Burt County Assignment of Deed of Trust Form

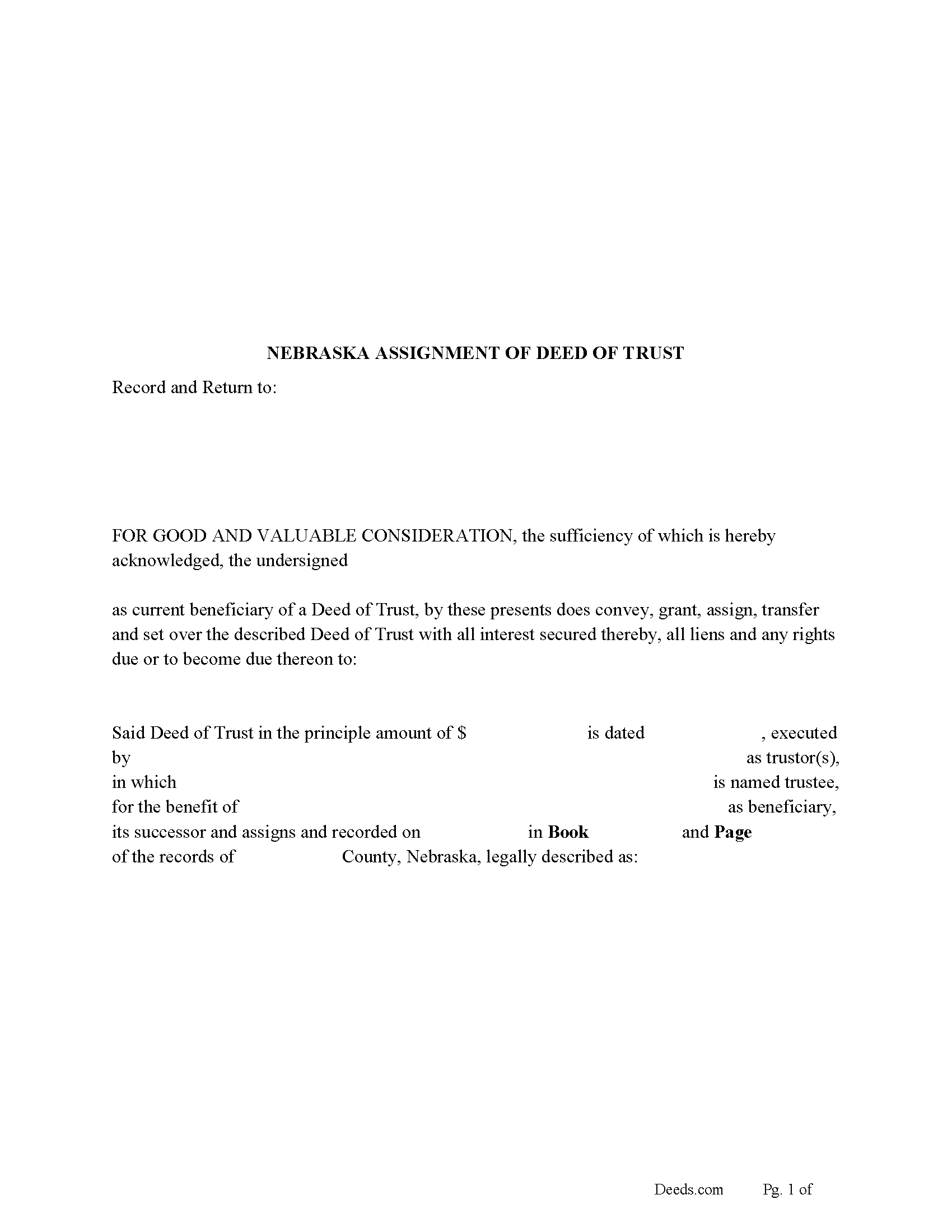

Burt County Assignment of Deed of Trust Form

Fill in the blank form formatted to comply with all recording and content requirements.

