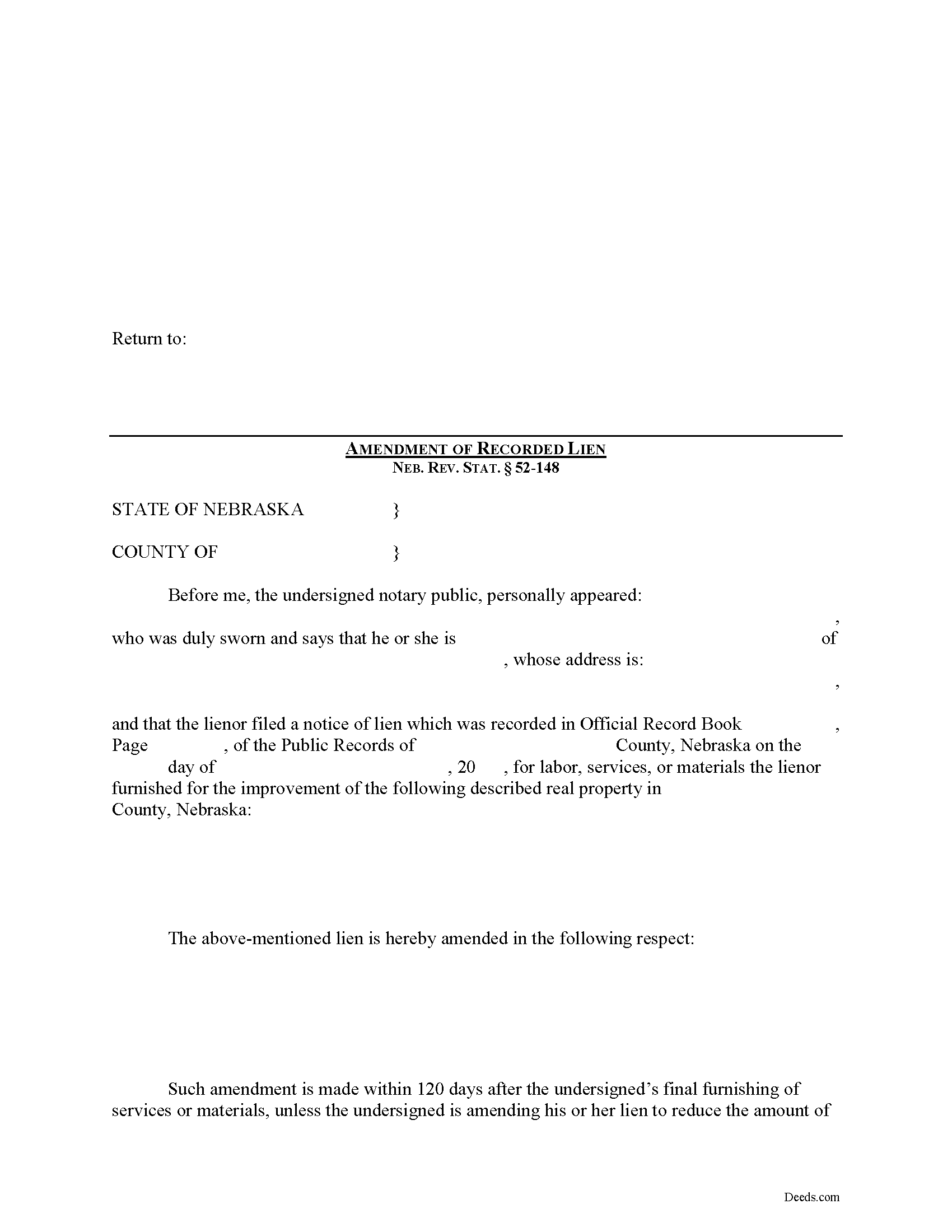

Sioux County Construction Lien Amendment Form

Sioux County Construction Lien Amendment Form

Fill in the blank Construction Lien Amendment form formatted to comply with all Nebraska recording and content requirements.

