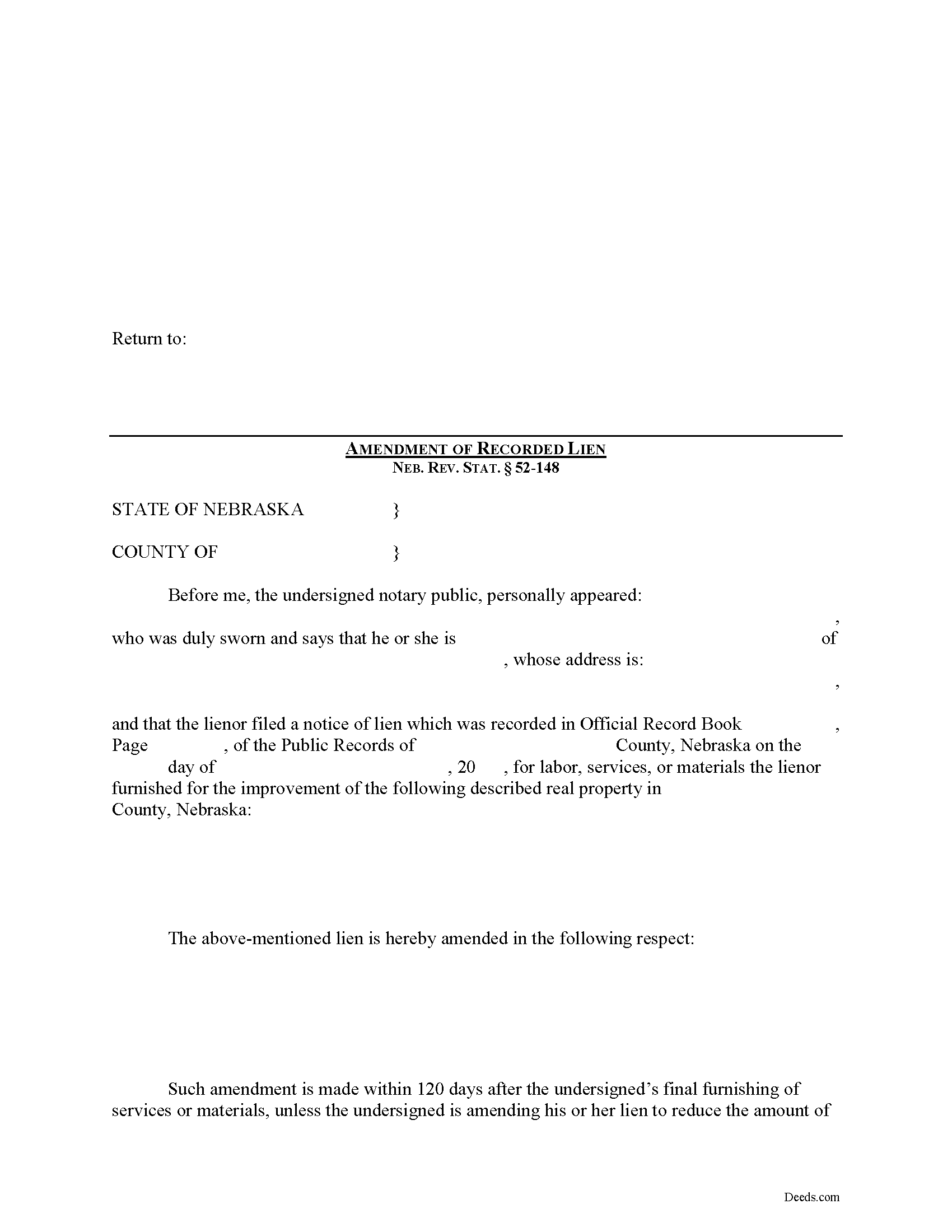

Holt County Construction Lien Amendment Form

Holt County Construction Lien Amendment Form

Fill in the blank Construction Lien Amendment form formatted to comply with all Nebraska recording and content requirements.

