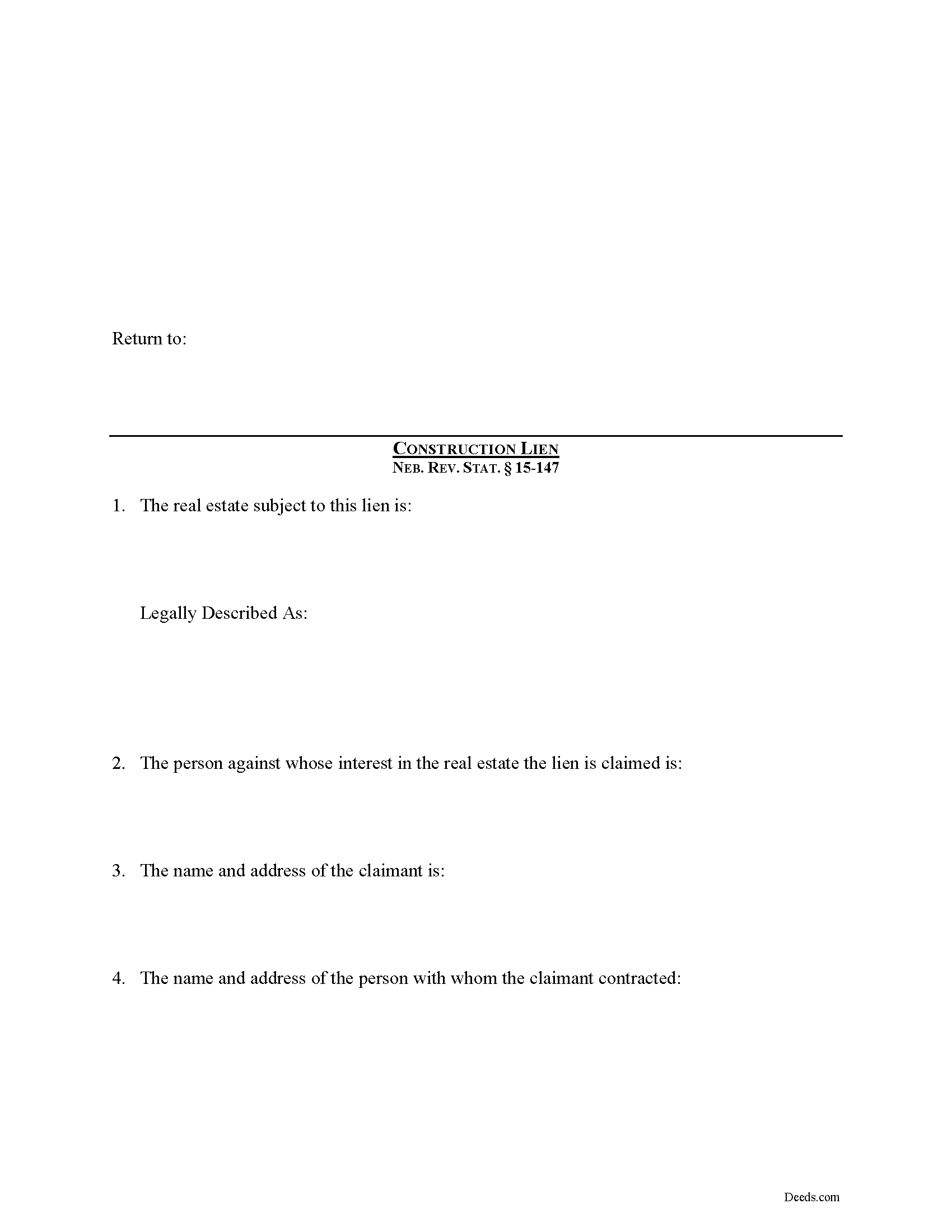

Johnson County Construction Lien Form

Johnson County Construction Lien Form

Fill in the blank Construction Lien form formatted to comply with all Nebraska recording and content requirements.

