they've given me the confidence to rewrite my own will on my own.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Sharon S.

June 18th, 2021

very satisfied...

Thank you!

Robert L.

May 10th, 2022

I did not use your service. $19 to upload a document to our local tax accessor office is a bit high. I drove the document to the office myself.

Thank you for your feedback Robert. Glad to hear that you got your document recorded. Sorry to hear that your time, fuel, and wear on your vehicle are valued at less than $19. Have a wonderful day.

Linda D.

April 27th, 2019

It was quick & easy so thank you!

Thank you Linda.

Peggy D.

August 26th, 2021

Very helpful in finding the information for me. Quick response. Very easy to use the forms.

Thank you for your feedback. We really appreciate it. Have a great day!

Tracy M.

July 9th, 2020

The form is easy to use. However, the quit claim deed form seems to be for parcel of land, because the word "real property" is not in the form.

Thank you for your feedback. We really appreciate it. Have a great day!

Kasie K.

May 15th, 2020

This was such an easy transaction and quicker than if I went to the recording office. During this time of COVID19 and not being able to record documents in person it helped us to get what we needed and quickly. Thank you!

Thank you!

Steve W.

February 3rd, 2023

Simple and easy transaction

Thank you for your feedback. We really appreciate it. Have a great day!

Natasha M.

January 9th, 2024

Your forms, guides, sample deeds and submission process were accessible, easy to understand and simple. I also was pleasantly surprised by the efficiency, professionalism and ease of staff communicating with me after I uploaded the document to ensure the county accepted it. I will continue to use this website to record deeds. Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!