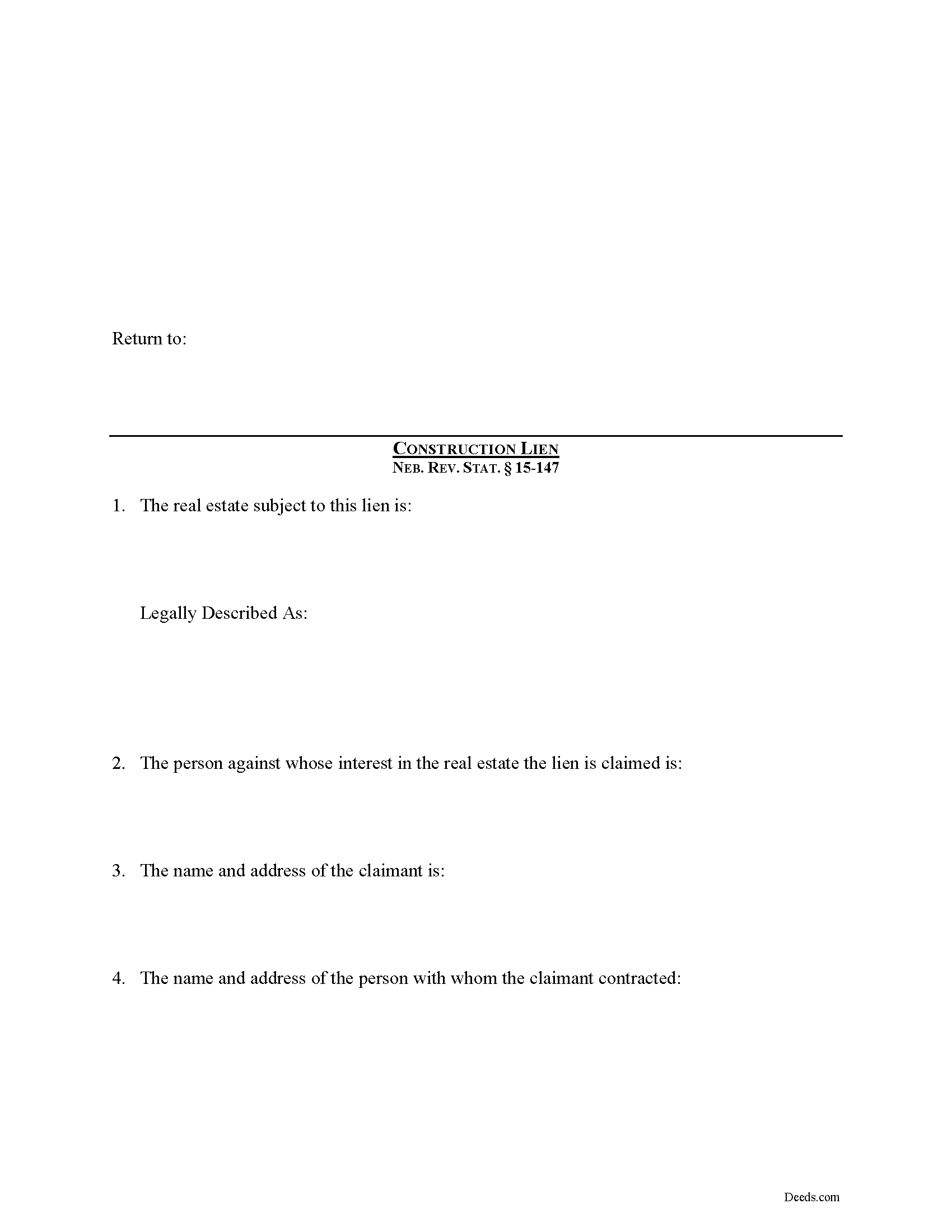

Kearney County Construction Lien Form

Kearney County Construction Lien Form

Fill in the blank Construction Lien form formatted to comply with all Nebraska recording and content requirements.

