Holt County Deed of Full Reconveyance for Deed of Trust Form

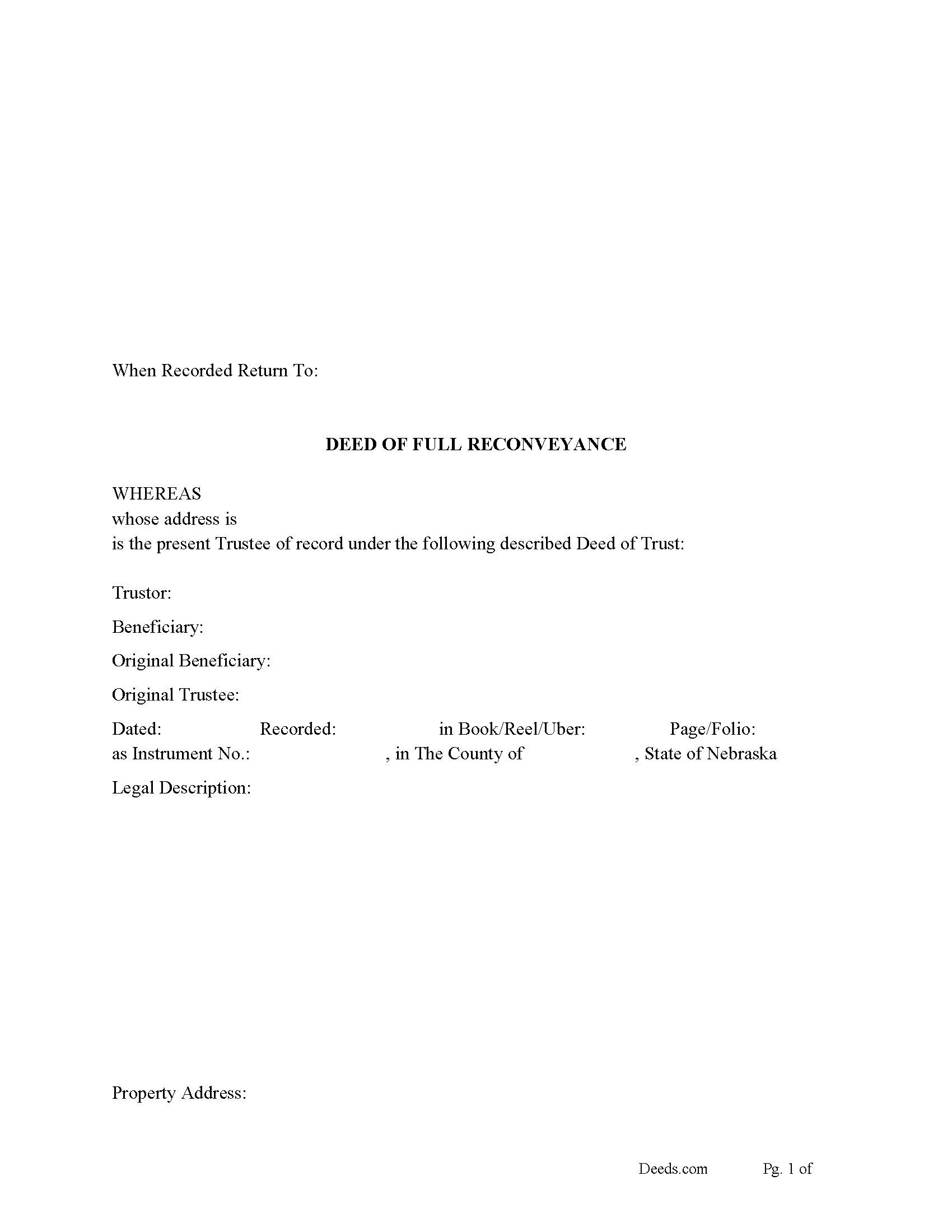

Holt County Deed of Full Reconveyance Form

Fill in the blank form formatted to comply with all recording and content requirements.