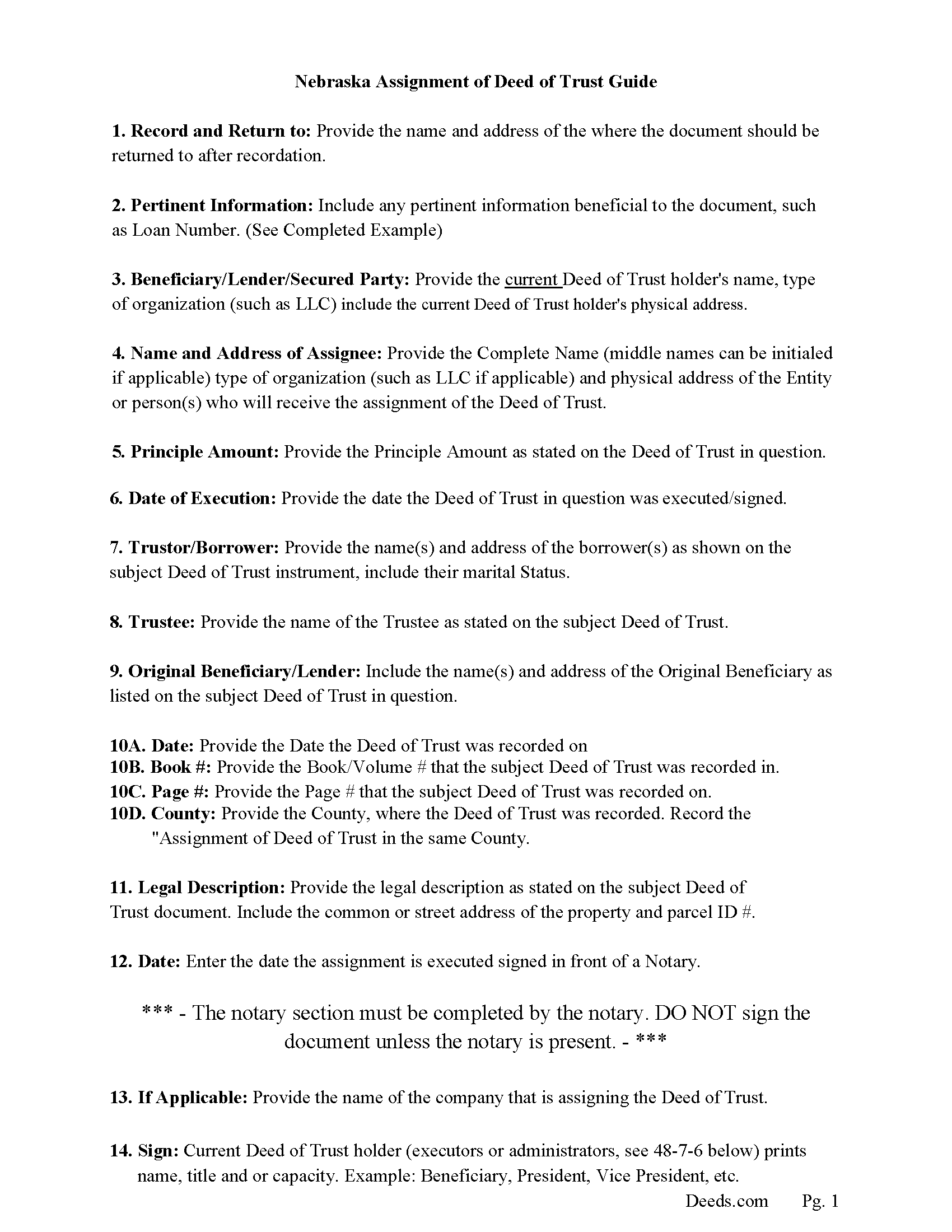

Burt County Assignment of Deed of Trust Guidelines

Line by line guide explaining every blank on the form.