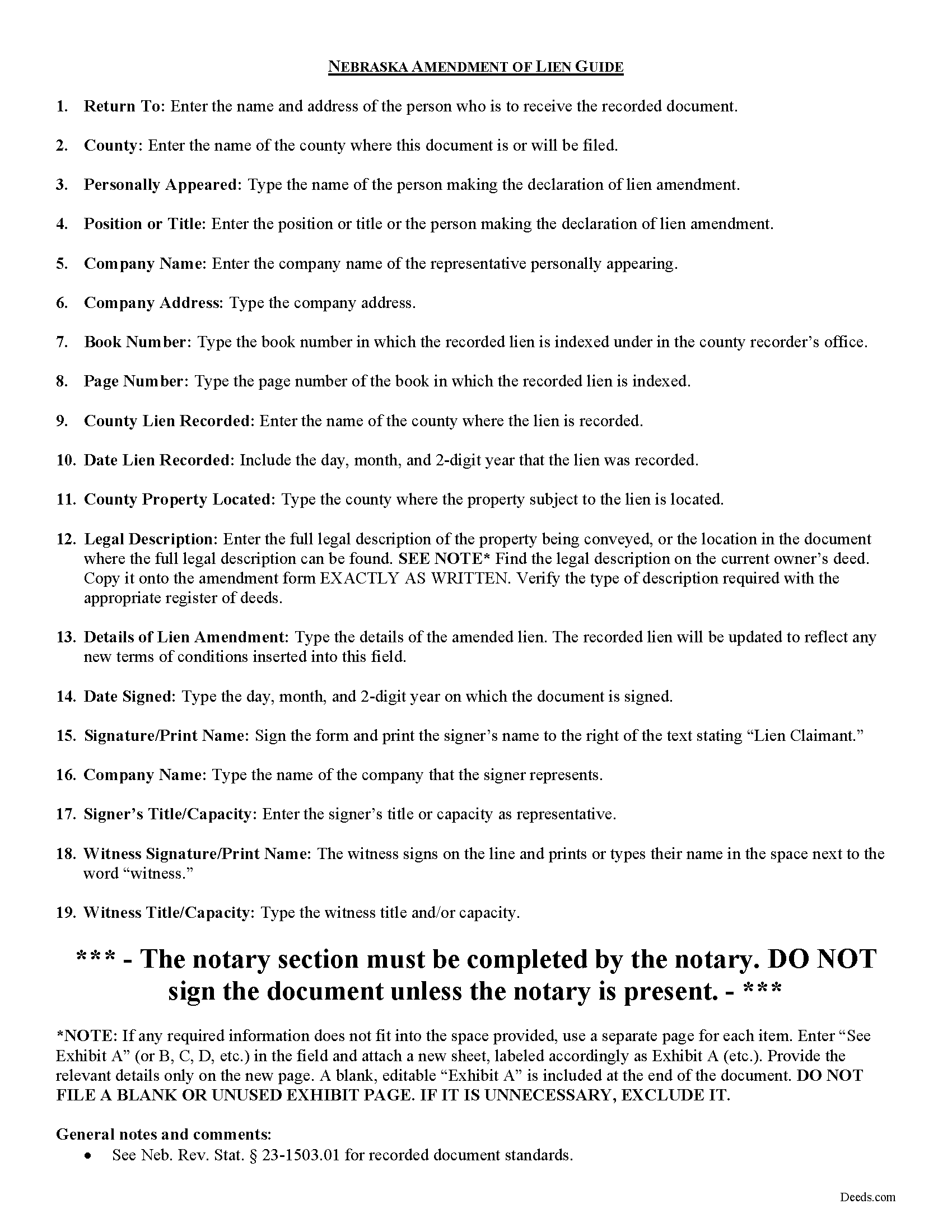

Sioux County Construction Lien Amendment Guide

Line by line guide explaining every blank on the form.