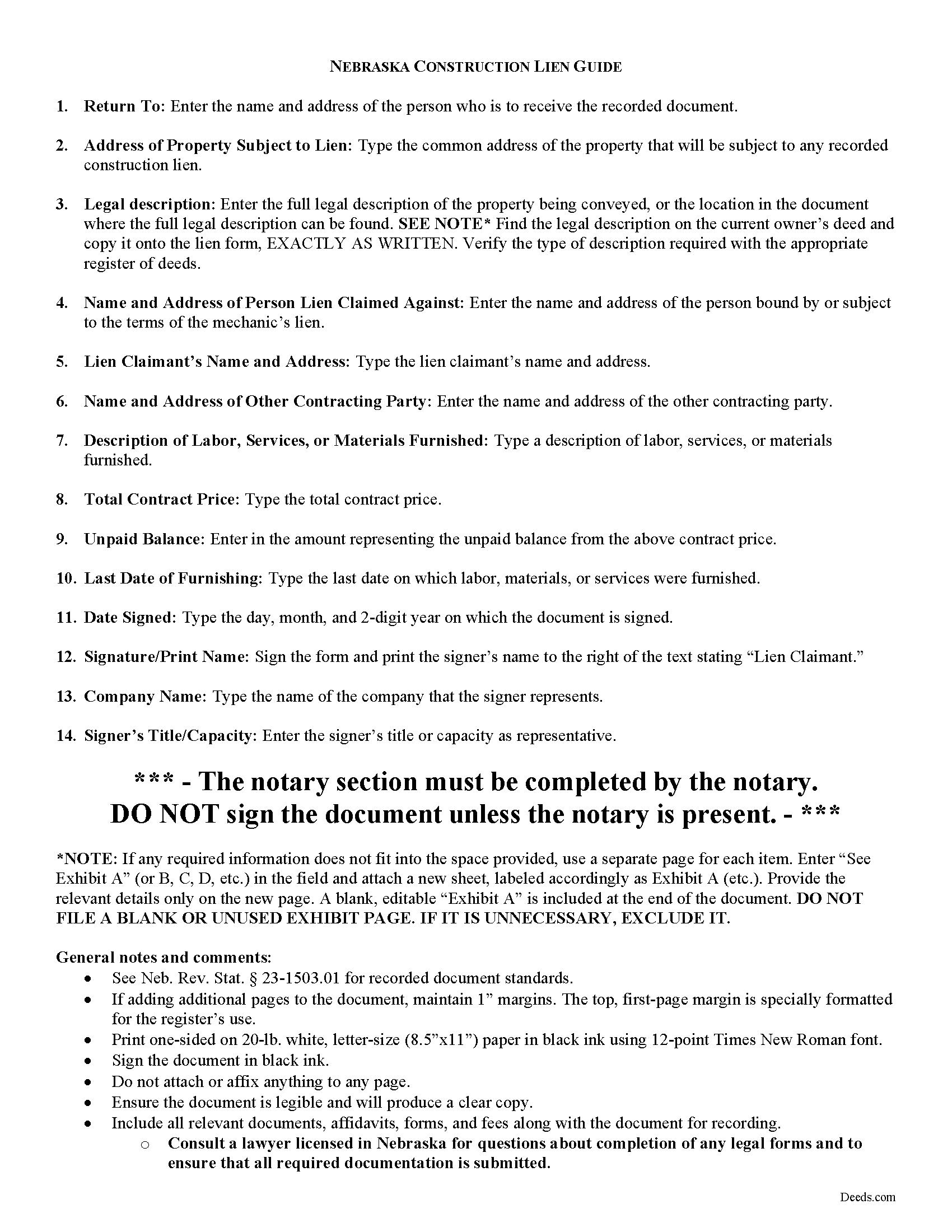

Kearney County Construction Lien Guide

Line by line guide explaining every blank on the form.

