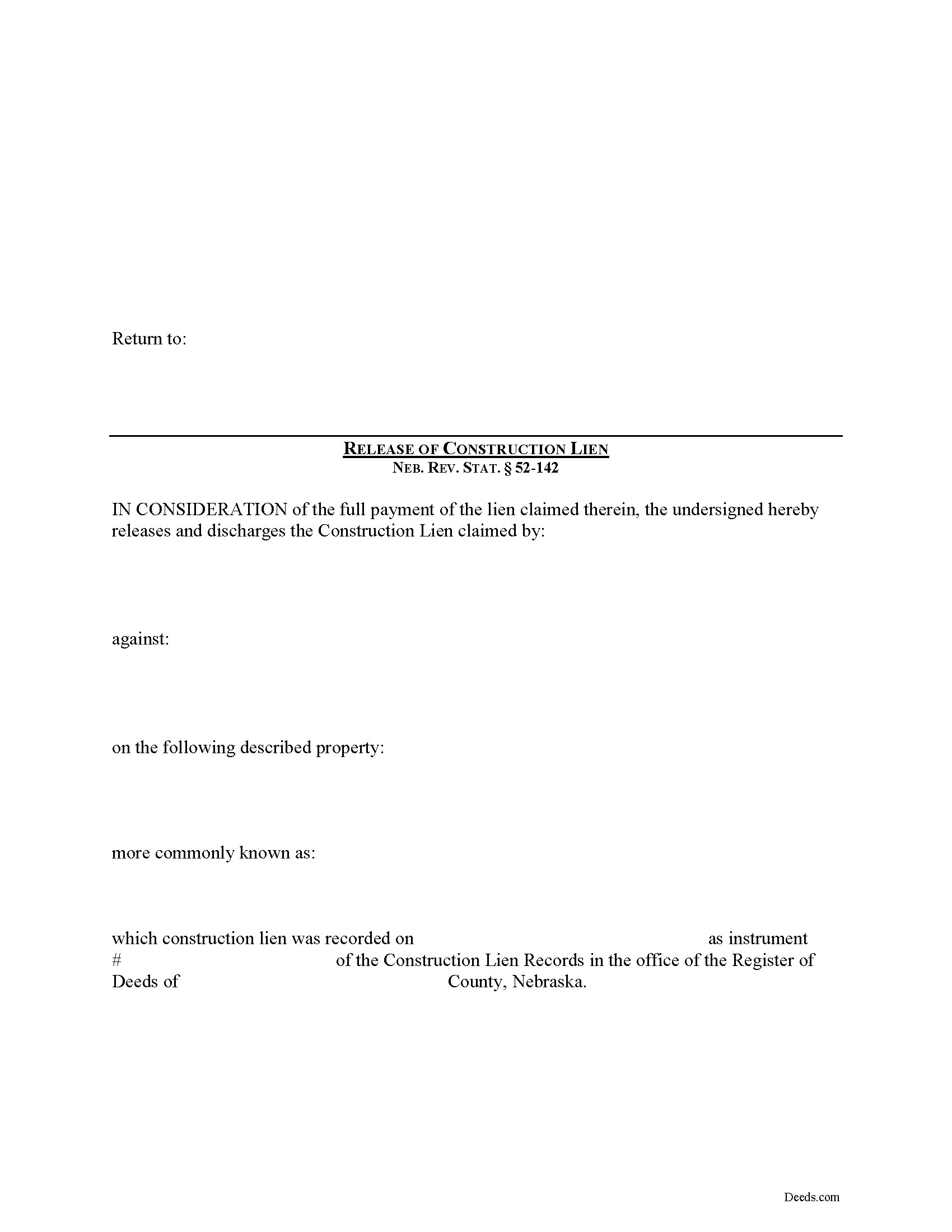

Keya Paha County Construction Lien Release Form

Keya Paha County Construction Lien Release Form

Fill in the blank Construction Lien Release form formatted to comply with all Nebraska recording and content requirements.