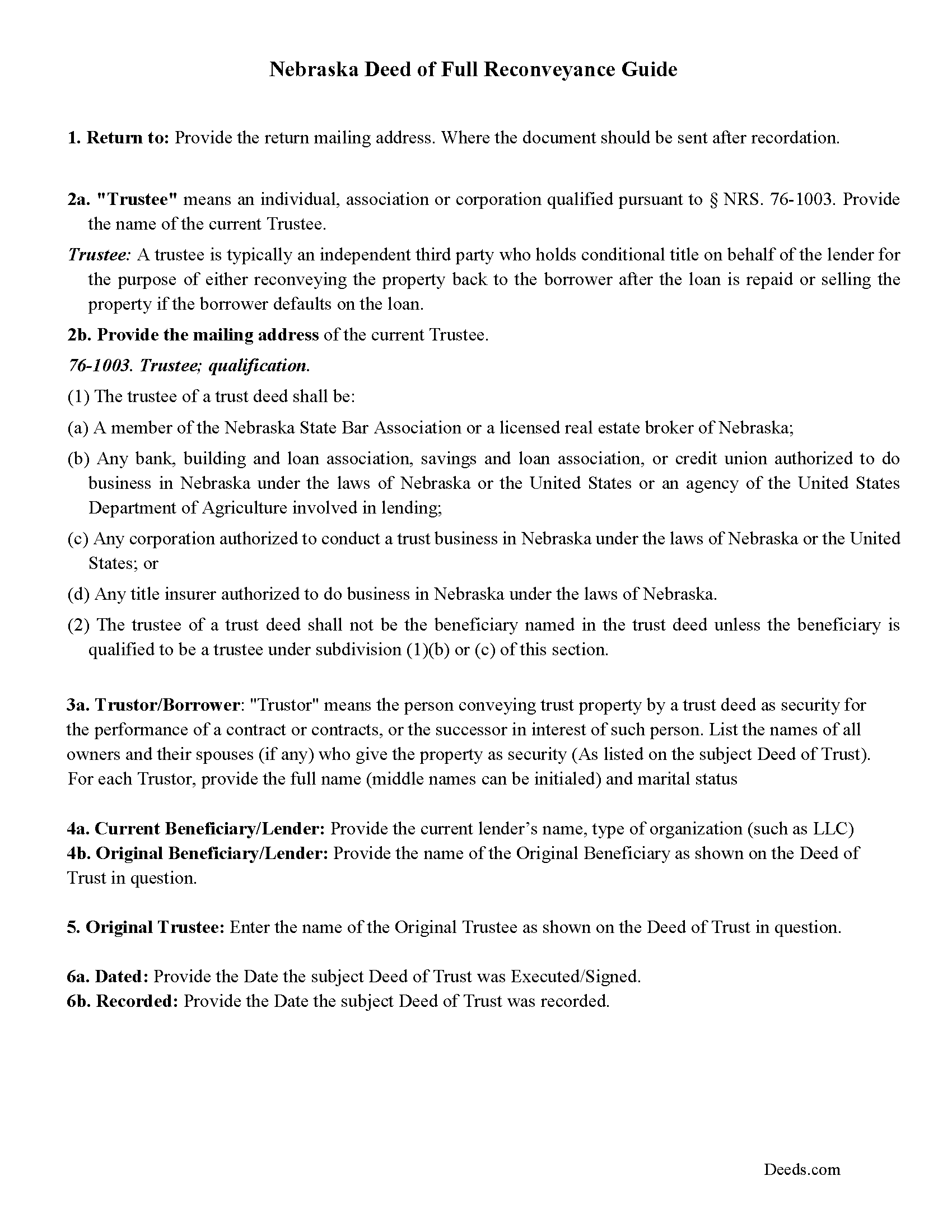

Holt County Deed of Full Reconveyance Guide

Line by line guide explaining every blank on the form.