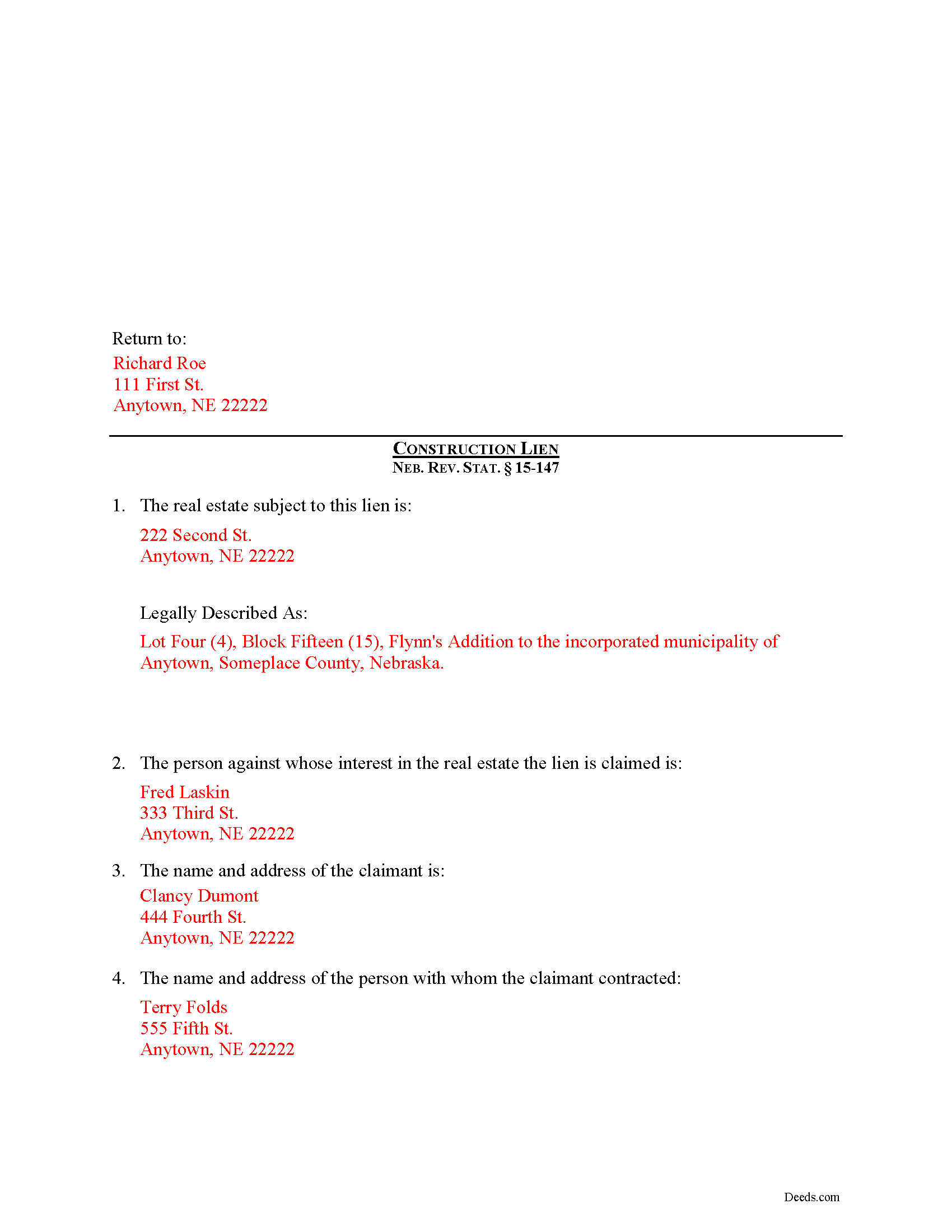

Kearney County Completed Example of the Construction Lien Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Nebraska and Kearney County documents included at no extra charge:

Where to Record Your Documents

Kearney County Register of Deeds

Minden, Nebraska 68959

Hours: 8:30 to 5:00 M-F

Phone: (308) 832-2723

Recording Tips for Kearney County:

- Ensure all signatures are in blue or black ink

- Verify all names are spelled correctly before recording

- Ask if they accept credit cards - many offices are cash/check only

- Make copies of your documents before recording - keep originals safe

Cities and Jurisdictions in Kearney County

Properties in any of these areas use Kearney County forms:

- Axtell

- Heartwell

- Minden

- Wilcox

Hours, fees, requirements, and more for Kearney County

How do I get my forms?

Forms are available for immediate download after payment. The Kearney County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Kearney County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Kearney County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Kearney County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Kearney County?

Recording fees in Kearney County vary. Contact the recorder's office at (308) 832-2723 for current fees.

Questions answered? Let's get started!

Securing a Nebraska Construction Lien

Construction liens are governed under the Nebraska Construction Lien Act, found at Sections 52-125 to 52-159 of the Nebraska Revised Statutes.

A lien is a legal right or interest in property, held by a creditor until the debtor pays the amount due on account. Construction liens are often used to persuade an owner or other party to pay a contractor the balance owed for work on real property. For instance, if a contractor who completed a project is waiting for payment, a lien might make sense. Because liens prevent an owner from selling or refinancing a property (or make it difficult to do so), they offer an effective remedy for contractors and other eligible parties.