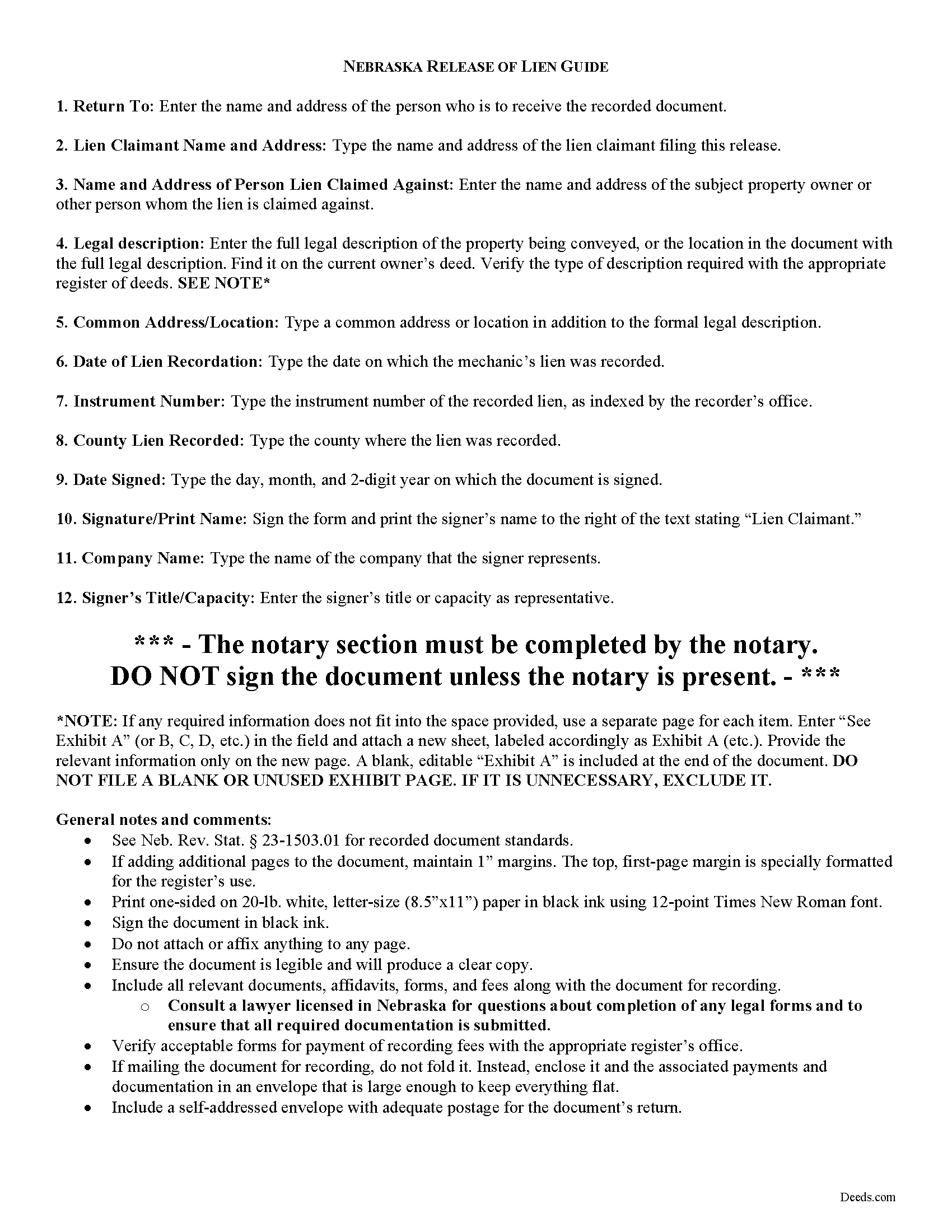

Keya Paha County Construction Lien Release Guide

Line by line guide explaining every blank on the form.