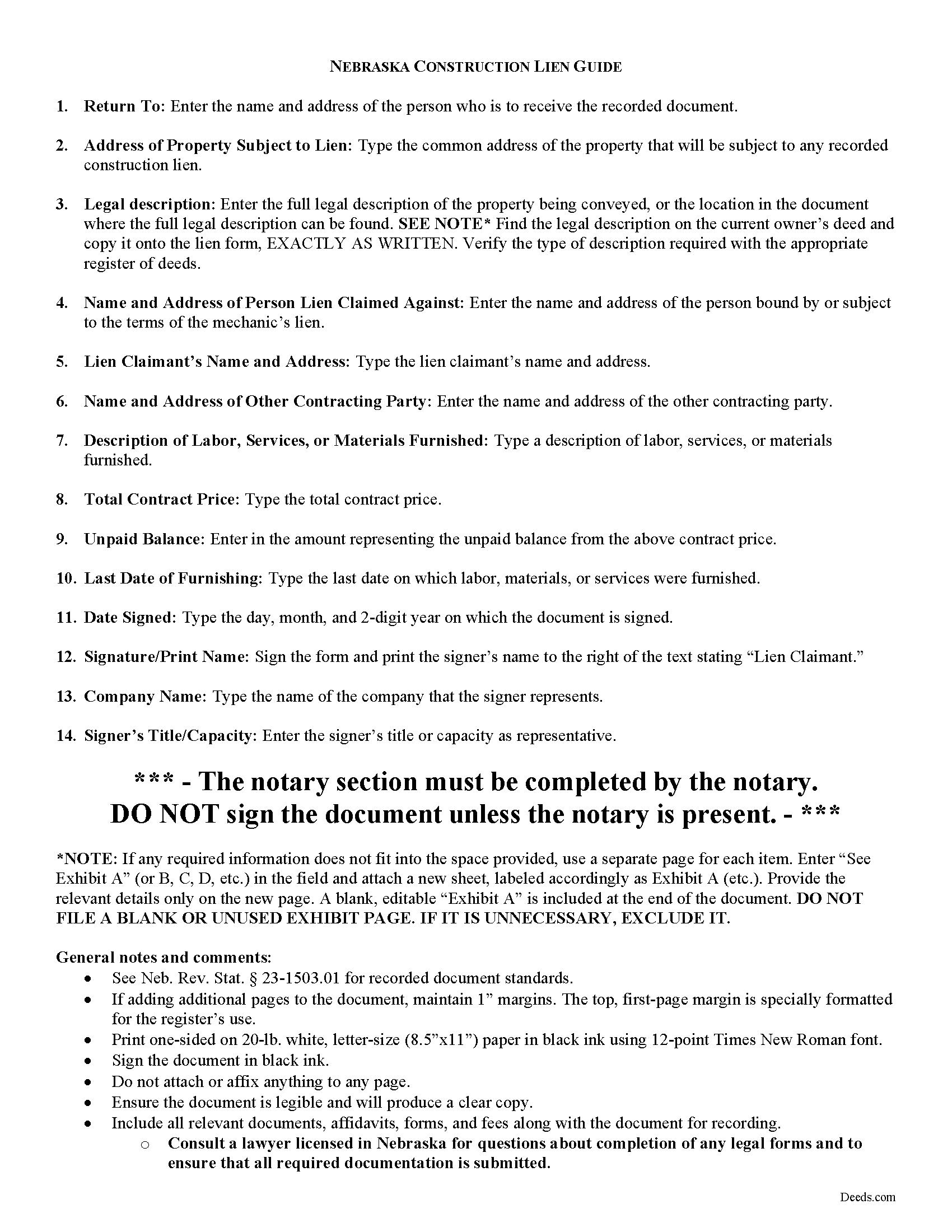

Johnson County Construction Lien Guide

Line by line guide explaining every blank on the form.