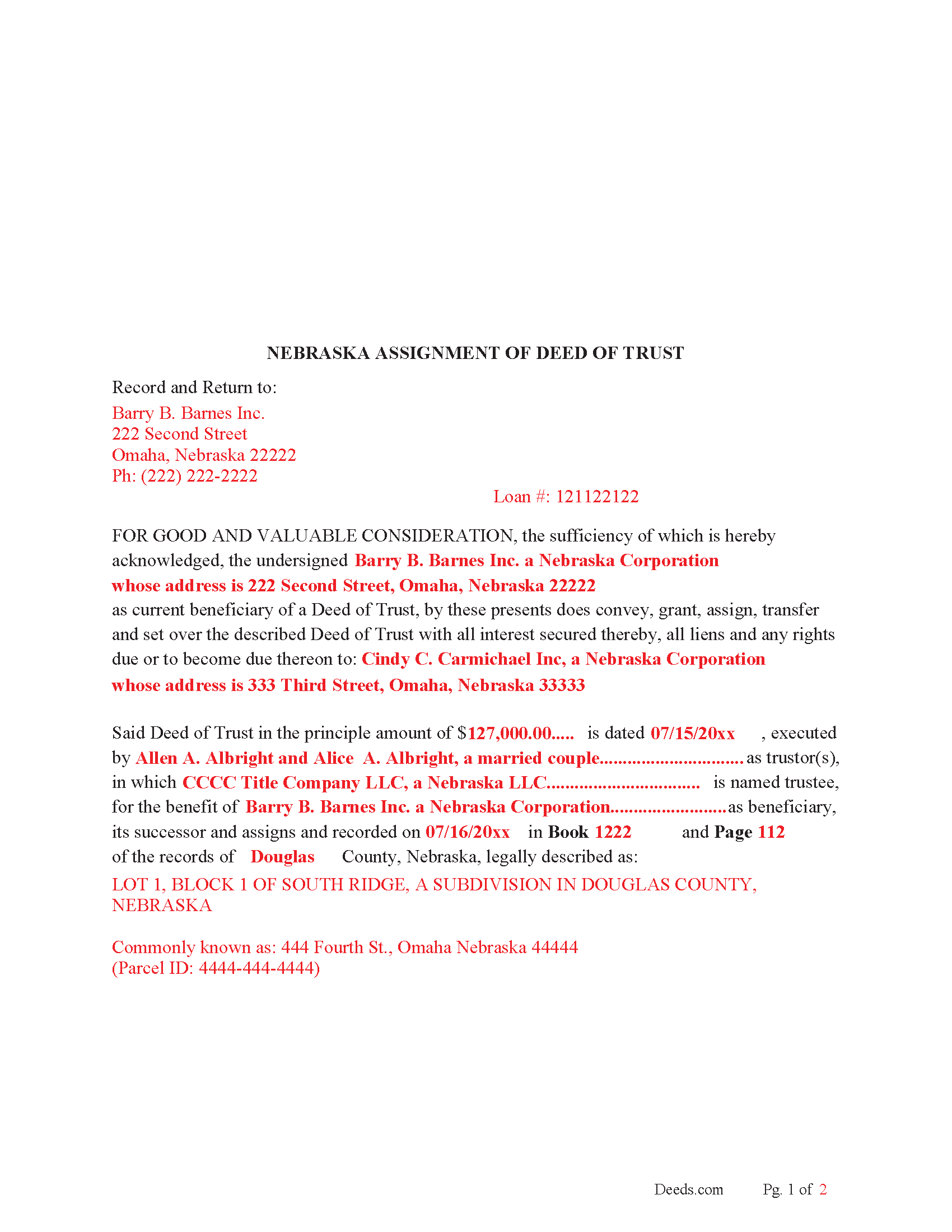

Burt County Completed Example of the Assignment of Deed of Trust Document

Example of a properly completed form for reference.