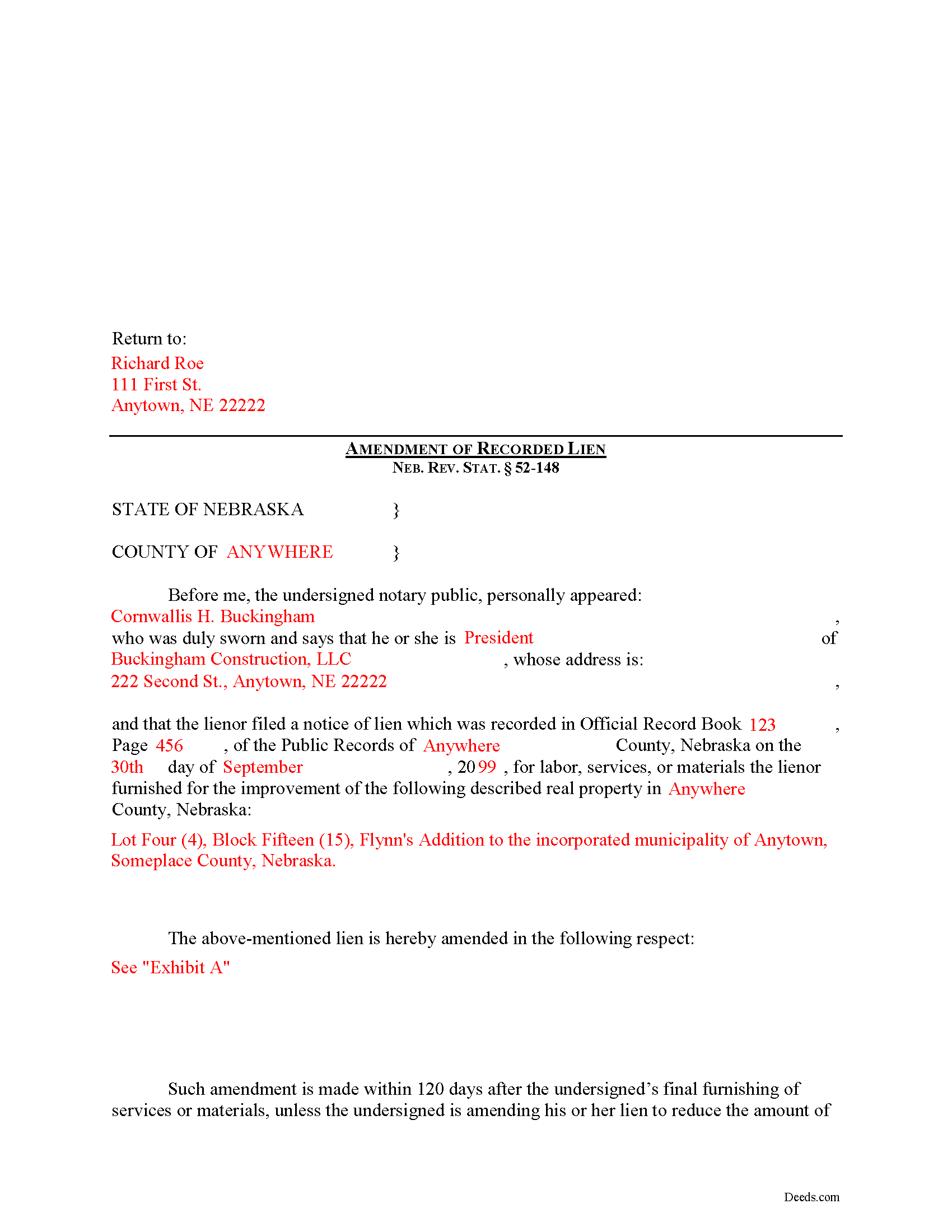

Sioux County Completed Example of the Construction Lien Amendment Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Nebraska and Sioux County documents included at no extra charge:

Where to Record Your Documents

Sioux County Register of Deeds

Harrison, Nebraska 69346

Hours: 8:00 to 4:30 M-F

Phone: (308) 668-2443

Recording Tips for Sioux County:

- Leave recording info boxes blank - the office fills these

- Some documents require witnesses in addition to notarization

- If mailing documents, use certified mail with return receipt

Cities and Jurisdictions in Sioux County

Properties in any of these areas use Sioux County forms:

- Harrison

Hours, fees, requirements, and more for Sioux County

How do I get my forms?

Forms are available for immediate download after payment. The Sioux County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Sioux County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Sioux County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Sioux County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Sioux County?