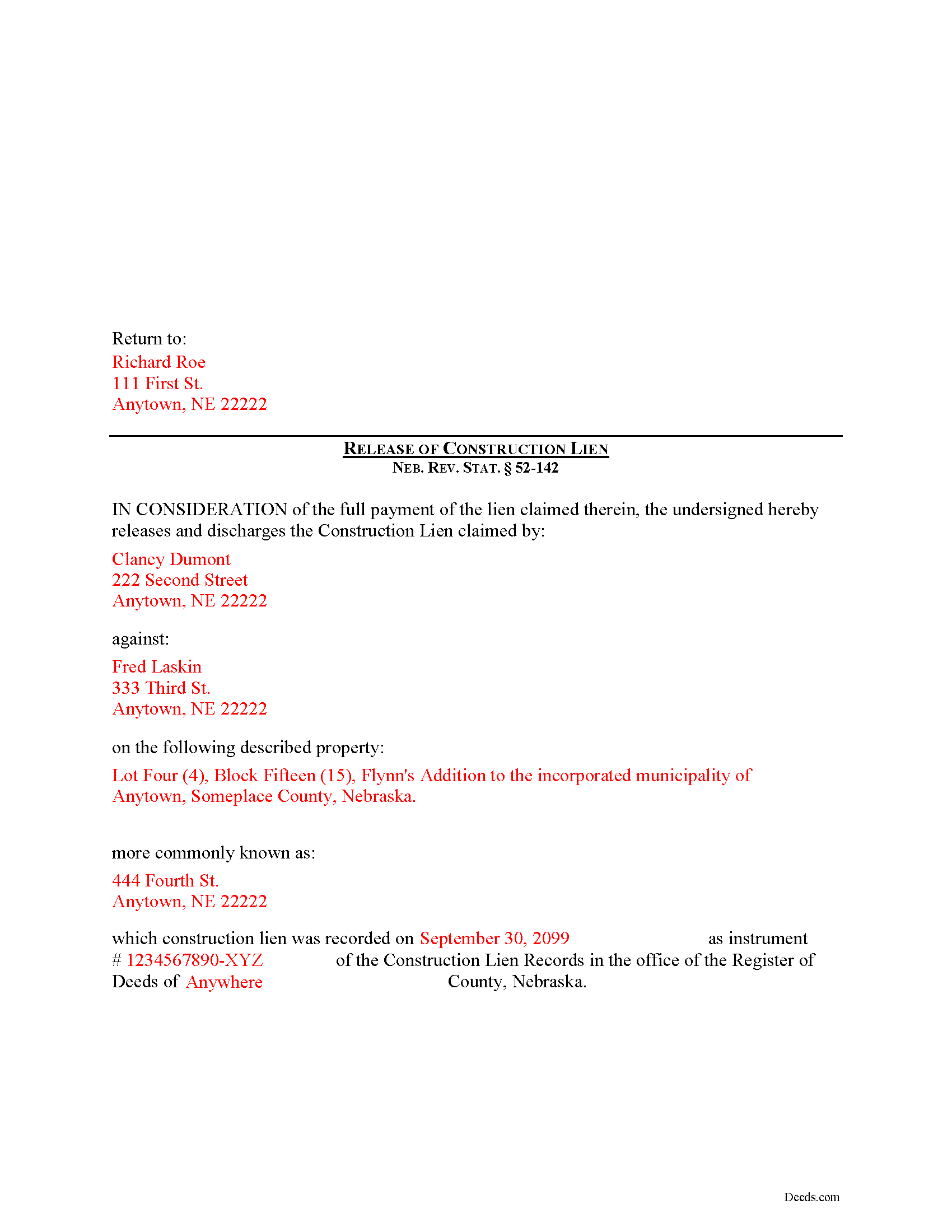

Keya Paha County Completed Example of the Construction Lien Release Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Nebraska and Keya Paha County documents included at no extra charge:

Where to Record Your Documents

Keya Paha County Register of Deeds

Springview, Nebraska 68778

Hours: 8:00am-5:00pm M-F

Phone: (402) 497-3791

Recording Tips for Keya Paha County:

- Ensure all signatures are in blue or black ink

- Double-check legal descriptions match your existing deed

- Make copies of your documents before recording - keep originals safe

- Both spouses typically need to sign if property is jointly owned

- If mailing documents, use certified mail with return receipt

Cities and Jurisdictions in Keya Paha County

Properties in any of these areas use Keya Paha County forms:

- Mills

- Newport

- Springview

Hours, fees, requirements, and more for Keya Paha County

How do I get my forms?

Forms are available for immediate download after payment. The Keya Paha County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Keya Paha County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Keya Paha County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Keya Paha County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Keya Paha County?

Recording fees in Keya Paha County vary. Contact the recorder's office at (402) 497-3791 for current fees.

Questions answered? Let's get started!