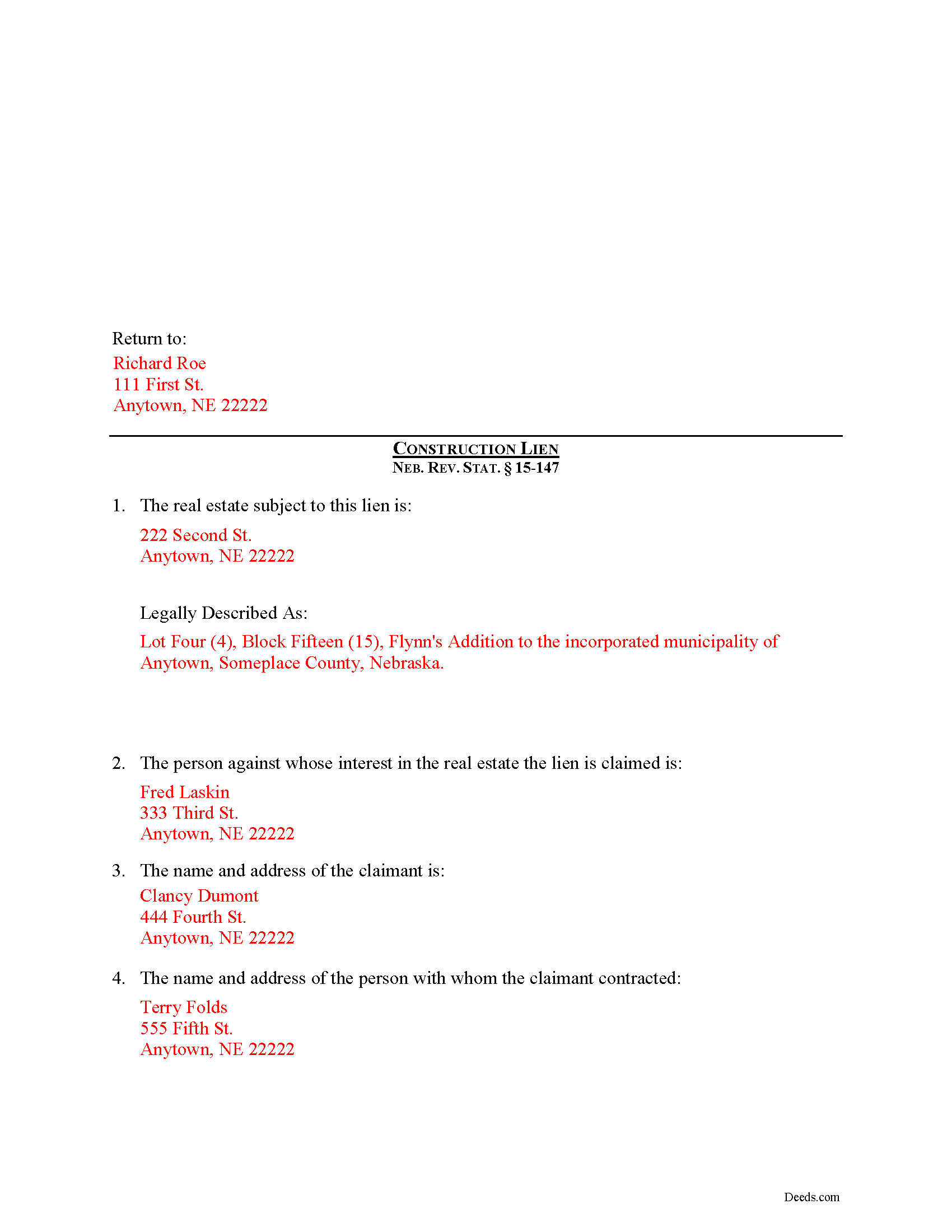

Johnson County Completed Example of the Construction Lien Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Nebraska and Johnson County documents included at no extra charge:

Where to Record Your Documents

Johnson County Register of Deeds

Tecumseh, Nebraska 68450

Hours: 8:00am to 4:30pm M-F

Phone: (402) 335-6300

Recording Tips for Johnson County:

- Ensure all signatures are in blue or black ink

- Ask if they accept credit cards - many offices are cash/check only

- White-out or correction fluid may cause rejection

- Check margin requirements - usually 1-2 inches at top

Cities and Jurisdictions in Johnson County

Properties in any of these areas use Johnson County forms:

- Cook

- Crab Orchard

- Elk Creek

- Sterling

- Tecumseh

Hours, fees, requirements, and more for Johnson County

How do I get my forms?

Forms are available for immediate download after payment. The Johnson County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Johnson County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Johnson County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Johnson County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Johnson County?

Recording fees in Johnson County vary. Contact the recorder's office at (402) 335-6300 for current fees.

Questions answered? Let's get started!

