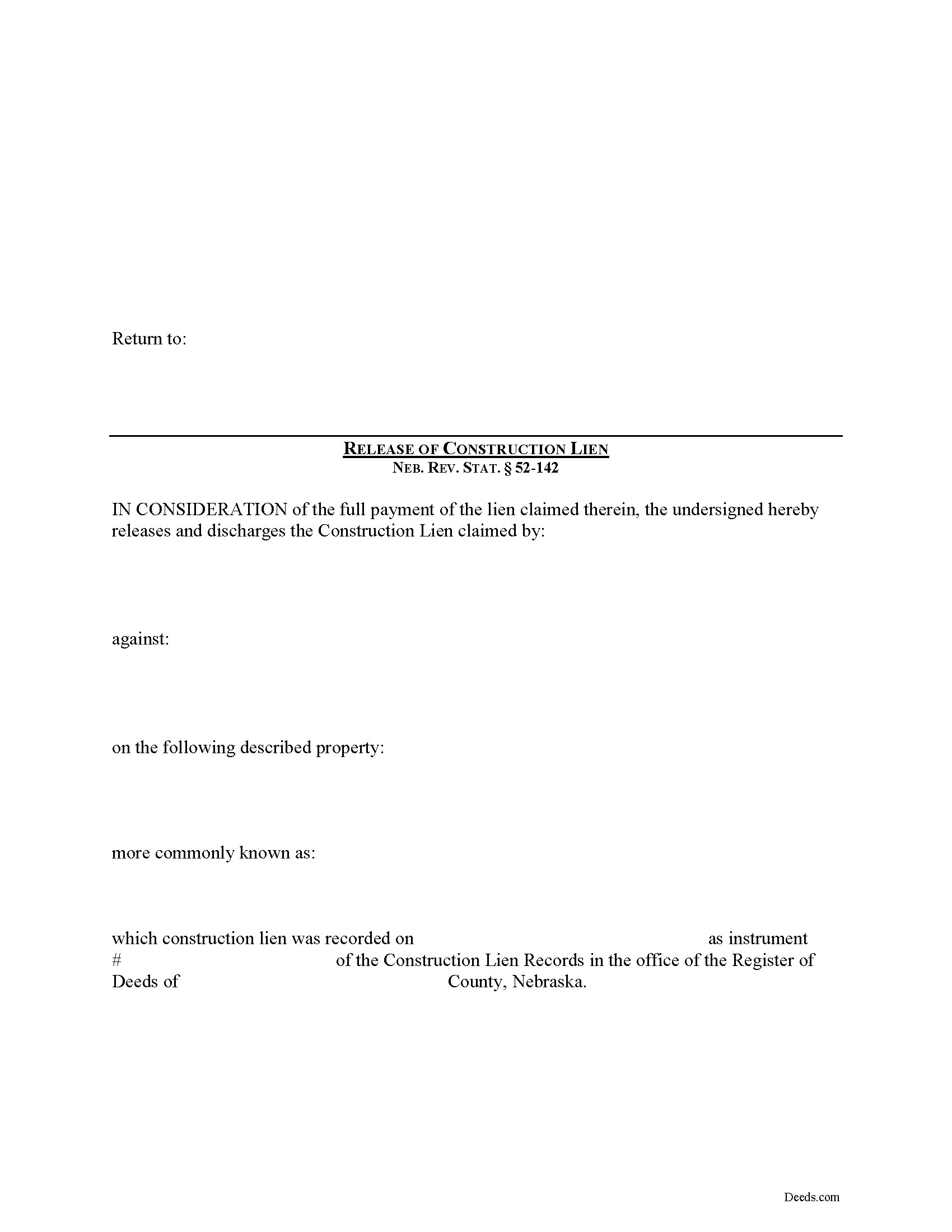

Kearney County Construction Lien Release Form

Kearney County Construction Lien Release Form

Fill in the blank Construction Lien Release form formatted to comply with all Nebraska recording and content requirements.