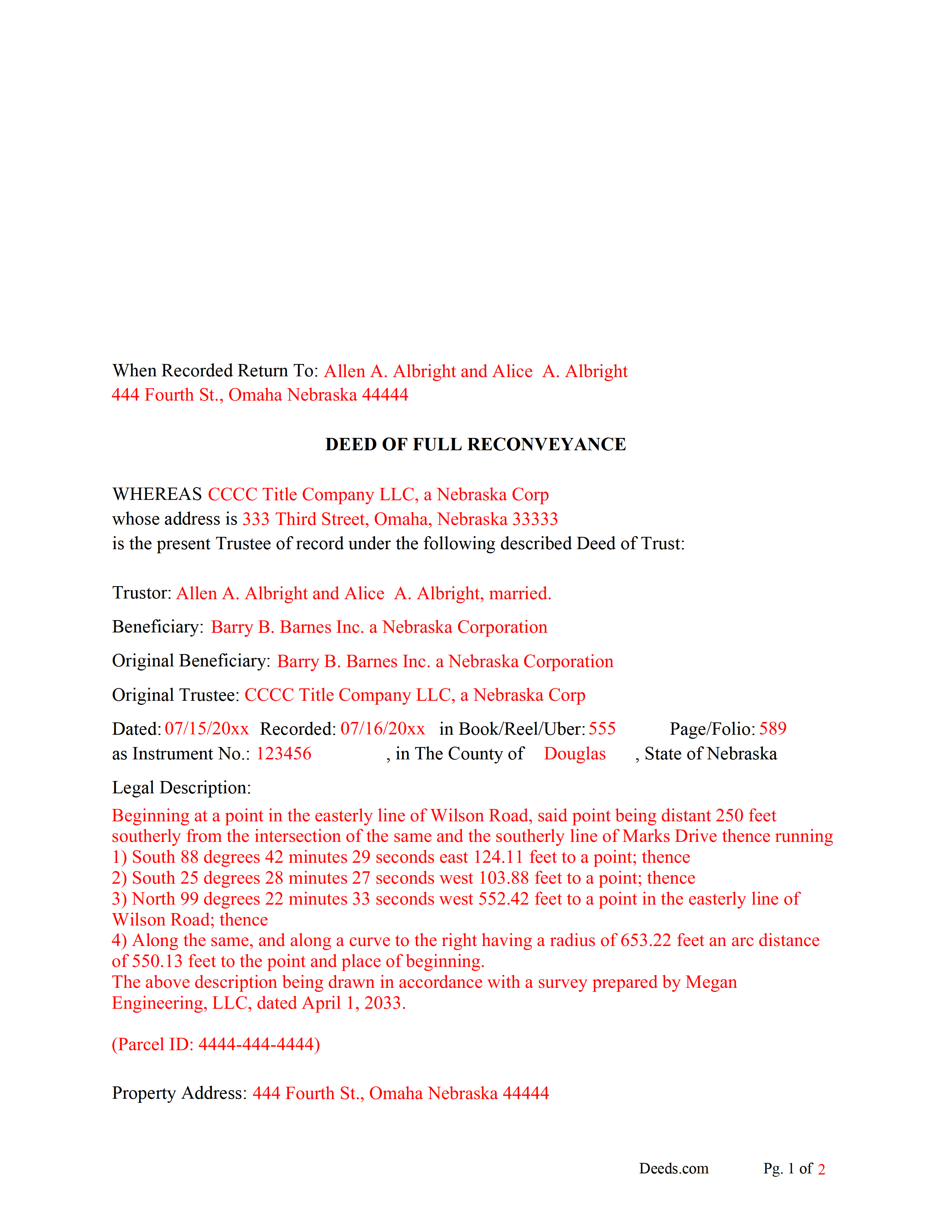

Holt County Completed Example of the Deed of Full Reconveyance Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Nebraska and Holt County documents included at no extra charge:

Where to Record Your Documents

Holt County Register of Deeds

O'Neill, Nebraska 68763

Hours: 8:00am to 4:30pm M-F

Phone: (402) 336-2250

Recording Tips for Holt County:

- Ensure all signatures are in blue or black ink

- Double-check legal descriptions match your existing deed

- Request a receipt showing your recording numbers

- Both spouses typically need to sign if property is jointly owned

- Bring multiple forms of payment in case one isn't accepted

Cities and Jurisdictions in Holt County

Properties in any of these areas use Holt County forms:

- Amelia

- Atkinson

- Chambers

- Emmet

- Ewing

- Inman

- Oneill

- Page

- Stuart

Hours, fees, requirements, and more for Holt County

How do I get my forms?