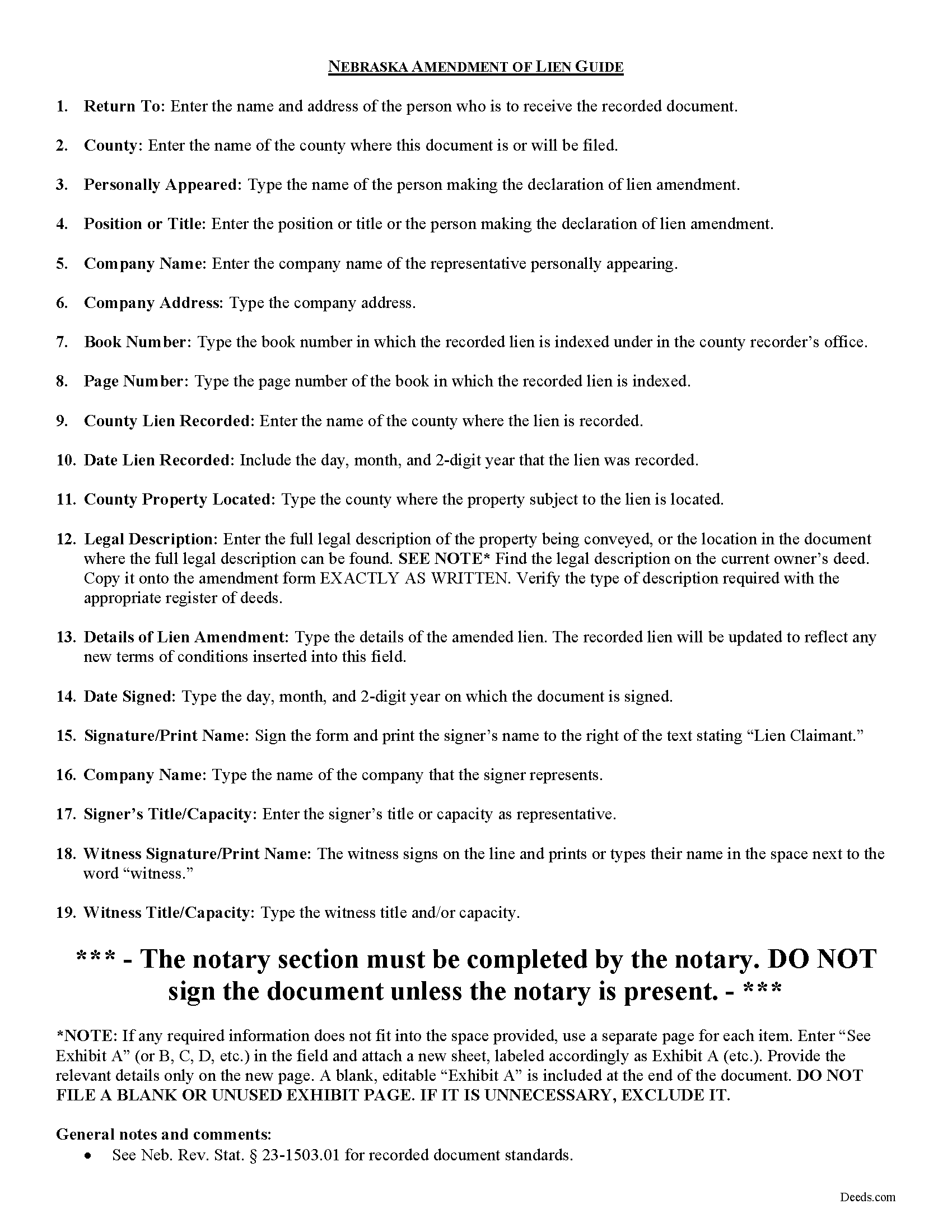

Holt County Construction Lien Amendment Guide

Line by line guide explaining every blank on the form.