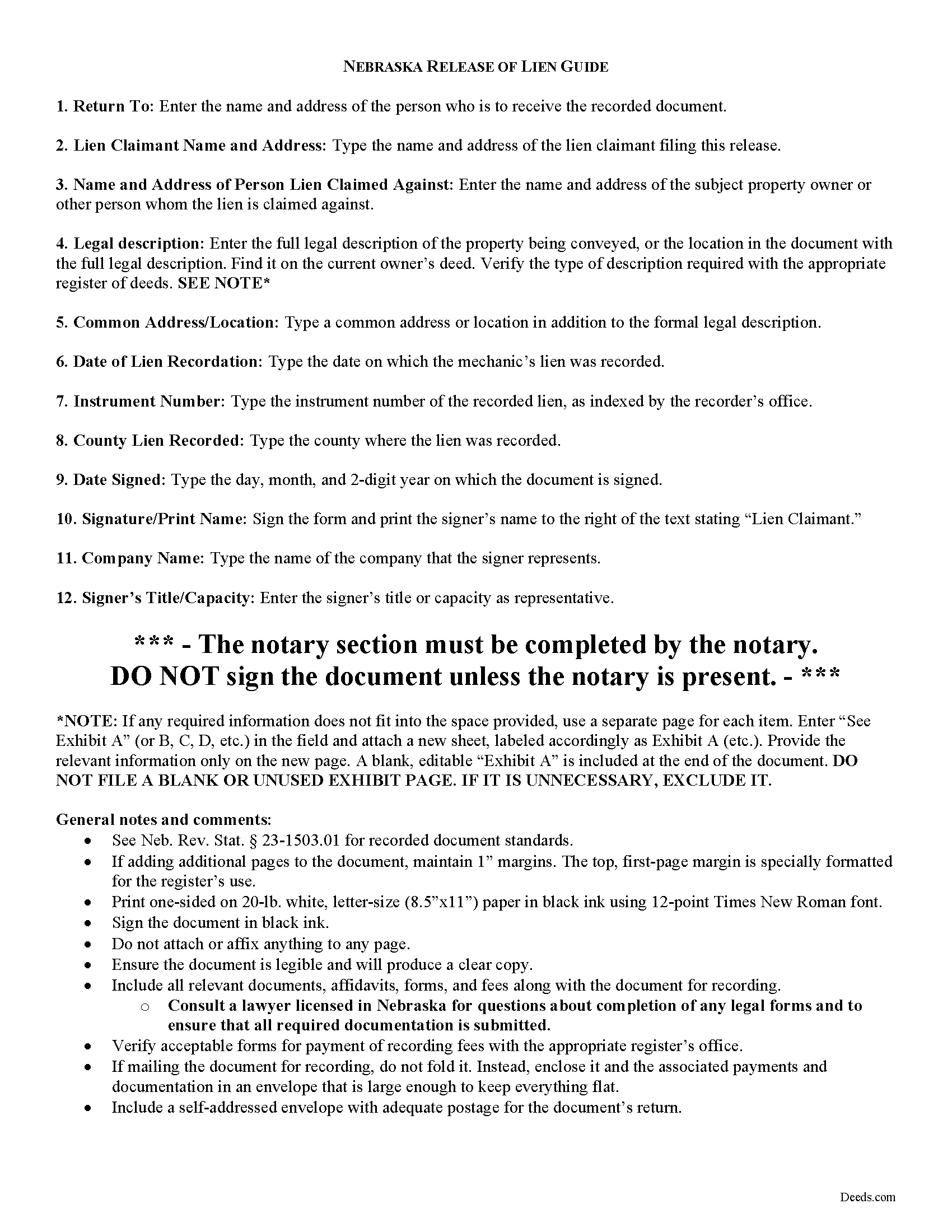

Kearney County Construction Lien Release Guide

Line by line guide explaining every blank on the form.