A claimant may record a lien which shall be signed by the claimant and state: (a) The real estate subject to the lien, with a description thereof sufficient for identification; (b) The name of the person against whose interest in the real estate a lien is claimed; (c) The name and address of the claimant; (d) The name and address of the person with whom the claimant contracted; (e) A general description of the services performed or to be performed or materials furnished or to be furnished for the improvement and the contract price thereof; (f) The amount unpaid, whether or not due, to the claimant for the services or materials or if no amount is fixed by the contract a good faith estimate of the amount designated as an estimate; and (g) The time the last services or materials were furnished or if that time has not yet occurred, an estimate of the time. Neb. Rev. Stat. 52-147(1).

In Nebraska, construction liens are recorded with the county recorder's office within the bounds of the county where the property is located. A recorded lien remains enforceable for two (2) years after its recordation. Neb. Rev. Stat. 52-140. Note that in addition to the statutory content requirements, the lien form must meet all state and local standards for recorded documents.

This article is offered for informational purposes only and is not legal advice. This information not be relied upon as a substitute for speaking with an attorney. Please speak with an attorney familiar with lien laws for any questions regarding filing and recording a construction lien in Nebraska.

Important: Your property must be located in Kearney County to use these forms. Documents should be recorded at the office below.

This Construction Lien meets all recording requirements specific to Kearney County.

Our Promise

The documents you receive here will meet, or exceed, the Kearney County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Kearney County Construction Lien form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4613 Reviews )

Erik N.

May 31st, 2025

I liked it, very much.

Thank you!

JOHNNY M.

September 28th, 2019

The information provided is quite thorough.I recommend this Site to anyone, in need of Material for Quit Claim Deeds.

Thank you!

Carol H.

October 8th, 2022

Easy to understand, quick access, inexpensive, and I took it to my registrar's office and he said the warranty deed was good to go. Thanks for saving me a bundle in lawyer's fees.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robert L.

May 10th, 2022

I did not use your service. $19 to upload a document to our local tax accessor office is a bit high. I drove the document to the office myself.

Thank you for your feedback Robert. Glad to hear that you got your document recorded. Sorry to hear that your time, fuel, and wear on your vehicle are valued at less than $19. Have a wonderful day.

Lawrence D.

March 14th, 2019

My first time using it; very fast service. I am an estate planning attorney (44 years). None of my old title company contacts are around anymore to provide deed copies, so this is a great source. I will be using it again.

Thank you Lawrence, we appreciate your feedback. Have a fantastic day!

Cynthia D.

May 22nd, 2021

It turned out I didn't need the information was taken care of by my husband. Thank you.

Thank you!

Caville B.

February 10th, 2019

Received the documents, but the explanation and process is not as straightforward as I would have liked. The Instructions and Sample document were not always easy to follow. I may just have a real estate lawyer perform the task.

Thank you for your feedback. We really appreciate it. Have a great day!

Richard R.

June 28th, 2022

Kind of expensive for a 3 page item...but I received it pronto and it will fill the bill.

Thank you!

JACQUELINE R.

March 23rd, 2021

We have been waiting for a Title Company to put a release of Lien together for the past 3 months. I figured it was taking way to long and decided to use template here instead. In less than hour I was able to add all the information on the template and provide forms to our Seller to use. We were buying and he didnt think they were necessary. But I refused to pay him in full until he agreed to sign papers at the bank, and of course in front of a notary. We turned around and filed the Release of lien paperwork at County Clerks office, we officially own our house. Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

Donaldo C.

August 7th, 2020

Deeds.com is very helpful when filling a Deed. I appreciate that. Thank you.

Thank you!

Nancy S.

July 6th, 2021

Terrific service, I found just what I needed, and priced reasonably. The decision to purchase a form instead of trying to create one of my own was easy to make. I will return to this service again.

Thank you!

Karen M.

May 6th, 2019

This was a very easy and organized system to use.

Thank you for your feedback. We really appreciate it. Have a great day!

ANGELA S.

February 13th, 2020

My E-deed was not excepted by the county, so I had to snail mail the documents to the recorders office. Will probably not use this site again, as it did not fulfill my purpose, but would recommend to those who do not have complicated forms.

Thank you for your feedback. We really appreciate it. Have a great day!

Susan T.

January 21st, 2019

This was perfect for my county I will be recommending your forms to all my clients thank you.

Thank you Susan, have a great day!

Margarette S.

November 27th, 2019

I found your website easy to use and very informative.

Thank you for your feedback. We really appreciate it. Have a great day!