Securing a Nebraska Construction Lien

Construction liens are governed under the Nebraska Construction Lien Act, found at Sections 52-125 to 52-159 of the Nebraska Revised Statutes.

A lien is a legal right or interest in property, held by a creditor until the debtor pays the amount due on account. Construction liens are often used to persuade an owner or other party to pay a contractor the balance owed for work on real property. For instance, if a contractor who completed a project is waiting for payment, a lien might make sense. Because liens prevent an owner from selling or refinancing a property (or make it difficult to do so), they offer an effective remedy for contractors and other eligible parties.

A claimant may record a lien which shall be signed by the claimant and state: (a) The real estate subject to the lien, with a description thereof sufficient for identification; (b) The name of the person against whose interest in the real estate a lien is claimed; (c) The name and address of the claimant; (d) The name and address of the person with whom the claimant contracted; (e) A general description of the services performed or to be performed or materials furnished or to be furnished for the improvement and the contract price thereof; (f) The amount unpaid, whether or not due, to the claimant for the services or materials or if no amount is fixed by the contract a good faith estimate of the amount designated as an estimate; and (g) The time the last services or materials were furnished or if that time has not yet occurred, an estimate of the time. Neb. Rev. Stat. 52-147(1).

In Nebraska, construction liens are recorded with the county recorder's office within the bounds of the county where the property is located. A recorded lien remains enforceable for two (2) years after its recordation. Neb. Rev. Stat. 52-140. Note that in addition to the statutory content requirements, the lien form must meet all state and local standards for recorded documents.

This article is offered for informational purposes only and is not legal advice. This information not be relied upon as a substitute for speaking with an attorney. Please speak with an attorney familiar with lien laws for any questions regarding filing and recording a construction lien in Nebraska.

Important: Your property must be located in Johnson County to use these forms. Documents should be recorded at the office below.

This Construction Lien meets all recording requirements specific to Johnson County.

Our Promise

The documents you receive here will meet, or exceed, the Johnson County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Johnson County Construction Lien form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4588 Reviews )

Gail D.

October 22nd, 2024

Very concise and thorough website. Easily navigated and easily affordable.

Knowing our customers are happy is our top priority. Thank you for the wonderful feedback!

Judy A D.

March 26th, 2022

It was quick and easy.

Thank you!

reed w.

February 26th, 2022

Great service that saved me a lot of time for under 30 bucks.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sara M.

February 4th, 2025

This makes work so much easier now that I don't have to drive to each county to record. Thank you.

It was a pleasure serving you. Thank you for the positive feedback!

ALICIA G.

January 16th, 2022

To set the service was incredibly easy and the results came back very fast. Very reasonable price.

Thank you for your feedback. We really appreciate it. Have a great day!

Doris M G.

June 9th, 2022

Excellent. Everything has gone well and the deed guide has helped so much. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

George S.

June 24th, 2020

Very good, very expensive. I hope that this is what my lawyer needed for us to finish our wills. George

Thank you!

Donaldo C.

August 7th, 2020

Deeds.com is very helpful when filling a Deed. I appreciate that. Thank you.

Thank you!

Pamela C.

July 19th, 2022

Easy to use, understand and pay on the website.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Philip C.

July 2nd, 2019

The product I purchased looks great and I added Adobe to be able to copy it, but for some reason I can't,so I will delete Adobe and then try again to copy what i paid for. I have all the PDFS' and my computer and printer are fairly new (windows 10),I should have tried to copy it first, I'll get it! Thanks

Thank you for your feedback. We really appreciate it. Have a great day!

Roger A.

November 2nd, 2023

Easy peasy to use! It's great to have the guide for completing the form and an example of a completed form.

It was a pleasure serving you. Thank you for the positive feedback!

Sunny S.

November 23rd, 2020

Easy to use and quick turnaround. I would use again.

Thank you!

cosmin B.

March 19th, 2021

It's all good!!!!

Thank you!

MARIA P.

April 16th, 2021

I finally was able to download the forms. Thank you and I know I will be able to use your service anytime I may need a legal document. Thanks again!

Thank you!

Suzy I.

June 5th, 2019

I was overwhelmed with information about what forms I needed to complete the probate process, and this site was very helpful! Everything was in one place to download. Thanks!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!