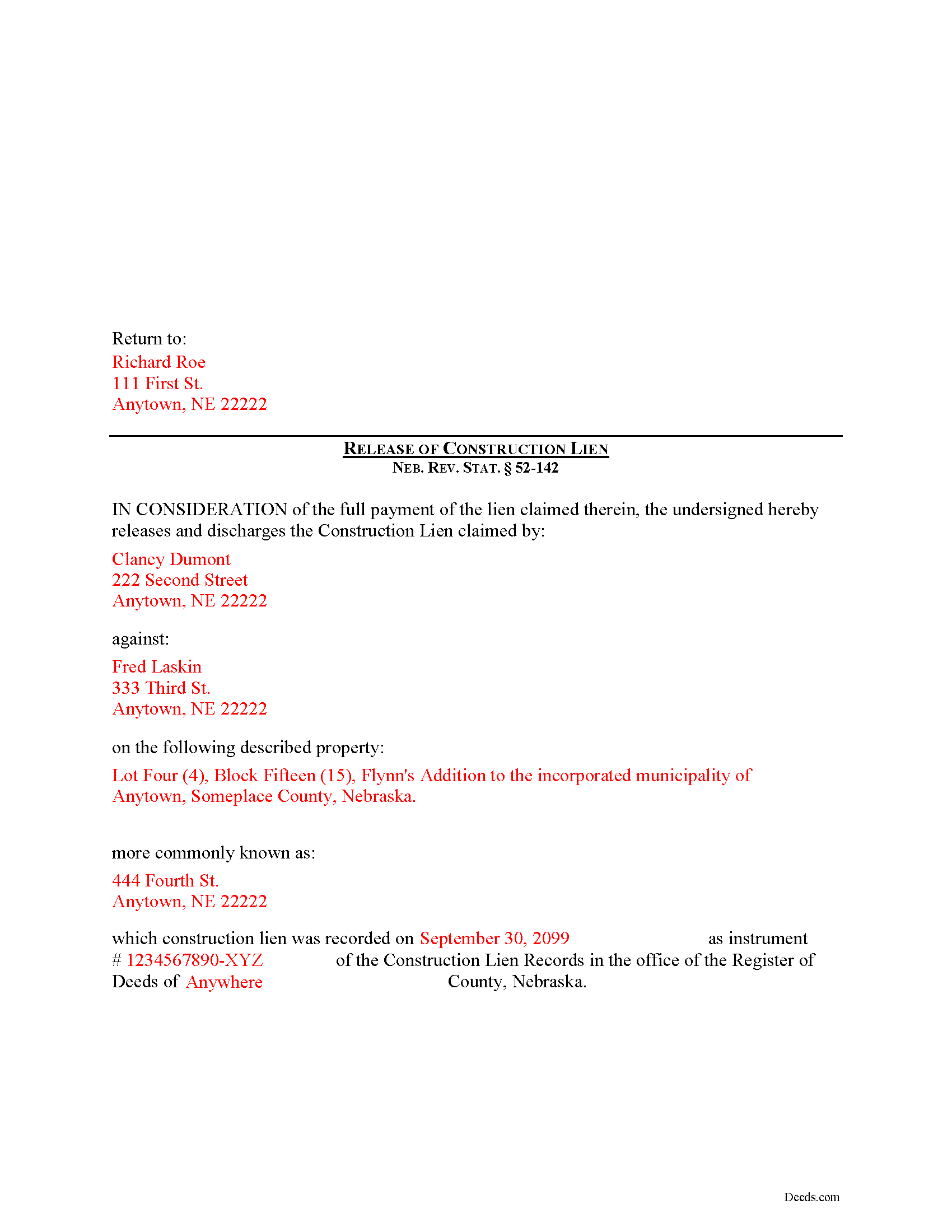

Kearney County Completed Example of the Construction Lien Release Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Nebraska and Kearney County documents included at no extra charge:

Where to Record Your Documents

Kearney County Register of Deeds

Minden, Nebraska 68959

Hours: 8:30 to 5:00 M-F

Phone: (308) 832-2723

Recording Tips for Kearney County:

- Check that your notary's commission hasn't expired

- Ask if they accept credit cards - many offices are cash/check only

- Ask about accepted payment methods when you call ahead

Cities and Jurisdictions in Kearney County

Properties in any of these areas use Kearney County forms:

- Axtell

- Heartwell

- Minden

- Wilcox

Hours, fees, requirements, and more for Kearney County

How do I get my forms?

Forms are available for immediate download after payment. The Kearney County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Kearney County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Kearney County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Kearney County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Kearney County?

Recording fees in Kearney County vary. Contact the recorder's office at (308) 832-2723 for current fees.