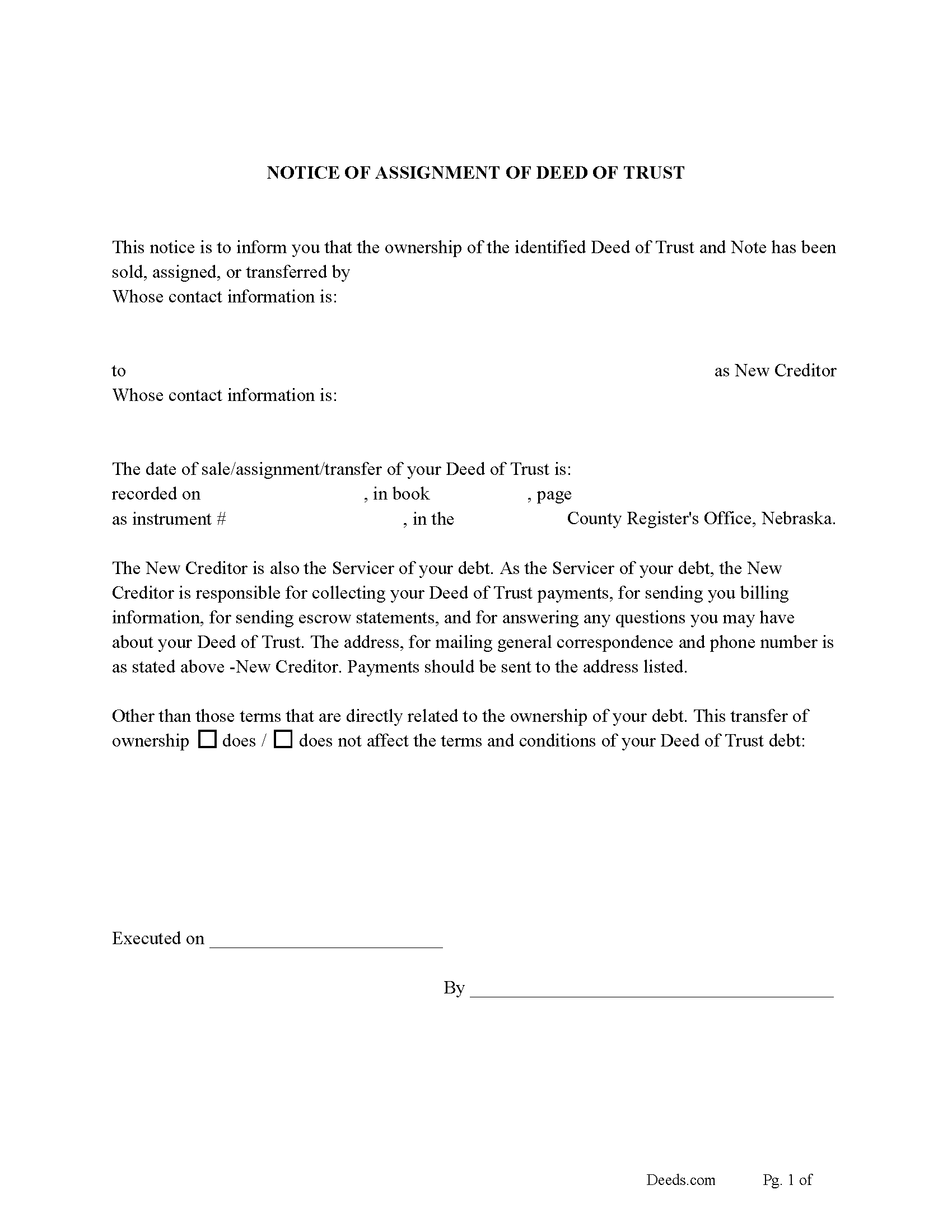

Burt County Notice of Assignment of Deed of Trust Form

Fill in the blank form formatted to comply with content requirements.