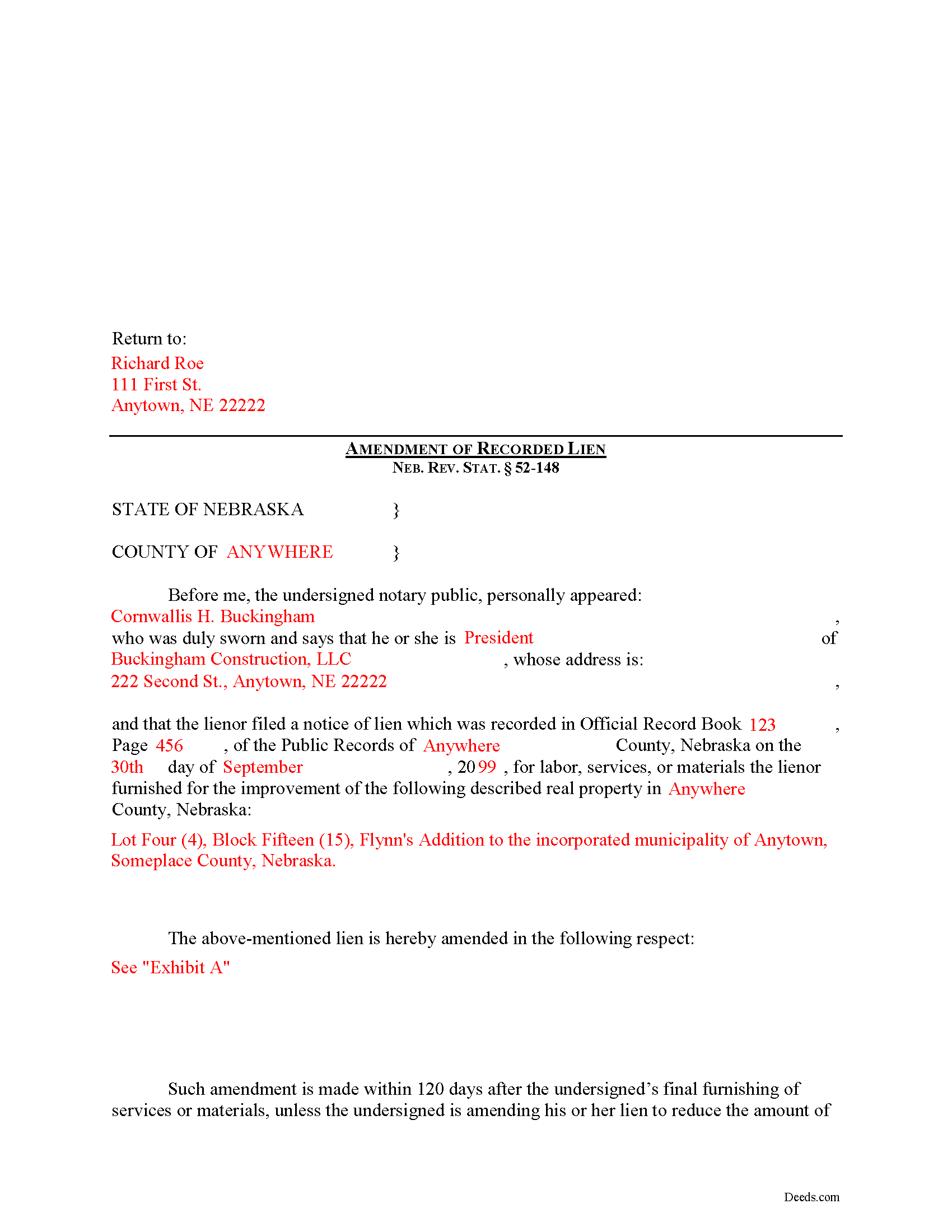

Holt County Completed Example of the Construction Lien Amendment Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Nebraska and Holt County documents included at no extra charge:

Where to Record Your Documents

Holt County Register of Deeds

O'Neill, Nebraska 68763

Hours: 8:00am to 4:30pm M-F

Phone: (402) 336-2250

Recording Tips for Holt County:

- Ensure all signatures are in blue or black ink

- Check that your notary's commission hasn't expired

- Double-check legal descriptions match your existing deed

- Ask about their eRecording option for future transactions

- Leave recording info boxes blank - the office fills these

Cities and Jurisdictions in Holt County

Properties in any of these areas use Holt County forms:

- Amelia

- Atkinson

- Chambers

- Emmet

- Ewing

- Inman

- Oneill

- Page

- Stuart

Hours, fees, requirements, and more for Holt County

How do I get my forms?

Forms are available for immediate download after payment. The Holt County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Holt County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Holt County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Holt County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Holt County?

Recording fees in Holt County vary. Contact the recorder's office at (402) 336-2250 for current fees.

Questions answered? Let's get started!

Amending a Construction Lien in Nebraska

Construction liens are governed under the Nebraska Construction Lien Act, found at Sections 52-125 to 52-159 of the Nebraska Revised Statutes.