Questions answered? Let's get started!

Releasing a Construction Lien in Nebraska

Construction liens are governed under the Nebraska Construction Lien Act, found at Sections 52-125 to 52-159 of the Nebraska Revised Statutes.

After a recorded lien has been paid off, it must be released by someone with an interest in the subject property. Neb. Rev. Stat. 52-142(1).

Any person having an interest in real estate may release the real estate from liens which have attached to it by: (a) Depositing in the office of the clerk of the district court of the county in which the lien is recorded a sum of money in cash, certified check, or other bank obligation, or a surety bond issued by a surety company authorized to do business in this state, in an amount sufficient to pay the total of the amounts claimed in the liens being released plus fifteen percent of such total; and (b) Recording a certificate of the clerk of the district court showing that the deposit has been made. 52-142(1)(a)-(c).

The clerk of the district court has an obligation to accept the deposit and issue the certificate. Neb. Rev. Stat. 52-142(2). Upon release of the real estate from a lien, the claimant's rights are transferred from the real estate to the deposit or surety bond and the claimant may establish his or her claim, and upon determination of the claim the court shall order the clerk of the district court to pay the sums due or render judgment against the surety company on the bond, as the case may be. 52-142(3).

The lien release form contains the names and addresses of both the lien claimant and property owner, a legal description of the subject property, and details of the underlying lien including the recorded instrument number, date of recordation, and amount of the lien. It must also meet all state and local standards for recorded documents.

This article is offered for informational purposes only and is not legal advice. This information should not be relied upon as a substitute for speaking with an attorney. Please speak with a Nebraska attorney familiar with lien laws for any questions regarding releasing a construction lien.

Important: Your property must be located in Kearney County to use these forms. Documents should be recorded at the office below.

This Construction Lien Release meets all recording requirements specific to Kearney County.

Our Promise

The documents you receive here will meet, or exceed, the Kearney County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Kearney County Construction Lien Release form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4588 Reviews )

Priscilla M.

December 30th, 2020

Instructions are easy to follow which make filling out the forms easy and simple. I would definitely recommend Deeds.com.

Thank you!

B A A.

March 9th, 2023

So far I like the ease of availability of the site and the help guides.

Thank you for your feedback. We really appreciate it. Have a great day!

Steven C.

May 1st, 2019

Easy but a little overpriced

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

terrence h.

October 14th, 2023

Professional

Thank you!

Bill M.

September 21st, 2022

I found the path from the home page to actually ordering the document I wanted extremely convoluted and non-intuitive. I went around in circles several times before I figured out how to actually buy the document.

Thank you for your feedback. We really appreciate it. Have a great day!

matthew h.

June 6th, 2022

Totally awesome. Useless waste of time looking anywhere else for real estate deed forms. All the stars!!

Thank you!

Rene S.

December 23rd, 2022

Amazing forms and great value. That may sound like hyperbole talking about legal forms but it's not, you really are getting way more than you pay for here.

Thank you for your feedback. We really appreciate it. Have a great day!

Jeannine W.

September 16th, 2020

prompt, efficient service.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Christine K.

February 12th, 2021

While I was initially disappointed I could not go to the local County to file my paperwork due to Covid-19, I was thrilled to work with Deeds.com. Their staff was INCREDIBLY FAST, super knowledgeable and the whole process happened from my computer in minutes. Very positive experience.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Cynthia M.

July 5th, 2019

I wanted the Lady Bird Deed for my estate, and it was very easy to download, fill out and file. My county records department accepted it with no issue. Thank you Deeds.com! You saved me over $500.00!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Judith G.

January 25th, 2019

Thank you, it was easy and fast. The clerks office filed without question.

Thank you Judith, have a fantastic day!

maria b.

November 1st, 2020

really easy and and helpful.

Thank you!

Kathy Ann M.

June 26th, 2020

Got the report. However, Retrieving process was not clear.

Thank you for your feedback. We really appreciate it. Have a great day!

Laura S.

April 21st, 2025

Easy to utilize database and instructions!

We are grateful for your feedback and looking forward to serving you again. Thank you!

Margaret G.

April 5th, 2022

Easy to navigate.

Thank you!