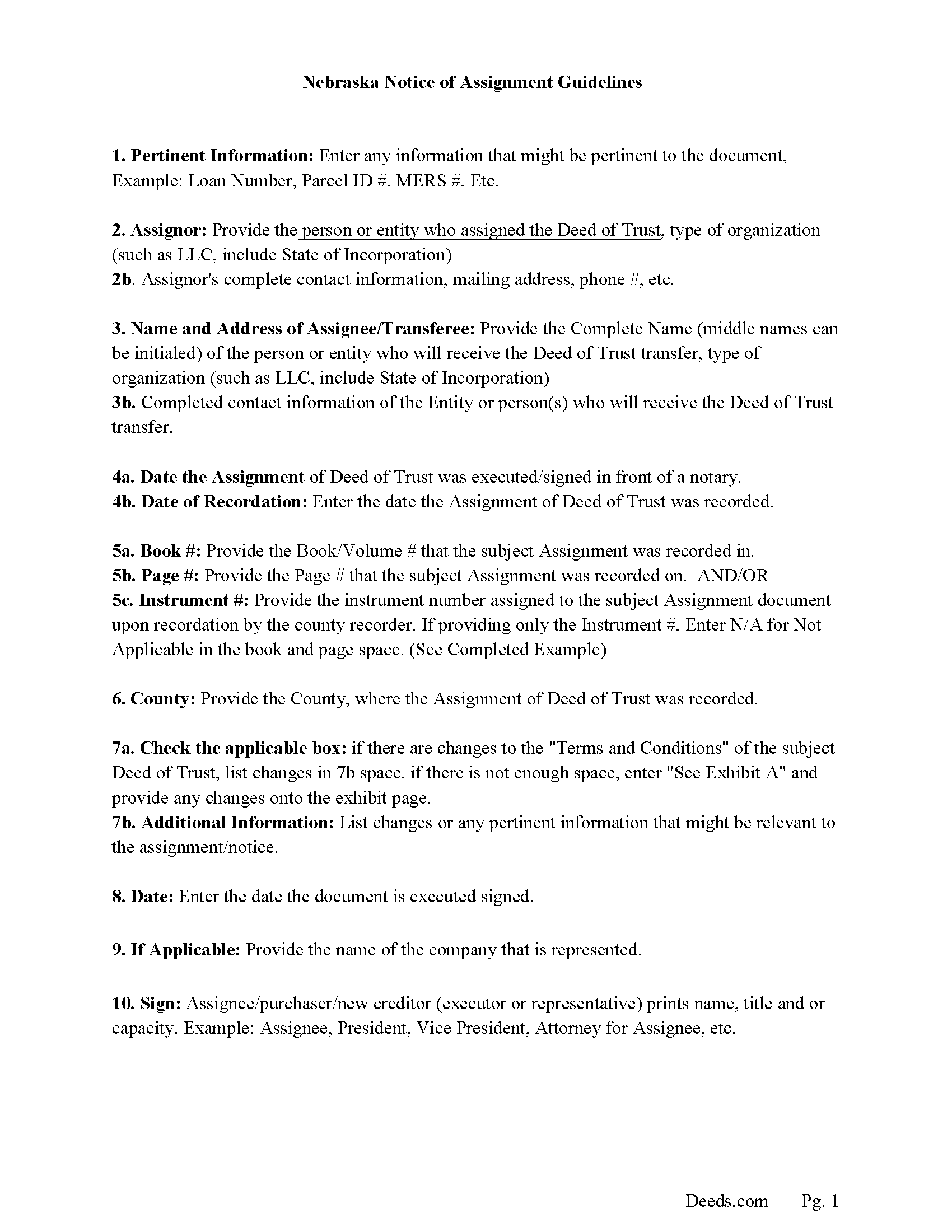

Burt County Notice of Assignment Guidelines

Line by line guide explaining every blank on the form.