Recording fees in Sioux County vary. Contact the recorder's office at (308) 668-2443 for current fees.

Questions answered? Let's get started!

Amending a Construction Lien in Nebraska

Construction liens are governed under the Nebraska Construction Lien Act, found at Sections 52-125 to 52-159 of the Nebraska Revised Statutes.

Once a lien is recorded, there may be a reason to modify it later on. Should a modification become necessary, the claimant must file an Amendment of Recorded Lien.

A recorded lien may be amended by an additional recording at any time during the period allowed for recording the original lien. Neb. Rev. Stat. 52-148(1). An amendment adding real estate or increasing the amount of lien claimed is effective as to the additional real estate or increased amount only from the time the amendment is recorded. Id.

After the period allowed for recording the original lien, it may be amended for the purpose of: (a) Reducing the amount of the lien; (b) Reducing the real estate against which the lien is claimed; or (c) Making an apportionment of the lien among lots of a platted subdivision of record. Neb. Rev. Stat. 52-148(2).

The amendment states the recording location and date of recording of the notice of lien being amended and sets out the respects in which it is being amended. Neb. Rev. Stat. 52-148(3). It identifies the parties, the location of the subject property, and must also meet state and local standards for recorded documents.

This article is offered for informational purposes only and is not legal advice. This information not be relied upon as a substitute for speaking with an attorney. Please speak with a Nebraska attorney familiar with lien laws for any questions regarding amending a construction lien.

Important: Your property must be located in Sioux County to use these forms. Documents should be recorded at the office below.

This Construction Lien Amendment meets all recording requirements specific to Sioux County.

Our Promise

The documents you receive here will meet, or exceed, the Sioux County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Sioux County Construction Lien Amendment form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Sven S.

April 10th, 2019

great experience so far! Im using Deeds.com for e-recording. Easy to use website, document upload is a snap, you are walked through and reminded if theres something missing.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Santos V.

March 18th, 2023

Great and easy to understand.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Megan L.

July 25th, 2022

Explanation of all forms is simple and easy to understand. The forms are made in accordance to my state. This website is easy to use and navigate.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

David H.

May 25th, 2021

So So

Thank you!

Myron M.

June 30th, 2020

This is what we need and it was very helpful and easy to fill out. Thanks

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Karen C.

July 28th, 2022

Easily find and print forms necessary for peace of mind.

Thank you for your feedback. We really appreciate it. Have a great day!

Marlin M.

March 10th, 2025

all round GREAT!

Always great to hear kind words from such a long time customer Marlin, thank you.

Doug C.

November 20th, 2020

Great Job guys! I would not even have thought to look for this service. The county recorder's office and kiosks are all closed because of covid. I was directed to you because of a referral on the county site. I wish I had known you had forms available as well. I searched for a day to find the appropriate form.

Thank you for your feedback. We really appreciate it. Have a great day!

David H.

March 25th, 2022

It was great

Thank you!

Deborah Anne C.

July 16th, 2024

Easy, Comprehensive and most importantly Easy!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Cameron M.

June 6th, 2023

This service is amazing. Always same day recording. Quick and easy. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Deborah P.

June 7th, 2021

Very good information. Easy access and easy to download. All the forms needed for TOD to be notarized and recorded with the county office. Much better than working with a Trust and the expense of lawyers, especially when several parties are involved and the owner of said property knows exactly to whom the property should go. Having forms and instructions available for the public to have their wishes recorded and confirmed makes handling final planning much easier and prevents family members from having the unnecessary task of going through court to solve property distribution issues. Thank you for this site and the forms you provide. I will recommend Deeds.com to those I know who are making final plans.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

John Q.

June 26th, 2020

I downloaded the forms, which was very easy, and filled them out with the help of the very helpful instructions! I was able to go down to my court house and file the forms within 24 hours of downloading! I am at peace knowing my son's will avoid a lot of headaches when I pass because my property deed will transfer to them without probate court TOD !!!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Aldona P.

April 9th, 2020

Awesome Job! thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jane D.

February 5th, 2021

Very easy to navigate and we get exactly what we need, when we need it! Also, they keep Tra k of previous purchases, so you don't have to repurchase! It's great!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!