Releasing a Construction Lien in Nebraska

Construction liens are governed under the Nebraska Construction Lien Act, found at Sections 52-125 to 52-159 of the Nebraska Revised Statutes.

After a recorded lien has been paid off, it must be released by someone with an interest in the subject property. Neb. Rev. Stat. 52-142(1).

Any person having an interest in real estate may release the real estate from liens which have attached to it by: (a) Depositing in the office of the clerk of the district court of the county in which the lien is recorded a sum of money in cash, certified check, or other bank obligation, or a surety bond issued by a surety company authorized to do business in this state, in an amount sufficient to pay the total of the amounts claimed in the liens being released plus fifteen percent of such total; and (b) Recording a certificate of the clerk of the district court showing that the deposit has been made. 52-142(1)(a)-(c).

The clerk of the district court has an obligation to accept the deposit and issue the certificate. Neb. Rev. Stat. 52-142(2). Upon release of the real estate from a lien, the claimant's rights are transferred from the real estate to the deposit or surety bond and the claimant may establish his or her claim, and upon determination of the claim the court shall order the clerk of the district court to pay the sums due or render judgment against the surety company on the bond, as the case may be. 52-142(3).

The lien release form contains the names and addresses of both the lien claimant and property owner, a legal description of the subject property, and details of the underlying lien including the recorded instrument number, date of recordation, and amount of the lien. It must also meet all state and local standards for recorded documents.

This article is offered for informational purposes only and is not legal advice. This information should not be relied upon as a substitute for speaking with an attorney. Please speak with a Nebraska attorney familiar with lien laws for any questions regarding releasing a construction lien.

Important: Your property must be located in Keya Paha County to use these forms. Documents should be recorded at the office below.

This Construction Lien Release meets all recording requirements specific to Keya Paha County.

Our Promise

The documents you receive here will meet, or exceed, the Keya Paha County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Keya Paha County Construction Lien Release form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4588 Reviews )

David K.

March 16th, 2023

Price seemed high (~$28) for just some forms (especially because we may not actually use the forms), but it beats navigating the Hawaii state and Honolulu county websites for forms. It would be better if a single button push would download all 7 or 8 forms.

Thank you for your feedback. We really appreciate it. Have a great day!

Ronnie W T.

September 16th, 2022

Very fast and efficient as soon as we paid for the document, it was downloaded to us immediately.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Dianne W.

July 14th, 2020

Thank you for responding so quickly to my question. I was able to locate the form and get everything downloaded. Once I saw the icon, it was easy peasy!!

Thank you!

David D.

January 28th, 2021

Forms were quick to receive and appear to be what I need to complete our task.

Thank you for your feedback. We really appreciate it. Have a great day!

Deirdre M.

July 11th, 2022

Thank for you guidance to amend & correct & recover my home with evidence you provide in Dead Fraud. I'll keep you updated.

Thank you!

michael k.

February 24th, 2023

fast and easy to fill out forms.

Thank you!

Cynthia W.

August 19th, 2022

I like the support documents that go along with the easement template and the fact that the format is specific to a state and county.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Tawnya P.

November 2nd, 2022

I can't believe I haven't found Deeds.com sooner. They made my job so much easier!! They make recording documents effortless. I'm so grateful.

Thank you for your feedback. We really appreciate it. Have a great day!

Greg G.

January 7th, 2021

Easiest Filing I've ever done, and filed in 24 hours.

Thank you!

Annelie A.

April 22nd, 2020

Unfortunately the forms were not useful to me, I still had to go pay a lawyer to create a deed for me.

Thank you for your feedback. We really appreciate it. Have a great day!

Susie k.

March 3rd, 2020

No complaints

Thank you!

pete k.

February 11th, 2021

Excellent service and quick turnaround time.I ordered a copy of my property deed and I received a downloadable digital copy in about 10 to 15 minutes. Very impressed. Thank You

Thank you for your feedback. We really appreciate it. Have a great day!

John G.

August 6th, 2019

Great on line help with the recording process!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robert B.

June 28th, 2019

Fast and easy and Jefferson County Colorado excepted the forms.

Thank you!

Stephen S.

March 18th, 2021

This is awesome. Making sure not only that everything is worded correctly but also formatted correctly is great. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!