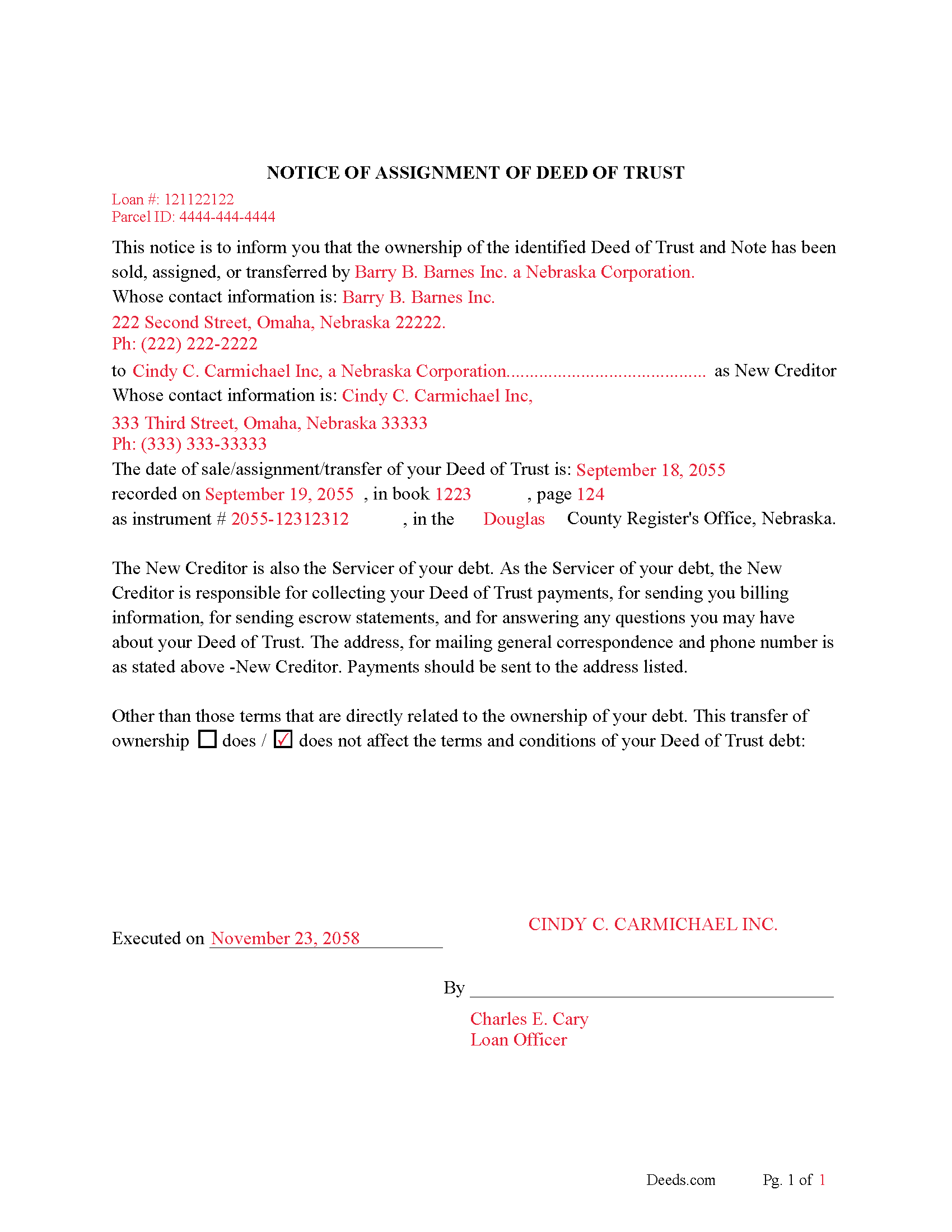

Burt County Completed Example of Notice of Assignment Document

Example of a properly completed form for reference.

All 6 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Nebraska and Burt County documents included at no extra charge:

Where to Record Your Documents

Burt County Register of Deeds

Tekamah, Nebraska 68061

Hours: 8:00 to 4:30 Monday through Friday

Phone: (402) 374-2955

Recording Tips for Burt County:

- Ensure all signatures are in blue or black ink

- Verify all names are spelled correctly before recording

- White-out or correction fluid may cause rejection

- Request a receipt showing your recording numbers

- Both spouses typically need to sign if property is jointly owned

Cities and Jurisdictions in Burt County

Properties in any of these areas use Burt County forms:

- Craig

- Decatur

- Lyons

- Oakland

- Tekamah

Hours, fees, requirements, and more for Burt County

How do I get my forms?