Once a lien is recorded, there may be a reason to modify it later on. Should a modification become necessary, the claimant must file an Amendment of Recorded Lien.

A recorded lien may be amended by an additional recording at any time during the period allowed for recording the original lien. Neb. Rev. Stat. 52-148(1). An amendment adding real estate or increasing the amount of lien claimed is effective as to the additional real estate or increased amount only from the time the amendment is recorded. Id.

After the period allowed for recording the original lien, it may be amended for the purpose of: (a) Reducing the amount of the lien; (b) Reducing the real estate against which the lien is claimed; or (c) Making an apportionment of the lien among lots of a platted subdivision of record. Neb. Rev. Stat. 52-148(2).

The amendment states the recording location and date of recording of the notice of lien being amended and sets out the respects in which it is being amended. Neb. Rev. Stat. 52-148(3). It identifies the parties, the location of the subject property, and must also meet state and local standards for recorded documents.

This article is offered for informational purposes only and is not legal advice. This information not be relied upon as a substitute for speaking with an attorney. Please speak with a Nebraska attorney familiar with lien laws for any questions regarding amending a construction lien.

Important: Your property must be located in Holt County to use these forms. Documents should be recorded at the office below.

This Construction Lien Amendment meets all recording requirements specific to Holt County.

Our Promise

The documents you receive here will meet, or exceed, the Holt County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Holt County Construction Lien Amendment form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Gary H.

October 18th, 2023

The package was very helpful and very easy to use. I saved me a lot of time and eliminated attorneys being involved. I would highly recommend your forms.

It was a pleasure serving you. Thank you for the positive feedback!

RUTH O.

November 9th, 2019

Got access to the forms immediately after ordering. Lots of helpful information, forms were easy to use. Happy I choose this site.

Thank you Ruth. Have a great day!

ROSALYN L.

May 31st, 2021

I just now downloaded the forms. So far, so good.

Thank you for your feedback. We really appreciate it. Have a great day!

Marilyn C.

March 16th, 2021

Fillable documents, after a download, would be helpful. Very good to have all these forms online and accessible for an overall fee.

Thank you!

Ricky P.

October 11th, 2019

Very hard to navigate and understand. Couldn't find what I was looking for.

Sorry to hear that we failed you with our navigation Ricky. We do hope that you were able to find what you were looking for elsewhere. Have a wonderful day.

Dale Mary G.

July 14th, 2020

This was an easy site to use - saving so much time and allowing me to complete what I needed to do. All the added information, guidelines and even a sample completed form. Great!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Stephen K.

April 1st, 2023

this 5-star rating is well-deserved.

Thank you!

Sierra S.

November 30th, 2020

Thank you so much for making this process seemless. We are very pleased with the service.

Thank you!

Steve B.

February 6th, 2020

Good format. Timely response. Adding a photo of the property would be a good improvement.

Thank you for your feedback. We really appreciate it. Have a great day!

Kenneth K.

October 8th, 2019

It was fast and easy to use.

Thank you!

Glenn H.

January 15th, 2022

Searched online 3 hours until I found Deeds.com, afterwards smooth sailing definitely 5 stars

Thank you for your feedback. We really appreciate it. Have a great day!

Michael D.

November 9th, 2019

I sent Deeds.com an email with a question, asking for a little guidance as to which form(s) I need, but I'm waiting for a reply. My wife and I own 3 homes (2 in Indiana & 1 in Florida). We are needing to deed each to ourselves and put them into our living trust. I asked Deeds.com to please help by suggesting which forms I need for this. I do not want to get the wrong ones. I have not received a reply yet. When I receive a helpful reply and am able to purchase the correct forms, I am fairly certain my rating will go from 1 to 5. I withhold judgement until later.

Thank you for your feedback Michael. We make available do it yourself deed documents. We do not prepare documents or provide legal advice. If you have done research and are still unsure of which documents you need we are not the website for you. We highly recommend seeking the advice of a legal professional familiar with your specific situation moving forward. Have a wonderful day.

Gloria R.

September 12th, 2023

The website was easy.

Thank you!

John G.

August 6th, 2019

Great on line help with the recording process!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

MATTHEW R.

March 12th, 2021

Absolutely amazing throughout the whole process

Thank you!