Forms are available for immediate download after payment. The Holt County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Holt County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Holt County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Holt County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Holt County?

Recording fees in Holt County vary. Contact the recorder's office at (402) 336-2250 for current fees.

Questions answered? Let's get started!

When a Deed of Trust has been paid in full the beneficiary/lender is responsible to deliver (a reconveyance in recordable form duly executed by the trustee) to the trustor/borrower. (Any beneficiary who fails to deliver such a reconveyance within sixty days after receipt of such written request shall be liable to the trustor or his or her successor in interest, as the case may be, for five thousand dollars or actual damages resulting from such failure, whichever is greater.) (76-1014.01)

(If a trustee fails or refuses to execute a reconveyance required by the beneficiary, the beneficiary shall appoint a successor trustee that will execute a reconveyance.) (76-1014.01)

This form can be used by the original beneficiary/lender or current beneficiary/lender- original trustee or current trustee,

(Nebraska DOFR Package includes form, guidelines, and completed example) For use in Nebraska only.

Important: Your property must be located in Holt County to use these forms. Documents should be recorded at the office below.

This Deed of Full Reconveyance for Deed of Trust meets all recording requirements specific to Holt County.

Our Promise

The documents you receive here will meet, or exceed, the Holt County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Holt County Deed of Full Reconveyance for Deed of Trust form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Earnest K.

January 8th, 2025

I used the "personal representative's deed." There were a few errors, after I went to record it at the county recorder's office. For #7, it should've stated "The estate of Joe Schmoe, hereby grants Mr. Personal Representative....." instead of, "I Mr. Personal Representative, as personal representative, hereby grant to personal representative...." The person at the recorder's office said you cannot state "you are granting property to yourself." Just fix that, and everything else is fine.

Your insights are invaluable to us and help us strive for better service. Thank you for taking the time to share your thoughts.

Cedric H.

April 6th, 2022

The Guide and Example documents included were a great help completing the form on my own.

Thank you!

Deborah B.

January 6th, 2019

Easy download, and super easy to fill out. Had them recorded Friday with zero issues. Recommended.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Andre W.

May 20th, 2020

I was truly impress with the customer service. The young lady that assisted me was AWESOME. She was very professional,patienc was extraordinary and very knowledgable. Thank you thank you

Thank you for your feedback. We really appreciate it. Have a great day!

Dennis D.

November 7th, 2019

Thanks for the efficient process and instructions.

Thank you for your feedback. We really appreciate it. Have a great day!

Shirley C.

November 17th, 2019

I liked that the documents could be filled in on my computer. All the documents came out nice, better than I expected really.

Thank you Shirley, we appreciate your feedback. Have a great day!

Colleen K.

September 15th, 2022

This product was easy to use and instructions were helpful.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

John C N.

June 17th, 2023

Just the website I needed. Very detailed and efficient.

Thank you for taking the time to provide your feedback John, we really appreciate it. Have an amazing day!

Carl T.

May 21st, 2020

Very simple to download and manage. very Impressed!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Tammie S.

February 8th, 2019

No review provided.

Thank you for your feedback. We really appreciate it. Have a great day!

Susie k.

March 3rd, 2020

No complaints

Thank you!

Joseph R.

July 23rd, 2022

Deeds.com has saved me quite a bit in attorney fees by making legal forms available on line. Easy to use, just fill in the blanks.

Thank you for your feedback. We really appreciate it. Have a great day!

raymond w.

February 24th, 2022

answeed many questions I had.

Thank you!

Shonda S.

April 5th, 2023

This is my first time using the site for business and I must say this site made it so easy for me. I was so lost, thank you so much.

Thank you!

DAVID JOHN M.

February 25th, 2019

The Transfer On Death Deed did work for New Mexico! Though I did have to add the long property description to the "Exhibit" page that was included with the document. Great website! Will use again! Thanks!!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!