Forms are available for immediate download after payment. The Burt County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Burt County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Burt County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Burt County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Burt County?

Recording fees in Burt County vary. Contact the recorder's office at (402) 374-2955 for current fees.

Questions answered? Let's get started!

A Deed of Trust assignment, also referred to as an "Assignment of Deed of Trust", occurs when the beneficiary/lender of the loan transfers their loan obligations to a third party. The lender usually assigns a Deed of Trust by selling it to a new bank or lender. This form can be used by the current beneficiary/lender even if the Deed of Trust in question states a different beneficiary/lender.

Current Borrowers must be notified of the assignment. Notification consists of contact information of the new creditor, recording dates, recording instrument numbers, changes in loan, etc. Included are "Notice of Assignment of Deed of Trust" forms.

The Truth and lending act requires that borrowers be notified when their Deed of Trust has been sold, transferred, or assigned to a new creditor. Generally, within 30 days to avoid up to $2,000.00 in statutory damages, plus reasonable attorney's fees. Systematic violations can reach up $500,000.00.

(Nebraska Assignment of DOT Package includes form, guidelines, and completed example) For use in Nebraska only.

Important: Your property must be located in Burt County to use these forms. Documents should be recorded at the office below.

This Assignment of Deed of Trust meets all recording requirements specific to Burt County.

Our Promise

The documents you receive here will meet, or exceed, the Burt County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Burt County Assignment of Deed of Trust form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Joan H.

March 30th, 2021

Your service was fine but as a newly widowed senior, I wish your price was lower.

Thank you for your feedback. We really appreciate it. Have a great day!

Viola J.

August 2nd, 2021

You made this so easy to process the Executor Deed. THANK YOU a thousand times. Appreciate that all forms are in one place and I did not have to search all over the internet to get what I needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

NATALIE A.

January 6th, 2021

The form was very easy to use and the sample tool you had was very helpful. the only problem i had was saving the document and then trying to find it later. I finally was able to figure out how to save it. but i still cannot find the saved document on my computer. Luckily i printed it before i closed it and did not need to make any changes.

Thank you for your feedback. We really appreciate it. Have a great day!

THOMAS K.

August 17th, 2020

Very pleased with all info and forms

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Linda S.

March 8th, 2019

I am quite pleased with this website. I was able to complete my task with relative ease thanks to all the help these forms provided .The example forms really helped me to navigate the process. I would recommend this service highly.

Thank you Linda, we really appreciate your feedback.

Edward E.

December 22nd, 2024

Easy to use.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

Charles F.

January 15th, 2021

I am happy with the document but did not know that it would still have to go before the court. Thought it could be handled by the recorder of deeds.

Thank you for your feedback. We really appreciate it. Have a great day!

Mark C.

November 29th, 2023

WOW! I am so pleased the County Registrar’s office recommended Deeds.com. From start to a very quick finish Deeds.com worked to ensure my documents were correct and they immediately filed them. The Warranty Deed was accepted by the County and registered within a hour. Deeds.com’s communication was superb. I will use this handy resource every time I am in need.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Albo A.

September 25th, 2020

Deeds.com was fast and easy to file documents

Thank you!

Thomas D.

January 6th, 2019

Can I use this for easement in gross ? Like to grant cousins easement to use river front property with riparian rights ?

Sorry, we are unable to give advice on specific legal situations.

Ron M.

December 2nd, 2020

The download of forms, etc. was easy and the guides that were provided were good, but more information would have been nice as to where to find tax map #, parcel #, and district mentioned in Exemptions from Property Transfer Fees (and Declaration of Consideration or Value. In general, I was quite pleased with your product.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Teresa R.

February 13th, 2020

Zero problems, ended up with quality documents. Will use again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robert W.

March 26th, 2020

Easier than I thought. No problem Nice service

Thank you!

John T.

January 11th, 2022

I bought a quitclaim deed package, and it was very easy to use. Prints nicely. Two thumbs up!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Barb S.

April 9th, 2020

if i could give this site ten stars i would

Thank you!